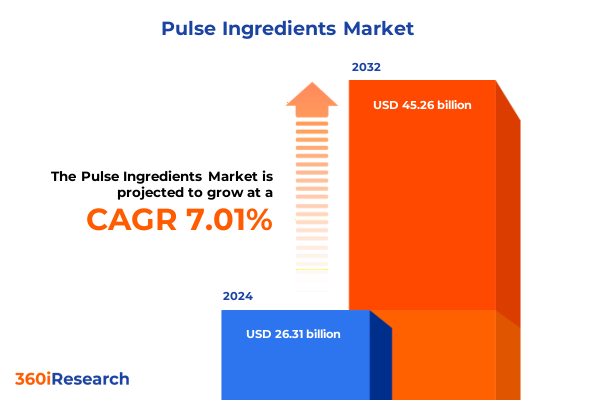

The Pulse Ingredients Market size was estimated at USD 4.40 billion in 2025 and expected to reach USD 4.66 billion in 2026, at a CAGR of 6.34% to reach USD 6.76 billion by 2032.

Understanding the Rising Demand for High-Quality Pulse Ingredients Driven by Health-Focused Consumers and Plant-Based Protein Trends

The pulse ingredients sector has garnered exceptional attention as consumers increasingly prioritize nutrition, sustainability, and plant-based proteins in their diets. Pulses-encompassing chickpeas, faba beans, lentils, and peas-offer not only robust protein content but also dietary fiber and micronutrients that align with health-oriented trends. As dietary preferences pivot toward clean labels and minimally processed foods, pulse ingredients have emerged as versatile building blocks for a wide range of applications. Furthermore, innovations in milling and fractionation techniques have enabled manufacturers to extract high-purity flours, concentrates, and isolates that maintain functional performance while meeting stringent quality standards.

Amid this backdrop, the industry is experiencing a paradigm shift driven by technological advancements and sustainability imperatives. The balance between cost efficiency and product performance has become a critical focus for ingredient suppliers, who are investing in dry fractionation and wet fractionation processes to optimize yield and functionality. Moreover, the expanding portfolio of pulse-derived ingredients is reinforcing their role in formulating bakery products, dairy alternatives, snacks, and even animal feed. Consequently, stakeholders throughout the supply chain-from growers to food manufacturers-are reconfiguring operations to capitalize on the growing demand, underscoring the importance of strategic positioning at every value-chain stage.

Exploring How Sustainability Imperatives and Technological Breakthroughs Are Redefining the Pulse Ingredients Landscape for Manufacturers

Recent years have witnessed transformative shifts that extend far beyond incremental product innovations. Sustainable agricultural practices, driven by the imperative to reduce environmental footprints, have prompted pulse growers to adopt precision farming and regenerative approaches. Simultaneously, regulatory environments are evolving to incentivize low-carbon protein sources, which is catalyzing investment in pulse-based ingredient infrastructure. Within processing facilities, automation and advanced fractionation equipment are streamlining production while ensuring consistency and traceability, positioning pulse ingredients as a cornerstone of future-forward food systems.

In addition to sustainability and technological drivers, consumer expectations are reshaping the competitive landscape. Clean-label demands are fostering transparency at every stage-from seed to shelf-so ingredient suppliers are increasingly providing comprehensive traceability data and certifications. Brand owners are responding by formulating products that highlight pulse proteins’ clean-label credentials while delivering sensory attributes on par with traditional counterparts. As a result, the confluence of environmental imperatives, technological breakthroughs, and consumer transparency demands is redefining how market participants conceive, produce, and position pulse ingredients.

Analyzing How 2025 United States Tariff Policies Are Reshaping Import Dynamics and Cost Structures for Pulse Ingredient Supply Chains

The introduction of new tariff measures by the United States in early 2025 has materially altered cost dynamics for imported pulse ingredients. With higher duties imposed on chickpea and lentil shipments from key exporting regions, processors have been compelled to reassess sourcing strategies. Consequently, importers face elevated landed costs, prompting a reassessment of long-term contracts and an accelerated shift toward domestic and near-nearshoring partnerships. In parallel, the landed cost increases have incentivized investment in local fractionation capabilities to mitigate exposure to external trade uncertainties.

Moreover, the tariff adjustments have had cascading implications across various applications. Food manufacturers leveraging chickpea and lentil proteins in dairy alternatives and bakery applications are experiencing margin pressures that may be passed through to end consumers. At the same time, animal feed producers are diversifying ingredient blends to sustain price competitiveness. However, these challenges have also spurred a wave of strategic collaborations between growers, technology providers, and processors aimed at strengthening domestic supply chains. As a result, stakeholders who proactively realign sourcing and invest in processing infrastructure stand to benefit from more resilient operations and improved cost predictability.

Uncovering Critical Insights from Product, Source, Application, and Distribution Segmentations That Define the Pulse Ingredients Market

A closer examination of product type segmentation reveals a market architecture centered on three primary categories: flours, protein concentrates, and protein isolates. Flours, available in coarse and fine grades, play a foundational role in bakery, snacks, and coating applications, offering a balance of functionality and nutritional value. Protein concentrates deliver elevated protein content with minimal off-flavors, while protein isolates-produced via dry or wet fractionation-achieve the highest purity levels for formulators seeking targeted performance in texture and solubility.

Source-based segmentation underscores the diversity of raw material inputs shaping supply considerations. Chickpea varieties, categorized as desi and kabuli, differ in starch profiles and pigment composition, which influence processing parameters and final product characteristics. Lentils, in green and red varieties, contribute distinct color and flavor profiles, while peas, both yellow and green, serve as versatile bases for neutral-tasting concentrates and isolates. Faba beans, with their robust protein yield, have also gained traction among manufacturers aiming to diversify away from traditional pulse sources.

Analyzing application-driven segmentation highlights how end-use demands steer innovation and procurement. Animal feed applications, including aquaculture and poultry formulations, capitalize on pulse proteins’ amino acid profiles and digestibility. In bakery, pulse-derived ingredients are integrated into breads, cakes, and cookies to boost protein content and moisture retention. Dairy alternatives encompass milk and yogurt analogs that rely on pulse proteins for texture and stability, whereas snack segments leverage bars and chips to meet on-the-go nutritional needs.

Distribution channel insights further refine market dynamics by contrasting offline and online pathways. Offline channels, which include specialty stores and supermarkets & hypermarkets, focus on in-store demonstrations and formulation partnerships to educate culinary professionals. Conversely, online retail has expanded the reach of pulse ingredient suppliers, leveraging digital platforms to offer direct-to-manufacturer procurement and streamlined logistics solutions, thus enabling agile fulfillment models.

This comprehensive research report categorizes the Pulse Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Application

- Distribution Channel

Evaluating Regional Dynamics Across the Americas, EMEA, and Asia-Pacific Regions to Identify Growth Hotspots and Strategic Opportunities

Regional analysis across the Americas illustrates a landscape where North American demand for pulse ingredients is accelerating in response to both consumer preferences and government initiatives promoting plant-based proteins. Canada’s role as a leading pulse exporter has been complemented by substantial investments in fractionation facilities, enhancing value addition before shipment. In the United States, processing capacity expansions are underway to support domestic formulation needs and reduce import dependency.

The Europe, Middle East & Africa region presents a multifaceted picture. In Europe, stringent labeling regulations and sustainability targets are driving interest in pulse ingredients that comply with clean-label mandates and carbon reduction goals. Meanwhile, the Middle East and Africa are emerging as growth frontiers, where pulse-based formulations address nutritional gaps and support local agricultural development programs. Cross-regional alliances are also forming to facilitate technology transfer and co-development initiatives, leveraging advanced fractionation expertise from established markets.

Across Asia-Pacific, rapid urbanization and rising disposable incomes are fueling demand for protein-enriched convenience foods. Australia and New Zealand, with established pulse cropping systems, are scaling up processing capabilities to serve regional and export markets. In Southeast Asia, collaborative ventures between local producers and multinational ingredient firms are expanding capacity for both traditional pulse flours and innovative isolates, meeting the needs of snack manufacturers and plant-based dairy analog developers alike.

This comprehensive research report examines key regions that drive the evolution of the Pulse Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Leading Industry Players Are Innovating Through Partnerships, Expansions, and Value Chain Optimization in Pulse Ingredients

Major industry players are differentiating through strategic investments in research and development, advanced processing technologies, and global footprint expansions. Global agribusiness conglomerates are forging partnerships with specialized fractionation firms to integrate pulse protein isolates into existing value chains, thereby accelerating time-to-market for new formulations. At the same time, nimble startups are carving out niches by focusing on novel sources such as faba bean and by developing proprietary wet fractionation methods that enhance protein functional properties.

In addition to technological differentiation, leading companies are pursuing vertical integration strategies. By collaborating directly with pulse growers, ingredient suppliers are securing feedstock quality and volume commitments, while providing agronomic support to optimize yield and protein content. Such alliances not only stabilize raw material supply but also create shared value across the value chain, ultimately translating into more predictable ingredient sourcing for food manufacturers.

Furthermore, market leaders are leveraging digital platforms to strengthen customer engagement and supply chain transparency. Online portals offering real-time inventory visibility, traceability documentation, and technical application support are becoming standard service offerings. These value-added services foster trust and collaboration, positioning companies that embrace digitalization to capture a larger share of the evolving pulse ingredients market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pulse Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGT Food and Ingredients Inc.

- Archer-Daniels-Midland Company

- Axiom Foods, Inc.

- Burcon NutraScience Corporation

- Cargill, Incorporated

- Cosucra Groupe Warcoing SA

- Emsland Group GmbH

- Ingredion Incorporated

- Puris Proteins LLC

- Roquette Frères SA

Strategic Recommendations for Industry Leaders to Enhance Competitive Positioning Within the Evolving Pulse Ingredients Sector

To maintain competitive advantage, industry leaders should prioritize investments in fractionation technologies that enhance both yield and functional performance. By piloting novel dry fractionation techniques alongside traditional wet processes, companies can optimize operational efficiency while minimizing water usage and environmental impact. This dual-track approach will enable rapid adaptation as customer requirements for purity, solubility, and clean-label credentials continue to evolve.

Moreover, to mitigate the impact of trade uncertainties, manufacturers and suppliers should diversify their sourcing portfolios across multiple pulse varieties and geographic origins. Establishing strategic partnerships with growers in non-traditional pulse-producing regions can bolster supply chain resilience and reduce dependency on any single market. When considering application-specific requirements, collaborating with end users to co-develop customized ingredient solutions will further strengthen customer loyalty and open new market segments.

Lastly, embracing a data-driven mindset will be critical. Leveraging digital tools for end-to-end supply chain visibility, predictive demand planning, and quality assurance will minimize operational disruptions and drive cost efficiencies. Industry leaders that integrate advanced analytics with sustainable sourcing and process innovation will be best positioned to navigate regulatory changes, respond to shifting consumer trends, and lead the pulse ingredients market forward.

Detailing a Robust Research Methodology Incorporating Primary Intelligence and Secondary Analysis to Ensure Comprehensive Market Insights

This research leverages a hybrid approach combining primary and secondary data sources to ensure comprehensive and actionable insights. Primary research entailed structured interviews and surveys with key stakeholders, including ingredient manufacturers, food formulators, and agricultural cooperatives. These engagements provided firsthand perspectives on sourcing challenges, processing innovations, and application trends. Additionally, expert interviews with technology providers and industry consultants enriched the qualitative understanding of emerging fractionation techniques and sustainability practices.

Secondary research included an exhaustive review of industry publications, regulatory frameworks, and scientific literature focused on pulse composition, functional properties, and processing methodologies. Trade databases and customs records were analyzed to track import-export flows and tariff evolutions, while sustainability reports and corporate disclosures helped assess environmental and social impact initiatives. Data triangulation, combining both qualitative and quantitative inputs, underpinned the integrity of findings and reinforced the strategic recommendations outlined in this document.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pulse Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pulse Ingredients Market, by Product Type

- Pulse Ingredients Market, by Source

- Pulse Ingredients Market, by Application

- Pulse Ingredients Market, by Distribution Channel

- Pulse Ingredients Market, by Region

- Pulse Ingredients Market, by Group

- Pulse Ingredients Market, by Country

- United States Pulse Ingredients Market

- China Pulse Ingredients Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Summarizing Key Findings and Strategic Imperatives to Guide Stakeholders Through Future Challenges in the Pulse Ingredients Market

The analysis underscores the transformative journey of the pulse ingredients market, driven by sustainability demands, technological advancements, and shifting tariff landscapes. Market participants who strategically align processing capabilities with evolving application requirements are poised to capture disproportionate value. In particular, businesses that integrate advanced fractionation processes, diversify sourcing portfolios, and harness digital supply chain tools will emerge as leaders in this dynamic environment.

Looking ahead, the pulse ingredients sector offers significant opportunities for innovation and growth. As consumer appetite for plant-based proteins and clean labels intensifies, the ability to deliver high-purity flours, concentrates, and isolates with traceable sourcing and environmental credentials will be paramount. Stakeholders that proactively adopt the strategic recommendations presented herein will not only navigate current challenges but also lay the foundation for long-term market leadership.

Engaging With Ketan Rohom to Access Comprehensive Pulse Ingredients Intelligence That Drives Informed Decisions and Accelerated Growth

To explore this wealth of insights and to equip your team with data-driven strategies that align with evolving market demands, reach out to Ketan Rohom, the Associate Director of Sales & Marketing. His expertise in translating complex market intelligence into actionable plans will ensure you harness emerging opportunities in pulse ingredients with confidence.

Engaging with Ketan Rohom opens a direct channel to obtain the full report and bespoke advisory services tailored to your organization’s objectives. Seize the opportunity to gain a competitive edge by contacting him today and unlock the detailed analysis required to drive innovation and growth in your pulse ingredients ventures.

- How big is the Pulse Ingredients Market?

- What is the Pulse Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?