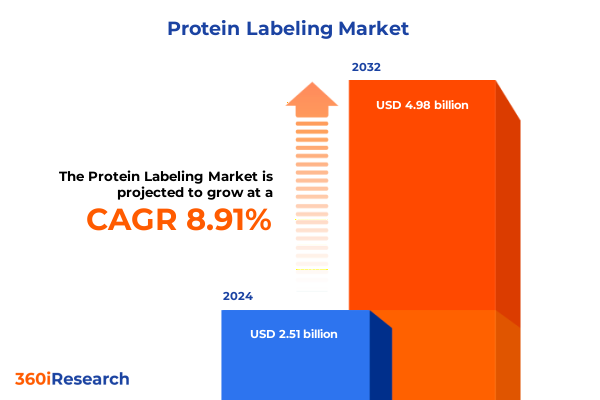

The Protein Labeling Market size was estimated at USD 2.73 billion in 2025 and expected to reach USD 2.98 billion in 2026, at a CAGR of 8.93% to reach USD 4.98 billion by 2032.

Exploring the Evolving Protein Labeling Ecosystem and Its Strategic Importance for Modern Bioscience Applications

Protein labeling stands at the forefront of modern bioscience, providing essential tools for detection, quantification, and visualization of proteins across research and industrial applications. By attaching diverse labels-ranging from affinity tags to fluorescent dyes-scientists unlock the ability to track protein interactions, monitor cellular events, and develop diagnostic assays with unprecedented precision. As laboratory workflows evolve toward high-throughput and single-cell analyses, the demand for reliable, sensitive, and multiplexed labeling solutions has surged. Simultaneously, interdisciplinary advances in nanotechnology, enzyme engineering, and isotope chemistry have expanded the palette of available labels, driving innovation and enabling new experimental paradigms.

Against this backdrop, stakeholders in academia, biotechnology, and pharmaceutical sectors are reevaluating their protein labeling strategies to harness next-generation capabilities. Strategic decisions now encompass not only selecting optimal labeling chemistries but also navigating complex supply chains, regulatory frameworks, and intellectual property landscapes. In this context, a holistic understanding of market dynamics, technological trajectories, and end-user requirements is imperative. This executive summary provides a concise yet thorough overview of the market environment, spotlighting transformative trends, segmentation insights, regional nuances, and practical guidance for industry leaders. By synthesizing diverse data sources and expert perspectives, it delivers the clarity needed to inform strategic investments and drive competitive differentiation.

Uncovering Disruptive Technological Advancements and Collaborative Breakthroughs Shaping the Protein Labeling Sector’s Future Trajectory

The protein labeling landscape is undergoing rapid transformation driven by the convergence of novel chemistries, advanced instrumentation, and digital data analytics. Recent breakthroughs in quantum dot synthesis and organic dye engineering have pushed the boundaries of fluorescent labeling, yielding probes with enhanced brightness, photostability, and tunable emission spectra. Meanwhile, affinity labeling techniques are benefiting from breakthroughs in bioconjugation, enabling site-specific attachments that preserve protein functionality. Such advancements facilitate multiplexed imaging workflows that generate richer datasets and reveal complex cellular mechanisms in real time.

Concurrently, enzymatic labeling reagents have evolved through protein engineering, with alkaline phosphatase variants and engineered horseradish peroxidase enzymes delivering improved signal-to-noise ratios for immunoassays and western blotting workflows. Integrations with mass spectrometry have been strengthened as isotopic and bio-orthogonal labels become more accessible and easier to incorporate into proteomic pipelines. Additionally, the rise of digital microscopy platforms, coupled with AI-driven image analysis, has created synergistic opportunities for higher-resolution visualization and automated quantification.

These technological shifts are accompanied by strategic collaborations across academic groups, instrument manufacturers, and reagent suppliers, fostering co-development of integrated solutions. As a result, end users increasingly demand packaged offerings that combine specialized labeling chemistries with compatible detection platforms and software analytics. This trend is catalyzing a consolidation of expertise and emphasizing the value of interoperable, turnkey systems that accelerate research timelines and reduce operational complexity.

Assessing How the 2025 United States Tariff Adjustments Are Reshaping Material Costs Supply Chains and Competitive Dynamics in Protein Labeling

In 2025, adjustments to U.S. import duties have had a pronounced effect on the cost structures and supply chain strategies within the protein labeling domain. Tariffs imposed on critical raw materials, including specialty isotopic reagents and high-purity enzymes, have elevated procurement expenses and pressured margins for reagent suppliers and kit manufacturers alike. In response, several organizations are reevaluating their sourcing models by exploring alternative suppliers in tariff-free regions or investing in localized manufacturing capabilities to mitigate import duty exposure.

This shift has also encouraged diversification of raw material portfolios, with research and development teams seeking synthetic analogs and enzyme mimetics that fall outside the highest tariff brackets. Moreover, the increased cost of transporting high-value labeling dyes has prompted consolidation of orders and optimization of logistic routes, ensuring full utilization of each international shipping container. While some established vendors have absorbed tariff hikes to maintain competitive pricing, smaller players are leveraging lean supply chains and strategic partnerships to preserve margins without passing significant increases onto end users.

From a regulatory perspective, the tariffs have accentuated the importance of compliance documentation and accurate classification of chemical substances. Companies are enhancing their customs and trade compliance functions to streamline classification processes, avoid penalties, and speed up customs clearance. As the marketplace adjusts, collaborative consortia among suppliers, contract research organizations, and academic laboratories are sharing best practices to navigate the evolving tariff environment, safeguarding continuity of research programs and diagnostic testing services.

Illuminating Diverse Product and Application Segments to Reveal Hidden Opportunities Within the Protein Labeling Market’s Intricate Structure

The protein labeling market exhibits a multifaceted segmentation structure that drives divergent growth opportunities across label types, applications, product offerings, end users, and techniques. Within label chemistries, affinity labeling remains a cornerstone for targeted detection, while biotin labeling continues to provide versatile conjugation handles for affinity-based assays. Enzymatic labeling, led by alkaline phosphatase and horseradish peroxidase systems, sustains robust demand in immunoassays and blotting protocols. Fluorescent labeling spans organic dyes-ranging from Alexa Fluor families to FITC and Rhodamine-and quantum dots such as cadmium selenide and indium phosphide nanoparticles, delivering superior multiplexing capabilities. Isotopic labels divide into traditional radioisotopes like 14C and 35S, alongside stable isotopes including 13C and 15N, which serve the expanding needs of quantitative proteomic studies.

Application segmentation further illuminates the market’s complexity. Flow cytometry has bifurcated into multi-color and single-color analysis workflows, each optimized for high-throughput cell phenotyping or simplified marker detection. Immunoassays encompass ELISA formats-competitive and sandwich-as well as western blotting variants that employ chemiluminescent or colorimetric readouts. Mass spectrometry methodologies include electrospray ionization mass spectrometry and MALDI-TOF platforms for high-resolution protein identification. Microscopy extends from confocal imaging to traditional fluorescence setups, while proteomics distinguishes between qualitative approaches, such as gel electrophoresis and mass spectrometry analysis, and quantitative techniques leveraging iTRAQ, SILAC, or TMT strategies.

Product type segmentation divides the domain into kits-offering fluorescent or radioactive labeling kits designed for streamlined workflows-and reagent portfolios, which encompass purified enzymes, isotopic reagents, and a spectrum of labeling dyes. End users span academic research institutes, biotechnology enterprises, contract research organizations, diagnostic laboratories, and pharmaceutical companies, each driving distinct demands for throughput, reproducibility, and regulatory compliance. Finally, labeling techniques differ between direct approaches-chemical or enzymatic attachments-and indirect systems based on biotin-avidin interactions or secondary antibody labeling, underlining the importance of method selection in assay design.

This comprehensive research report categorizes the Protein Labeling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Label Type

- Technique

- Application

- End User

Analyzing Regional Dynamics Across the Americas Europe Middle East Africa and Asia Pacific to Unveil Growth Patterns in Protein Labeling

Regional dynamics in the protein labeling arena reflect converging yet distinct drivers across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, strong academic research infrastructures and a robust pharmaceutical development pipeline fuel demand for advanced labeling reagents. Investments in biologics and personalized medicine have amplified usage of fluorescent and enzymatic labels, while regulatory incentives for domestic manufacturing have encouraged capacity expansions among key reagent suppliers.

Within Europe, Middle East and Africa, the market is characterized by stringent regulatory environments and a growing emphasis on diagnostic innovation. Fluorescence-based immunoassays and mass spectrometry proteomics are expanding, driven by public health initiatives and collaborations between research consortia and diagnostic laboratories. Manufacturers in this region are increasingly partnering with contract research organizations to co-develop tailored labeling solutions, optimizing products for localized compliance requirements.

Asia Pacific continues to emerge as the fastest-growing region, underpinned by rapid expansion of academic institutions, biotechnology startups, and contract research organizations. The rise of precision medicine programs in China, South Korea, and Japan has accelerated adoption of multiplexed fluorescent dyes and stable isotope-based proteomic workflows. Meanwhile, growing investments in manufacturing infrastructure and favorable trade agreements have attracted global reagent and kit producers to establish regional hubs, ensuring faster market access and enhanced technical support for end users.

This comprehensive research report examines key regions that drive the evolution of the Protein Labeling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Corporations and Agile Innovators Driving Technological Progress Partnership Strategies and Competitive Differentiation in the Protein Labeling Field

The competitive landscape of protein labeling is dominated by a blend of established multinational corporations and agile specialty firms. Industry leaders such as Thermo Fisher Scientific, Merck Millipore, GE Healthcare, Abcam, and Bio-Rad have leveraged extensive product portfolios, comprehensive distribution networks, and deep application expertise to maintain market predominance. These organizations continuously invest in research collaborations and acquisition strategies to integrate cutting-edge chemistries, proprietary labeling platforms, and digital analytics capabilities, thereby solidifying their foothold across diverse end-user segments.

At the same time, emerging innovators are carving out niche positions by focusing on unique value propositions. Companies like LabelTech are developing novel organic dye libraries tailored for spectral unmixing, while QuantumBio pioneers quantum dot formulations designed for low-toxicity applications in live-cell imaging. IsoMark is distinguishing itself through customizable isotopic reagent kits optimized for high-throughput proteomic quantification. These specialized players often collaborate closely with academic laboratories to accelerate product validation and refine performance characteristics, positioning themselves as preferred partners for bespoke research applications.

Contract research organizations and diagnostic solution providers are also playing an influential role by integrating proprietary labeling workflows into turnkey services. This segment’s growth has fostered deeper partnerships with reagent suppliers and instrument manufacturers, enabling co-development of end-to-end platforms that address specific workflow challenges. As a result, the market is witnessing a dynamic interplay between large incumbents and focused challengers, each driving innovation and expanding the scope of protein labeling capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Protein Labeling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abcam plc

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Bio-Techne Corporation

- Danaher Corporation

- LI-COR Biosciences

- Merck KGaA

- PerkinElmer, Inc.

- Promega Corporation

- Thermo Fisher Scientific Inc.

Strategic Actions Industry Leaders Should Adopt to Harness Innovation Enhance Market Position and Navigate Evolving Regulatory and Trade Landscapes

Industry leaders should prioritize investments in next-generation labeling chemistries, particularly those that offer enhanced multiplexing and compatibility with emerging detection platforms. By allocating R&D resources toward advanced organic dye engineering, quantum dot optimization, and enzyme mimetic development, organizations can create differentiated product offerings that cater to evolving end-user demands. Simultaneously, diversifying supply chain partnerships and exploring nearshore manufacturing options will mitigate risks associated with import tariffs and logistical disruptions.

Furthermore, forging strategic alliances with instrument vendors and software developers can accelerate time-to-market for integrated solutions. Co-marketing agreements and joint development programs should focus on interoperability, enabling seamless workflows from labeling reagent selection to data analysis. In parallel, industry stakeholders must strengthen their regulatory and compliance capabilities to navigate complex classification systems and expedite product introductions in key markets.

To capitalize on regional growth trajectories, companies should tailor portfolio strategies for the Americas, EMEA, and Asia Pacific. This entails developing application-specific kits for diagnostic laboratories in Europe, offering localized technical support and training programs, and establishing regional hubs in Asia Pacific to serve the rapidly expanding research community. Finally, leveraging digital marketing channels, virtual demonstration platforms, and customer-centric training initiatives will enhance brand visibility, foster user adoption, and reinforce long-term customer relationships.

Detailing the Rigorous Multi Source Research Framework Data Validation and Expert Engagement Processes Underpinning Our Protein Labeling Market Insights

This report’s insights are grounded in a rigorous, multi-source research methodology that combines primary interviews, secondary data analysis, and expert panel validation. First, in-depth discussions were conducted with senior executives across reagent suppliers, instrument manufacturers, contract research organizations, and end-user laboratories to capture qualitative perspectives on technological trends, supply chain challenges, and purchasing behaviors. These interviews informed the development of detailed segmentation frameworks and hypothesis generation.

Next, secondary research leveraged peer-reviewed publications, patent filings, regulatory filings, and industry conference proceedings to corroborate primary findings and track recent product launches. Data triangulation techniques were applied to ensure consistency across disparate sources, enhancing the reliability of thematic conclusions. Market intelligence databases and citation analysis tools were also employed to identify high-impact innovations and emerging players that may not yet be widely recognized.

Finally, a panel of subject matter experts-including protein chemists, process engineers, and bioinformatics specialists-reviewed preliminary draft insights, providing critical feedback on methodological assumptions and validating market narratives. Quality control measures, such as consistency checks and iterative revisions, were implemented throughout the research process to maintain analytical rigor. The resulting synthesis offers a balanced, comprehensive perspective on the protein labeling landscape, providing actionable intelligence for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Protein Labeling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Protein Labeling Market, by Product Type

- Protein Labeling Market, by Label Type

- Protein Labeling Market, by Technique

- Protein Labeling Market, by Application

- Protein Labeling Market, by End User

- Protein Labeling Market, by Region

- Protein Labeling Market, by Group

- Protein Labeling Market, by Country

- United States Protein Labeling Market

- China Protein Labeling Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 4134 ]

Synthesizing Key Findings and Strategic Imperatives to Guide Stakeholders Toward Informed Decision Making in the Protein Labeling Arena

As protein labeling continues to evolve, the convergence of advanced chemistries, digital analytics, and dynamic supply chain strategies will define the next phase of innovation. The interplay between fluorescent dyes, quantum dots, enzymatic reagents, and isotopic labels underscores the market’s technical diversity, while shifts in tariff regimes and regional investment priorities highlight the importance of adaptive strategies. By understanding the nuanced segmentation of label types, applications, product offerings, end-user requirements, and techniques, stakeholders can identify high-potential niches and align their resources accordingly.

The competitive landscape, marked by both established industry titans and specialized challengers, reinforces the value of strategic partnerships and targeted R&D investments. Entities that successfully integrate complementary capabilities-from reagent formulation to instrument compatibility and software analytics-will be best positioned to deliver end-to-end solutions that resonate with diverse customer needs. Moreover, a proactive approach to regulatory compliance and supply chain optimization will buffer organizations against external shocks and regulatory complexities.

Ultimately, the protein labeling market offers a fertile ground for innovation and growth. Organizations that leverage granular market intelligence, embrace collaborative ecosystems, and adopt forward-looking operational strategies will secure competitive advantage. The insights presented herein provide a roadmap for stakeholders seeking to navigate the complexities of the current landscape and capitalize on emerging opportunities.

Connect with Ketan Rohom Today to Unlock Exclusive Protein Labeling Market Intelligence Customized Solutions and Drive Growth Opportunities

To uncover the opportunities that lie within the intricacies of the protein labeling market, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He will guide you through a tailored exploration of comprehensive market intelligence, ensuring you receive the precise strategic insights you need. Engage directly with Ketan to access the full depth of our expert analysis, benchmark your competitive positioning, and gain customized recommendations that align with your organization’s unique goals. Begin the conversation today to transform data into actionable plans and elevate your market impact with the definitive research report.

- How big is the Protein Labeling Market?

- What is the Protein Labeling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?