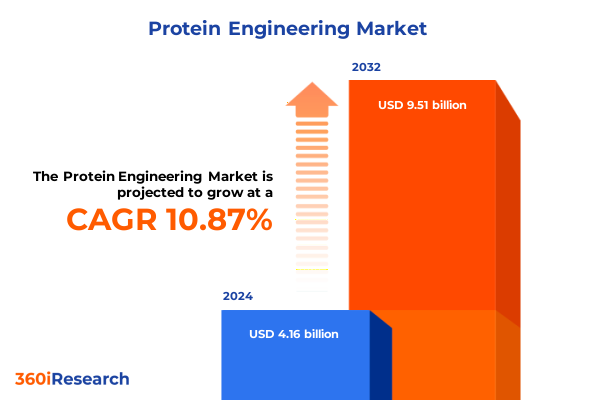

The Protein Engineering Market size was estimated at USD 4.55 billion in 2025 and expected to reach USD 4.98 billion in 2026, at a CAGR of 11.08% to reach USD 9.51 billion by 2032.

Pioneering the Next Generation of Protein Engineering Solutions Through Advanced Technologies and Collaborative Innovations for High-Impact Applications Across Industries

The field of protein engineering stands at the forefront of biotechnology innovation, leveraging precision tools and interdisciplinary approaches to tailor proteins for increasingly complex and high-value applications. Over the past decade, researchers and organizations have harnessed directed evolution, rational design, and gene synthesis strategies to modify enzymes, therapeutic proteins, and biomaterials, thereby accelerating breakthroughs in industries from biopharmaceuticals to sustainable agriculture. This convergence of molecular biology, computational modeling, and high-throughput screening has enabled unprecedented levels of control over protein function, stability, and selectivity, transforming once-theoretical concepts into practical solutions for global challenges.

Amid rising demand for novel biologics, industrial catalysts, and diagnostic reagents, stakeholders across academia, biotech startups, and established life sciences corporations are intensifying their investments in next-generation engineering platforms. Partnerships among instrument manufacturers, reagent suppliers, and software developers have cultivated rich ecosystems where new methodologies are rapidly integrated into laboratory workflows. As a result, organizations are attaining shorter development timelines, higher product quality, and enhanced regulatory compliance. This introduction sets the stage for a detailed exploration of the fundamental shifts, segmentation insights, regional dynamics, and actionable recommendations that will define the protein engineering market landscape through 2025 and beyond.

Unveiling the Convergence of Machine Learning, Automation, and Open Innovation That Is Transforming Protein Engineering Workflows Worldwide

In recent years, the protein engineering landscape has undergone transformative shifts driven by technological breakthroughs and evolving market needs. Machine learning–driven design tools are now predicting protein folding and function with increasing accuracy, reducing the reliance on iterative lab-based screening. These computational platforms are complemented by automation advances in chromatography systems, sequencers, and fermenters that streamline workflows, improve reproducibility, and cut operational costs. Simultaneously, cell-free synthesis and microfluidics have emerged as powerful enablers for high-throughput exploration of protein variants, unlocking possibilities that were unimaginable just a few years ago.

At the same time, the democratization of synthetic biology is fueling a broader participation in protein engineering, with an expanding base of startups and academic spin-offs applying directed evolution and site-directed mutagenesis to create bespoke biocatalysts for biofuel production, waste remediation, and novel therapeutic modalities. The integration of cloud-based analytics and digital twins into instrument control systems is further accelerating data-driven decision-making, enabling scientists to iterate designs in silico before committing to costly wet-lab experiments. These shifts not only reflect a maturation of core technologies but also underscore a move toward open innovation, where data sharing and collaborative platforms are becoming essential to staying ahead in a crowded, fast-paced market.

Analyzing the Far-reaching Consequences of New United States Tariff Policies on Protein Engineering Supply Chains and Collaborative Dynamics

The introduction of new United States tariffs on imported laboratory instruments, reagents, and consumables in early 2025 has reverberated across the global protein engineering supply chain. Increased duties have led to higher prices for chromatography systems, fermenters, and sequencers sourced from key manufacturing hubs, prompting researchers to reevaluate procurement strategies and consider onshoring options. Simultaneously, reagents and consumables such as enzymes, kits, and oligonucleotides have experienced cost pressures, amplifying budget constraints for both academic and corporate R&D programs. These developments have spurred innovation in reagent-free and minimal-reagent workflows, as well as greater emphasis on sourcing materials from domestic or allied producers.

Beyond direct cost implications, the tariff regime has influenced collaborative dynamics among multinational biotech firms and contract research organizations. With cross-border partnerships subject to increased logistical complexity, stakeholders are accelerating efforts to localize manufacturing of critical supplies and to establish regional centers of excellence. In parallel, software and service providers are stepping in to offer virtual laboratory solutions that reduce dependency on imported hardware. Collectively, these responses have reshaped market priorities, with resilience and supply chain diversification becoming as critical as technological sophistication in driving protein engineering initiatives.

Delineating Core Product Categories Technology Platforms Applications and End Users to Uncover Key Insights in Protein Engineering Market Segmentation

In assessing the protein engineering market through the lens of product category, the spectrum spans instruments, reagents and consumables, and software and services. Within instruments, the evolution of chromatography systems has unlocked higher-resolution purification capabilities, while advanced fermenters support scalable production and sequencers enable rapid genomic analysis. For reagents and consumables, novel enzyme formulations and precision-designed kits are fueling greater efficiency in directed evolution and site-directed mutagenesis workflows, alongside specialized oligonucleotides that streamline gene synthesis protocols. Meanwhile, software platforms and service offerings are converging to provide integrated solutions for data analysis, workflow automation, and regulatory compliance.

From the technology platform perspective, directed evolution, gene synthesis, and site-directed mutagenesis form the core methodologies. Directed evolution is split between DNA shuffling approaches that recombine genetic diversity pools and error-prone PCR techniques that introduce targeted mutations, each accelerating the discovery of high-performance variants. Gene synthesis platforms differentiate into gene fragment synthesis, which assembles short oligonucleotide building blocks, and synthetic gene assembly, which constructs full-length sequences for complex engineering tasks. Site-directed mutagenesis approaches divide into random mutagenesis strategies for broad exploration and rational mutagenesis guided by structural and computational insights.

When evaluating applications, agricultural biotechnology has become a proving ground for protein-engineered traits focused on crop improvement and enhanced pest resistance, contributing to sustainable yield gains. Industrial enzyme engineering is driving innovations in biofuels, where designer cellulases and esterases improve biomass conversion, and in detergents, with bespoke proteases and lipases that boost cleaning efficacy under mild conditions. Therapeutic protein development is witnessing rapid growth in monoclonal antibody engineering, optimizing binding affinity and stability, as well as vaccine design leveraging recombinant and peptide-based strategies.

Considering end users, academic and research institutes remain pivotal in early-stage discovery, supported by specialized research centers and universities that cultivate skilled talent and foundational methodologies. Biotechnology companies, spanning mid-size enterprises and agile startups, are translating proof-of-concept studies into commercial products, while contract research organizations, both clinical and preclinical, are providing crucial outsourced expertise for candidate screening and regulatory studies. Large pharmaceutical companies and smaller biopharma firms are investing heavily to incorporate protein engineering into their pipelines, seeking to enhance therapeutic portfolios with next-generation biologics.

This comprehensive research report categorizes the Protein Engineering market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Category

- Technology Platform

- Application

- End User

Examining the Diverse Regional Drivers and Strategic Priorities Shaping Protein Engineering Adoption Across Americas EMEA and Asia-Pacific

Regional dynamics in the protein engineering market reveal divergent growth trajectories and strategic priorities. In the Americas, strong funding landscapes, robust academic–industry collaborations, and a concentration of leading biotech clusters drive continuous innovation. North American research institutes and life sciences hubs benefit from supportive government policies and venture capital influx, positioning the region as a global leader in advanced engineering platforms and therapeutic protein development.

Across Europe, the Middle East, and Africa, diverse regulatory environments and varying levels of infrastructure investment shape market adoption. Western Europe maintains a competitive edge in precision instruments and high-end reagents, supported by an established network of contract research organizations. Meanwhile, emerging markets in the Middle East and North Africa are nurturing local biotech capabilities through targeted grant programs and public–private partnerships, aiming to reduce dependence on imported technologies. Sub-Saharan Africa, though historically underinvested, is beginning to leverage protein engineering for crop resilience and public health applications.

In Asia-Pacific, rapid industrialization and government-driven biotech initiatives have fueled substantial growth. China, India, Japan, and South Korea are investing heavily in domestic manufacturing of instruments and reagents, while also scaling up research initiatives in therapeutic proteins and industrial enzymes. Collaborative consortia between academia and industry are fostering technology transfer, and incentives for local production are reshaping global supply chains. As a result, the region is emerging as both a major consumer and a formidable competitor in the global protein engineering arena.

This comprehensive research report examines key regions that drive the evolution of the Protein Engineering market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping the Competitive Protein Engineering Landscape Through Strategic Collaborations Acquisitions and Technological Differentiation

The competitive landscape of protein engineering is defined by a mix of established life sciences conglomerates and innovative niche players. Leading instrument manufacturers continue to refine chromatography systems, fermenters, and sequencers to offer higher throughput and modular scalability. Meanwhile, specialized reagent and consumable providers are introducing next-generation enzymes and oligonucleotides optimized for precision engineering tasks. Software and service organizations are intensifying development of AI-driven analytics and cloud-based workflow platforms that deliver end-to-end data integration and compliance support.

Strategic partnerships and acquisitions have become a hallmark of industry activity, as companies seek to complement internal capabilities with external expertise. Large pharmaceutical and biotechnology firms are forging alliances with academic institutions and startups to co-develop tailored protein solutions, while contract research organizations are expanding their service portfolios through targeted investments in automated engineering platforms. At the same time, venture-backed startups are disrupting traditional value chains by offering turnkey directed evolution services and proprietary mutagenesis technologies, challenging incumbents to innovate or collaborate to maintain market share.

This comprehensive research report delivers an in-depth overview of the principal market players in the Protein Engineering market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abcam plc

- AbCellera

- ABZENA PLC

- Agilent Technologies Inc

- Amgen Inc

- AMSilk GmbH

- Arzeda

- AstraZeneca plc

- Bio-Rad Laboratories Inc

- Biomatter

- Codexis Inc

- Creative Biomart

- Cyrus Biotechnology Inc

- Danaher Corporation

- Eli Lilly and Company

- Evozyne

- Genentech Inc (a member of the Roche Group)

- GenScript Biotech Corporation

- Johnson & Johnson

- Lonza Group AG

- Merck KGaA

- Nabla Bio

- New England Biolabs

- PerkinElmer Inc

- Thermo Fisher Scientific Inc

Driving Growth Through Integrated Design Automation Supply Chain Diversification and Collaborative Innovation in Protein Engineering

Industry leaders must adopt a multi-pronged approach to capitalize on the dynamic protein engineering ecosystem. First, integrating computational design tools with automated laboratory platforms will streamline R&D cycles and reduce time-to-market for novel products. Investing in hybrid workflows that combine in silico predictions with high-throughput experimental validation can unlock greater efficiency and discovery potential. Second, diversifying supply chains by qualifying multiple sources for critical instruments and reagents, and exploring domestic manufacturing partnerships, will mitigate risks associated with tariff fluctuations and geopolitical uncertainties.

Third, fostering open innovation through consortia and data-sharing frameworks can accelerate progress in challenging application areas such as therapeutic antibody engineering and industrial biocatalysis. Organizations should consider establishing collaborative research agreements with academic and startup ecosystems to access specialized expertise and novel platforms. Fourth, prioritizing workforce development by upskilling scientists in bioinformatics, automation, and regulatory affairs will ensure teams can effectively leverage emerging tools and navigate complex compliance landscapes. Finally, monitoring evolving policy trends and participating in industry advocacy will help shape favorable regulatory environments that support sustainable growth and innovation.

Leveraging a Rigorous Framework of Secondary Review and In-depth Primary Interviews to Deliver Actionable Protein Engineering Market Intelligence

The research methodology underpinning this report combines rigorous primary and secondary data collection to ensure comprehensive market insights. In the initial phase, a thorough review of peer-reviewed literature, patent filings, industry white papers, and regulatory filings established a foundational understanding of historical trends and technological developments. Secondary sources also encompassed company financial reports, investor presentations, and conference proceedings from leading biotechnology forums.

Building on this foundation, extensive primary research was conducted through in-depth interviews with key opinion leaders, including research directors at academic institutions, R&D heads at biotech and pharmaceutical companies, and executives at leading instrument and reagent providers. Additional insights were gathered via structured surveys distributed to professional associations and contract research organizations. Data triangulation techniques were employed to validate findings across multiple sources and ensure consistency.

Quantitative analysis involved mapping product portfolios, technology adoption rates, and application areas, while qualitative assessments evaluated competitive strategies, partnership dynamics, and regulatory impacts. Expert panels convened to review preliminary findings and refine key assumptions, ensuring the final recommendations reflect both empirical data and strategic foresight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Protein Engineering market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Protein Engineering Market, by Product Category

- Protein Engineering Market, by Technology Platform

- Protein Engineering Market, by Application

- Protein Engineering Market, by End User

- Protein Engineering Market, by Region

- Protein Engineering Market, by Group

- Protein Engineering Market, by Country

- United States Protein Engineering Market

- China Protein Engineering Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Aligning Innovation Agility Supply Chain Resilience and Collaborative Ecosystems to Navigate the Future of Protein Engineering Market

The protein engineering market is poised for sustained growth, fueled by converging advances in computational biology, automation, and synthetic biology. Despite challenges posed by evolving tariff environments and supply chain complexities, the field’s intrinsic value proposition-designing proteins with enhanced functionality for therapeutic, industrial, and agricultural applications-remains compelling. Stakeholders who embrace integrated workflows, diversify supply sources, and engage in collaborative ecosystems will be best positioned to capture emerging opportunities.

As companies continue to refine their technology stacks and establish strategic partnerships, the competitive landscape will favor those that balance innovation agility with operational resilience. Regional market variations present both growth potential and considerations for localized strategies, underscoring the importance of informed decision-making. Ultimately, the ability to anticipate technological shifts, navigate regulatory changes, and cultivate interdisciplinary talent will define success in the protein engineering arena.

Empower Your Strategic Decisions with the Definitive Protein Engineering Market Research Report and Expert Guidance with Ketan Rohom

To secure your organization’s competitive advantage in the rapidly evolving protein engineering arena, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, and gain instant access to the comprehensive market research report that will guide your strategic decisions and growth plans.

- How big is the Protein Engineering Market?

- What is the Protein Engineering Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?