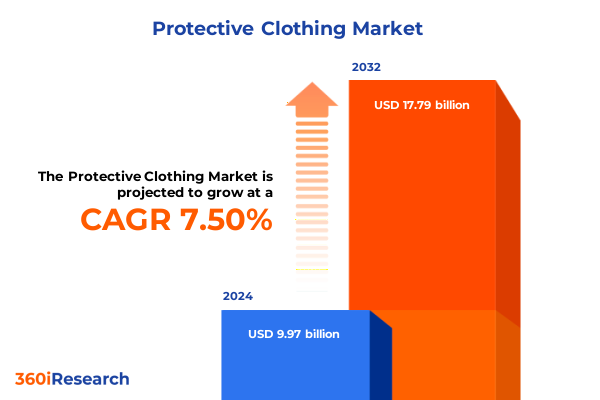

The Protective Clothing Market size was estimated at USD 10.63 billion in 2025 and expected to reach USD 11.33 billion in 2026, at a CAGR of 7.63% to reach USD 17.79 billion by 2032.

Unveiling How Modern Protective Clothing Innovations Fortify Worker Safety Across Diverse High-Risk Industries and Operational Environments

Protective clothing stands as an indispensable line of defense in environments where occupational hazards threaten health and productivity. From chemical plants where corrosive substances impose severe risks to construction sites that demand high-visibility gear under dynamic conditions, the right protective apparel can mean the difference between routine operation and critical incident. Over the past decade, advancements in material science have opened new pathways for enhanced barrier performance, ergonomics, and wearer comfort, empowering organizations to align safety protocols with evolving industrial requirements.

This executive summary distills the core insights uncovered through rigorous research into the protective clothing domain. It outlines transformative trends reshaping product development, regulatory shifts influencing supply chains, and key segmentation nuances illuminating demand drivers across end-use verticals. By synthesizing these findings, decision-makers can navigate complex market dynamics with confidence, pinpoint opportunities for strategic differentiation, and develop resilient supply chain frameworks that reinforce both compliance and profitability. Transitioning from foundational context to forward-looking analysis, this report equips industry leaders with the actionable knowledge necessary to prosper in an increasingly safety-conscious global economy.

Exploring the Emerging Technological, Regulatory, and Sustainability-Driven Transformations Reshaping the Protective Clothing Landscape in 2025 and Beyond

The protective clothing landscape is undergoing transformative change driven by intersecting forces across technology, regulation, and sustainability. Smart textiles embedded with sensors now monitor biometric and environmental metrics in real time, enabling proactive hazard detection and response-a development that transcends traditional passive protection paradigms. Concurrently, regulatory bodies have tightened performance standards to address emerging concerns around exposure thresholds and ergonomic fatigue, compelling manufacturers to invest in advanced testing protocols and certification pathways.

Simultaneously, sustainability has become a central theme, with circular economy principles influencing material selection and end-of-life considerations. Recyclable polymers and bio-based composites are gaining traction, reducing environmental impact without compromising flame resistance or barrier integrity. Digital platforms for product lifecycle management further streamline compliance tracking and data transparency, allowing organizations to demonstrate adherence to evolving regulatory requirements. By embracing these converging shifts, companies can not only meet heightened safety expectations but also leverage innovation to drive market differentiation and cost efficiencies over the long term.

Assessing How the 2025 United States Tariff Adjustments Are Influencing Supply Chains, Cost Structures, and Strategic Sourcing in Protective Apparel Markets

In 2025, adjustments to United States tariff structures have exerted significant influence on protective apparel supply chains and cost architectures. Import duties on specialty textiles and chemical-resistant materials have risen, prompting manufacturers to reevaluate sourcing strategies and negotiate new partnerships with domestic suppliers. Consequently, production costs have experienced upward pressure, compelling organizations to adopt leaner inventory models and pursue vertical integration where feasible to preserve margin stability.

The tariff environment has also catalyzed strategic shifts toward regional manufacturing hubs, reducing reliance on long-haul shipments and mitigating exposure to geopolitical volatility. While nearshoring has accelerated lead times and enhanced supply chain agility, it has introduced complexity in qualifying new suppliers for stringent safety certifications. As a result, industry stakeholders are investing in collaborative quality assurance frameworks and joint development agreements to expedite material validation processes. In balancing the trade-offs between cost, compliance, and continuity, the protective clothing sector is redefining sourcing paradigms to ensure that elevated tariffs translate into diversified resilience rather than persistent cost burdens.

Revealing Segmentation Insights That Illuminate Product Types, End Users, Materials, Applications, and Distribution Methods Driving Protective Clothing Demand

A granular examination of market segmentation highlights the multifaceted drivers shaping protective clothing demand. Within product categorizations, chemical protective clothing encompasses aprons, coveralls, gloves, hoods, and full-body suits engineered for resistance against corrosive agents. Cut resistant options leverage high-strength fibers to shield workers in manufacturing and mining environments, while electrical protective ensembles integrate insulating materials to guard against arc flash and electrocution. High visibility garments, crafted from retroreflective fabrics, serve public safety and transportation sectors where conspicuity is paramount. Medical protective clothing addresses infection control through disposable and reusable gloves, gowns, masks, and isolation suits. Thermal and flame resistant offerings utilize inherently stable fibers to prevent burn injuries in oil and gas or welding applications.

Demand patterns further vary across end-user categories such as chemical processing, construction, defense, healthcare, manufacturing, mining, oil and gas, public safety, and transportation, each imposing unique performance and compliance requirements. Material composition influences both protective properties and cost profiles, with composite laminates delivering lightweight durability, metals providing localized reinforcement, polymers offering chemical resistance, fabric materials balancing flexibility with barrier function, and rubber-based solutions excelling in splash protection. The intended application-whether chemical splash defense, cold weather insulation, cut abrasion mitigation, electrical insulation, high-visibility signaling, or thermal flame protection-dictates design priorities. Finally, distribution channels range from direct sales and distributor networks to online platforms and retail outlets, shaping accessibility and customization options for end-users.

This comprehensive research report categorizes the Protective Clothing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- End User

- Application

- Distribution Channel

Uncovering Regional Dynamics Across Americas, Europe Middle East Africa, and Asia-Pacific That Shape Protective Garment Adoption and Compliance

Regional dynamics exert profound influence on protective clothing adoption and regulatory landscapes. In the Americas, stringent OSHA mandates and robust insurance frameworks drive demand for specialized chemical and electrical protective gear, while domestic production capabilities continue to expand in response to tariff-induced reshoring initiatives. North American manufacturers leverage established certification bodies to guarantee product compliance, fostering a competitive environment centered on rapid innovation cycles and end-user collaboration.

Across Europe, the Middle East and Africa, harmonized CE marking regulations and evolving REACH restrictions define performance thresholds, particularly in chemical and medical protective segments. Manufacturers operating in EMEA prioritize ecodesign principles and transparent supply chains to meet stringent environmental directives and public scrutiny. The Asia-Pacific region, characterized by its diverse industrial base, balances cost competitiveness with rising local standards. Nations such as Japan and South Korea spearhead high-technology integration into safety equipment, while emerging markets in Southeast Asia and Australia pursue upgraded workplace safety regulations that align with global best practices. These regional distinctions guide strategic market entry, localization of product portfolios, and investments in certification infrastructure.

This comprehensive research report examines key regions that drive the evolution of the Protective Clothing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players and Their Strategic Innovations to Drive Growth, Differentiation, and Resilience in the Protective Apparel Sector

Industry leaders are leveraging innovation portfolios and strategic alliances to reinforce market positioning. Major chemical protective pioneers integrate proprietary barrier composites into next-generation suits, achieving improved comfort without sacrificing resistance to aggressive solvents. Firms specializing in cut and abrasion resistance collaborate with fiber technology developers to introduce ultralight materials that reduce wearer fatigue in manufacturing and mining operations. In the electrical protection domain, alliances between textile manufacturers and electronics companies yield smart garments capable of transmitting real-time data on arc flash events, enhancing both safety and incident response efficiency.

High visibility and medical protective segments witness similar collaborative momentum, as retroreflective innovators partner with design firms to create garments that conform to ergonomic and aesthetic requirements for first responders and healthcare professionals. Global supply chain integrators invest in digital traceability solutions to assure authenticity and streamline certification across multiple jurisdictions. By orchestrating these strategic moves-spanning new product launches, joint research initiatives, and targeted acquisitions-leading companies cultivate resilience, diversify risk, and accelerate time to market in a competitive landscape defined by rapid technological and regulatory evolution.

This comprehensive research report delivers an in-depth overview of the principal market players in the Protective Clothing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Alpha Pro Tech, Ltd.

- Ansell Limited

- Carhartt, Inc.

- Cintas Corporation

- Delta Plus Group

- DuPont de Nemours, Inc.

- Honeywell International Inc.

- Kimberly-Clark Corporation

- Koninklijke Ten Cate B.V.

- Lakeland Industries, Inc.

- MSA Safety Incorporated

- Teijin Limited

Strategic Imperatives and Practical Recommendations for Industry Leaders to Enhance Product Innovation, Supply Chain Resilience, and Market Penetration

To maintain competitive advantage, industry leaders must embrace a multifaceted strategic playbook. First, prioritizing investment in smart textile technologies and advanced composite materials will unlock new safety functionalities while enhancing wearer comfort and data-driven risk management. Concurrently, diversifying supply chain footprints through regional sourcing and nearshoring initiatives can mitigate tariff exposure and geopolitical disruption. Organizations should cultivate supplier partnerships that focus on co-development of materials with validated performance credentials, expediting product certification cycles.

Sustainability should serve as a guiding principle: integrating recyclable fibers, reducing waste in manufacturing processes, and pursuing circular economy models will not only meet regulatory mandates but also resonate with end-users increasingly attuned to environmental stewardship. Strengthening digital platforms for product lifecycle management and traceability will enhance compliance oversight and support rapid response to regulatory updates across jurisdictions. Finally, aligning go-to-market strategies with end-user communities-through joint pilot programs, interactive training modules, and service-based offerings-will amplify customer engagement and drive adoption of premium protective solutions. By executing these practical initiatives, organizations can secure operational resilience, foster innovation, and capture emerging market opportunities.

Outlining Rigorous Hybrid Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Expert Validation to Ensure Robust Insights

This research leverages a hybrid methodology designed to ensure data integrity and comprehensive perspective. Primary research involved structured interviews with safety managers, procurement officers, and technical experts across key end-use sectors, providing firsthand insights into functional requirements, compliance challenges, and innovation priorities. Secondary research encompassed systematic review of academic publications, industry standards documentation, regulatory filings, and corporate disclosures to map the evolving technical and legal landscape.

Quantitative data underwent rigorous validation through triangulation, cross-referencing supplier shipment records, customs databases, and trade association reports to confirm material flows and distribution patterns. Segmentation frameworks were constructed based on product attributes, end-user applications, material typologies, regulatory criteria, and distribution modalities. Analytical techniques included comparative benchmarking, trend analysis, and scenario-based assessments to elucidate the effects of tariff adjustments and regional variations. Expert panel reviews, comprising veteran safety engineers and compliance auditors, further vetted conclusions to deliver actionable, high-fidelity insights tailored to both strategic planners and operational leaders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Protective Clothing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Protective Clothing Market, by Product Type

- Protective Clothing Market, by Material Type

- Protective Clothing Market, by End User

- Protective Clothing Market, by Application

- Protective Clothing Market, by Distribution Channel

- Protective Clothing Market, by Region

- Protective Clothing Market, by Group

- Protective Clothing Market, by Country

- United States Protective Clothing Market

- China Protective Clothing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings to Highlight How Evolving Technologies, Regulations, and Market Dynamics Will Shape the Future of Protective Apparel

This executive summary highlights how protective clothing markets are being redefined by technological advances, regulatory realignments, and evolving supply chain dynamics. Smart textiles and digital integration are moving protective apparel beyond passive barriers into proactive safety management tools, while circular design principles are reshaping material sourcing and end-of-life workflows. Tariff recalibrations in 2025 underscore the importance of diversified sourcing strategies and localized production capacities to maintain cost efficiency and supply continuity.

Critical segmentation insights reveal that product type, end-user application, material composition, and distribution channels each play decisive roles in shaping market demand and performance expectations. Regional dynamics-from stringent OSHA standards in the Americas to CE marking in EMEA and varied compliance trajectories across Asia-Pacific-underscore the need for tailored go-to-market and certification approaches. Industry leaders, by forging strategic partnerships, investing in sustainable innovation, and reinforcing digital traceability, will secure competitive differentiation. As the protective clothing landscape continues to evolve, sustained adaptability and informed decision-making will determine which organizations emerge as frontrunners in safeguarding global workforces.

Engage with Ketan Rohom to Unlock Comprehensive Market Intelligence and Empower Your Strategic Decisions in the Protective Clothing Industry

To explore tailored insights, cutting-edge innovation strategies, and comprehensive intelligence that drive decisive action, reach out to Ketan Rohom. As Associate Director, Sales & Marketing, he will guide you through the unique advantages and in-depth analysis included in this report, ensuring your organization secures the specialized knowledge needed to stay ahead in the evolving protective clothing landscape. Engage now to transform data into strategic decisions and empower your next phase of growth.

- How big is the Protective Clothing Market?

- What is the Protective Clothing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?