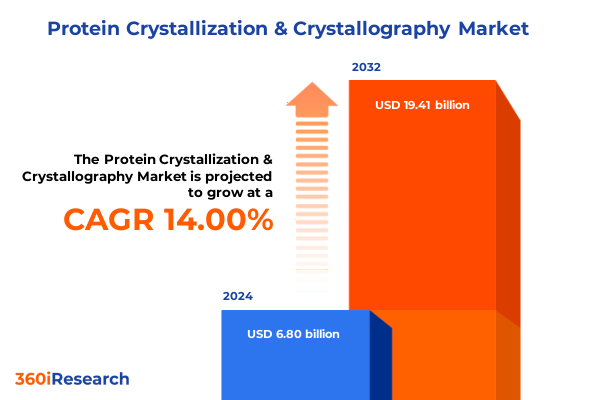

The Protein Crystallization & Crystallography Market size was estimated at USD 7.72 billion in 2025 and expected to reach USD 8.78 billion in 2026, at a CAGR of 14.06% to reach USD 19.41 billion by 2032.

Unveiling the Core Fundamentals and Strategic Context of Protein Crystallization for Advancing Structural Understanding and Therapeutic Innovation

Protein crystallization and crystallography stand at the intersection of fundamental science and transformative application, serving as indispensable tools for elucidating molecular structures. As biomolecules crystallize into highly ordered lattices, they reveal detailed atomic arrangements that underpin crucial insights into biological function. This depth of understanding enables the rational design of targeted therapeutics and the optimization of biotechnological processes. In this context, the executive summary provides a strategic overview of key trends, technological advancements, and emerging opportunities shaping the protein crystallization landscape.

Establishing a robust foundation, this analysis outlines the critical stages of the crystallization workflow, from buffer formulation to diffraction data processing. It highlights how innovations in automation, imaging, and computational modeling have streamlined experimental reproducibility and throughput. Moreover, the convergence of high-throughput platforms with advanced software solutions has accelerated structural biology projects across both academic and commercial settings. Consequently, decision-makers can capitalize on enhanced instrument capabilities and integrative data analysis to reduce time-to-insight, thereby advancing drug discovery pipelines and elevating quality control in protein engineering.

By framing the strategic context alongside emerging market forces, this introduction sets the stage for a deeper exploration of transformative shifts, regulatory influences, segmentation nuances, and regional dynamics. It underscores how stakeholders across consumables, instruments, and software domains must adapt to evolving demands for precision, scalability, and collaborative research. Ultimately, this section equips readers with the conceptual grounding necessary to interpret subsequent insights and craft informed strategic responses in an increasingly competitive and innovation-driven environment.

Examining the Transformative Technological Shifts and Innovative Paradigm Changes Reshaping Protein Crystallography Workflows Across Scientific Sectors

Over the past decade, the protein crystallography landscape has undergone profound technological shifts that redefine experimental workflows and outcome reliability. Contemporary imaging systems now integrate advanced algorithms for automated crystal detection, significantly reducing manual oversight and error rates. In parallel, microfluidic platforms have introduced precise fluid handling at nanoliter scales, enabling researchers to perform crystallization trials with minimal sample volumes while exploring extensive parameter spaces. These developments underscore a broader movement toward miniaturization and automation, yielding higher throughput and reproducibility.

Moreover, crystallization robots equipped with AI-powered screening capabilities have transformed the trial-and-error paradigm into a data-driven process. Machines can now design, execute, and analyze hundreds of crystallization conditions in parallel, learning from previous outcomes to refine subsequent experiments. This iterative intelligence accelerates hit identification and crystallization optimization. In addition, integration of X-ray diffractometers with real-time feedback systems empowers rapid in situ data collection, reducing sample handling and preserving crystal integrity.

Furthermore, the advancement of electron crystallography and neutron diffraction techniques has expanded the methodological toolkit, permitting structural elucidation of challenging samples such as membrane proteins and large macromolecular complexes. Enhanced detector sensitivity and computational reconstruction algorithms facilitate high-resolution models that were previously unattainable. Consequently, these transformative shifts foster a more agile research environment in which stakeholders can pursue complex structural targets with increased confidence and efficiency.

Assessing the Economic and Operational Ramifications of 2025 United States Tariff Policies on Protein Crystallization Supply Chains and Research Ecosystems

In 2025, adjustments to United States tariff policies have introduced tangible economic and operational impacts across the protein crystallization supply chain. Heightened duties on specialized reagents and precision instruments have led procurement teams to revisit sourcing strategies and evaluate the total cost of ownership. For many laboratories, the price increases on buffers, crystallization plates, and advanced imaging systems have prompted negotiations for long-term supply agreements and the exploration of alternative regional vendors. This shift emphasizes resilience and cost management as primary decision criteria.

Beyond cost pressures, regulatory complexities have deepened as customs clearance timelines extend. Research organizations report longer lead times for importing microfluidic platforms, diffraction-grade screens, and high-performance X-ray detectors. These delays can disrupt tightly scheduled structural biology projects, creating bottlenecks in drug discovery timelines. Consequently, stakeholders emphasize the importance of local inventory buffers and closer collaboration with logistics providers to mitigate supply chain friction.

Operationally, manufacturers are reevaluating global manufacturing footprints, with some electing to establish assembly facilities or reagent preparation sites within North America to circumvent trade barriers. At the same time, consortia among academic institutions and industry partners are exploring bulk purchasing initiatives to offset increased procurement costs. Overall, the cumulative effect of tariff adjustments has catalyzed a strategic realignment toward diversified sourcing, regional manufacturing investments, and supply chain agility to sustain research momentum.

Deriving Nuanced Market Segmentation Insights Across Products Technologies Applications and User Verticals to Guide Strategic Decision-Making

Analyzing the market through multiple segmentation lenses reveals nuanced insights that can guide targeted strategies. When evaluating product categories, it becomes evident that consumables and reagents, such as buffers, crystallization plates, and screening kits, serve as the foundational elements for early-stage experiments and command continuous replenishment cycles. Instruments-including crystallization robots, imaging systems, microfluidic platforms, and X-ray diffractometers-drive throughput and resolution improvements, positioning equipment suppliers at the forefront of innovation. Meanwhile, software solutions for data analysis and experimental design unify these components, offering streamlined interfaces and advanced modeling capabilities.

From a technological perspective, electron crystallography enables researchers to resolve structures of smaller or radiation-sensitive samples, while neutron crystallography affords complementary insights into proton positions, crucial for understanding hydrogen bonding networks. These divergent approaches address specific experimental challenges and underscore the value of diversified technology portfolios. Additionally, applications spanning drug discovery, materials science, and structural biology exhibit distinct requirement profiles: drug discovery demands high throughput and regulatory compliance, materials science prioritizes novel compound screening, and structural biology focuses on fundamental mechanistic studies.

End users further refine the landscape, with academic and research institutes driving basic research and method development, contract research organizations offering specialized services for bioanalysis and crystallization optimization, and pharmaceutical and biotechnology companies investing in integrated platforms to accelerate pipeline progression. Recognizing these segments’ unique priorities enables vendors and service providers to tailor offerings that align with experimental objectives, regulatory demands, and budgetary constraints.

This comprehensive research report categorizes the Protein Crystallization & Crystallography market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Application

- End User

Uncovering Regional Dynamics and Divergent Growth Drivers in the Americas Europe Middle East Africa and Asia-Pacific Protein Crystallography Markets

Regional dynamics in the protein crystallization market are shaped by diverse funding landscapes, regulatory frameworks, and research priorities. In the Americas, strong governmental and private investment underpins extensive drug discovery pipelines and academic research hubs. The United States remains a hub for high-throughput crystallization facilities and cutting-edge instrument development, while Latin American research networks are increasingly collaborating on structural biology projects to address regional health challenges. This environment fosters innovation in automation and data analytics platforms.

Across Europe, the Middle East, and Africa, collaborative consortia and EU-funded initiatives drive cross-border research programs that integrate neutron sources, synchrotron facilities, and computational resources. Regulatory harmonization within the EU facilitates reagent and equipment movement, promoting efficiency in multi-site structural studies. At the same time, emerging research centers in the Middle East and North Africa focus on expanding capacity for macromolecular crystallography to support translational research and industrial partnerships.

Asia-Pacific exhibits rapidly growing investments in life sciences infrastructure, with nations establishing national synchrotrons and advanced crystallography centers. Governments are incentivizing public-private partnerships to bolster drug discovery and materials science applications. In addition, regional manufacturers are scaling production of consumables and instruments to serve both domestic and export markets. These trends converge to create a diverse, competitive landscape in which supply chain localization and collaborative research networks are key growth drivers.

This comprehensive research report examines key regions that drive the evolution of the Protein Crystallization & Crystallography market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders Their Strategic Initiatives Collaborations and Technological Innovations Driving Competitive Differentiation

The competitive landscape of protein crystallization and crystallography features established instrument manufacturers, specialized reagent providers, and innovative software developers. Leading equipment companies have prioritized modular designs that support seamless integration of robotics, imaging hardware, and diffraction analysis modules. These strategic initiatives often include partnerships with software vendors to deliver end-to-end solutions that minimize data transfer friction and enhance reproducibility.

Reagent suppliers have differentiated their portfolio by offering advanced buffer systems and proprietary crystallization screens optimized for challenging protein classes. Collaborative research agreements with academic institutions allow them to validate new formulations and adapt to emerging structural targets. Meanwhile, software developers are enhancing machine learning algorithms for crystallization condition prediction and automated data processing, enabling users to navigate complex parameter spaces with greater confidence.

Cross-sector collaborations are becoming increasingly prevalent, with instrument manufacturers forging alliances with biotechnology firms to co-develop bespoke platforms for therapeutic target validation. In parallel, several companies have undertaken open innovation challenges to crowdsource novel crystallization approaches, thereby accelerating methodological breakthroughs. Collectively, these strategic moves emphasize the industry’s focus on interoperability, data-driven automation, and collaborative innovation to maintain competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Protein Crystallization & Crystallography market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Art Robbins Instruments, LLC

- Bio‑Techne Corporation

- Bruker Corporation

- Charles River Laboratories, Inc.

- Creative Biostructure, Inc.

- Danaher Corporation

- Formulatrix, Inc.

- Greiner Bio‑One International GmbH

- Hampton Research Corporation

- Jena Bioscience GmbH

- Merck KGaA

- MiTeGen LLC

- Molecular Dimensions Ltd.

- Oxford Instruments plc

- Proteros Biostructures GmbH

- Revvity, Inc.

- Rigaku Corporation

- SARomics Biostructures AB

- Tecan Group Ltd.

- Thermo Fisher Scientific Inc.

Formulating Actionable Strategic Guidance for Industry Leaders to Optimize Investments Partnerships and Technological Adoption in Crystallography

Industry leaders should prioritize the integration of automated workflows and predictive analytics to enhance experimental efficiency and reliability. By investing in modular robotics platforms that incorporate real-time imaging and AI-driven condition optimization, organizations can reduce trial iterations and accelerate time-to-structure. Establishing strategic partnerships with software providers will further consolidate data management pipelines, enabling seamless transfer from crystallization screening to diffraction data interpretation.

Diversifying supply chain networks is essential in response to ongoing tariff-related pressures. Leaders are advised to evaluate regional manufacturing and distribution hubs to minimize lead times and stabilize reagent availability. Entering consortium-based bulk procurement agreements can also leverage collective purchasing power, mitigating cost volatility and fostering stronger vendor relationships.

Expanding capabilities in electron and neutron crystallography will enable access to structures that challenge conventional X-ray methods. Strategic investment in these complementary technologies, supported by targeted training programs, will empower research teams to address complex biological questions with greater precision. Finally, fostering open innovation ecosystems through academic partnerships and industry consortia will accelerate methodological advances and unlock new applications in drug discovery and materials science.

Detailing the Comprehensive Mixed Methodology Employed to Ensure Data Reliability Integrity and Holistic Market Understanding

This analysis is grounded in a mixed methodology that blends primary and secondary research to ensure data accuracy and comprehensive market understanding. The primary research component involved in-depth interviews with thought leaders across academic institutions, contract research organizations, and pharmaceutical companies, as well as discussions with procurement specialists and R&D managers to capture firsthand insights into operational challenges and technology adoption drivers. Proprietary surveys quantified preferences across product categories, technologies, and applications, delivering nuanced qualitative feedback.

Secondary research encompassed an extensive review of scientific publications, patent filings, and regulatory guidelines, complemented by an examination of publicly disclosed company strategies, partnership announcements, and white papers from instrument and reagent providers. Triangulation of data points was achieved through cross-verification of multiple sources, ensuring consistency and reliability of findings. Furthermore, case studies of recent technological implementations provided context for understanding the practical implications of automation, advanced imaging, and diffraction techniques.

Analytical rigor was maintained through the application of trend analysis frameworks and SWOT evaluations, which were refined through iterative feedback loops with subject matter experts. This methodological approach guarantees that the insights presented are both robust and actionable, reflecting the latest developments and stakeholder perspectives in the protein crystallization and crystallography domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Protein Crystallization & Crystallography market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Protein Crystallization & Crystallography Market, by Product

- Protein Crystallization & Crystallography Market, by Technology

- Protein Crystallization & Crystallography Market, by Application

- Protein Crystallization & Crystallography Market, by End User

- Protein Crystallization & Crystallography Market, by Region

- Protein Crystallization & Crystallography Market, by Group

- Protein Crystallization & Crystallography Market, by Country

- United States Protein Crystallization & Crystallography Market

- China Protein Crystallization & Crystallography Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing the Core Analytical Takeaways to Illuminate Key Opportunities Challenges and Strategic Imperatives in Protein Crystallization

The strategic examination of protein crystallization and crystallography reveals several core imperatives for stakeholders seeking to thrive in this dynamic environment. Technological advancement remains a central pillar, with automation, microfluidics, and AI-driven analytics poised to redefine experimental throughput and accuracy. Concurrently, supply chain agility is critical, especially in light of evolving tariff regimes that can disrupt reagent and instrument availability.

Segmentation insights underscore the importance of aligning product offerings with end-user priorities, whether that be high-throughput consumables for drug discovery, specialized instrumentation for structural biology, or integrated software ecosystems that streamline experimental design. Regional analyses highlight divergent growth drivers, from North American research investments to collaborative EU initiatives and Asia-Pacific infrastructure expansion, signaling opportunities for targeted market entry and partnership formation.

For industry leaders, actionable recommendations concentrate on forging strategic alliances, diversifying supply chains, and investing in complementary crystallography techniques to address complex structural challenges. The methodological transparency underpinning this report ensures that stakeholders can adopt its findings with confidence, positioning them to capitalize on emerging opportunities and mitigate potential disruptions. Ultimately, this executive summary equips decision-makers with a coherent framework for driving innovation and sustaining competitive advantage in protein crystallization and crystallography.

Engaging with Associate Director Ketan Rohom to Secure Exclusive Access to In-Depth Protein Crystallization Market Insights and Drive Business Growth

We invite you to reach out directly to Ketan Rohom, an experienced Associate Director of Sales & Marketing specializing in life sciences research solutions, to explore how this report can inform and accelerate your strategic initiatives in protein crystallization and crystallography. By engaging with Ketan, you will gain tailored insights, hands-on guidance, and exclusive excerpts that align with your organization’s priorities. Leverage his expertise to navigate complex market dynamics, identify high-impact opportunities, and ensure your teams are equipped with the most current and actionable intelligence. Take the next step toward driving innovation in structural biology and drug discovery by contacting Ketan Rohom today to discuss report access options and customized advisory services

- How big is the Protein Crystallization & Crystallography Market?

- What is the Protein Crystallization & Crystallography Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?