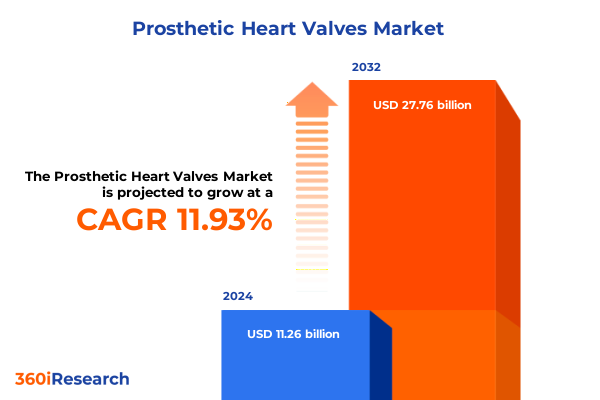

The Prosthetic Heart Valves Market size was estimated at USD 12.62 billion in 2025 and expected to reach USD 14.19 billion in 2026, at a CAGR of 11.91% to reach USD 27.76 billion by 2032.

Comprehensive Overview of Prosthetic Heart Valves Emphasizing Technological Evolution Clinical Impact and Strategic Opportunities in Cardiac Surgery

Prosthetic heart valves stand at the forefront of interventions for severe valvular heart disease, where durable mechanical designs and advanced bioprosthetic solutions converge to restore cardiac function. The escalating prevalence of aortic and mitral valve disorders underscores the strategic significance of valve therapies in mitigating morbidity and mortality globally.

Advances in materials science and fluid dynamics have driven innovations ranging from bileaflet mechanical valves to tissue-based constructs derived from bovine and porcine sources. These developments reflect a concerted effort to optimize hemodynamic performance, reduce thrombogenic risk, and extend device longevity in diverse patient populations.

Simultaneously, emerging transcatheter techniques complement traditional surgical approaches, enabling minimally invasive access for high-risk patients and expanding procedural options. The integration of refined imaging modalities and catheter-based delivery systems has accelerated adoption among interventional cardiologists and surgical teams alike.

Against this backdrop, healthcare providers and device manufacturers prioritize efficiency and clinical outcomes, navigating complex regulatory landscapes and reimbursement environments. Stakeholders are increasingly focused on supply chain resilience and real-world evidence collection to support product differentiation.

The insights presented in this summary will guide decision-makers in aligning strategic investments with evolving clinical and policy trends, setting the stage for detailed exploration of transformative technological, regulatory, and market dynamics.

Examining Critical Technological Scientific and Regulatory Shifts Driving Innovation Adoption and Market Dynamics in Prosthetic Heart Valve Development

In recent years, the prosthetic heart valve landscape has undergone transformative shifts driven by converging technological, scientific, and regulatory forces. Innovations in device design and procedural techniques are rapidly redefining clinical pathways, while evolving regulatory frameworks foster a faster translation of novel concepts to patient care.

Technological breakthroughs such as polymeric valve leaflets with enhanced durability and integrated hemodynamic sensors have ushered in a new era of intelligent prostheses. Manufacturers are leveraging computational fluid dynamics to optimize valve geometry, reduce shear stress, and minimize the need for lifelong anticoagulation, thereby enhancing patient safety and procedural predictability.

On the scientific front, advances in tissue engineering and regenerative medicine are enabling the development of bioprosthetic valves that harness autologous cells and decellularized scaffolds. Combined with additive manufacturing techniques, these approaches promise patient-specific customization and accelerated healing, potentially extending valve longevity and reducing immunologic complications.

Regulatory bodies have responded by implementing adaptive pathways and accelerated approval mechanisms aimed at addressing unmet clinical needs. The FDA’s Breakthrough Devices Program and the updated European Medical Device Regulation facilitate earlier market entry for cutting-edge valves, while maintaining rigorous post-market surveillance to ensure safety and efficacy.

Together, these dynamic shifts are reshaping strategic collaborations, product pipelines, and clinical trial designs. As stakeholders adapt to this evolving ecosystem, they are positioned to capitalize on emerging opportunities that align with patient-centric care models and global regulatory harmonization efforts.

Evaluation of the Cumulative Effects of United States Tariffs Implemented in 2025 on Supply Chains Manufacturing Costs and Clinical Accessibility

In early 2025, the introduction of targeted United States tariffs on key raw materials and finished medical devices has exerted a pronounced effect on the prosthetic heart valve sector. These measures, aimed at bolstering domestic production, have reverberated through global supply chains and reshaped procurement strategies among device manufacturers and healthcare systems.

The imposed tariffs on metals such as cobalt-chrome and titanium alloys, alongside duty adjustments on high-performance polymers used in valve leaflets, have elevated input costs. Manufacturers reliant on international sourcing confronted increased production expenses, prompting a reevaluation of vendor agreements and strategic stockpiling of critical components.

Consequently, production timelines experienced modest extensions as domestic and offshore facilities adjusted inventory management protocols. In response, several firms expanded partnerships with vertically integrated suppliers in North America to mitigate exposure to cross-border tariffs. This shift also encouraged exploration of alternative material formulations to sustain design innovation without compromising cost structures.

Clinicians and hospital procurement teams navigated these changes by revisiting contract frameworks and exploring group purchasing arrangements. While some clinical centers experienced transient delays in valve availability, collaborative forecasting and enhanced communication between manufacturers and healthcare providers ensured continuity of care for patients requiring urgent valve interventions.

Overall, the 2025 tariff landscape has underscored the importance of supply chain agility and strategic supplier diversification. Stakeholders are now prioritizing resilience measures that balance cost containment with uninterrupted access to advanced prosthetic valve technologies.

Detailed Insights into Prosthetic Heart Valve Market Segmentation Across Valve Type Procedure Application and End User Dimensions

Analysis of valve type segmentation reveals distinct dynamics between mechanical and tissue prostheses. Mechanical valves, encompassing bileaflet, caged ball, and tilting disc designs, continue to appeal for their durability and predictable hemodynamics, especially in younger patient cohorts. In contrast, tissue valves fashioned from bovine, homograft, and porcine sources prioritize biocompatibility and reduced anticoagulation requirements, resonating with elderly or lower-risk populations.

Procedure segmentation further delineates the market into surgical and catheter-based interventions. Traditional sternotomy and minimally invasive surgical replacement pathways remain foundational for standard valve implantation, offering direct visualization and established long-term data. Concurrently, transcatheter methods have matured, with transapical and transfemoral access options broadening treatment eligibility, particularly for high-risk patients and those seeking shorter recovery intervals.

Application segmentation underscores clinical demand across aortic, mitral, and tricuspid valve anatomies, each presenting unique physiological challenges. Aortic valve replacement commands the largest procedural volume, yet innovations in mitral and tricuspid valve repair and replacement are gaining traction as devices adapt to complex geometries, fostering expanded indications and collaborative heart team decision-making.

End user segmentation contrasts the roles of hospitals and ambulatory surgical centers in procedural delivery. Hospitals maintain comprehensive capabilities for high-acuity cases and complex revisions, while ambulatory centers increasingly serve low-risk patients under streamlined protocols. This dual-channel model reflects a broader shift toward decentralizing care and optimizing resource utilization.

This comprehensive research report categorizes the Prosthetic Heart Valves market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Valve Type

- Procedure

- Application

- End User

Strategic Regional Perspectives Highlighting Market Trends Opportunities and Challenges in the Americas EMEA and Asia Pacific Prosthetic Heart Valve Sectors

In the Americas, the United States and Canada represent mature markets characterized by established reimbursement frameworks and high procedural volumes. Leading healthcare institutions invest heavily in transcatheter valve programs and post-market registries. Strategic emphasis on value-based care and outcome metrics has propelled adoption of advanced prosthetic designs that demonstrate durability and favorable cost-effectiveness profiles.

Within Europe, the Middle East, and Africa region, regulatory harmonization under the European Medical Device Regulation has elevated quality standards and bolstered clinician confidence. Germany, France, and the Nordic countries drive significant procedural throughput, while emerging Gulf Cooperation Council markets are increasing investments in advanced surgical infrastructure. Persistent challenges remain in aligning reimbursement across heterogeneous national healthcare systems.

Asia Pacific presents a dynamic growth environment, with China and Japan leading adoption of minimally invasive and catheter-based solutions. Government initiatives targeting cardiovascular disease management and expanding national insurance coverage have supported greater patient access. Meanwhile, Southeast Asian markets are progressively enhancing local manufacturing capabilities to address cost constraints and build supply chain resilience.

Across all regions, cross-border collaborations and localized partnerships play pivotal roles in facilitating technology transfer and clinician training. Multinational companies are forging alliances with regional distributors and academic centers to initiate clinical trials and real-world evidence studies tailored to local patient demographics.

These regional insights illustrate the diverse regulatory, economic, and clinical landscapes that influence strategic planning for device developers, healthcare providers, and policy makers worldwide.

This comprehensive research report examines key regions that drive the evolution of the Prosthetic Heart Valves market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Comprehensive Analysis of Leading Industry Players Strategies Collaborations and Innovations Shaping the Competitive Landscape of Prosthetic Heart Valves

Leading industry participants actively vie to expand their prosthetic heart valve portfolios through targeted acquisitions, strategic collaborations, and internal innovation programs. Major players leverage decades-long experience in cardiovascular devices to refine product pipelines, while emerging specialists challenge conventions with disruptive technologies and niche offerings.

Edwards Lifesciences has maintained a robust market position by advancing transcatheter aortic valve replacement platforms and investing in next-generation bioprosthetics. Through collaborative research agreements with academic institutions, the company explores enhanced leaflet materials and integration of hemodynamic sensing technologies to optimize procedural outcomes and remote patient monitoring.

Medtronic continues to diversify its valve portfolio by improving mechanical valve designs and expanding its transcatheter valve delivery systems. Partnerships with engineering firms have accelerated the prototyping of smaller profile devices, enabling access to previously untreatable patient subsets. Additionally, the firm is pursuing additive manufacturing techniques to streamline production workflows.

Abbott and Boston Scientific bolster their competitive footing by forging alliances with hospital networks and specialized centers of excellence. These cooperation models emphasize physician training, clinical data generation, and iterative device refinement. Meanwhile, niche innovators focus on personalized solutions, such as customizable valve scaffolds and hybrid repair-replacement technologies that blend reconstruction and prosthetic implantation.

Collectively, industry leaders and agile newcomers are reshaping the competitive landscape by aligning strategic investments with evolving clinical needs, driving a continuous cycle of product differentiation and enhanced patient care.

This comprehensive research report delivers an in-depth overview of the principal market players in the Prosthetic Heart Valves market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 4C Medical Technologies, Inc.

- Abbott Laboratories

- Artivion, Inc.

- Boston Scientific Corporation

- Braile Biomédica Indústria, Comércio e Representações S.A.

- Colibri Heart Valve, LLC

- Corcym S.r.l.

- Edwards Lifesciences Corporation

- Foldax, Inc.

- JenaValve Technology, Inc.

- Labcor Laboratórios Ltda.

- Lepu Medical Technology (Beijing) Co., Ltd.

- LivaNova PLC

- Medtronic plc

- Meril Life Sciences Private Limited

- MicroPort CardioFlow Medtech Corporation

- On-X Life Technologies, Inc.

- Symetis SA

- TTK Healthcare Limited

- Venus Medtech Inc.

Strategic and Actionable Recommendations Empowering Industry Leaders to Enhance Innovation Efficiency and Market Penetration in the Prosthetic Heart Valve

Industry leaders can capitalize on current momentum by focusing on strategic initiatives that bolster innovation pipelines, strengthen operational resilience, and elevate market penetration. A proactive stance that integrates cross-functional collaboration and evidence-driven decision making will prove critical to maintaining competitive advantage in the evolving prosthetic valve landscape.

Investing in collaborative R&D platforms with academic centers and technology incubators is essential for accelerating the development of next-generation valve materials and smart delivery systems. By co-creating with experts in biomaterials and computational modeling, device manufacturers can more rapidly iterate designs and validate performance characteristics under real-world conditions.

To mitigate supply chain disruptions, stakeholders should establish diversified sourcing strategies and prioritize local manufacturing partnerships in key markets. Developing dual-sourcing agreements for critical alloys and polymers, while incorporating advanced inventory management tools, will enhance production flexibility and reduce lead times.

Engaging regulatory authorities early through pre-submission consultations and leveraging adaptive approval pathways will streamline market entry for innovative products. Concurrently, generating robust clinical evidence via post-market registries and pragmatic trials will support value-based care models and facilitate favorable reimbursement negotiations.

Finally, embracing digital health solutions, such as remote patient monitoring platforms and predictive analytics, can differentiate product offerings and foster long-term customer relationships. By integrating comprehensive service models with device deployments, companies can deliver holistic care solutions that resonate with payers, providers, and patients alike.

Rigorous Research Methodology Detailing Combined Primary Interviews Secondary Data Analysis and Data Triangulation Techniques Employed in Study

The insights presented in this executive summary derive from a meticulously structured research methodology that combines both secondary and primary data sources. This multi-modal approach ensures comprehensive coverage of technological trends, regulatory developments, and market dynamics shaping the prosthetic heart valve sector.

Secondary research encompassed a thorough review of peer-reviewed journals, regulatory publications, clinical trial registries, and industry conference proceedings. Proprietary databases were leveraged to analyze historical device launches, patent filings, and supply chain configurations. An extensive evaluation of published guidelines and reimbursement frameworks provided contextual depth for regional and global assessments.

The primary research phase involved in-depth interviews with key opinion leaders, including cardiac surgeons, interventional cardiologists, device engineers, and procurement directors. These interviews yielded qualitative insights on clinical preferences, procedural workflow optimization, and emerging unmet needs. Discussions with regulatory consultants and payers further informed the assessment of approval pathways and coverage criteria.

To ensure robustness, data triangulation techniques were applied, cross-verifying findings across multiple sources and stakeholder perspectives. Quantitative segmentation analyses were validated through expert panels, while thematic coding of qualitative responses enhanced the accuracy of market and technology narratives. Ongoing validation sessions with industry specialists and supplemental desk research further solidified the analytical framework and ensured alignment with the latest industry developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Prosthetic Heart Valves market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Prosthetic Heart Valves Market, by Valve Type

- Prosthetic Heart Valves Market, by Procedure

- Prosthetic Heart Valves Market, by Application

- Prosthetic Heart Valves Market, by End User

- Prosthetic Heart Valves Market, by Region

- Prosthetic Heart Valves Market, by Group

- Prosthetic Heart Valves Market, by Country

- United States Prosthetic Heart Valves Market

- China Prosthetic Heart Valves Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesized Conclusions Highlighting Key Findings Strategic Implications and Future Outlook for Stakeholders in Prosthetic Heart Valve Ecosystem

This executive summary synthesizes critical insights into the prosthetic heart valve domain, revealing a landscape defined by rapid technological advancements, evolving clinical pathways, and dynamic regulatory frameworks. Emergent materials, smart device integrations, and minimally invasive techniques converge to expand patient access and enhance post-operative outcomes.

Tariff-induced shifts in supply chain management have underscored the necessity of resilient procurement strategies and strategic supplier diversification. Concurrently, detailed segmentation analyses illuminate distinct opportunities across valve types, procedural modalities, anatomical applications, and end-user channels, guiding tailored approaches to market engagement.

Regional perspectives highlight nuanced regulatory, reimbursement, and infrastructural variations that influence adoption patterns in the Americas, EMEA, and Asia Pacific. Leading companies are responding with strategic collaborations, localized manufacturing models, and robust clinical evidence generation to maintain competitive differentiation.

Collectively, these findings offer a roadmap for device developers, healthcare providers, and policy makers to navigate the complex interplay of innovation, regulation, and market forces. By aligning strategic investments with clinical imperatives and stakeholder priorities, industry participants can realize sustained growth and improved patient outcomes. The comprehensive outlook emphasizes agility, evidence-based decision making, and collaborative partnerships as foundational pillars for future success in the prosthetic heart valve ecosystem.

Engaging Call To Action Inviting Collaboration with Associate Director Sales and Marketing Ketan Rohom to Secure the Comprehensive Market Research Report

For stakeholders seeking an in-depth understanding of the prosthetic heart valve landscape, this research report provides strategic intelligence across segmentation, regional profiles, and recommendations. Prospective clients are invited to collaborate directly with Ketan Rohom, Associate Director of Sales and Marketing, to access the full analysis.

Accessing this report equips leadership teams with insights to guide product development, optimize regulatory strategies, and enhance market positioning. It serves as an essential decision support tool for refining business models and driving innovation in valve technologies.

To begin the procurement process and discuss tailored research solutions, please contact Ketan Rohom and discover how this market intelligence can support your organization’s goals in advancing prosthetic heart valve care.

- How big is the Prosthetic Heart Valves Market?

- What is the Prosthetic Heart Valves Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?