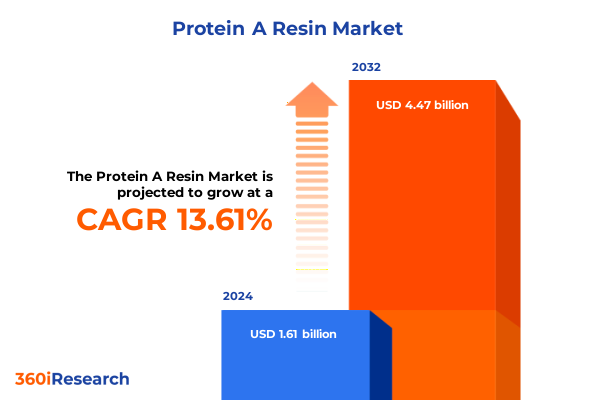

The Protein A Resin Market size was estimated at USD 1.82 billion in 2025 and expected to reach USD 2.07 billion in 2026, at a CAGR of 13.65% to reach USD 4.47 billion by 2032.

Understanding the Critical Role of Protein A Resin in Modern Biopharmaceutical Purification Processes and Its Impact on Product Quality and Yield

Protein A Resin serves as the cornerstone of antibody purification, shaping the efficiency and fidelity of biopharmaceutical production. In recent years, the industry’s reliance on high-purity resins has intensified, driven by surging demand for monoclonal antibodies in therapeutic and diagnostic applications. This introduction outlines the critical function of Protein A Resin within downstream processing and frames the scope of our executive summary, which delves into technological trends, tariff impacts, segmentation nuances, regional variances, and strategic imperatives that companies must navigate today.

By exploring the interplay between evolving market demands and resin technology, this section establishes foundational knowledge that contextualizes subsequent analysis. It underscores why selecting the right resin type, application focus, and purity grade can dramatically influence yield, process economics, and compliance with regulatory standards. In doing so, stakeholders from biotech innovators to contract manufacturing organizations will gain clarity on the strategic importance of resin performance as they seek to optimize process workflows and deliver high-quality biologics.

Exploring the Transformative Technological Advances and Market Dynamics Reshaping Protein A Resin Industry with a Focus on Innovation Drivers

The Protein A Resin landscape is undergoing transformative shifts propelled by breakthroughs in resin design and downstream processing methodologies. Advances in monolithic structures have unlocked higher flow rates and reduced processing times, enabling continuous bioprocessing frameworks that were once unfeasible. Simultaneously, magnetic bead formats have emerged as a versatile solution for small-scale and high-throughput applications, further diversifying the tools available for research institutes and biotechs focusing on rapid assay development.

Synthetic polymer resins, with enhanced chemical stability and tailored surface chemistries, are gaining traction in both industrial and clinical-grade workflows. These formats allow for extended reuse cycles and simplified cleaning protocols, addressing cost and sustainability concerns. As digital control systems and process analytical technologies become more integrated, real-time monitoring and automated adjustments of binding and elution parameters are transforming batch chromatography into an agile, data-driven operation.

These trends collectively signify a move away from one-size-fits-all solutions toward a tiered, application-driven approach to resin selection. Organizations that successfully align resin innovations with process digitization will be best positioned to capitalize on efficiency gains, regulatory compliance, and accelerated time to market.

Assessing the Cumulative Effects of United States Tariffs in 2025 on Protein A Resin Supply Chains Costs and Competitive Landscape for Biotech Firms

United States tariffs implemented throughout 2025 are exerting a cumulative pressure on the Protein A Resin supply chain, prompting companies to reassess sourcing strategies and cost structures. Tariffs targeting resin raw materials such as specialized agarose and synthetic polymer precursors have translated into higher input expenses for both bulk resin manufacturers and prepacked column suppliers. Many vendors have responded by negotiating new supplier agreements, diversifying procurement to include nonaffected regions or domestic production partners.

These shifts have ripple effects on contract manufacturing organizations and pharmaceutical enterprises, which must now factor in extended lead times and potential inventory holding costs. Regulatory complexities compound the challenge, as tariff classifications can differ between raw materials and finished goods. In some cases, downstream users are exploring tariff mitigation through bonded warehousing or tariff engineering-restructuring component assembly to minimize duty exposure.

Despite these pressures, some regionally based suppliers have capitalized on the higher barriers to import by investing in local manufacturing capacity, thereby offering more stable pricing and accelerated delivery. The net result is a realignment of competitive dynamics, where tariff-aware procurement and agile supply chain orchestration have emerged as critical competencies for all stakeholders.

Unveiling Critical Segmentation Insights to Navigate Type, Application, End User, Product Form, Distribution Channels, and Purity Perspectives in the Protein A Resin Market

An in-depth look at market segmentation reveals that resin type diversity has become a defining factor in vendor differentiation. Agarose matrices retain their status as the workhorse format for large-scale antibody capture, yet magnetic bead approaches have gained prominence for rapid screening and diagnostic workflows. Monolithic supports, offering ultra-low pressure drops and high binding capacities, are increasingly adopted in continuous bioprocessing, while synthetic polymer varieties address specialized applications requiring greater chemical resilience.

When examining application-specific demands, monoclonal antibody purification drives the largest resin usage, with diagnostic and therapeutic subsegments exerting distinct performance requirements around purity thresholds and cycle stability. Polyclonal antibodies continue to serve research and niche therapy needs, and recombinant protein purification fosters further innovation in resin ligand engineering.

Turning to end users, biotech startups are leveraging flexible resin formats to accelerate R&D timelines, whereas contract manufacturing organizations prioritize scalable, validated resin solutions. Pharmaceutical companies require consistent clinical- and industrial-grade quality, and research institutes demand cost-effective analytical-grade options. Product form preferences range from bulk resin for in-house column packing to prepacked columns that streamline process validation. Moreover, distribution channels vary between direct manufacturer relationships, distributor networks catering to regional markets, and online portals facilitating rapid reorder. Purity classifications-analytical through industrial grade-guide end users in selecting the most appropriate resin for their quality and regulatory needs.

This comprehensive research report categorizes the Protein A Resin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Product Form

- Purity

- Application

- End User

- Distribution Channel

Deriving Strategic Regional Perspectives from Americas EMEA and Asia-Pacific to Capitalize on Emerging Opportunities and Mitigate Market Challenges in Protein A Resin

Regional considerations in the Protein A Resin market spotlight contrasting growth drivers and pain points across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, robust pharmaceutical R&D infrastructure and high levels of biologics development underpin strong demand for advanced resin formats, with many organizations integrating continuous processing and digital control systems in their purification suites. North American suppliers are increasingly investing in local capacity to mitigate tariff-induced unpredictability and support rapid scale-up for clinical production.

Within EMEA, stringent regulatory frameworks and an emphasis on cost-containment shape resin adoption. Suppliers offering high-cycle stability and extended resin lifetimes align with European manufacturers’ priorities for operational efficiency. Emerging biotech clusters in the Middle East are starting to adopt prepacked columns to reduce qualification timelines, while African markets remain nascent but show promise for growth through partnerships with international service providers.

Asia-Pacific stands out for its rapid expansion in both research and commercial biologics manufacturing capacity, driven by government incentives and rising regional demand. Domestic resin manufacturers have gained footholds by tailoring products to local quality requirements, supported by joint ventures with global technology providers. Supply chain collaborations and regional distribution hubs are key to fulfilling the fast-evolving needs of this dynamic landscape.

This comprehensive research report examines key regions that drive the evolution of the Protein A Resin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Corporate Strategies and Collaborations Driving Innovation and Market Advancement Among Protein A Resin Key Industry Players Worldwide

Leading corporations are defining the competitive contours of the Protein A Resin market through strategic portfolio expansion, alliance formation, and advanced manufacturing investments. One major player has broadened its resin portfolio by acquiring specialized ligand suppliers, enabling customized solutions for both diagnostic and therapeutic-grade purification. Another innovator has forged partnerships with automation platform providers, embedding its resin cartridges within turnkey downstream processing lines to offer an end-to-end value proposition.

Several companies are accelerating capacity growth by commissioning new localized production facilities, thereby reducing exposure to global tariff fluctuations and minimizing logistical complexities. In parallel, research collaborations between resin manufacturers and biotech firms are surfacing next-generation affinity ligands designed for enhanced binding specificity and viral clearance. These R&D alliances underscore a collective push toward higher throughput and more sustainable purification processes.

As competition intensifies, the ability to deliver holistic purification solutions that integrate resin, hardware, and software support will distinguish market leaders. Investments in digital services-such as predictive maintenance algorithms and remote process analytics-are further elevating the bar for corporate differentiation, ensuring that customers receive both product performance and actionable insights.

This comprehensive research report delivers an in-depth overview of the principal market players in the Protein A Resin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Amicogen, Inc.

- Avantor, Inc.

- BIA Separations d.o.o.

- Bio-Rad Laboratories, Inc.

- Cytiva

- GenScript Biotech Corporation

- JSR Life Sciences, LLC

- Kaneka Corporation

- Merck KGaA

- Pall Corporation

- Purolite Co. Ltd.

- Repligen Corporation

- Sartorius AG

- Thermo Fisher Scientific Inc.

- Tosoh Bioscience LLC

Formulating Actionable Strategic Recommendations to Enhance Supply Chain Resilience Foster Innovation and Strengthen Competitive Positioning in the Protein A Resin Sector

Industry leaders seeking to fortify their competitive standing should pursue a multifaceted strategy that balances innovation, resilience, and customer-centricity. First, investment in alternative ligand chemistries and resin support materials can open new performance frontiers, enabling higher binding capacities and improved cleaning cycles. Coupling these material innovations with predictive digital analytics will allow real-time process optimization and reduce unplanned downtime.

Second, diversifying supply sources and developing regional manufacturing hubs will mitigate tariff and logistics risks, ensuring consistency in resin availability and pricing. Partnerships with contract manufacturing organizations should include joint risk-sharing arrangements to align incentives around service levels and quality standards.

Finally, delivering comprehensive purification solutions-bundling prepacked columns, cleaning-in-place protocols, and remote monitoring services-will reinforce vendor stickiness and unlock new revenue streams. By crafting targeted offerings for different purity requirements and end-user profiles, organizations can deepen customer relationships and differentiate their value proposition. Together, these recommendations will empower companies to respond nimbly to market shifts and secure long-term leadership.

Detailing a Robust Mixed Research Methodology Integrating Primary Interviews Secondary Data Sources and Quantitative Validation for Market Intelligence Integrity

Our approach to gathering and analyzing data for this executive summary was rooted in a robust mixed-methodology designed to ensure both depth and validity. Initially, a series of structured interviews and discussions with industry stakeholders-including bioprocess engineers, procurement leads, and regulatory experts-provided firsthand insights into current challenges, technological preferences, and purchase criteria. These primary engagements were complemented by analyses of publicly available technical papers, regulatory guidance documents, and patent filings, which contextualized emerging innovations and compliance considerations.

To triangulate findings, we employed quantitative validation through structured surveys targeting key decision-makers across biotech companies, contract manufacturing organizations, and academic research centers. Data points were cross-verified against secondary sources such as trade association reports and vendor product catalogs. This iterative process of data collection and validation upheld research integrity, while regular quality reviews ensured consistency and objectivity in synthesizing insights.

Overall, the methodology underscores a focus on actionable intelligence, blending qualitative depth with quantitative rigor to support strategic decision-making without relying on speculative projections.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Protein A Resin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Protein A Resin Market, by Type

- Protein A Resin Market, by Product Form

- Protein A Resin Market, by Purity

- Protein A Resin Market, by Application

- Protein A Resin Market, by End User

- Protein A Resin Market, by Distribution Channel

- Protein A Resin Market, by Region

- Protein A Resin Market, by Group

- Protein A Resin Market, by Country

- United States Protein A Resin Market

- China Protein A Resin Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Overarching Conclusions to Illuminate the Future Trajectory of the Protein A Resin Market Landscape and Its Strategic Implications

Bringing together the core findings of this analysis highlights a market in the midst of rapid transformation, where advanced resin technologies intersect with evolving regulatory and trade dynamics. The growing appetite for high-throughput, continuous purification platforms has elevated monolithic and synthetic polymer resins as catalysts of process efficiency, while traditional agarose formats maintain their relevance for large-scale antibody capture. Digital process control and automation are unlocking stewardship of critical quality attributes, driving the industry toward more predictable and reproducible outputs.

Tariff-induced cost pressures have underscored the importance of supply chain agility and localized manufacturing strategies. Companies that proactively diversify sourcing and develop robust tariff mitigation tactics are poised to manage risk more effectively. Segmentation analysis confirms that understanding the nuanced requirements of diagnostic versus therapeutic monoclonal antibody workflows, as well as the diverse needs of biotech innovators, pharmaceutical incumbents, and research institutes, is essential for product portfolio alignment.

Regionally, North America leads in process innovation and digital integration, EMEA prioritizes cost-efficient, high-stability solutions, and Asia-Pacific drives volume expansion through supportive policy measures and domestic capacity growth. As competition intensifies among established players and new entrants, the ability to pair resin performance with turnkey services and digital analytics will define market leadership. This synthesis underscores strategic imperatives for stakeholders to harness technological advances, navigate evolving trade landscapes, and craft customer-centric solutions that align with diverse market segments and regional priorities.

Compelling Call to Engage Ketan Rohom for In-Depth Market Insights Secure Executive Briefings and Accelerate Informed Decision-Making in the Protein A Resin Domain

To obtain a comprehensive understanding of the Protein A Resin market landscape tailored to your organization’s needs and to secure a strategic advantage, we invite you to engage directly with Ketan Rohom. As Associate Director, Sales & Marketing, Ketan brings expert guidance on report customization, exclusive executive briefings, and ongoing market insights to help you make data-driven decisions with confidence.

Reaching out to Ketan will enable access to additional advisory services including one-on-one consultations, tailored workshops, and priority support for future updates. Accelerate your decision-making process and stay ahead of industry trends by partnering with him for personalized recommendations and strategic planning.

Connect with Ketan Rohom today to discuss your specific challenges and objectives, and learn how our detailed market intelligence can empower your team to optimize protein purification workflows, enhance product quality, and drive sustainable growth.

- How big is the Protein A Resin Market?

- What is the Protein A Resin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?