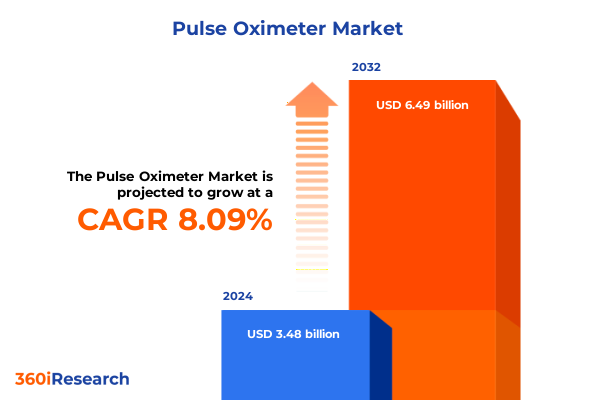

The Pulse Oximeter Market size was estimated at USD 3.75 billion in 2025 and expected to reach USD 4.05 billion in 2026, at a CAGR of 8.14% to reach USD 6.49 billion by 2032.

Unveiling the Crucial Role of Pulse Oximetry Technology in Shaping the Future of Patient Monitoring and Healthcare Delivery Worldwide

The pulse oximeter has evolved from a niche hospital instrument into an indispensable tool for continuous patient monitoring across a diverse array of healthcare settings. What was once confined to critical care units and operating rooms is now routinely found in ambulatory clinics, fitness and sports facilities, and homecare environments. This expansion has been driven by an aging population with chronic respiratory and cardiovascular conditions, heightened awareness of early detection of hypoxemia, and the growing emphasis on telemedicine and remote patient management.

In this context, the pulse oximetry landscape presents both opportunities and challenges for manufacturers, healthcare providers, and policymakers. Technological innovations have enabled miniaturization, improved accuracy, and seamless connectivity, while regulatory agencies have introduced new guidelines to ensure device reliability and patient safety. As the market matures, strategic differentiation, supply chain resilience, and a deep understanding of end-user needs become increasingly critical factors for success. This executive summary synthesizes the key trends, transformative shifts, tariff impacts, segmentation dynamics, regional outlooks, competitive intelligence, and actionable recommendations to guide decision-makers in navigating the complexities of the evolving pulse oximeter market.

Identifying the Revolutionary Shifts Redefining Pulse Oximeter Applications Across Clinical Settings, Consumer Health, and Remote Monitoring Trends

Healthcare delivery is undergoing a profound transformation as digital innovations redefine how clinicians and consumers monitor vital signs. Remote patient monitoring platforms now integrate pulse oximeters into telehealth ecosystems, enabling continuous data streaming that informs clinical decision support algorithms. These advances have accelerated the shift from episodic assessments to proactive, data-driven care models, thereby improving patient outcomes and reducing hospital readmissions.

Simultaneously, wearable sensor technology has disrupted traditional form factors by embedding pulse oximetry capabilities into smartwatches, fitness bands, and adhesive patches. This convergence of medical-grade accuracy and consumer convenience empowers users to track oxygen saturation during routine activities, exercise sessions, and sleep studies without clinical supervision. Moreover, the integration of artificial intelligence and predictive analytics has enhanced signal processing accuracy, facilitated artifact reduction, and provided early warning of deteriorating respiratory function. These transformative shifts underscore a new era in which pulse oximetry transcends the hospital bedside to become an integral component of connected health ecosystems.

Examining the Ripple Effects of 2025 United States Tariff Measures on the Pulse Oximeter Supply Chain, Cost Structures, and Market Accessibility

In 2025, newly implemented United States tariffs on imported medical devices have sent ripples throughout the pulse oximeter supply chain. Many manufacturers that historically relied on cost-effective components and assembly in China have faced higher input costs, which have consequently exerted pressure on gross margins. At the same time, distributors and end users are grappling with elevated purchase prices, prompting some to delay replacement cycles or seek alternative sourcing strategies.

To mitigate these impacts, industry stakeholders have accelerated efforts to diversify manufacturing footprints. Nearshoring initiatives in Mexico and partnerships with contract manufacturers in India have gained momentum, buffering against further tariff escalations. Concurrently, domestic production lines have been retooled to accommodate higher demand for Made-in-America devices, supported by federal incentives for onshore medical device manufacturing. Nevertheless, the transition requires careful balancing of capital investments, lead times, and quality assurance measures to ensure uninterrupted device supply and maintain affordability for providers and patients.

Illuminating Strategic Segmentation Drivers That Influence Product Development, Sensor Technology Adoption, Connectivity Features, Patient Demographics, and Distribution

A nuanced understanding of market segmentation is vital for tailoring product strategies, and this analysis dissects multiple dimensions to illuminate actionable insights. The spectrum of form factors encompasses fingertip pulse oximeters favored for point-of-care screening, handheld models used in emergency and transport settings, phone-based solutions that leverage mobile displays for consumer applications, tabletop and benchtop systems designed for clinical diagnostics, and next-generation wearable devices that offer continuous monitoring during daily activities.

Equally significant is the variety of sensor technologies-from single-use disposables that ensure infection control to reflectance sensors embedded in flexible substrates, reusable clips that withstand repeated use in institutional environments, and transmission sensors suited to specialized applications. In parallel, technology tiers range from conventional pulse oximeters with basic pulse rate and SpO₂ displays to Bluetooth-enabled platforms that support wireless data transmission, and smart pulse oximeters featuring integrated analytics and customizable alarms. Patient demographics introduce further granularity, with device requirements tailored to adult patients managing chronic conditions, geriatric users who benefit from simplified interfaces, and pediatric cohorts requiring gentle sensors and compact form factors.

Turning to end-user settings, ambulatory surgical centers demand rapid assessment tools for preoperative screening, diagnostic centers emphasize data accuracy for clinical protocols, fitness and sports facilities prioritize ease of use during performance tracking, homecare settings call for user-friendly operation and remote clinician connectivity, while hospitals and clinics integrate oximetry into comprehensive monitoring systems. Finally, the landscape of distribution channels spans traditional offline networks, from value-added distributors to direct hospital supply chains, alongside an expanding online ecosystem that includes brand websites offering direct ordering and e-commerce platforms providing broad product access.

This comprehensive research report categorizes the Pulse Oximeter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Sensor Type

- Technology

- Patient Type

- End-User

- Sales Channel

Exploring Regional Dynamics That Shape Market Adoption Patterns, Innovation Investments, Regulatory Landscapes, and Demand Variations Across Key Geographies

Regional dynamics play an instrumental role in shaping the diffusion of pulse oximetry innovations and the evolution of clinical practices. In the Americas, robust healthcare infrastructure and high per-capita healthcare spending have fostered rapid adoption of advanced oximetry solutions across hospitals, homecare providers, and fitness enthusiasts. Moreover, reimbursement frameworks that incentivize remote patient monitoring have spurred investments in telehealth platforms that integrate pulse oximeters into broader care pathways.

Across Europe, the Middle East, and Africa, divergent market maturities and regulatory environments drive distinct adoption patterns. Western European nations benefit from streamlined regulatory harmonization under centralized authorities, facilitating faster market entry for devices equipped with cutting-edge connectivity features. Conversely, emerging markets in the Middle East and Africa present untapped potential, where growing private healthcare spending and expanding medical infrastructure create demand for cost-effective and portable oximetry solutions.

In the Asia-Pacific region, rapid urbanization, rising healthcare access, and government initiatives to bolster domestic manufacturing have catalyzed market expansion. Countries such as China, India, and Japan have witnessed a surge in clinical and consumer-grade pulse oximeters, with local manufacturers competing alongside global incumbents. Additionally, digital health strategies endorsed by regional health ministries have accelerated the integration of pulse oximetry into nationwide telemedicine and chronic disease management programs.

This comprehensive research report examines key regions that drive the evolution of the Pulse Oximeter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping Competitive Strategies and Innovation Trajectories of Leading Pulse Oximeter Manufacturers, Emerging Disruptors, and Collaborative Partnerships

The competitive landscape of the pulse oximeter market is characterized by a blend of established medical device conglomerates, specialized sensor firms, and agile technology startups. Leading companies have invested heavily in research and development to enhance sensor accuracy, reduce signal artifacts, and integrate connectivity protocols that facilitate seamless data interoperability with electronic health record systems.

Strategic partnerships and acquisitions have emerged as key tactics for enriching product portfolios and accelerating time to market. Collaborations between device manufacturers and wireless technology providers have yielded Bluetooth-enabled modules that support real-time monitoring dashboards. Moreover, industry frontrunners are leveraging in-house manufacturing capabilities alongside contract production agreements to optimize cost structures and respond swiftly to shifting demand. Simultaneously, emerging disruptors are differentiating through user-centric design, cloud-based analytics platforms, and direct-to-consumer distribution models, intensifying competitive pressures and driving continuous innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pulse Oximeter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Diagnostic Corporation

- Beurer GmbH

- BioIntelliSense, Inc.

- Compass Health Brands

- CONTEC MEDICAL SYSTEMS CO., LTD

- Criticare Systems, Inc.

- Drägerwerk AG & Co. KGaA

- GE HealthCare

- ICU Medical, Inc.

- Koninklijke Philips N.V.

- LOOKEETech

- Masimo Corporation

- Meditech Equipment Co., Ltd.

- Medtronic plc

- METTLER TOLEDO

- Mindray Medical International Limited

- Nihon Kohden Corporation

- Nonin Medical, Inc.

- OMRON Corporation

- Smiths Group plc

- Spacelabs Healthcare (OSI Systems, Inc.)

- Telli Health Inc.

- Turner Medical

- Zensorium Pte Ltd

Presenting Actionable Recommendations for Industry Leaders to Capitalize on Emerging Opportunities, Optimize Product Portfolios, and Enhance Market Penetration

Industry leaders should prioritize the development of advanced sensor technologies that strike an optimal balance between clinical accuracy and user comfort. Investing in miniaturized reflectance sensors and disposable modules can cater to both professional and consumer segments, while ensuring compliance with evolving regulatory standards. Furthermore, integrating artificial intelligence algorithms will enhance real-time signal processing, predictive alerts, and automated data validation, thereby elevating the clinical utility of pulse oximetry platforms.

Given the tariff-induced supply chain challenges, organizations must diversify manufacturing footprints by cultivating relationships with contract manufacturers in emerging regions, as well as exploring strategic joint ventures for onshore production. Strengthening logistics resilience and implementing robust quality management systems will mitigate risks associated with geopolitical fluctuations. Simultaneously, expanding direct-to-consumer channels through proprietary e-commerce portals and partnerships with digital health marketplaces will unlock new revenue streams and foster brand loyalty.

Additionally, forging alliances with telehealth providers, fitness and sports organizations, and homecare agencies can create integrated care pathways that amplify device utilization. Tailoring marketing initiatives to specific patient demographics-such as ergonomic pediatric sensors and simplified interfaces for geriatric users-will further differentiate offerings. By executing these recommendations, industry stakeholders can capitalize on emerging opportunities, future-proof their portfolios, and drive sustainable growth.

Detailing a Robust Mixed-Method Research Approach Combining Primary Insights, Secondary Data Analysis, and Expert Validation to Ensure Accurate Market Intelligence

This market analysis employs a mixed-method research framework, initiating with comprehensive secondary research derived from peer-reviewed journals, regulatory databases, government health statistics, and patent filings. These sources establish a foundational understanding of historical trends, technology evolutions, and policy developments. Subsequently, a series of in-depth interviews were conducted with clinical end users, biomedical engineers, procurement managers, and industry executives to validate secondary findings and uncover nuanced insights into purchasing criteria, adoption barriers, and unmet clinical needs.

Data triangulation was achieved by cross-referencing primary interview feedback with company annual reports, product catalogs, clinical trial registries, and global trade data. Quantitative analyses were performed to assess adoption rates across different healthcare settings and patient demographics, ensuring segmentation accuracy. Finally, expert validation workshops brought together leading clinicians, technology architects, and market strategists to review interim conclusions and refine forecast assumptions. This rigorous methodology guarantees that the report delivers actionable intelligence grounded in empirical evidence and expert consensus.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pulse Oximeter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pulse Oximeter Market, by Product Type

- Pulse Oximeter Market, by Sensor Type

- Pulse Oximeter Market, by Technology

- Pulse Oximeter Market, by Patient Type

- Pulse Oximeter Market, by End-User

- Pulse Oximeter Market, by Sales Channel

- Pulse Oximeter Market, by Region

- Pulse Oximeter Market, by Group

- Pulse Oximeter Market, by Country

- United States Pulse Oximeter Market

- China Pulse Oximeter Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Summarizing Core Insights on Market Drivers, Technological Advancements, Regulatory Influences, and Strategic Imperatives for Industry Stakeholders

The pulse oximeter market stands at a pivotal juncture, propelled by relentless innovation in sensor design, connectivity, and analytics, as well as transformative shifts toward remote patient management. While tariff dynamics have introduced new cost considerations, they have simultaneously catalyzed efforts to localize manufacturing and enhance supply chain resilience. Segmentation analyses reveal that success hinges on understanding the diverse needs of product form factors, sensor types, connectivity platforms, patient demographics, end-user settings, and distribution channels.

Regional variations underscore the necessity for adaptive strategies that address distinct regulatory requirements, reimbursement frameworks, and healthcare infrastructures. Competitive intelligence highlights the importance of strategic partnerships, agile product development, and direct-to-consumer engagement models. By synthesizing these insights and implementing targeted recommendations, industry stakeholders can position themselves at the forefront of a market characterized by both rapid growth potential and dynamic technological evolution. Ultimately, a clear focus on innovation, operational agility, and customer-centric design will define the leaders in the next phase of pulse oximetry advancement.

Seize the Opportunity to Access Comprehensive Pulse Oximeter Market Intelligence with Personalized Support from Ketan Rohom, Associate Director of Sales & Marketing

I appreciate your interest in gaining a competitive edge through comprehensive pulse oximeter market insights. To explore deeper analyses, detailed company profiles, strategic roadmaps, and actionable forecasts tailored to your organization’s needs, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise will ensure you receive a customized engagement package, including exclusive briefings and priority support.

Connect with Ketan today to secure early access to proprietary data, leverage expert guidance, and accelerate your strategic planning. The full market research report will empower your team with the clarity and direction required to navigate emerging trends, regulatory shifts, and technological innovations with confidence. Don’t miss this opportunity to transform insights into impactful business outcomes

- How big is the Pulse Oximeter Market?

- What is the Pulse Oximeter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?