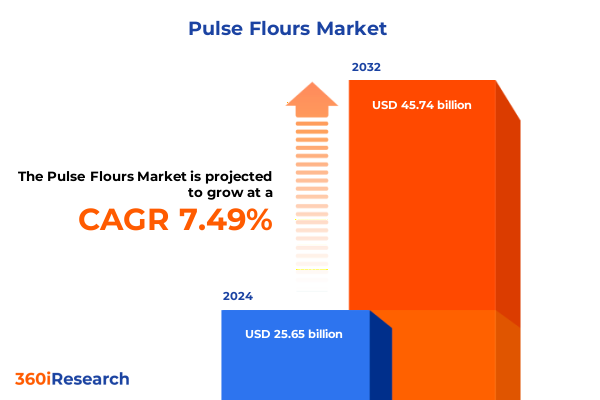

The Pulse Flours Market size was estimated at USD 27.56 billion in 2025 and expected to reach USD 29.25 billion in 2026, at a CAGR of 7.50% to reach USD 45.74 billion by 2032.

Exploring the Foundations of Pulse Flours to Illuminate Their Role as Sustainable, Nutrient-Dense Alternatives in Modern Food Formulations

Pulse flours have emerged as a compelling ingredient category, offering a combination of nutritional density, functional versatility, and sustainable credentials. As dietary preferences increasingly gravitate toward plant-based proteins and clean-label solutions, pulse flours derived from beans, peas, lentils, and chickpeas are finding broad acceptance across consumer and industrial applications. This introduction lays the groundwork for understanding how pulse flours align with macro-nutritional trends, address formulators’ needs for texturizing and binding properties, and deliver the ecological benefits of reduced water usage and lower greenhouse gas emissions compared to traditional cereal grains. These attributes collectively underscore the strategic potential of pulse flours as both a mainstream ingredient and a premium offering in health-oriented markets.

Against a backdrop of evolving dietary guidelines and heightened environmental awareness, the pulse flour segment is positioned at a critical inflection point. Stakeholders across the value chain-including farmers transitioning to legume cultivation, processors innovating milling technologies, and brands launching plant-forward products-are converging to scale up production and commercial adoption. This section introduces key themes that resonate throughout the report: the intersection of consumer demand and ingredient functionality, the role of policy frameworks in shaping supply dynamics, and the imperative for market participants to stay ahead of emerging processing innovations. With this foundation, readers will be equipped to delve into the transformative shifts and market forces detailed in subsequent sections.

Examining the Rise of Plant-Based Innovation Coupled with Evolving Consumer Preferences Shaping Transformative Shifts in the Pulse Flour Landscape

The pulse flour landscape is undergoing rapid transformation, driven by the confluence of shifting consumer mindsets and technological advancements. Innovators in product development are harnessing novel milling techniques to enhance protein retention and optimize particle size distribution, thereby delivering superior sensory experiences in baked goods, snacks, and meat analogs. Concurrently, consumer preferences have veered toward diets rich in plant-based proteins and natural ingredients, prompting brands to reformulate traditional offerings with pulse flours to meet clean-label expectations. This synergy between processing capabilities and consumer trends is accelerating the integration of pulse flours beyond niche health segments into mainstream food categories.

Beyond formulation and sensory enhancements, sustainability considerations are catalyzing transformative shifts in supply chain practices. Cultivation of pulses requires significantly less water and emits fewer greenhouse gases relative to commodity grains, positioning legume-based flours as a low-impact solution. Market leaders are now forging strategic partnerships with agricultural cooperatives and technology providers to implement regenerative farming practices, traceable sourcing, and digital monitoring systems. These advancements not only bolster environmental stewardship but also support traceability demands from ethically conscious consumers and large foodservice operators. As a result, the pulse flour sector is evolving into a dynamic ecosystem where innovation, sustainability, and consumer engagement converge.

Assessing the Cumulative Impact of 2025 United States Tariffs on Pulse Flours and Their Implications for Supply Chain Resilience and Trade Dynamics

In 2025, adjustments to United States tariff schedules have significantly influenced the pulse flour supply chain, prompting a reconfiguration of sourcing and pricing strategies. The imposition of higher duties on imported raw pulses has elevated the cost base for processors reliant on foreign legume supplies, particularly those importing large volumes of chickpeas and peas. Consequently, manufacturers are exploring dual approaches: sourcing domestically grown pulses to mitigate tariff exposure and leveraging long-term procurement agreements with tariff-inclusive pricing structures. These adaptations underscore the importance of agile sourcing models in an environment characterized by evolving trade policies.

The ripple effects of these tariffs extend downstream to product pricing and market accessibility. While some brands have absorbed incremental cost pressures through operational efficiencies and optimized production yields, others have enacted modest price increases to maintain margin thresholds. At the same time, there is a discernible uptick in investments directed toward vertical integration, with select industry players acquiring or contracting domestic pulse processing facilities. These strategic moves aim to establish consistent input quality, reduce transportation costs, and insulate operations from future tariff volatility. Collectively, the 2025 tariff landscape has galvanized the pulse flour industry to strengthen supply chain resilience and foster collaborative partnerships that prioritize stability and cost predictability.

Unveiling Key Segmentation Insights to Illuminate Differentiated Opportunities across Product Types, Packaging, Certifications, Applications, Distribution Channels, and End Users

Analysis across multiple segmentation dimensions reveals distinct patterns in pulse flour adoption and performance. By product type, chickpea flour maintains its lead thanks to its high protein content and versatile functional profile, while lentil and pea flours are gaining traction as formulations optimized for specific textural and nutritional attributes. Bean flour, though smaller in volume, commands attention in specialty applications where its unique flavor profiles are desirable. Packaging type segmentation indicates that bulk packaging remains the preferred format for industrial processors seeking economies of scale, whereas retailers are increasingly gravitating toward retail-ready formats that incorporate innovation in shelf-life extension and consumer convenience.

Certification standards further delineate market dynamics, with conventional pulse flours continuing to dominate volume metrics, yet organic variants are growing at a robust pace driven by health-conscious consumers. This dual-track certification strategy underscores the need for manufacturers to balance cost considerations with premium positioning. Application-based segmentation highlights bakery as the traditional stronghold, while beverages, meat alternatives, pasta, and snacks represent high-growth frontiers leveraging pulse flour’s functional versatility. Distribution channel insights illustrate a proliferation of e-commerce and specialty store offerings catering to niche consumer segments, alongside entrenched supermarket and hypermarket channels. End-user segmentation demonstrates that food service operations value consistency and price stability, households prioritize ease of use and label claims, and industrial end users emphasize specification compliance and logistical reliability.

This comprehensive research report categorizes the Pulse Flours market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Certification

- Application

- Distribution Channel

- End User

Decoding Regional Disparities and Growth Drivers across the Americas, Europe Middle East & Africa, and Asia-Pacific Pulse Flour Markets for Strategic Planning

A regional lens on the pulse flour market underscores nuanced growth drivers and competitive dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific regions. In the Americas, the United States leads consumption with robust demand from both retail and food service sectors, supported by expanding domestic production and investment in pulse processing infrastructure. Canada’s pulse flour market benefits from its position as a major pulse exporter, with value-added processing facilities enabling higher-margin product flows. Meanwhile, Latin American markets are beginning to explore pulse-based solutions for traditional culinary applications, signaling an emergent opportunity.

Across Europe, Middle East & Africa, regulatory emphasis on clean-label formulations and nutritional transparency is fueling interest in pulse flours, particularly in baked goods and meat alternative segments. The European Union’s alignment on sustainable agriculture policies and carbon footprint reduction targets has further incentivized legume cultivation, creating favorable conditions for local and imported pulse flours. In the Asia-Pacific region, rapid urbanization and rising disposable incomes are driving experimentation with plant-based diets, with India and China emerging as pivotal markets. Australia and New Zealand contribute through advanced processing capabilities and strong export linkages, reinforcing the region’s strategic importance in the global pulse flour value chain.

This comprehensive research report examines key regions that drive the evolution of the Pulse Flours market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation, Strategic Partnerships, and Competitive Dynamics in the Global Pulse Flour Market Landscape

A review of competitive activity reveals a landscape characterized by both established multinationals and specialized innovators. Leading players have prioritized strategic partnerships with agricultural cooperatives to secure raw material supply and implement joint R&D initiatives focused on novel applications. At the same time, agile start-ups are carving out niches through product differentiation, such as enzyme-treated pulse flours or customized particle profiles for targeted functional attributes. Mergers and acquisitions remain a prominent theme, enabling companies to augment downstream capabilities and expand geographic reach.

Brand alliances and co-branding agreements have emerged as effective mechanisms to leverage complementary strengths, particularly in penetrating new retail segments and catering to region-specific dietary preferences. Investment in capacity expansion projects-from precision milling facilities to solar-powered drying technologies-reflects a shared commitment to operational excellence and sustainability. As a result, industry consolidation is balanced by the entrance of specialized players, ensuring a dynamic competitive environment that continually raises the bar for ingredient performance and value proposition.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pulse Flours market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGT Food and Ingredients Inc.

- Archer-Daniels-Midland Company

- Avena Foods Limited

- Axiom Foods, Inc.

- Best Cooking Pulses, Inc.

- Briess Malt & Ingredients Co.

- Bunge Limited

- CanMar Grain Products Ltd.

- Diefenbaker Seed Processors Inc.

- EHL Limited

- Grain Millers, Inc.

- Ingredion Incorporated

- Nexcel Natural Ingredients

- Nutriati, Inc.

- Puris Proteins, LLC

- Roquette Frères

- The Scoular Company

- Viterra Inc.

Formulating Actionable Strategic Recommendations to Empower Industry Leaders in Capturing Emerging Value Pools and Navigating Market Disruptions

To maximize market traction and build sustainable competitive advantage, industry leaders should prioritize a holistic innovation roadmap that integrates product development with end-user insights. Investing in research to optimize functional properties, such as water absorption and emulsification, will enhance formulation versatility across bakery, snacks, and beverage applications. Concurrently, deepening partnerships with organic cooperatives and regional growers can secure supply continuity while bolstering premium positioning through certified sourcing practices.

Strengthening digital engagement strategies is also critical: empowering consumers with transparent information on traceability, nutritional attributes, and sustainability credentials can drive brand loyalty and command higher price premiums. On the operational front, diversifying sourcing regions and establishing hedging mechanisms against tariff fluctuations will safeguard margins. Collaboration on industry-wide sustainability standards and regenerative agriculture initiatives offers a proactive way to differentiate offerings and align with stakeholder expectations. Finally, scenario planning exercises and agile Go-to-Market frameworks will enable swift responses to emerging trends and geopolitical shifts.

Detailing Rigorous Research Methodology Underpinning Data Collection, Analytical Frameworks, and Validation Processes for Pulse Flour Market Insights

This research combines primary and secondary methodologies to ensure robust, validated insights. Primary data was collected through in-depth interviews with C-level executives, R&D specialists, and procurement directors across the pulse flour value chain. These qualitative inputs were complemented by surveys of formulators and end-users to capture real-time feedback on functional performance and purchasing drivers. Secondary research involved a comprehensive review of regulatory filings, trade association reports, and peer-reviewed studies to contextualize market trends and validate statistical benchmarks.

Quantitative analysis employed a data triangulation approach, leveraging import-export databases, production capacity reports, and trade flow statistics to map supply-demand dynamics across regions. Segmentation analysis used cross-tabulation techniques to identify correlations between product attributes and application success rates. Rigorous validation was conducted through an expert advisory panel, ensuring alignment with on-the-ground realities and industry best practices. This methodology framework underpins the credibility of the report’s findings and provides a replicable model for future pulse flour market assessments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pulse Flours market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pulse Flours Market, by Product Type

- Pulse Flours Market, by Packaging Type

- Pulse Flours Market, by Certification

- Pulse Flours Market, by Application

- Pulse Flours Market, by Distribution Channel

- Pulse Flours Market, by End User

- Pulse Flours Market, by Region

- Pulse Flours Market, by Group

- Pulse Flours Market, by Country

- United States Pulse Flours Market

- China Pulse Flours Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Crafting a Strategic Conclusion Synthesizing Core Findings, Market Challenges, and Future Outlook for Stakeholders in the Pulse Flour Ecosystem

The pulse flour market stands at a strategic crossroads, fueled by the convergence of sustainability mandates, health-driven consumer behaviors, and manufacturing innovations. Chickpea and lentil flours are setting new benchmarks in protein-rich applications, while technological advancements in milling and processing are unlocking unique textures and functionalities. Regional nuances-from North America’s mature infrastructure to Asia-Pacific’s burgeoning consumption-highlight the importance of targeted strategies.

The impact of evolving tariff regimes has underscored the necessity for supply chain resilience and diversification. At the same time, certification pathways and distribution channel dynamics reveal opportunities for specificity and premium positioning. As competition intensifies, the ability to adapt swiftly through product innovation, strategic partnerships, and digital engagement will define market leadership. Stakeholders equipped with the insights and recommendations outlined in this report are well-positioned to capitalize on the next wave of pulse flour growth and steer the industry toward a sustainable, high-performance future.

Engaging with Associate Director Ketan Rohom to Secure Access to Comprehensive Market Research Insights for Informed Decision-Making in Pulse Flour Investments

To empower strategic decision-makers with a comprehensive and granular understanding of the pulse flour market landscape, reach out directly to Ketan Rohom, whose expertise as Associate Director, Sales & Marketing equips you with personalized guidance and tailored insights. By engaging with Ketan Rohom, you will gain immediate access to an extensive repository of research findings, enabling you to benchmark against competitive best practices and capitalize on emerging opportunities. His deep familiarity with stakeholder priorities ensures that the information you receive addresses your specific business challenges, from optimizing supply chain efficiency to identifying new product development avenues. Secure your competitive edge by scheduling a consultation, in which you can explore customized data sets, scenario planning tools, and strategic market intelligence solutions that will drive growth. Don’t miss the chance to transform these critical insights into actionable strategies-connect with Ketan Rohom today and take the first step toward data-driven decision-making excellence in the pulse flour sector.

- How big is the Pulse Flours Market?

- What is the Pulse Flours Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?