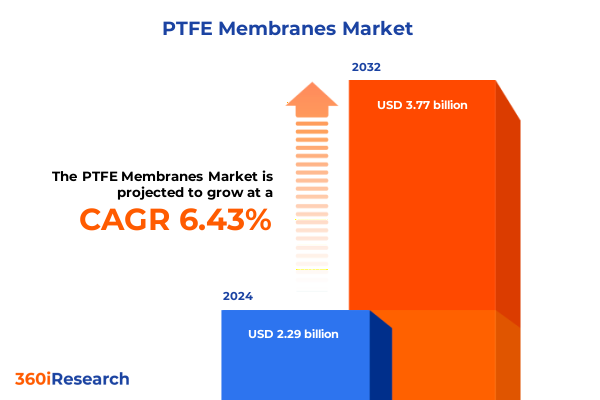

The PTFE Membranes Market size was estimated at USD 2.43 billion in 2025 and expected to reach USD 2.58 billion in 2026, at a CAGR of 6.49% to reach USD 3.77 billion by 2032.

Revolutionizing Filtration Across Industries With PTFE Membrane Technologies Delivering High Chemical Resistance and Thermal Stability With Exceptional Longevity

The PTFE membrane landscape has emerged as a vital frontier in advanced filtration technologies, driven by an ever-growing demand for reliable separation solutions across critical sectors. At its core, PTFE membrane material is renowned for its exceptional chemical inertness and thermal stability, rendering it uniquely suited for environments characterized by aggressive solvents, fluctuating temperatures, and stringent purity requirements. As a result, this technology underpins filtration performance in industries where contaminant control, process efficiency, and regulatory compliance intersect with high operational standards.

In recent years, progress in production techniques such as mechanical stretching and composite lamination has significantly enhanced membrane porosity control while preserving structural integrity. Furthermore, the integration of advanced backing materials has catalyzed performance gains, enabling membranes to withstand elevated pressures and corrosive media without compromising flux or selectivity. Consequently, filtration system designers and end users are increasingly leveraging PTFE membranes to achieve long service life and low maintenance cycles, thus optimizing total cost of ownership.

Given these attributes and evolving industry requirements, an in-depth examination of the PTFE membrane sector reveals pivotal drivers shaping technology adoption, competitive positioning, and strategic partnership models. Understanding these dynamics is essential for stakeholders seeking to capitalize on filtration innovations, address emerging environmental and health regulations, and navigate the complexities of global supply chains.

Navigating Breakthrough Developments and Sustainability Imperatives Reshaping the PTFE Membrane Ecosystem for Next-Generation Filtration Solutions

The PTFE membrane sector is undergoing transformative shifts as a result of converging technological advancements and rising sustainability imperatives. One of the most significant developments involves the refinement of microporous PTFE structures, which has enabled manufacturers to achieve pore size distributions that yield unparalleled selectivity for particulate and aerosol applications. Simultaneously, composite PTFE membranes enhanced with polyester or polypropylene bases have demonstrated improved mechanical performance, opening new avenues for high-pressure and dynamic fluid environments.

Moreover, the industry’s prioritization of green manufacturing practices has prompted vendors to innovate solvent-free processing routes and energy-efficient production lines. This transition not only reduces the carbon footprint associated with membrane fabrication but also aligns with stringent regulatory requirements related to volatile organic compound emissions. As a result, end users in sectors ranging from pharmaceutical purification to municipal water treatment are placing greater emphasis on membrane lifecycle assessment and sustainability certifications.

Additionally, digital monitoring and predictive maintenance technologies are reshaping membrane asset management, enabling real-time flux monitoring and early detection of fouling patterns. In turn, these capabilities enhance operational reliability and extend service intervals, fulfilling the dual demand for high performance and cost-effective maintenance strategies. Taken together, these advancements underscore a dynamic ecosystem in which material science, environmental stewardship, and Industry 4.0 integration redefine the trajectory of PTFE membrane applications.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Adjustments on Global PTFE Membrane Supply Chains and Competitive Dynamics

The cumulative impact of United States tariff adjustments in early 2025 has generated pronounced ripple effects across the global PTFE membrane supply chain and competitive landscape. By increasing import duties on select fluoropolymer raw materials and finished membrane products, domestic tariffs have elevated input costs for manufacturers reliant on international sourcing. Consequently, original equipment manufacturers and integrators have begun reevaluating supplier portfolios, placing greater consideration on regionalization of production and nearshoring strategies to mitigate duty exposure.

At the same time, these tariff measures have incentivized certain global producers to establish or expand manufacturing footprints within North America. This repositioning not only helps circumvent import duties but also accelerates delivery times and fortifies supply chain resilience. However, the shift has also intensified competition among localized and established players, challenging incumbents to differentiate through technology licensing, value-added services, and strategic partnerships with distributors.

Furthermore, downstream consumers have faced upward pressure on membrane replacement and maintenance budgets, prompting a growing interest in extended-service membrane configurations and performance guarantees. In response, membrane providers are bundling aftermarket support services such as predictive diagnostics and performance audits to offset cost increases and reinforce customer loyalty. Thus, the 2025 tariff landscape has catalyzed a reconfiguration of supply chain networks, underscoring the strategic importance of adaptive sourcing, manufacturing convergence, and value-driven service integration.

Unlocking Comprehensive Segmentation Perspectives to Illuminate Diverse Applications, Industries, and Materials Driving PTFE Membrane Market Diversification

A closer examination of the PTFE membrane sector reveals that application-driven requirements, end use industry demands, membrane material variations, pore size specifications, thickness preferences, and backing material choices collectively shape market dynamics. In air filtration environments such as cleanrooms and HVAC systems, membrane porosity and durability must harmonize to deliver consistent particulate capture while resisting high flow rates. Chemical processing applications in oil and gas, petrochemical, and pharmaceutical operations place a premium on chemical inertness, thermal tolerance, and pressure resistance.

Within food and beverage facilities, breweries and dairy processing units rely on fine-pore membranes to ensure microbial exclusion without impeding processing throughput or affecting product integrity. Medical filtration contexts from dialysis treatments to surgical environments demand absolute separation standards, sterilizable membrane assemblies, and biocompatible support layers. In water treatment scenarios spanning industrial effluents, municipal supply purification, and residential point-of-use systems, thickness and pore size directly influence fouling propensity and cleaning protocols.

End use industries including automotive exhaust systems and paint booths, specialty chemical reactors, offshore and onshore oil and gas platforms, as well as API production and drug formulation facilities, leverage tailored membrane configurations for optimized separation performance. Material innovation further extends to composite, expanded, and microporous PTFE variants, with composite types offering hybrid performance through polyester or polypropylene reinforcement. Pore size classifications-from ultra-fine membranes below 0.1 micron to those exceeding 0.5 micron-cater to diverse particulate thresholds, while film thicknesses between 50 to over 100 microns meet pressure retention and flex fatigue requirements. Backing options spanning metal, nonwoven meltblown or spunbond, and woven substrates round out the performance matrix by providing mechanical support or enhanced surface area.

This comprehensive research report categorizes the PTFE Membranes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Membrane Structure

- Form Factor

- Pore Size

- Thickness

- Porosity

- Backing Material

- Application

- End-Use Industry

Comparative Regional Dynamics Revealing How Mature and Emerging Markets in the Americas, EMEA, and Asia-Pacific Shape PTFE Membrane Demand and Innovation

Regional landscapes for PTFE membrane demand and innovation reveal distinct growth trajectories across the Americas, EMEA, and Asia-Pacific. In the Americas, robust end use sectors such as pharmaceutical manufacturing hubs in the United States, dairy and food processing clusters, and advanced chemical production sites drive steady membrane adoption. Furthermore, increasing regulations on air quality and water discharge in North America stimulate demand for high-grade filtration solutions and aftermarket support.

Conversely, Europe, the Middle East & Africa present a mosaic of mature and emerging markets. Western Europe’s stringent environmental and safety standards bolster demand for premium PTFE membranes, particularly within pharmaceutical and specialty chemical verticals. At the same time, Middle Eastern oil and gas sectors are progressively integrating high-performance membranes into onshore and offshore operations to address corrosive conditions and stringent discharge norms. In Africa, infrastructure investments in municipal water treatment projects signal an expanding role for corrosion-resistant membrane technologies.

Asia-Pacific has emerged as a dynamic frontier, led by rapid industrialization in China and India, burgeoning pharmaceutical sectors in South Asia, and growing environmental compliance initiatives in Southeast Asia. Localized production facilities have scaled to meet surging demand, while regional manufacturers strive to differentiate through cost efficiencies and strategic alliances. As a result, Asia-Pacific continues to redefine competitive benchmarks, prompting global players to align their product portfolios and regional strategies accordingly.

This comprehensive research report examines key regions that drive the evolution of the PTFE Membranes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Distilling Strategic Profiles of Leading PTFE Membrane Manufacturers and Innovators Steering Competitive Differentiation and Technological Advancement

Key industry participants are advancing the PTFE membrane narrative through strategic investments in R&D, manufacturing capacity, and service offerings. Leading global manufacturers have directed resources toward refining microporous structures and composite laminates that enhance performance under diverse operating conditions. Concurrently, some firms are forging alliances with filter system integrators to embed proprietary membranes within end user solutions, thereby securing downstream value capture and fostering long-term partnerships.

A number of companies are differentiating through vertically integrated supply chains, controlling raw material production, membrane fabrication, and aftermarket services to ensure quality traceability and delivery consistency. Others are pursuing targeted acquisitions of regional players to bolster local presence, streamline distribution channels, and tap into established customer relationships. Beyond growth through expansion, several innovators are piloting digital platforms that integrate real-time performance data with predictive maintenance analytics, offering customers comprehensive lifecycle management.

In parallel, a subset of membrane specialists is channeling efforts into emerging applications such as fine aerosol filtration for semiconductor manufacturing, advanced water reclamation for circular economy projects, and customized medical-grade membranes designed for novel therapeutic protocols. These initiatives underscore an industry-wide commitment to evolve product portfolios and service models, positioning PTFE membrane technologies at the forefront of high-performance filtration solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the PTFE Membranes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AGC Inc.

- Avantor, Inc.

- Axiva Sichem Pvt.Ltd.

- Compagnie de Saint-Gobain S.A.

- Corning Incorporated

- Cytiva by Danaher Corporation

- DAIKIN INDUSTRIES, Ltd.

- Donaldson Company Inc.

- Filtration Group GmbH

- General Electric Company

- Hangzhou Cobetter Filtration Equipment Co. Ltd

- Hangzhou Ipro Membrane Technology Co. Ltd.

- HYUNDAI MICRO CO.,LTD.

- Komemtec Co., Ltd.

- Lydall, Inc.

- Markel Corporation

- Membrane Solution LLC

- Merck KGaA

- Micro Separations

- Pall Corporation

- Poly Fluoro Ltd.

- PPG Industries, Inc.

- Sartorius AG

- SKC, Inc.

- The Chemours Company

- Trinity Filtration Technologies Pvt. Ltd.

- Unicare Biomedical, Inc.

- W. L. Gore & Associates, Inc.

- Zeus Industrial Products, Inc.

Implementing Forward-Looking Strategic Initiatives to Strengthen Supply Chains, Research Investments, and Collaborative Partnerships in the PTFE Membrane Sector

To navigate the complexities of a rapidly evolving PTFE membrane landscape, industry leaders should prioritize strategic initiatives that enhance supply chain resilience, accelerate innovation cycles, and foster collaborative partnerships. First, diversifying sourcing through regional production hubs mitigates exposure to geopolitical disruptions and tariff fluctuations, while also reducing lead times. Establishing co-development agreements with raw material suppliers can further secure preferential access to advanced fluoropolymer resins and reduce input cost volatility.

Second, reinvesting in R&D programs focused on hybrid composite membranes and green manufacturing processes will enable companies to meet tightening environmental standards and differentiate performance attributes. Integrating solvent-free fabrication methods and energy-efficient production technologies can serve as powerful brand differentiators in markets where sustainability considerations carry significant weight.

Finally, cultivating strategic alliances with system integrators, end users, and technology partners will accelerate market penetration and catalyze cross-industry innovation. Collaborative ventures can yield bespoke filtration solutions tailored to niche applications such as bioprocessing, semiconductor cleanrooms, and zero-liquid discharge initiatives. By adopting a customer-centric mindset and aligning value propositions with operational pain points, membrane providers can reinforce competitive positioning and unlock new revenue pathways.

Articulating a Robust Mixed-Methods Research Framework Combining Qualitative and Quantitative Analysis to Illuminate PTFE Membrane Market Insights

This report synthesizes insights derived from a meticulously structured research process combining qualitative and quantitative methodologies. Primary research efforts encompassed in-depth interviews with key stakeholders across the PTFE membrane value chain, including raw material suppliers, membrane manufacturers, system integrators, and end users. These conversations provided nuanced perspectives on technology adoption drivers, operational challenges, and innovation priorities.

Secondary research sources were systematically reviewed to establish a comprehensive understanding of industry trends, regulatory frameworks, and competitive landscapes. Technical papers, patent filings, and environmental regulation documents were analyzed to validate material performance claims and production advancements. Market segmentation and value chain mapping were developed through data triangulation of verified company reports, trade association publications, and selectively accessed proprietary databases.

Data analysis involved cross-validation of quantitative shipment statistics and capacity utilization metrics with qualitative insights to ensure consistency and accuracy. The segmentation structure was refined iteratively through expert workshops, ensuring that application, end use industry, membrane type, pore size, thickness, and backing material dimensions capture the full spectrum of market requirements. This robust framework underpins the strategic guidance and actionable recommendations presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our PTFE Membranes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- PTFE Membranes Market, by Product Type

- PTFE Membranes Market, by Membrane Structure

- PTFE Membranes Market, by Form Factor

- PTFE Membranes Market, by Pore Size

- PTFE Membranes Market, by Thickness

- PTFE Membranes Market, by Porosity

- PTFE Membranes Market, by Backing Material

- PTFE Membranes Market, by Application

- PTFE Membranes Market, by End-Use Industry

- PTFE Membranes Market, by Region

- PTFE Membranes Market, by Group

- PTFE Membranes Market, by Country

- United States PTFE Membranes Market

- China PTFE Membranes Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2385 ]

Synthesis of Critical Findings Highlighting Key Drivers, Challenges, and Strategic Imperatives That Define the PTFE Membrane Landscape

The convergence of advanced material science, sustainability mandates, and dynamic regional developments is redefining the strategic imperatives for PTFE membrane stakeholders. Key drivers include demand for high-performance separation in chemically aggressive environments, the push for solvent-free manufacturing processes, and the integration of digital asset management to extend membrane service life. Simultaneously, challenges such as tariff-induced input cost volatility, competitive pressures from localized production, and evolving regulatory landscapes require adaptive strategies.

Successful market participants are those that balance portfolio diversification-ranging from ultra-fine pore membranes to reinforced composite structures-with an unwavering focus on operational excellence and customer outcomes. The emergence of novel applications in biopharmaceuticals, semiconductor manufacturing, and water reuse underscores the importance of collaborative innovation and cross-sector partnerships. Moreover, regional insights highlight that while the Americas emphasize stringent environmental compliance, EMEA presents a mix of mature regulatory frameworks and high-potential markets, and Asia-Pacific drives scale through cost efficiency and rapid industrial growth.

In sum, stakeholders who proactively align their R&D, supply chain, and go-to-market strategies with these multifaceted drivers will secure a distinct competitive advantage. Anchoring long-term success on sustainability, service integration, and strategic alliances will be critical as the PTFE membrane sector continues to evolve and mature.

Empowering Decision Makers to Secure Actionable Intelligence and Drive Value With Direct Engagement for Comprehensive PTFE Membrane Market Research

For industry decision makers seeking to deepen their understanding of PTFE membrane dynamics, engaging directly with Ketan Rohom, Associate Director of Sales & Marketing at our firm, presents a streamlined path to acquiring a comprehensive market research report tailored to strategic objectives. By collaborating with Ketan Rohom, organizations can access bespoke insights that address specific filtration challenges across applications and regions, ensuring that investments in PTFE membrane technologies align with evolving operational and regulatory requirements.

This direct engagement empowers stakeholders to clarify report scope, explore custom data segments, and secure timely delivery of actionable intelligence. Ketan’s expertise in sales and marketing facilitation bridges the gap between data-rich findings and practical implementation, enabling leaders to translate research conclusions into investment decisions, technology roadmaps, and partnership strategies. His consultative approach ensures that report deliverables are contextualized within the framework of each client’s unique goals, from optimizing supply chains to accelerating product innovation.

To initiate a seamless purchasing process, interested parties can request an executive briefing with Ketan Rohom to discuss tailored service packages, timeline considerations, and value-added options such as follow-up workshops or customized analyst calls. This personalized engagement model mitigates the risk of one-size-fits-all recommendations, instead offering a research collaboration that evolves in tandem with market developments and organizational priorities.

- How big is the PTFE Membranes Market?

- What is the PTFE Membranes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?