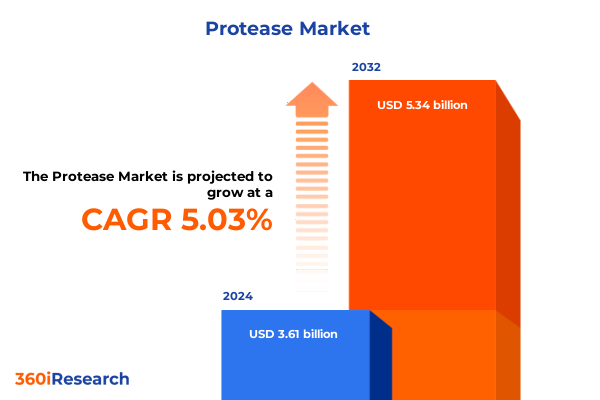

The Protease Market size was estimated at USD 3.75 billion in 2025 and expected to reach USD 3.89 billion in 2026, at a CAGR of 5.20% to reach USD 5.34 billion by 2032.

Exploring the Pervasive Role of Protease Enzymes in Catalyzing Innovation Across Diverse Industrial and Biomedical Sectors

Protease enzymes have become indispensable catalysts in a wide spectrum of industrial and biomedical processes, underpinning innovations that span from food processing to advanced therapeutics. Accounting for approximately 60% of the global enzyme market and representing nearly 40% of total enzyme revenues, proteases play a pivotal role in protein modification and degradation, enabling enhanced product functionality and process efficiency. These enzymes demonstrate exceptional versatility by facilitating tenderization in meat processing, enhancing stain removal in detergents, and supporting targeted peptide synthesis in pharmaceutical applications.

Examining the Groundbreaking Technological and Market Transformations Reshaping Protease Enzyme Development and Application Paradigms

The protease landscape is undergoing a fundamental transformation driven by breakthroughs in biotechnology and enzyme engineering. Advances in recombinant DNA technology now allow for the design of proteases with tailored specificity and improved stability under extreme pH and temperature conditions, while high-throughput screening and protein evolution platforms accelerate the discovery of novel variants that address unmet industrial needs. Moreover, the shift toward microbial fermentation processes has reduced production costs and enhanced scalability, enabling the supply of high-purity proteases for sensitive applications such as diagnostics and therapeutics.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Measures on Protease Enzyme Supply Chains and Cost Structures

In 2025, the introduction of new United States tariffs on key protein hydrolysis enzyme categories has reshaped cost structures across the protease supply chain. These measures have prompted domestic manufacturers to expand local production capacity, capturing incremental volume previously sourced through imports, while international exporters reassess market strategies in response to higher duty burdens. Downstream industries, including detergents, animal feed, and pharmaceuticals, have been compelled to adapt budgeting frameworks and reformulate products to absorb or mitigate elevated raw material expenses.

Unveiling Strategic Segmentation Dynamics That Illuminate Application, Type, Source, and End User Trends Driving Protease Market Evolution

A deep dive into protease market segmentation reveals critical drivers shaping demand across application, type, source, and end-user categories. Within application domains encompassing detergents, diagnostics, food & beverages, leather & textiles, pharmaceuticals, and waste management, demand is particularly robust in bakery, brewing, dairy, and meat processing subsegments, while therapeutic and diagnostic uses within pharma are gaining momentum. Proteases are further categorized by enzymatic class-Aspartic, Cysteine, Metalloprotease, Serine, and Threonine-with collagenase and thermolysin variants leading metalloprotease applications and chymotrypsin, subtilisin, and trypsin driving serine protease deployment. Sources span animal-derived pancreatin, pepsin, and rennet; microbial enzymes from bacterial and fungal origins; plant extracts; and recombinant constructs, each offering distinct performance attributes. End-user segmentation underscores diverse consumption patterns across household laundry and personal care; industrial food processing, pharmaceuticals, and waste treatment; and institutional applications in healthcare, hospitality, and research environments, illuminating nuanced growth opportunities across the value chain.

This comprehensive research report categorizes the Protease market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Source

- Application

- End User

Mapping Regional Growth Trajectories to Illustrate Differential Drivers and Opportunities Across Americas, EMEA, and Asia-Pacific Protease Markets

Regional analysis highlights differentiated growth trajectories across the Americas, Europe, Middle East & Africa, and Asia-Pacific. The Americas benefit from mature detergent and dietary supplement sectors, supported by robust innovation pipelines in recombinant proteases that cater to high-value pharmaceutical and industrial processes. In EMEA, stringent regulatory frameworks and a growing emphasis on sustainable clean-label ingredients drive adoption of plant-derived and eco-friendly protease solutions. Asia-Pacific leads global production with nearly 45% of market capacity, fueled by burgeoning food & beverage and textile industries, while rapid urbanization and expanding healthcare infrastructure continue to propel demand for therapeutic and diagnostic proteases.

This comprehensive research report examines key regions that drive the evolution of the Protease market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Imperatives Shaping Competition and Innovation Within the Protease Enzyme Landscape

The competitive protease landscape is defined by a blend of industry giants and specialized innovators. Leading players such as Novozymes, Royal DSM, DuPont, Advanced Enzymes, Amano Enzymes, and Ab Enzymes are investing heavily in R&D to expand their portfolios with thermostable, recombinant, and multi-functional proteases. Strategic alliances, mergers, and capacity expansions characterize the sector, enabling rapid penetration into emerging applications like bioactive peptide production and sustainable protein hydrolysis. Meanwhile, niche players are differentiating through custom enzyme formulations, small-batch fermentation services, and targeted support for biotech startups, fostering a dynamic ecosystem of collaboration that accelerates time-to-market for novel protease solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Protease market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Enzyme Technologies Limited

- Amano Enzyme Inc.

- Associated British Foods plc

- BASF SE

- BIO-CAT, Inc.

- Biocatalysts Ltd.

- dsm-firmenich AG

- Dyadic International, Inc.

- Evonik Industries AG

- International Flavors & Fragrances Inc.

- Kerry Group plc

- Merck KGaA

- Novonesis A/S

- Specialty Enzymes & Probiotics, Inc.

- Thermo Fisher Scientific Inc.

Formulating Targeted Action Plans Empowering Industry Leaders to Navigate Market Complexity and Capitalize on Protease Enzyme Growth Frontiers

To maintain competitive advantage amid evolving market dynamics, industry leaders should prioritize three strategic imperatives. First, invest in advanced enzyme engineering platforms to develop tailored protease variants with enhanced specificity, stability, and multifunctionality. Second, strengthen vertical integration by securing feedstock supply through partnerships with microbial fermentation specialists and plant extraction facilities, thereby mitigating raw material volatility. Third, expand customer engagement through co-innovation programs and application labs that facilitate rapid product customization and regulatory support. By adopting these measures, organizations can capture new growth avenues, optimize cost structures, and deliver differentiated enzyme solutions that meet the escalating demands of food, pharmaceutical, and industrial customers.

Detailing Comprehensive Research Methodology Integrating Primary Insights and Secondary Analyses to Ensure Rigorous Protease Market Intelligence

This research integrates primary and secondary methodologies to ensure a robust and comprehensive analysis of the protease enzyme market. Primary insights were derived from interviews with industry executives, enzyme process engineers, and end-user procurement specialists, providing firsthand perspectives on supply chain challenges and application requirements. Secondary data were collected from reputable scientific journals, patent databases, trade publications, and regulatory filings to validate market trends and technological advancements. The study employs triangulation techniques to cross-verify quantitative data points and qualitative insights, ensuring methodological rigor and reducing bias. Quality assurance processes, including peer review and data consistency checks, underpin the reliability of the findings presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Protease market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Protease Market, by Type

- Protease Market, by Source

- Protease Market, by Application

- Protease Market, by End User

- Protease Market, by Region

- Protease Market, by Group

- Protease Market, by Country

- United States Protease Market

- China Protease Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Summarizing the Critical Findings and Strategic Insights Thatunderscore the Future Trajectory of the Global Protease Enzyme Market

Through a synthesis of technological innovations, regulatory impacts, and supply chain dynamics, this analysis underscores the pivotal role of protease enzymes in driving efficiency and sustainability across multiple industries. The convergence of enzyme engineering, tariff-driven localization, and segmented market demand signals a future where tailored protease solutions will deliver targeted performance enhancements, cost optimization, and compliance with evolving environmental standards. Stakeholders equipped with these insights are well positioned to navigate competitive pressures, capitalize on emerging application frontiers, and lead the next wave of protease-enabled innovation.

Engaging Directly with Ketan Rohom to Secure the Authoritative Protease Market Research Report That Drives Strategic Decision Making

To explore how the protease enzyme market can empower your strategic planning, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, and secure access to the in-depth market research report that delivers actionable intelligence and competitive edge. His expertise will guide you to the insights you need to make informed investment decisions, optimize your product portfolio, and anticipate industry shifts.

Connect with Ketan to discuss tailored solutions and exclusive findings that will support your organization’s growth objectives. Don’t miss the opportunity to leverage this comprehensive analysis to drive innovation and capture emerging market segments.

- How big is the Protease Market?

- What is the Protease Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?