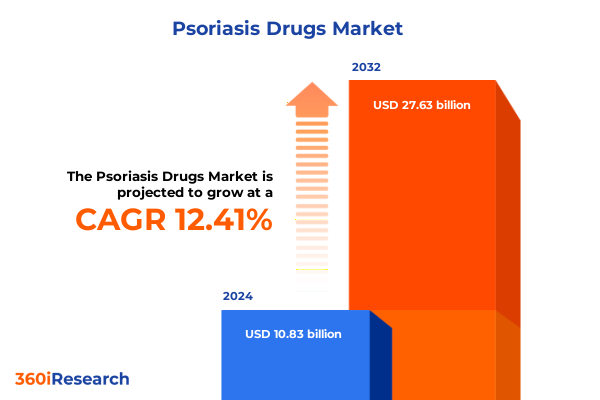

The Psoriasis Drugs Market size was estimated at USD 12.18 billion in 2025 and expected to reach USD 13.59 billion in 2026, at a CAGR of 12.41% to reach USD 27.63 billion by 2032.

Understanding the Rising Imperative of Targeted Therapeutics in Addressing the Global Psoriasis Burden and Market Dynamics

Introduction

Psoriasis remains a pervasive, chronic, immune-mediated dermatological condition affecting an estimated 2 to 3 percent of the global population-translating to roughly 125 million individuals worldwide seeking effective, sustained treatment approaches. In the United States alone, approximately 3.0 percent of adults, or over 7.5 million people, live with psoriasis, underscoring a substantial, persistent healthcare burden. This autoimmune disorder often manifests as plaque psoriasis but encompasses a diverse spectrum of disease subtypes that range from mild, localized presentations to severe, systemic involvement.

Against this backdrop, the demand for innovative, patient-centric therapeutic solutions is intensifying. Advances in molecular biology and immunology have yielded a robust pipeline of targeted biologics, small molecules, and next-generation agents that promise to address unmet clinical needs. Meanwhile, evolving reimbursement frameworks, novel distribution models, and heightened focus on health equity continue to shape the market landscape. In tandem, regulatory shifts and supply chain considerations underscore the imperative for strategic agility across the pharmaceutical ecosystem. This executive summary offers a concise yet authoritative overview of the current dynamics, illustrating how stakeholders can harness emerging opportunities and navigate critical challenges to enhance patient outcomes and drive sustainable growth.

Exploring Paradigm Shifts Driven by Novel Biologics Oral Small Molecules and Digital Therapies Revolutionizing Psoriasis Treatment Options

Transformative Shifts

Recent years have witnessed unprecedented innovation in psoriasis treatment modalities, driven by a deepening understanding of immunopathogenesis and precision medicine. Leading the charge are interleukin-17 inhibitors such as bimekizumab, a dual IL-17A and IL-17F antagonist approved in October 2023 that demonstrated rapid, durable skin clearance in Phase 3 trials-with up to 91 percent of patients achieving clear or almost clear skin by Week 16. Building on this momentum, the IL-23 inhibitor class, exemplified by risankizumab, continues to show sustained high levels of skin clearance, with over 80 percent of patients maintaining PASI 90 responses at one year.

Concurrently, the advent of first-in-class oral small molecules such as deucravacitinib has expanded the therapeutic armamentarium beyond injectables. As a selective TYK2 inhibitor, deucravacitinib achieved superior efficacy versus both placebo and apremilast in POETYK PSO trials, offering patients a once-daily oral alternative with a well-characterized safety profile. On the horizon, IL-36 receptor antagonists like spesolimab are redefining management of generalized pustular psoriasis through targeted immunomodulation, reducing flare risk by over 80 percent in pivotal studies. Beyond drug innovation, digital health solutions and teledermatology platforms are empowering remote monitoring and personalized care pathways, further enhancing adherence and patient satisfaction. Together, these paradigm-shifting developments herald a new era of precision-guided, multi-modal therapy in psoriasis care.

Analyzing the Far Reaching Effects of Proposed and Actual U S Pharmaceutical Tariffs on Costs Supply Chains and Patient Access through 2025

Cumulative Impact of United States Tariffs

The potential imposition of tariffs on pharmaceutical imports has emerged as a critical factor shaping industry strategies through 2025. A Section 232 investigation launched by the U.S. Commerce Department in April 2025 targets both finished drugs and key inputs, signaling heightened regulatory scrutiny. President Trump’s administration has threatened tariffs up to 25 percent, with possibilities of escalation to 200 percent within 12 to 18 months if reshoring objectives are unmet. According to an Ernst & Young analysis, a 25 percent levy on imported pharmaceuticals could inflate U.S. drug costs by nearly $51 billion annually, driving price increases of up to 12.9 percent for consumers if fully passed through the supply chain.

Industry experts warn that such levies may inadvertently exacerbate supply disruptions and compound the complexity of biologics manufacturing, which relies heavily on imported active pharmaceutical ingredients from Europe and Asia. Generic segments, characterized by thinner margins, are particularly vulnerable to immediate cost pass-through, whereas brand-name therapies often absorb a greater share of added duties. In response, leading manufacturers are accelerating domestic capacity expansions and forging resilient supplier partnerships. However, the long-term feasibility of comprehensive onshoring remains uncertain, underscoring the need for strategic risk mitigation and proactive policy engagement to safeguard patient access and cost efficiencies.

Delving into Multifaceted Segmentation Insights Unveiling Treatment Preferences Patient Profiles and Distribution Nuances Shaping Psoriasis Therapeutics

Key Segmentation Insights

Treatment selection in psoriasis is inherently tied to drug class, with biologics commanding a leading position for moderate to severe disease. Within this class, IL 17 inhibitors have emerged as front-line options, rapidly followed by IL 23 inhibitors and TNF inhibitors, while small molecules such as JAK and PDE 4 inhibitors offer oral-based alternatives for patients seeking non-injectable regimens. Route of administration dynamics further refine prescribing patterns; subcutaneous self-injectables continue to gain traction for their convenience, whereas intravenous infusions remain essential for select hospital-based therapies. Oral options, spanning capsules, tablets, and suspensions, are expanding the addressable patient population, and topical formulations including creams, foams, gels, and ointments uphold their pivotal role in managing mild to moderate disease.

Tailoring to patient severity is equally critical, as individuals with mild to moderate presentations benefit from topicals and PDE 4 inhibitors, in contrast to those with moderate to severe manifestations who derive greater efficacy from targeted biologics and TYK2 inhibitors. Psoriasis subtype dictates therapeutic nuance, with plaque psoriasis comprising the majority of cases, while rarer forms such as pustular, erythrodermic, and nail psoriasis require specialized approaches. Demographic segmentation reveals an adult predominance, although pediatric and geriatric populations are gaining focused attention as clinical data evolve. Distribution channels are diversifying, with hospital and specialty pharmacies handling complex biologics, retail pharmacies supporting broad OTC and prescription products, and online platforms rapidly emerging to meet patient convenience demands. Finally, treatment settings span home-based self-administration, hospital infusion centers, and specialized dermatology clinics, underscoring the spectrum of care environments shaping patient journeys.

This comprehensive research report categorizes the Psoriasis Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Route Of Administration

- Psoriasis Type

- Patient Type

- Distribution Channel

- Treatment Setting

Assessing Regional Market Nuances Across the Americas Europe Middle East Africa and Asia Pacific Influencing Access to Psoriasis Therapeutics

Key Regional Insights

The Americas lead global adoption of advanced psoriasis therapies, buoyed by favorable reimbursement frameworks and a mature biosimilar market that is gradually enhancing access. The United States, representing the largest single-country market, closely tracks the rapid uptake of next-generation biologics and oral small molecules. Meanwhile, Canada is witnessing growing momentum for value-based contracts that emphasize long-term patient outcomes.

In Europe, Middle East and Africa, continental pricing controls and national health technology assessments drive cost containment, resulting in variable uptake across markets. Western European nations have embraced IL 17 and IL 23 inhibitors with high penetration, whereas Eastern Europe and parts of the Middle East are increasingly reliant on biosimilar infliximab and etanercept to optimize constrained formularies. Africa’s nascent psoriasis market is characterized by limited specialist infrastructure and uneven drug availability, presenting both hurdles and opportunities for market entry.

Asia-Pacific embodies dynamic contrasts: Japan and Australia maintain high-per-capita utilization of biologics and small molecules, supported by progressive regulatory pathways. In contrast, China and India prioritize domestic manufacturing of generics and biosimilars, leveraging cost advantages and local partnerships to broaden access. Southeast Asian markets are emerging as strategic growth engines, with rising patient awareness and expanding dermatologist networks catalyzing incremental uptake of specialty therapies.

This comprehensive research report examines key regions that drive the evolution of the Psoriasis Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Advancements Collaborations and Competitive Strategies Driving Innovation in Psoriasis Drug Development

Key Companies Insights

Industry incumbents and agile entrants alike are intensifying efforts to consolidate leadership in the psoriasis domain. Johnson & Johnson’s Cosentyx continues to command a substantial share of the IL 17A inhibitor market, even as legal disputes with Samsung Bioepis over Stelara biosimilar launches underscore the competitive stakes of patent expirations and licensing agreements. Amgen’s Wezlana and AbbVie’s Humira biosimilars are also reshaping the TNF inhibitor space, compelling innovators to reinforce value propositions through outcome-based contracting.

UCB’s Bimzelx has rapidly established itself as a differentiated IL 17A/F inhibitor since its October 2023 FDA approval, while offering new device presentations to enhance patient convenience. Bristol Myers Squibb’s Sotyktu, as the first TYK2 inhibitor, anchors the oral small molecule segment by delivering robust Phase 3 efficacy versus apremilast and placebo. AbbVie’s Skyrizi reinforces the IL 23 inhibitor franchise, showcasing sustained PASI 90 and PASI 100 responses through two years of treatment. Boehringer Ingelheim’s Spevigo, an IL 36R antagonist, has advanced into preventive maintenance studies for generalized pustular psoriasis, with a global licensing partnership poised to expand its commercial footprint into new markets.

Collectively, these leading players are differentiating through strong clinical data, enhanced delivery systems, strategic partnerships, and targeted indications, underscoring a fiercely competitive yet innovation-rich environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Psoriasis Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Almirall S.A.

- Amgen Inc

- AstraZeneca PLC

- Biogen Inc.

- Boehringer Ingelheim International GmbH

- Bristol‑Myers Squibb Company

- Dermavant Sciences Ltd.

- Eli Lilly and Company

- Glenmark Pharmaceuticals Ltd.

- Incyte Corporation

- Johnson & Johnson Services, Inc.

- LEO Pharma A/S

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd

- Takeda Pharmaceutical Company Limited

- UCB S.A.

Strategic Recommendations for Stakeholders to Navigate Supply Chain Risks Enhance Patient Outcomes and Capitalize on Emerging Psoriasis Therapy Trends

Actionable Recommendations for Industry Leaders

Manufacturers should prioritize diversification of their supply chains by investing in domestic manufacturing capacity and securing multiple sourcing agreements for critical active pharmaceutical ingredients. This approach will mitigate risks posed by potential import tariffs and global logistical disruptions. Additionally, expanding small molecule oral offerings can capture patient segments averse to injectable therapies and reduce treatment administration costs.

Engagement with payers and policymakers is essential to craft value-based performance contracts that link reimbursement to real-world patient outcomes, fostering affordability while incentivizing long-term efficacy. Integrating digital health solutions such as teledermatology platforms and patient adherence apps will improve treatment persistence and quality-of-life metrics. Furthermore, targeted expansion into high-growth emerging markets-leveraging local partnerships and regulatory pathways-will secure future revenue streams. Finally, bolstering patient support programs and clinician education initiatives will enhance market penetration and amplify brand differentiation in an increasingly crowded therapeutic landscape.

Outlining Our Robust Methodological Framework Integrating Primary Expert Interviews Secondary Research and Data Triangulation for Comprehensive Market Analysis

Research Methodology Overview

Our analysis synthesizes primary and secondary research to deliver a multidimensional view of the psoriasis therapeutics landscape. Secondary research encompassed a comprehensive review of peer-reviewed journals, regulatory filings, company press releases, pipeline databases, and industry white papers. We systematically excluded conflicting data sources to ensure objectivity and relevance.

Primary insights were derived from in-depth interviews with leading dermatologists, pharmaceutical executives, payers, and patient advocacy representatives. Data triangulation techniques were employed to validate findings, cross-referencing expert opinions with quantitative metrics and emerging trend reports. This rigorous methodological framework ensures that our conclusions are grounded in both clinical evidence and real-world market dynamics, equipping decision-makers with reliable, forward-looking intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Psoriasis Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Psoriasis Drugs Market, by Drug Class

- Psoriasis Drugs Market, by Route Of Administration

- Psoriasis Drugs Market, by Psoriasis Type

- Psoriasis Drugs Market, by Patient Type

- Psoriasis Drugs Market, by Distribution Channel

- Psoriasis Drugs Market, by Treatment Setting

- Psoriasis Drugs Market, by Region

- Psoriasis Drugs Market, by Group

- Psoriasis Drugs Market, by Country

- United States Psoriasis Drugs Market

- China Psoriasis Drugs Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Summarizing Key Findings Emphasizing Collaborative Imperatives and Forward Looking Perspectives on the Evolving Psoriasis Therapeutics Landscape

Conclusion

The psoriasis therapeutics ecosystem stands at a critical inflection point, characterized by groundbreaking biologic and small molecule innovations, evolving health policy directives, and intensifying competitive dynamics. As IL 17 and IL 23 inhibitors cement their roles in moderate-to-severe disease, oral TYK2 and IL 36R antagonists are poised to expand the therapeutic frontier, offering new hope for patients with complex or refractory subtypes.

Meanwhile, regulatory and supply chain challenges-accelerated by tariff considerations-underscore the need for strategic resilience and stakeholder collaboration. By leveraging nuanced segmentation insights, embracing data-driven value propositions, and adapting to regional market priorities, industry leaders can navigate this complex landscape. Collective commitment to patient-centered care, sustainable access models, and adaptive innovation will define the next era of progress in psoriasis management.

Connect with Ketan Rohom to Secure Exclusive Market Intelligence and Drive Your Strategic Decisions in the High Growth Psoriasis Therapeutics Sector

Ready to transform your strategic approach and secure a competitive advantage in the evolving psoriasis therapeutics market? Contact Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to explore how our comprehensive market research report can illuminate actionable insights, guide critical investments, and optimize your market positioning in this high-potential, rapidly shifting landscape

- How big is the Psoriasis Drugs Market?

- What is the Psoriasis Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?