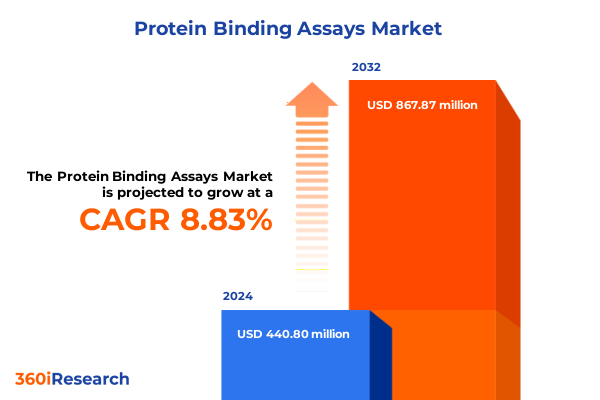

The Protein Binding Assays Market size was estimated at USD 479.09 million in 2025 and expected to reach USD 521.73 million in 2026, at a CAGR of 8.85% to reach USD 867.86 million by 2032.

Exploring the Core Principles and Emerging Significance of Protein Binding Assays in Modern Biomedical Research and Therapeutic Development

Protein binding assays underpin critical advancements in biomedical research and therapeutic discovery by quantifying molecular interactions at an unparalleled level of precision. In recent years, the evolution of biophysical and biochemical methodologies has empowered researchers to measure binding affinities, kinetics, and thermodynamics with greater sensitivity and specificity than ever before. This landscape has been shaped by robust competition among instrumentation suppliers, growing demand for high-throughput screening capabilities, and the integration of automated workflows that streamline experimental design and data analysis.

Researchers across academic and research institutes pursue fundamental insights into protein function and disease mechanisms, while contract research organizations leverage advanced assay technologies to accelerate preclinical validation processes. Diagnostic laboratories increasingly incorporate protein binding assays into biomarker development pipelines, and pharmaceutical and biotechnology companies deploy these techniques across drug discovery, candidate optimization, and proteomics initiatives. Moreover, collaboration among stakeholders continues to drive novel applications beyond traditional use cases, unlocking new avenues for personalized medicine and translational research.

As the strategic importance of protein binding assays intensifies, organizations must adapt to emerging trends in assay types, detection modes, and application areas. This introduction provides context for the subsequent analysis, establishing the foundation for understanding how technological innovations and market dynamics converge to shape the future of protein binding assays.

Identifying the Major Technological and Methodological Innovations Redefining the Protein Binding Assay Landscape in Recent Years

The protein binding assay landscape has undergone transformative shifts driven by breakthroughs in label-free detection technologies and advancements in high-throughput automation. Where traditional methods once relied predominantly on enzyme-linked immunosorbent assays or fluorescence polarization, today’s researchers harness surface plasmon resonance, biolayer interferometry, isothermal titration calorimetry, microscale thermophoresis, and thermal shift assays to obtain detailed kinetic and thermodynamic profiles of biomolecular interactions. These label-free techniques mitigate potential artifacts associated with molecular tagging, enabling more accurate representation of native protein behavior. Furthermore, the integration of robotics and microfluidic platforms has dramatically increased screening capacity, reducing manual intervention and accelerating data acquisition.

Beyond instrumentation, software innovations have enhanced assay data processing and modeling. Advanced algorithms now facilitate real-time monitoring of binding events, automated curve fitting, and predictive analytics, fostering a deeper understanding of complex interaction networks. Artificial intelligence and machine learning applications have begun to emerge, offering predictive insights that inform assay design and optimize experimental parameters. Coupled with cloud-based data management solutions, these developments enable seamless collaboration across research teams and geographies.

Consequently, the landscape of protein binding assays has shifted from isolated, labor-intensive experiments toward fully integrated, data-driven ecosystems. This evolution underscores the imperative for researchers to adopt flexible, interoperable assay platforms and to invest in digital infrastructure that supports scalable workflow automation and cross-institutional knowledge sharing.

Assessing the Comprehensive Effects of 2025 United States Tariff Policies on the Supply Chain Dynamics of Protein Binding Assay Technologies

In 2025, newly implemented United States tariff policies have exerted a cumulative impact on the protein binding assay arena, influencing reagent costs, instrument availability, and supply chain resilience. Tariffs on imported polymers, specialty chemicals, and precision-engineered optical components have incrementally increased the price of assay plates, sensor chips, and detection modules sourced from international manufacturers. As a result, research institutions and commercial laboratories have felt pressure to re-evaluate procurement strategies, balancing the need for cost-efficiency with the imperative to maintain assay performance and reproducibility.

These shifts have triggered strategic responses from both end users and suppliers. Some assay developers have diversified their sourcing channels, seeking alternative suppliers in tariff-exempt jurisdictions or investing in domestic production capabilities to mitigate exposure to import duties. Instrument manufacturers have explored localized assembly and regional distribution centers, reducing logistical bottlenecks and minimizing the impact of cross-border cost fluctuations. Furthermore, collaborative frameworks between reagent providers and research consortia have emerged to negotiate bulk procurement agreements, thereby smoothing price volatility and safeguarding access to critical consumables.

While the short-term effect of increased operational expenditure has been challenging, these adaptations have fostered a more resilient supply chain ecosystem. By proactively addressing tariff-driven disruptions, stakeholders are establishing safeguard mechanisms that will prove beneficial in future periods of geopolitical uncertainty. Moving forward, the ability to pre-emptively adjust sourcing strategies and invest in flexible logistics infrastructure will continue to be a key determinant of sustained assay performance and cost containment.

Unveiling Critical Insights Across Assay Types Detection Modes End User Profiles and Application Areas That Shape Protein Binding Assay Strategies

A nuanced understanding of the protein binding assay market requires attention to multiple segmentation criteria that inform research priorities and purchasing behaviors. When considering assay types, platforms such as Alphascreen, biolayer interferometry, enzyme-linked immunosorbent assay, fluorescence polarization, isothermal titration calorimetry, microscale thermophoresis, surface plasmon resonance, and thermal shift assay each offer distinct advantages for measuring binding kinetics or thermodynamics under various experimental conditions. Detection mode further refines these distinctions into label-based approaches, encompassing Alphascreen, enzyme-linked immunosorbent assays, and fluorescence polarization, and label-free methods, which include biolayer interferometry, isothermal titration calorimetry, microscale thermophoresis, surface plasmon resonance, and thermal shift assays. These classifications guide end users as they select technologies that optimize throughput, sensitivity, or native-state measurements according to their specific research goals.

End users also shape market dynamics through their unique needs. Academic and research institutes prioritize method versatility and data reproducibility to support foundational studies, while contract research organizations focus on scalability and turnaround time to serve multiple clients. Diagnostics laboratories demand high sensitivity and regulatory compliance to enable biomarker validation, and pharmaceutical and biotechnology companies seek integrated workflows that seamlessly link discovery, optimization, and high-volume screening. Application segmentation further delineates usage with categories spanning basic research, diagnostics, drug discovery, and proteomics. Each application drives distinct feature requirements, ranging from low-volume exploratory assays in academic labs to high-throughput screening campaigns in drug discovery pipelines.

By weaving together these segmentation dimensions, stakeholders can align procurement and development strategies with the specific assay types, detection modes, end-user characteristics, and applications that deliver maximal scientific and operational value.

This comprehensive research report categorizes the Protein Binding Assays market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Assay Type

- Detection Mode

- Application

- End User

Discerning Regional Adoption Drivers Infrastructure Strengths and Collaborative Models Shaping Protein Binding Assay Trends Across Key Global Territories

Regional variations in infrastructure investment, regulatory frameworks, and academic–industry collaboration models have produced differing adoption patterns for protein binding assays across major territories. In the Americas, robust funding mechanisms and established clinical research networks underpin widespread deployment of advanced biosensor technologies and high-throughput screening platforms. North American research centers leverage strong domestic manufacturing capabilities for critical assay components, while Latin American institutions emphasize cost-effective methods to address resource constraints and emerging public health priorities.

In Europe Middle East and Africa, European Union directives on data protection and in vitro diagnostic regulation drive stringent validation standards, shaping assay development and adoption. Major research hubs in Western Europe benefit from integrated consortium funding for translational research, whereas Middle Eastern and African markets are experiencing gradual expansion, driven by strategic partnerships and capacity-building initiatives aimed at strengthening local diagnostic and pharmaceutical research infrastructures.

Asia Pacific markets exhibit rapid growth fueled by increasing investment in biotechnology and a growing network of contract research organizations. In countries such as China, Japan, and India, government-backed research grants and incentive programs have accelerated the establishment of state-of-the-art assay laboratories. This region’s diverse regulatory environment encourages local adaptation of global best practices, fostering innovation in assay miniaturization and automation to meet high-throughput screening demands.

Recognizing these regional nuances allows industry participants to tailor market entry strategies, regulatory submissions, and collaborative models for maximum impact and sustainable growth within each territory’s distinctive ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Protein Binding Assays market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Investments Partnerships and Platform Expansions by Leading Organizations Driving Innovation in Protein Binding Assay Solutions

Leading organizations in the protein binding assay domain have distinguished themselves through strategic investments in technology development, targeted acquisitions, and collaborative partnerships. Major players have expanded their portfolios by integrating label-free platforms, advanced microfluidics, and AI-driven data analytics into their existing solutions. Several companies have pursued exclusive partnerships with academic institutions and biotech startups to co-develop next-generation assay reagents and sensor technologies, fostering rapid innovation cycles that address emerging research challenges.

Acquisition strategies have played a pivotal role in consolidating technological capabilities. By acquiring specialized assay development firms, industry leaders have incorporated proprietary detection chemistries and microarray platforms, thereby broadening their addressable customer base. Simultaneously, investments in in-house R&D centers have accelerated the translation of novel assay modalities, such as single-molecule tracking and high-resolution thermodynamic profiling, into commercially available instruments and consumables.

In addition to technology-focused initiatives, these companies have pursued global distribution agreements and regional service networks to enhance customer support and training. This approach ensures end users receive comprehensive guidance on assay implementation-from experimental design through data interpretation-ultimately driving higher adoption rates and customer satisfaction. As market demands evolve, the ability to anticipate research trends and deliver end-to-end solutions will remain a critical differentiator among top assay providers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Protein Binding Assays market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3B Pharmaceuticals GmbH

- Abcam Limited

- Absorption Systems, LLC

- Abzena Ltd.

- ADMEcell, Inc.

- Agilent Technologies, Inc.

- Arrayit Corporation

- Beckman Coulter, Inc.

- BioDuro‑Sundia

- Biotium, Inc.

- Bio‑Rad Laboratories, Inc.

- Charles River Laboratories International, Inc.

- Creative Biolabs, Inc.

- Cyprotex

- Danaher Corporation

- Eurofins Scientific SE

- GE Healthcare

- GVK Biosciences Private Limited

- Merck KGaA

- nanoComposix, Inc.

- PerkinElmer, Inc.

- Promega Corporation

- Sartorius AG

- Sovicell GmbH

- Thermo Fisher Scientific, Inc.

Strategic Imperatives for Leaders to Enhance Platform Flexibility Strengthen Supply Chains and Foster Collaborative Innovation Ecosystems

Industry leaders can capitalize on current trends by prioritizing flexible platform development that accommodates both label-based and label-free detection modalities within a single instrument architecture. This approach enables laboratories to transition seamlessly between assay types such as Alphascreen or fluorescence polarization and biolayer interferometry or surface plasmon resonance, optimizing resource utilization without necessitating multiple standalone systems. Equally important is the establishment of diverse supply chain partnerships that include secondary domestic suppliers for critical components to offset potential geopolitical or tariff-related disruptions.

Moreover, organizations should invest in data management and analytics frameworks that integrate artificial intelligence algorithms for predictive modeling of binding interactions and automated outlier detection. This capability accelerates decision-making, reduces experimental repeat rates, and underpins more robust assay validation processes. Strengthening cross-functional teams with expertise in both life sciences and data science will ensure seamless adoption of these digital solutions.

Finally, leaders should explore collaborative innovation models that bring together instrument vendors, reagent developers, and end users to co-create proprietary assay kits tailored to niche research applications. These partnerships can harness the application-specific knowledge of academic and diagnostic laboratories alongside the technical acumen of assay manufacturers, yielding customized solutions that address unmet needs in drug discovery, biomarker validation, and proteomics. By embedding flexibility, digital intelligence, and collaborative frameworks into their strategic roadmaps, industry participants can sustain competitive advantage in a rapidly evolving landscape.

Detailing Rigorous Qualitative and Quantitative Research Approaches Employed to Deliver Robust Protein Binding Assay Market Intelligence

The research methodology underpinning this analysis combined rigorous secondary research, primary data collection, and expert validation to ensure comprehensive coverage of the protein binding assay domain. Secondary research involved systematic review of peer-reviewed journals, patent filings, conference proceedings, and technical whitepapers to catalog assay technologies, detection modalities, and emerging applications. Concurrently, an extensive database of corporate announcements, financial disclosures, and regulatory filings provided insights into strategic investments, partnership announcements, and supply chain adjustments relevant to tariff impacts.

Primary research consisted of structured interviews with senior scientists, R&D directors, and procurement managers across academic institutions, contract research organizations, diagnostics laboratories, and pharmaceutical companies. These interviews offered real-world perspectives on assay performance priorities, operational challenges, and forthcoming innovation needs. Data triangulation techniques reconciled insights from both secondary and primary sources, while a validation step involved a panel review by independent subject-matter experts to confirm the accuracy and relevance of key findings.

Quantitative analysis employed statistical modeling to identify correlations between adoption drivers, regional variables, and segmentation criteria. This was complemented by qualitative assessments of technology roadmaps and corporate strategy documents to map future innovation trajectories. Together, these methods produced a nuanced, multi-dimensional understanding of the protein binding assay field, supporting robust, actionable intelligence for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Protein Binding Assays market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Protein Binding Assays Market, by Assay Type

- Protein Binding Assays Market, by Detection Mode

- Protein Binding Assays Market, by Application

- Protein Binding Assays Market, by End User

- Protein Binding Assays Market, by Region

- Protein Binding Assays Market, by Group

- Protein Binding Assays Market, by Country

- United States Protein Binding Assays Market

- China Protein Binding Assays Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Key Takeaways to Illuminate Strategic Priorities and Future Innovation Pathways in the Protein Binding Assay Field

This executive summary has outlined the core principles of protein binding assays, highlighted transformative technological shifts, and examined the cumulative effects of 2025 United States tariff policies on supply chains. Key segmentation insights across assay types, detection modes, end users, and applications have illuminated critical usage patterns, while regional analysis underscored the unique drivers and barriers present in the Americas, Europe Middle East and Africa, and Asia Pacific territories. Company profiles have demonstrated how strategic investments, acquisitions, and collaborative models continue to define the competitive landscape.

The actionable recommendations provide a roadmap for industry participants to enhance platform flexibility, diversify supply chains, and harness digital analytics, while the research methodology assures stakeholders of the rigor and validity underpinning these findings. Looking ahead, innovation will be guided by the convergence of label-free detection precision, AI-driven data insights, and collaborative partnerships. Organizations that embrace these imperatives will be poised to accelerate research outcomes, reduce operational risks, and capture emerging opportunities in drug discovery, diagnostics, and proteomics.

Synthesizing these insights reveals a field in dynamic evolution; one characterized by technological convergence, strategic resilience, and a commitment to collaborative innovation. Stakeholders who integrate these strategies stand to lead the next generation of discoveries in protein binding assays.

Connect Directly with Ketan Rohom to Access Tailored Protein Binding Assay Market Intelligence and Strategic Insights

For organizations seeking a deeper understanding of evolving protein binding assay trends and strategic guidance tailored to specific research objectives, direct engagement with Ketan Rohom, Associate Director of Sales & Marketing, will unlock access to comprehensive intelligence and bespoke analytical support. Collaborating with Ketan Rohom ensures timely delivery of insights addressing your organization’s unique challenges, including real-time data on emerging assay methodologies, cost optimization strategies, and regulatory landscapes.

Establishing a partnership through this contact point provides priority scheduling for consultations, enabling stakeholders to refine project scopes and align research roadmaps with actionable market developments. Whether your focus lies in expanding drug discovery pipelines, enhancing diagnostic workflows, or pioneering novel proteomics applications, this tailored consultation will equip your team with the evidence-based direction necessary to accelerate innovation and secure competitive advantage. Engage today to transform high-level market data into impactful decision-making frameworks that drive sustainable growth and research excellence.

- How big is the Protein Binding Assays Market?

- What is the Protein Binding Assays Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?