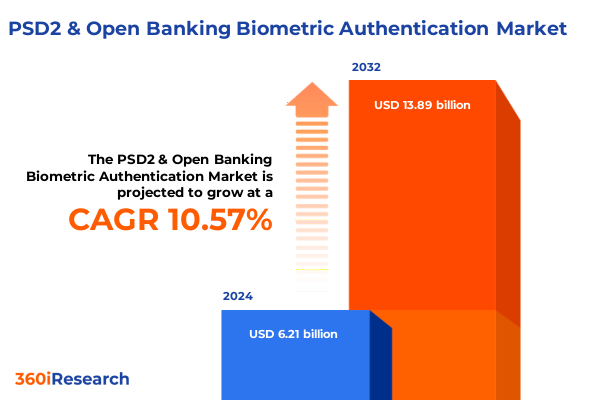

The PSD2 & Open Banking Biometric Authentication Market size was estimated at USD 6.88 billion in 2025 and expected to reach USD 7.55 billion in 2026, at a CAGR of 10.54% to reach USD 13.89 billion by 2032.

Redefining Financial Authentication Strategies through Innovative PSD2 and Open Banking Biometric Solutions in an Era of Heightened Security

The financial services landscape is undergoing a profound transformation driven by regulatory mandates and rapid technological innovation. As Open Banking initiatives like PSD2 compel institutions to rethink traditional customer authentication approaches, biometric authentication has emerged as a cornerstone capability. By leveraging unique physical and behavioral traits-from fingerprint and facial recognition to gait analysis-organizations can deliver frictionless yet robust user experiences while simultaneously addressing stringent security and compliance requirements.

In this dynamic environment, the convergence of digital banking, mobile proliferation, and heightened cybersecurity threats has accelerated the shift toward biometric-based solutions. Consumers have grown accustomed to seamless interactions in other technology domains and now expect the same fluidity when accessing financial services. Meanwhile, financial institutions and fintech players recognize that meeting these expectations is critical to driving customer retention, mitigating fraud, and unlocking new revenue streams.

This report delves into how biometric authentication is reshaping the Open Banking landscape, tracing the evolution of standards, exploring technological enablers, and highlighting best practices for implementation. It provides a strategic overview designed to equip decision-makers with the context required to navigate this emerging frontier of secure, user-centric financial services.

Navigating the Convergence of Regulatory Mandates and Technological Advances Driving a New Paradigm in Biometric Authentication for Open Banking

Regulatory frameworks and technological capabilities are intersecting to create a paradigm shift in how financial institutions secure customer identities. PSD2 opened the door to third-party providers, mandating stronger customer authentication and secure communication channels. This has spurred a wave of innovation as banks and fintechs deploy advanced biometric modalities-such as iris scanning and voice recognition-to satisfy regulatory requirements while differentiating the user experience.

Simultaneously, breakthroughs in artificial intelligence and machine learning are driving the maturation of behavioral biometrics. Gait analysis and keystroke dynamics now provide continuous, passive authentication, enabling real-time risk assessment without disrupting the user journey. These capabilities extend beyond initial login, offering ongoing validation throughout the banking session.

Moreover, the integration of biometric systems with cloud-native architectures fosters scalability and flexibility, allowing organizations to customize deployment models, whether private or public cloud, to meet security and cost objectives. As these transformative shifts coalesce, market actors are rethinking their strategies to move from legacy password-based systems toward a holistic, multimodal biometric approach that embraces converged risk management and customer-centricity.

Assessing the Ripple Effects of 2025 United States Tariff Policies on Biometric Device Supply Chains and Industry Cost Structures

In 2025, the imposition of elevated United States tariffs on semiconductor imports and hardware components has reverberated across the biometric authentication supply chain. Device manufacturers have experienced increased input costs for sensors and integrated circuits, prompting recalibration of sourcing strategies. As a result, many vendors are exploring nearshoring alternatives and fostering deeper partnerships with domestic foundries to mitigate exposure to trade policy volatility.

These cost pressures have had a cascading impact on product roadmaps, with research and development investments being reprioritized. Some companies have shifted focus toward software-centric authentication modules that leverage existing consumer hardware, thereby reducing reliance on specialized biometric sensor procurement. Others have accelerated strategic alliances with regional assemblers to streamline logistics and benefit from preferential trade agreements.

Beyond procurement, end users in financial services are reassessing total cost of ownership for deploying biometric authentication platforms. Institutions are placing greater emphasis on modular solutions enabling phased rollouts across mobile banking, ATM kiosks, and point-of-sale terminals. This incremental approach helps distribute capital expenditure over multiple budgets, easing the strain induced by higher hardware pricing. Looking ahead, industry stakeholders are intensifying dialogue with policymakers to advocate targeted exemptions and foster a stable trade environment conducive to innovation.

Uncovering Nuanced Market Opportunities through Multi-Dimensional Segmentation Across Authentication Methods Deployment Patterns and Application Scenarios

By examining diverse authentication methods, it becomes clear that behavioral biometrics-encompassing gait analysis and keystroke dynamics-are gaining traction among institutions seeking seamless continuous verification without intrusive hardware. At the same time, traditional modalities such as fingerprint scanning, facial recognition, iris recognition, and voice analysis are evolving with enhanced liveness detection and spoof resistance to meet enterprise-grade security thresholds.

Deployment mode segmentation reveals that cloud architectures dominate early-stage implementations, offering both public and private cloud options that balance agility with compliance needs. Public cloud adoption is appealing to fintech startups aiming for rapid scaling, while established banks often leverage private cloud to maintain greater control over sensitive biometric data and regulatory alignment.

Different application scenarios underscore nuanced demand patterns. Mobile banking on Android and iOS platforms is the primary battleground for user authentication, whereas in-person channels like countertop point-of-sale terminals and self-service kiosks in retail and ATM environments rely on embedded hardware sensors. Combining these modes within a unified ecosystem ensures consistent security levels across digital and physical touchpoints.

Organizational priorities also vary by end-user industry. Retail and corporate banking divisions within traditional banks focus on customer onboarding and fraud reduction, while asset management and insurance firms leverage biometrics for privileged user access and claims processing. Payment service providers and wealth technology companies differentiate through streamlined user journeys, often prioritizing minimal friction during transaction authorization.

Finally, organizational size influences adoption pace. Large enterprises benefit from comprehensive governance frameworks and can invest in multi-modal biometric platforms at scale, whereas small and medium enterprises favor lighter, subscription-based models to minimize upfront expenditure and accelerate time-to-value.

This comprehensive research report categorizes the PSD2 & Open Banking Biometric Authentication market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Authentication Method

- Deployment Mode

- Organization Size

- Application

- End User Industry

Strategic Regional Dynamics Shaping Adoption Rates and Innovation Trajectories within the Americas Europe Middle East Africa and Asia Pacific Biometric Ecosystems

Regional dynamics are shaping how biometric authentication solutions are adopted across the Americas, Europe Middle East and Africa, and Asia Pacific. In North and South America, financial institutions are driven by innovation hubs in the United States and Brazil that prioritize mobile-first strategies and consumer convenience. These markets place a premium on integrating biometric authentication into internet and mobile banking channels to combat rising fraud rates and digital account takeovers.

Meanwhile, the Europe, Middle East and Africa region navigates a complex tapestry of regulatory regimes-from the European Union’s Revised Payment Services Directive to targeted initiatives in the Gulf Cooperation Council. This regulatory mosaic has fostered a collaborative ecosystem in Europe where banks, technology providers, and regulators co-create standardized frameworks and conformance testing for biometric solutions in Open Banking environments.

In the Asia Pacific region, strong smartphone penetration and large unbanked populations have accelerated the deployment of biometrics across mobile wallets and kiosk-driven branches. Governments in India and Southeast Asia have championed national biometric identity schemes, creating an environment where financial service providers can seamlessly tap into unified digital identity frameworks for customer onboarding.

These distinct regional trajectories underscore the importance of tailoring go-to-market strategies. Solution providers must adapt to local regulatory requirements, technology infrastructure maturity, and cultural attitudes toward privacy. By articulating value propositions that resonate with regional priorities-whether fraud reduction, customer experience enhancement, or financial inclusion-industry leaders can capture high-growth opportunities across each geography.

This comprehensive research report examines key regions that drive the evolution of the PSD2 & Open Banking Biometric Authentication market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Differentiators and Strategic Imperatives of Leading Technology Providers Driving Biometric Authentication Integration in Open Banking Environments

Leading technology providers are defining the competitive landscape through differentiated portfolios and strategic partnerships. Major payment networks and core banking vendors are integrating native biometric modules into their platforms, enhancing their appeal to incumbent institutions seeking turnkey solutions. Concurrently, specialist vendors focus on niche capabilities such as liveness detection, AI-driven fraud analytics, and decentralized identity frameworks, securing footholds in the most demanding use cases.

Partnership models are evolving beyond traditional reseller agreements. Several incumbents have forged collaborative alliances with cloud hyperscalers to deliver managed biometric authentication services, enabling faster adoption cycles and streamlined compliance. At the same time, fintech startups with agile development cycles are leveraging open-source components and developer APIs to rapidly iterate and penetrate underserved segments.

Investment trends reveal a keen interest in multi-modal authentication, leading to a wave of acquisitions and joint ventures aimed at combining complementary technologies. This consolidation is fostering integrated suites capable of addressing the full authentication lifecycle-from enrollment and verification to continuous risk monitoring-within Open Banking frameworks.

Ultimately, success in this space hinges on balancing innovation speed with regulatory foresight. Companies that can demonstrate end-to-end security assurance, seamless interoperability with core banking systems, and a clear road map for future standards alignment will emerge as market leaders in the convergence of biometric authentication and Open Banking.

This comprehensive research report delivers an in-depth overview of the principal market players in the PSD2 & Open Banking Biometric Authentication market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Aldermore Group plc

- Apple Inc.

- BehavioSec Inc.

- CardinalCommerce Corporation

- ClearBank Limited

- Danal, Inc.

- Diamond Fortress Technologies, Inc.

- Enfuce Financial Services Oy

- Fulcrum Biometrics, LLC

- Incode Technologies, Inc.

- iProov Ltd.

- IriTech, Inc.

- Mastercard Incorporated

- Metro Bank plc

- Monzo Bank Limited

- Nok Nok Labs, Inc.

- NXT-ID, Inc.

- OakNorth Bank plc

- Okta, Inc.

- Samsung Electronics Co., Ltd.

- VoiceVault, Inc.

Empowering Financial Institutions with Targeted Action Plans and Best Practices to Accelerate Secure Biometric Authentication Adoption under Evolving Regulatory Frameworks

To capitalize on the momentum behind biometric authentication, financial institutions should embark on a strategic roadmap that begins with executive sponsorship and cross-functional stakeholder alignment. Robust governance structures must be established early to address data privacy, consent management, and compliance with PSD2 and other jurisdictional regulations. By prioritizing clear policy frameworks, institutions can mitigate risk and foster stakeholder confidence.

Next, organizations are advised to pilot multi-modal biometric proof-of-concept projects across high-impact channels such as mobile banking and ATM kiosks. Iterative testing with representative user cohorts will yield actionable insights into performance, user acceptance, and operational considerations. Coupled with rigorous fraud scenario analysis, these pilots can validate technology choices and inform phased rollouts.

Meanwhile, forging strategic alliances with technology partners-ranging from cloud service providers to specialized AI vendors-will enhance scalability and expedite integration. Institutions should negotiate flexible commercial terms that accommodate usage-based pricing and modular feature deployment. This approach enables resource allocation optimization and positions organizations to adjust swiftly to shifting market demands.

Lastly, ongoing monitoring and continuous improvement are paramount. Establishing a centralized operations center for biometric performance analytics will facilitate real-time detection of anomalies, user friction, and potential vulnerabilities. By embedding these processes within an agile feedback loop, industry leaders can ensure their authentication frameworks remain resilient, customer-friendly, and aligned with evolving regulatory landscapes.

Detailing Rigorous Research Frameworks and Analytical Methods Deployed to Ensure Robust Insights on PSD2 Open Banking Biometric Authentication Trends

This analysis is underpinned by a rigorous research design combining qualitative and quantitative methodologies. Primary research included structured interviews with senior executives from global banks, fintech innovators, and regulatory bodies, alongside workshops involving technology providers and system integrators. These engagements provided deep insights into strategic priorities, implementation challenges, and emerging requirements for biometric authentication in Open Banking.

Secondary research supported these findings through an extensive review of industry white papers, regulatory directives, technical standards, and academic publications. Emphasis was placed on credible open-access sources and publicly available regulatory documentation to ensure objectivity. Data was triangulated to validate trends and reconcile differing perspectives across stakeholder groups.

The segmentation framework applied across authentication methods, deployment modes, applications, end-user industries, and organization sizes informed a structured analysis of market dynamics. Regional deep dives examined local regulatory regimes, infrastructure maturity, and cultural factors influencing adoption. Competitive mapping assessed vendor capabilities, partnership models, and strategic initiatives through a combination of public disclosures and expert consultations.

Throughout this process, adherence to ethical research principles was maintained, with strict data governance protocols to protect confidentiality and ensure the integrity of insights. The result is a comprehensive, multi-dimensional perspective designed to guide decision-makers in navigating the evolving landscape of PSD2 and Open Banking biometric authentication.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our PSD2 & Open Banking Biometric Authentication market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- PSD2 & Open Banking Biometric Authentication Market, by Authentication Method

- PSD2 & Open Banking Biometric Authentication Market, by Deployment Mode

- PSD2 & Open Banking Biometric Authentication Market, by Organization Size

- PSD2 & Open Banking Biometric Authentication Market, by Application

- PSD2 & Open Banking Biometric Authentication Market, by End User Industry

- PSD2 & Open Banking Biometric Authentication Market, by Region

- PSD2 & Open Banking Biometric Authentication Market, by Group

- PSD2 & Open Banking Biometric Authentication Market, by Country

- United States PSD2 & Open Banking Biometric Authentication Market

- China PSD2 & Open Banking Biometric Authentication Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Future Outlook to Navigate the Evolving Intersection of Open Banking Directives and Biometric Security Innovations

The intersection of PSD2 directives and biometric authentication technologies presents both significant opportunities and complex challenges for financial service providers. Strong customer authentication requirements have catalyzed the adoption of innovative biometric modalities, yet the diversity of regulatory regimes and evolving threat landscapes demand a strategic, adaptable approach.

Key insights reveal that multi-modal biometric solutions-combining fingerprint, facial recognition, iris scanning, and behavioral patterns-can deliver the highest levels of security and user satisfaction. Cloud-based deployment modes offer the agility needed for rapid scaling, while hybrid private-public architectures can reconcile data privacy with operational efficiency. Regional case studies demonstrate that alignment with local regulations and infrastructural realities is critical to successful deployment.

Industry leaders are pursuing collaborative partnerships and flexible commercial models to stay ahead of supply chain disruptions and regulatory shifts. Continuous performance monitoring and iterative refinement of authentication frameworks ensure resilience against sophisticated fraud attempts. By embedding these practices within a broader digital transformation agenda, institutions can unlock new channels for customer engagement and revenue generation.

Looking forward, the convergence of decentralized identity frameworks, enhanced AI-driven risk analytics, and interoperability standards will further redefine the Open Banking ecosystem. Organizations that proactively invest in these capabilities and foster an innovation-centric culture will secure competitive advantage and deliver the next generation of secure, seamless financial services.

Connect with Ketan Rohom to Unlock Comprehensive Market Insights and Drive Strategic Decisions in Biometric Authentication and Open Banking Implementation

To explore how tailored insights can inform your strategic roadmap and unlock high-value growth opportunities, reach out to Associate Director of Sales & Marketing, Ketan Rohom. Engaging with this thought leader will connect you to an authoritative resource who can provide exclusive access to granular research findings and bespoke advisory support. By partnering directly through this channel, you will gain personalized guidance on integrating cutting-edge biometric authentication solutions within Open Banking ecosystems. Seize the chance to leverage these actionable market insights to fortify your competitive advantage and accelerate secure digital transformation initiatives.

- How big is the PSD2 & Open Banking Biometric Authentication Market?

- What is the PSD2 & Open Banking Biometric Authentication Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?