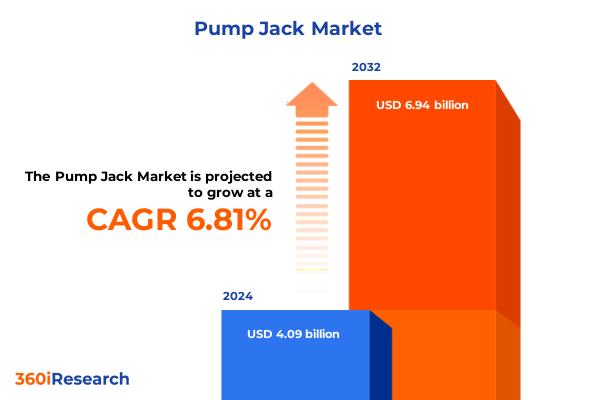

The Pump Jack Market size was estimated at USD 4.32 billion in 2025 and expected to reach USD 4.56 billion in 2026, at a CAGR of 6.99% to reach USD 6.94 billion by 2032.

Setting the Stage for Deep Analysis of Pump Jack Market Dynamics and Emerging Opportunities in a Rapidly Evolving Energy Sector

The pump jack market has experienced a remarkable transformation in recent years, driven by shifting energy demands, environmental imperatives, and regulatory landscapes. This introduction establishes the core context by tracing the historical significance of pump jack technology as a cornerstone of onshore oil extraction and highlighting the evolving challenges and opportunities that define today’s industry. As traditional oilfields mature and unconventional energy sources gain traction, operators must navigate complex operational requirements while balancing cost efficiency and sustainability objectives.

This executive summary sets the stage for an in-depth exploration of the emerging market landscape, detailing how infrastructure modernization, automation, and digitization are revolutionizing production processes. It also previews critical themes-such as tariffs, segmentation insights, and regional dynamics-that will shape competitive strategies and investment priorities. By synthesizing these dimensions, stakeholders from drilling service providers to major oil companies can better understand the pathways to operational excellence, regulatory compliance, and long-term growth.

Identifying Key Technological Advancements Operational Models and Environmental Drivers Redefining Competitive Advantages Across the Pump Jack Ecosystem

The pump jack industry is undergoing transformative shifts as groundbreaking technologies converge with changing stakeholder expectations. Advancements in digital monitoring systems and automated control platforms now enable real-time performance optimization, reducing downtime and energy consumption. Coupled with predictive maintenance algorithms, these solutions not only extend asset lifespans but also facilitate proactive decision making. At the same time, environmental regulations are accelerating the adoption of cleaner power alternatives, prompting suppliers to explore electric drive systems and solar-assisted configurations that minimize carbon footprints and improve regulatory compliance.

In parallel, the increased focus on energy efficiency has spurred innovations in hydraulic and gas engine-driven pump jacks, which deliver higher throughput and adaptability to varying well conditions. Industry participants are collaborating on modular designs that simplify retrofitting older units with modern components, effectively bridging the gap between legacy assets and next-generation capabilities. Furthermore, digital twin technologies are emerging as a critical enabler, allowing engineers to simulate and optimize operations across diverse geographical and geological scenarios. Taken together, these technological breakthroughs and sustainability drivers are redefining competitive advantages and market positioning.

Assessing the Multifaceted Consequences of Recent U.S. Tariff Policies on Supply Chains Operational Costs and Global Trade Patterns in 2025

The introduction of new tariff structures by the United States in 2025 has created multifaceted implications for the pump jack supply chain. Import duties on steel components and specialized drive assemblies have led manufacturers and operators to reassess sourcing strategies. Firms that traditionally relied on offshore suppliers for critical parts are now exploring local supply chain partnerships to mitigate duty-related cost increases. Consequently, there is heightened demand for domestically produced castings, sealing systems, and electronic modules, as well as greater scrutiny of total landed costs.

Beyond component procurement, tariff influences extend to capital equipment acquisitions and aftermarket services. Several operators report extended lead times and higher sticker prices on imported units, compelling them to delay expansion plans or seek alternative financing models. At the same time, U.S.-based manufacturers are scaling production to capture rising domestic demand, but capacity constraints and labor considerations impose limitations. Collectively, these dynamics are reshaping global trade patterns, accelerating regionalization strategies, and prompting industry stakeholders to build more resilient, diversified operational frameworks.

Unpacking Rich Insights from Comprehensive Segment Analysis Across Power Sources Applications End Users Well Depths and Technologies for Strategic Decision Making

A granular segmentation analysis uncovers nuanced opportunities and challenges across multiple dimensions of the pump jack market. Based on power source, demand is shifting steadily from diesel engine–driven units toward electric and solar configurations, as operators prioritize sustainability and lower lifecycle costs; however, gas engine and hydraulic pumps remain integral where fuel availability and remote operations are critical.

When examined by application, the offshore segment presents unique complexity: deep water operations require robust corrosion protection and high-pressure designs, whereas shallow water sites benefit from simplified maintenance protocols; conversely, onshore activities span greenfield developments where infrastructure is built from scratch and mature fields where integration with legacy systems is paramount. Differentiation also emerges across end users: contract drilling firms leverage land drilling contractors and service companies to access specialized expertise, while independent operators-both private and public-focus on agile, cost-effective deployments; major oil companies, whether international or national, command scale efficiencies and extensive aftermarket support.

Considering well depth, deep-depth operations between 1,500 meters and above 3,000 meters necessitate high-capacity units with advanced pressure management, while medium-depth wells rely on systems optimized for the 500-meter to 1,500-meter range, balancing throughput and energy efficiency; shallow-depth sites under 500 meters capitalize on lower-power technologies that reduce wear and enhance operational uptime. Finally, technology-driven segmentation reveals a diverse landscape in which air balanced designs-dual and single pilot variants-compete with conventional beam solutions featuring crank-balanced and horsehead-balanced configurations, as well as hydraulically balanced units differentiated by dual and single cylinder architectures, each offering distinct trade-offs in maintenance, energy consumption, and operational stability.

This comprehensive research report categorizes the Pump Jack market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Power Source

- Well Depth

- Technology

- Application

- End User

Examining Geographic Nuances Across the Americas Europe Middle East Africa and Asia-Pacific to Reveal Demand Patterns and Growth Catalysts in the Pump Jack Industry

Regional dynamics significantly influence pump jack adoption, driven by geological formations, regulatory climates, and local infrastructure. In the Americas, the revitalization of shale plays and mature onshore fields fuels sustained demand for both conventional and electric-driven units, supported by robust local supply chains and incentive programs aimed at reducing emissions. Market players in North America are advancing electrification and automation to maximize output in tight oil formations, while Latin American countries are adapting legacy assets to newer configurations amid fluctuating oil prices.

Europe, the Middle East, and Africa exhibit diverse trends: regulators in Western Europe emphasize carbon neutrality goals, prompting operators to pilot solar-assisted pump jacks in remote fields, whereas North African producers leverage cost-competitive gas engine units to capitalize on regional fuel surpluses. In the Middle East, ongoing investments in digital transformation complement high-capacity pump jack deployments, addressing deep reservoir extraction. Meanwhile, sub-Saharan Africa’s onshore sites rely on modular designs to overcome logistical constraints and capture incremental production gains.

Asia-Pacific is characterized by heterogeneous market maturity. Australia’s established operations focus on retrofitting existing pump jacks with advanced monitoring and control systems, while Southeast Asian nations navigate infrastructure limitations by deploying medium-depth configurations. China and India, driven by energy security imperatives, prioritize domestic manufacturing of key components and investment in electrification initiatives, setting the stage for accelerated growth in solar-powered and electric-driven technologies.

This comprehensive research report examines key regions that drive the evolution of the Pump Jack market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Major Market Players with Their Strategic Initiatives Technological Portfolios and Collaborative Ventures Shaping the Competitive Landscape

The competitive landscape is marked by a blend of long-established engineering firms and emerging technology providers. Leading conglomerates leverage decades of manufacturing expertise, extensive service networks, and comprehensive product portfolios spanning diesel, gas engine, electric, and hydraulically balanced pump jacks. These incumbents invest heavily in R&D centers to refine digital control systems, enhance energy efficiency, and develop integrated asset management platforms.

Meanwhile, niche innovators are carving out specialized market positions. Some focus exclusively on solar-assisted drive technologies, forging partnerships with renewable energy suppliers to deliver hybrid solutions that reduce operational costs and emissions. Others excel in retrofitting legacy pump jacks, offering modular upgrade kits that minimize downtime and capital expenditure. Strategic alliances between large equipment manufacturers and fintech firms are also emerging, enabling flexible leasing models and pay-per-output contracts that align vendor incentives with operator performance goals.

Collectively, these firms are advancing the market through a combination of M&A activity, collaborative ventures, and targeted innovation roadmaps. By aligning their product strategies with evolving regulatory requirements and customer priorities, they reinforce their competitive edges while fostering broader industry transformation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pump Jack market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allspeeds Ltd.

- Baker Hughes Company

- Cook Pump Company

- Dover Corporation

- Halliburton Company

- Jereh Petroleum Equipment Co., Ltd.

- Jiuzhou Pump Co., Ltd.

- National Oilwell Varco, Inc.

- Redhead Artificial Lift Ltd.

- Schlumberger Limited

- Shandong Dongyi Petroleum Equipment Co., Ltd.

- Star Hydraulics

- The Weir Group plc

- Weatherford International plc

Delivering Practical and Evidence-Based Strategic Guidance to Industry Executives for Navigating Regulatory Complexities and Maximizing Operational Efficiencies

To steer organizations through the complexities of a dynamic pump jack market, industry leaders should prioritize investment in digital infrastructure and process automation. Deploying cloud-based monitoring platforms and predictive analytics not only reduces unplanned downtime but also enhances regulatory compliance reporting. It is equally crucial to evaluate supplier resilience by mapping critical component sources and developing contingency plans to navigate tariff volatility and supply chain disruptions.

Leaders must also adopt a modular mindset when approaching equipment acquisitions and upgrades. Selecting pump jack designs that accommodate future electrification or hybrid power integration will safeguard against obsolescence and support evolving sustainability targets. Furthermore, forging strategic partnerships-whether with technology providers specializing in digital twin simulations or with local manufacturers capable of delivering custom components-can unlock cost efficiency and foster innovation.

Finally, executives should champion workforce development initiatives that equip technicians with digital skills, ensuring seamless adoption of advanced control systems and condition-based maintenance practices. By embedding continuous improvement frameworks and cross-functional collaboration between engineering, procurement, and operations teams, organizations will be better positioned to capitalize on emerging opportunities and mitigate evolving risks.

Detailing a Robust Mixed-Method Research Framework Combining Primary Interviews Secondary Data Validation and Rigorous Analytical Protocols

This research adopts a mixed-methodology approach to ensure robust, validated insights. Primary data was gathered through in-depth interviews with field engineers, C-suite executives, and procurement specialists across leading oil and gas operators. These qualitative inputs were complemented by a comprehensive survey targeting regional equipment distributors and service providers to quantify technology adoption rates and investment priorities.

Secondary research included a systematic review of publicly available regulatory filings, technical whitepapers, and trade association reports. Data triangulation techniques were employed to cross-verify key findings and minimize bias. Advanced analytics tools facilitated trend analysis, while scenario modeling assessed the impact of tariff changes and technology shifts under varying market conditions. Throughout, a rigorous peer-review process and stakeholder validation workshops reinforced the credibility and accuracy of the conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pump Jack market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pump Jack Market, by Power Source

- Pump Jack Market, by Well Depth

- Pump Jack Market, by Technology

- Pump Jack Market, by Application

- Pump Jack Market, by End User

- Pump Jack Market, by Region

- Pump Jack Market, by Group

- Pump Jack Market, by Country

- United States Pump Jack Market

- China Pump Jack Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Consolidating Key Findings into an Integrated Perspective on Market Dynamics Regulatory Trends Technological Innovations and Competitive Forces

In conclusion, the pump jack market stands at a strategic inflection point, influenced by accelerating technological innovation, evolving tariff structures, and the imperative for sustainable operations. Segmentation analysis underscores the importance of aligning power source choices and equipment specifications with application requirements and well characteristics. Regional insights highlight differentiated growth trajectories shaped by regulatory environments and supply chain configurations, while competitive profiling reveals a dynamic interplay between legacy manufacturers and agile disruptors.

As the industry moves forward, the integration of digital platforms, modular design principles, and renewable power solutions will be essential in driving operational excellence and achieving cost efficiency. Stakeholders who proactively adapt their strategies to encompass these multidimensional trends will secure a competitive edge and foster long-term resilience in an ever-changing energy landscape.

Engage with Ketan Rohom to Unlock Comprehensive Market Intelligence and Empower Strategic Investments in the Pump Jack Sector

To gain unparalleled visibility into evolving market dynamics and actionable strategies tailored for sustainable success in the pump jack industry, connect with Ketan Rohom, Associate Director, Sales & Marketing, who will guide you through a personalized consultation and secure access to the full, authoritative report.

- How big is the Pump Jack Market?

- What is the Pump Jack Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?