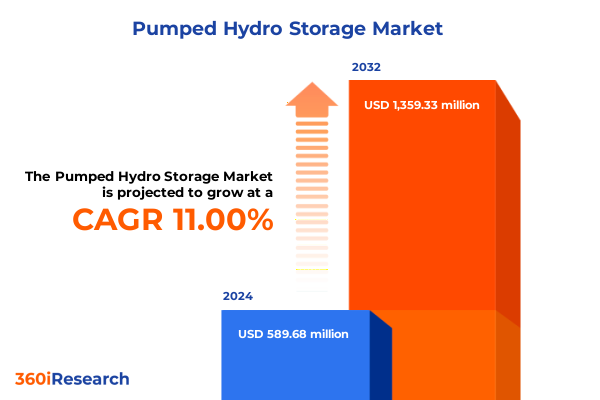

The Pumped Hydro Storage Market size was estimated at USD 653.47 million in 2025 and expected to reach USD 716.17 million in 2026, at a CAGR of 11.03% to reach USD 1,359.33 million by 2032.

A concise orientation to how pumped hydro storage integrates with modern grids and why it remains a cornerstone resource for long-duration and system-level reliability planning

Pumped hydro storage occupies a distinctive place at the intersection of long-duration energy storage and utility-scale firming resources. This executive summary synthesizes technical trends, policy and trade developments, segmentation insights, and regional dynamics that are reshaping project economics and sourcing strategies. Rather than offering a narrow technology pitch, the intent here is to present a balanced view of how pumped hydro can support large-scale renewable integration, provide multi-day and seasonal balancing, and serve as a durable asset class for regulated utilities and merchant operators alike.

The narrative that follows emphasizes the roles of closed-loop and open-loop configurations, the evolving technology supply chain for turbines and civil works, and the operational value streams that distinguish pumped hydro from shorter-duration battery systems. Throughout, emphasis is placed on the practical constraints - siting, permitting, capital intensity - and the countervailing policy and financing mechanisms that are lowering some of these barriers. Readers will find analysis that links engineering realities to market mechanisms, enabling clearer evaluation of development-stage risk and commercialization pathways.

How technological, regulatory, and financial innovations are jointly reshaping the pumped hydro storage landscape and expanding viable project pathways across markets

The landscape for pumped hydro storage is undergoing several transformative shifts that extend beyond pure engineering refinements. Advances in civil and liner technologies, together with more nuanced environmental mitigation practices, are reducing project-level uncertainty and widening the palette of viable sites. Simultaneously, a renewed focus on long-duration storage driven by increasing shares of variable renewables has elevated pumped hydro from a specialized niche to a central option for planners seeking multi-day firming and seasonal buffering.

Policy and procurement mechanisms have also evolved; capacity procurement frameworks, storage carve-outs, and grid resilience initiatives are creating clearer revenue stacks for long-duration assets. Financial innovation is emerging in parallel: green infrastructure debt, resilience-linked instruments, and blended public-private sponsorships are addressing the palpable financing gap for capital-intensive projects. At the same time, the supply chain that supports mechanical-electrical balance-of-plant equipment is recalibrating as trade measures and domestic content incentives alter sourcing decisions. Together, these technical, policy, and financial drivers are shifting the competitive calculus in favor of projects that can demonstrate low lifecycle emissions, robust permitting strategies, and integrated grid-value propositions.

Assessing the practical supply-chain and procurement consequences of United States tariff adjustments enacted around 2025 and their effects on pumped hydro project planning

United States tariff actions implemented in late 2024 and into 2025 have introduced new variables that materially affect equipment sourcing, supply-chain resiliency, and procurement strategy for pumped hydro projects. The expansion of Section 301 tariff coverage to include polysilicon, solar wafers, certain battery components, and other hardware categories, together with tariff increases that took effect on January 1, 2025 for specific product groups, has created both direct and indirect cost pressures for developers who rely on imported electromechanical and electrical components. The tariffs were explicitly framed to address strategic manufacturing concerns, but the practical implication for pumped hydro projects is a greater emphasis on alternative sourcing routes and qualification of domestic or third-country suppliers for critical items such as transformers, power electronics, motors, and control systems. This shift is encouraging earlier procurement planning, longer lead-time allowances, and closer alignment between engineering procurement and construction (EPC) timelines and trade compliance teams.

In addition to the direct tariff hikes, the policy environment has introduced mechanisms for exemptions and exclusion processes for certain machinery categories; these administrative routes have become an essential part of procurement playbooks for projects that depend on specialized equipment not readily available domestically. The cumulative impact to date has been to accelerate two strategic responses among project sponsors: first, near-term projects are increasingly prioritizing suppliers within aligned trade jurisdictions to reduce tariff exposure; second, longer-term development pipelines are recalibrating supply strategies to support local or regional supply-chain investments where feasible. The net effect is a more complex procurement landscape, where tariff risk is now an explicit component of commercial bids and where developers are evaluating hybrid sourcing strategies that mix domestic fabrication, third-country imports, and strategic inventory pre-positioning to preserve schedule certainty and cost competitiveness.

How development stage, capacity range, end-user demand, technology choice, application focus, and ownership model collectively determine project design, financing, and commercial pathways

Segmentation analysis reveals multiple decision levers that determine project design, financing, and commercial positioning. When projects are analyzed by their development stage, the operational cohort delivers defined revenue histories and operational data valuable for refinancing and repowering decisions, while near-term planned projects must balance permitting timelines against grid interconnection milestones and offtake certainty. Long-term planned sites are evaluated more like strategic land and water assets, where value accrues from optionality and future policy shifts. Capacity ranges also create different development archetypes: very large above-500 megawatt facilities require distinct civil works contracting capacity and grid integration studies, while below-100 megawatt projects can be more modular and sometimes faster to permit in constrained geographies. End-user segmentation clarifies commercial offtake models; commercial and industrial customers may pursue pumped hydro to hedge volumetric and time-of-use exposure, independent power producers typically focus on merchant arbitrage and ancillary service revenues, and utilities often value pumped hydro for capacity, resilience, and system balancing. Within industrial demand, sectors such as chemical, manufacturing, and mining bring unique operational reliability requirements and may favor co-located solutions or firming contracts. Utilities themselves present different procurement dynamics when public versus investor-owned structures are considered, because capital access, regulatory approval processes, and rate-recovery mechanisms vary significantly.

Technology choice between off-stream and on-stream designs affects environmental permitting pathways and water use profiles, with off-stream closed-loop systems generally presenting lower ecological risk and permitting complexity. Application-driven segmentation further clarifies where pumped hydro adds the greatest value: bulk energy storage and seasonal shifting prioritize duration and headroom, while frequency regulation and grid stability deployments focus on fast response and dispatch flexibility. Ownership models - private, public, and public-private partnerships - influence capital structuring, risk allocation, and community engagement approaches. A nuanced segmentation lens therefore yields actionable implications for project developers, financiers, and policy makers by tying technical design and commercial strategy to the specific needs and constraints of each segment.

This comprehensive research report categorizes the Pumped Hydro Storage market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Project Development Stage

- Capacity Range

- End User

- Technology Type

- Application

Regional drivers and policy regimes in the Americas, Europe-Middle East-Africa, and Asia-Pacific are dictating distinct pumped hydro deployment models and financing preferences

Regional dynamics are shaping where investment flows, which technology variants are favored, and how policy frameworks allocate incentives and permitting support. In the Americas, grid planners and utilities are increasingly prioritizing long-duration solutions to complement growing solar and wind fleets, prompting policy incentives, state-level storage mandates, and renewed attention to eligible sites that minimize transmission expansion costs. These regional drivers favor projects that can integrate with existing hydro corridors or leverage brownfield civil works to shorten timelines.

Across Europe, the Middle East and Africa, market conditions are heterogeneous but clear patterns emerge: Europe emphasizes grid stability, hybridization with offshore renewables, and strong environmental safeguards that push developers toward closed-loop designs and advanced mitigation strategies; the Middle East is experimenting with large-scale storage tied to ambitious solar targets and water-conservation approaches; African markets are focusing on least-cost electrification and resilience where pumped hydro can provide multi-day reliability in regions with seasonal hydrology. In Asia-Pacific, strong industrial demand and major national programs are accelerating both conventional hydropower upgrades and pumped storage deployments, with China continuing to lead large-scale buildouts while other jurisdictions pair pumped hydro with transmission investments to balance fast-growing renewables. These regional differences affect supply-chain choices, financing structures, and community engagement practices, and they underscore the importance of tailoring project strategies to local regulatory, environmental, and social frameworks.

This comprehensive research report examines key regions that drive the evolution of the Pumped Hydro Storage market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Why a hybrid of legacy engineering capability, modular technology entrants, and flexible financing partners will determine which companies successfully scale pumped hydro deployments

Competitive dynamics among key companies and technology providers are evolving as a combination of legacy engineering expertise and new entrants focused on closed-loop innovations seek to capture the expanding opportunity set. Established civil engineering and hydro-electric OEMs remain central because the scale and complexity of pumped hydro projects demand proven project management, geological assessment, and heavy-works capability. At the same time, new technology firms and modular system integrators are advancing components and digital controls that shorten commissioning timelines and improve operational flexibility. Equipment suppliers that can demonstrate qualification across multiple jurisdictions and that maintain diversified fabrication footprints are positioned to mitigate trade-related supply risk and to meet accelerating procurement timelines.

Service providers that bundle project development, environmental permitting, and community engagement tend to reduce execution risk for lenders and off-takers, while financing partners that provide flexible capital structures - combining construction debt, infrastructure equity, and public grants - are enabling transactions that previously stalled during early-stage de-risking. Strategic alliances between utilities, industrial offtakers, and independent developers are becoming more common as firms seek to align grid service needs with commercial offtake. Ultimately, companies that can integrate best-in-class civil execution, electro-mechanical reliability, and adaptive commercial models will exert the greatest influence on how the pipeline converts into operational assets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pumped Hydro Storage market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alstom S.A.

- Andritz AG

- Bechtel Corporation

- China Energy Investment Corporation

- China Three Gorges Corporation

- Enel S.p.A.

- General Electric Company

- Hitachi, Ltd.

- Iberdrola, S.A.

- Kansai Electric Power Co., Inc.

- Mitsubishi Heavy Industries, Ltd.

- Sinohydro Corporation

- SNC-Lavalin Group Inc.

- State Power Investment Corporation Limited

- Strabag SE

- Tokyo Electric Power Company Holdings, Inc.

- Toshiba Corporation

- Voith GmbH & Co. KGaA

- Électricité de France S.A.

Practical procurement, design, financing, digital, and stakeholder engagement steps that industry leaders should implement immediately to accelerate credible pumped hydro project delivery

For industry leaders seeking to convert opportunity into executed projects, a set of pragmatic, actionable moves can materially lower execution risk and preserve upside. First, embed trade and procurement risk assessment early in project development so sourcing choices and lead times are reflected in both technical design and contractual terms. This entails qualifying multiple suppliers, establishing conditional purchase agreements with tariff pass-through mechanisms where appropriate, and leveraging exclusion processes for essential machinery when available. Second, prioritize closed-loop configurations or brownfield retrofit opportunities where environmental complexity and water-permitting timelines are reduced; these options often shorten time-to-first-dispatch and simplify stakeholder negotiations.

Third, adopt financing structures that layer concessional public financing with private capital to optimize weighted average cost of capital and to align incentives across partners; blended instruments and resilience-linked terms can unlock institutional interest. Fourth, integrate digital condition-based monitoring and advanced controls during the EPC phase to enhance operational flexibility and lower long-run maintenance risk. Fifth, engage communities and regulators early with transparent environmental and socioeconomic plans, and where possible, build local supply-chain commitments into procurement language to secure political and permitting goodwill. Collectively, these steps convert conceptual advantage into credible, financeable projects that can clear interconnection, attract capital, and deliver reliable system services.

An evidence-based methodology blending primary interviews, national laboratory studies, policy analysis, and tariff sensitivity testing to produce actionable and verifiable insights

The research methodology underpinning the analysis combined primary and secondary sources, technical review, and cross-validation with public-sector studies. Primary inputs included structured interviews with project developers, OEMs, grid planners, and financing institutions to understand real-world procurement timelines, contract structures, and operational risk drivers. Secondary analysis incorporated peer-reviewed life-cycle assessments, national laboratory studies, international industry outlooks, and recent trade and policy announcements to ensure the analysis reflected both technical and regulatory realities.

Cross-validation steps included triangulating developer-reported lead times against public permitting records and procurement notices, and testing tariff-sensitivity scenarios against observed customs classifications and Section 301 product lists. Where applicable, national laboratory lifecycle assessments were used to evaluate emissions and material trade-offs, while industry association outlooks informed the regional pipeline characterization. The methodology emphasized traceability: all significant assertions can be tied to primary interviews, official government notices, or peer-reviewed technical publications used during the analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pumped Hydro Storage market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pumped Hydro Storage Market, by Project Development Stage

- Pumped Hydro Storage Market, by Capacity Range

- Pumped Hydro Storage Market, by End User

- Pumped Hydro Storage Market, by Technology Type

- Pumped Hydro Storage Market, by Application

- Pumped Hydro Storage Market, by Region

- Pumped Hydro Storage Market, by Group

- Pumped Hydro Storage Market, by Country

- United States Pumped Hydro Storage Market

- China Pumped Hydro Storage Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

A concise synthesis of why pumped hydro remains strategically vital for long-duration storage and the pragmatic pathways to convert pipeline opportunity into operational assets

Pumped hydro storage remains a foundational long-duration storage technology with distinctive strengths in lifecycle emissions performance, system-level reliability, and multi-day energy shifting. Recent advances in closed-loop design, liner technology, and digital asset management are lowering several practical barriers, while evolving procurement and financing structures are beginning to bridge the project-capitalization gap. The 2025 trade environment introduces meaningful procurement complexity, but it also incentivizes clearer qualification of domestic and diversified supply chains, which in many cases will improve resilience and local economic benefits.

Decision-makers evaluating pumped hydro projects should approach opportunities with a segmented lens that links technical design, end-user requirements, and ownership models to financing and permitting strategy. Where speed to market is essential, brownfield retrofits and closed-loop smaller-capacity options often offer the best path; where long-duration and seasonal storage are the priority, larger site builds with integrated transmission planning provide the system-level value that justifies longer lead times. Ultimately, pumped hydro’s role within decarbonized power systems is pragmatic rather than speculative: when deployed with disciplined procurement, robust environmental planning, and finance-ready commercial structures, these assets deliver durable operational value for grids and stakeholders alike.

Purchase the comprehensive pumped hydro storage market report and arrange a private briefing with the Associate Director to accelerate commercial and policy decisions

To acquire the full market research report and strategic briefing on pumped hydro storage dynamics, regulatory impacts, and investment-ready opportunities, please contact Ketan Rohom, Associate Director, Sales & Marketing. The report package offers an executive-level briefing, deep-dive chapter-level analysis, and customizable data extracts designed to support commercial diligence, capital planning, and policy assessments. A tailored briefing with scenario-based implications can be scheduled to align with your investment horizon and technical due diligence timelines.

Engaging directly with Ketan will enable a confidential discussion about how the report’s proprietary datasets, project-level profiling, supply-chain risk matrices, and policy-impact analyses can be adapted to your organization’s decision-making needs. The sales team can outline licensing options, single-user and multi-user access arrangements, and bespoke research add-ons such as competitor benchmarking and opportunity heat maps. For commercial teams and procurement groups looking to accelerate vendor shortlists or accelerate project underwriting, this report can be delivered with optional briefing workshops and Q&A sessions with the research authors.

If you are evaluating strategic entry, partnership, or procurement opportunities tied to long-duration grid storage, reaching out will provide immediate visibility into the most relevant chapters, regional appendices, and the specific segmentation slices that support transaction-level diligence. Please contact Ketan to arrange a private demonstration of the report contents and to discuss pricing, delivery timelines, and corporate licensing.

- How big is the Pumped Hydro Storage Market?

- What is the Pumped Hydro Storage Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?