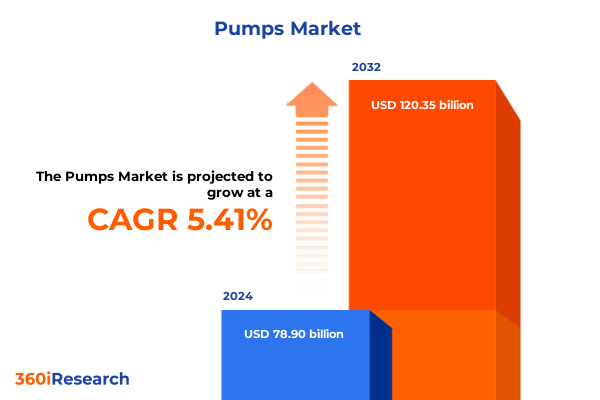

The Pumps Market size was estimated at USD 82.90 billion in 2025 and expected to reach USD 87.18 billion in 2026, at a CAGR of 5.46% to reach USD 120.35 billion by 2032.

Unveiling how shifting industrial priorities and technological advancements are shaping the future trajectory of the global pump industry landscape

The pump industry serves as a critical backbone for global infrastructure processes from water treatment and oil and gas extraction to chemical processing and power generation. These engineered devices facilitate the movement of fluids under precise pressure and flow conditions making them indispensable components across a broad array of industrial commercial and residential applications. As aging municipal systems demand upgrades and as energy providers seek to optimize extraction and distribution workflows pump technologies have come under increasing scrutiny for their reliability maintainability and overall total cost of ownership. Consequently stakeholders ranging from original equipment manufacturers to end users are placing renewed emphasis on product innovation and lifecycle service models that can drive efficiency improvements while aligning with stricter environmental mandates.

Amid this dynamic backdrop several converging forces are reshaping market priorities and investment patterns. Rapid urban population growth is signaling heightened demand for resilient water management systems even as decarbonization targets are prompting adoption of energy-efficient pumping solutions. Simultaneously the digitization wave has catalyzed a push for connected devices that enable real-time condition monitoring predictive maintenance and remote process control. This initial section lays the foundation by outlining the core drivers and contextual factors underpinning the contemporary pump market narrative and sets the stage for deeper analysis that follows

Exploring the seismic technological innovations and strategic paradigm shifts redefining operational efficiency and sustainability across the pump sector

Technological innovation has emerged as a catalyst for transformative change in the pump sector driving operational enhancements and unlocking new value pools throughout the product lifecycle. The proliferation of Internet of Things (IoT) solutions has made it possible to embed sensors within pump assemblies that continuously stream data on vibration temperature and pressure parameters. By integrating this real-time telemetry with advanced analytics platforms operators can transition from reactive maintenance regimes to predictive frameworks that reduce unplanned downtime and optimize energy consumption. Beyond connectivity pure component design is also benefiting from computational fluid dynamics and additive manufacturing techniques that enable engineers to refine hydraulic pathways minimize cavitation and develop lightweight bespoke impellers for specialized applications.

Alongside these engineering breakthroughs industry stakeholders have witnessed a growing emphasis on sustainability driven by evolving regulatory landscapes and corporate net-zero commitments. Variable frequency drive technologies are being increasingly paired with conventional pump designs to fine-tune motor speeds and reduce overall power draw during off-peak load cycles. Concurrently magnetic drive pumps that eliminate the need for mechanical seals are gaining traction in applications requiring zero-leak performance such as corrosive fluid handling and pharmaceutical manufacturing. As a result of these parallel advancements the sector is experiencing a seismic shift toward smarter more efficient greener pumping solutions that can meet rigorous process requirements while lowering total lifecycle costs

Analyzing the repercussions of recent United States tariffs on pump imports and the consequential realignment of manufacturing and supply chain operations

The imposition of new United States tariffs on imported pump assemblies and key components in early 2025 has imposed an immediate cost burden on many distributors and end users reliant on foreign-sourced equipment. While specific duty rates vary by pump classification the combined impact on landed costs has been significant, prompting pass-through pressure along the supply chain. For organizations with slim margin tolerances the enhanced costs have accelerated conversations around product repricing renegotiated supplier agreements and deeper scrutiny of total procurement expenses. In certain instances capital project budgets have been revised and in-service thresholds extended to avoid the elevated price premiums associated with tariff-affected product categories.

In response domestic original equipment manufacturers have pursued a dual strategy of capacity expansion and vertical integration to capture market share from foreign incumbents while mitigating import duty exposure. Several pump builders have announced the establishment of localized fabrication facilities and assembly lines to circumvent cross-border levies and shorten lead times for critical maintenance spares. Simultaneously supply chain teams are exploring alternative sourcing hubs in tariff-friendly regions and are reclassifying certain auxiliary components to benefit from reduced duty schedules. Although these adjustments require upfront CapEx and operational realignment the net result has been a more resilient and diversified value chain that is better positioned to absorb future trade policy shifts

Deriving vital segmentation observations revealing the growth trajectories across pump types technology power sources end users and distribution channels

Within the pump market a nuanced set of segmentation lenses sheds light on distinct adoption patterns and service requirements. In terms of pump types the landscape is divided between dynamic pumps and positive displacement pumps. The former category comprises centrifugal pumps including fire hydrant systems horizontal centrifugal models submersible configurations and vertical centrifugal variants which collectively serve applications with variable flow demands. Conversely positive displacement units-encompassing reciprocating mechanisms such as diaphragm piston and plunger pumps along with rotary offerings like gear lobe peristaltic and screw pumps-are selected for processes that require consistent volumetric output under high pressure conditions.

Technology orientation offers another perspective revealing that magnetic drive pumps are carving out share in industries prioritizing containment and leak-free performance while variable frequency drive solutions are capturing momentum within operations aiming to maximize energy efficiency. Further differentiation emerges when considering power sources: diesel-driven units retain relevance in remote or off-grid settings although electric pumps dominate centralized facilities; hydraulic pumps continue to serve niche heavy-equipment applications; and solar-powered systems are gaining early adoption in water irrigation and decentralized water treatment projects.

End-use segmentation underscores that industrial applications lead volume demand driven by sectors such as oil and gas petrochemicals and wastewater treatment; commercial installations follow closely reflecting sustained investment in building services and municipal infrastructure; while residential uptake, although smaller, is characterized by steady growth in point-of-use booster and condensate removal solutions. Finally distribution channels bifurcate between offline networks of authorized dealers service centers and wholesalers which deliver turnkey support and online platforms that offer expedited procurement and component-level customization for experienced buyers

This comprehensive research report categorizes the Pumps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Pump Type

- Technology

- Power Source

- End User

- Distribution Channel

Highlighting the regional dynamics shaping demand and innovation in the pump domain across the Americas Europe Middle East Africa and Asia Pacific territories

Across the Americas the pump market is underpinned by robust momentum in energy exploration municipal water infrastructure and industrial modernization initiatives. In North America regulatory programs aimed at reducing water loss and enhancing treatment capacity have spurred demand for advanced centrifugal and submersible pumps while at the same time shale and offshore production activities sustain volumetric requirements for positive displacement equipment. Meanwhile in Latin America the push to expand electrification and boost agricultural productivity has driven orders for diesel and electric-powered pump sets even as macroeconomic volatility continues to impose budgetary constraints on large-scale CAPEX projects.

In the Europe Middle East and Africa region a confluence of stringent environmental regulations and ageing asset bases is fueling opportunities for retrofit and aftermarket service offerings. European Union directives targeting water reuse and energy efficiency have accelerated the replacement of legacy pump installations with variable speed and magnetic drive solutions across process plants and municipal facilities. Gulf countries are investing in desalination capacity and water distribution networks that favor corrosion-resistant and high-pressure pumping systems while sub-Saharan Africa has seen growing interest in solar-driven pumps for rural water access programs.

The Asia Pacific market retains its status as a high-growth frontier fueled by rapid urbanization infrastructure build-outs and industrial diversification. China and India represent the largest demand centers for both dynamic and positive displacement pumps as authorities prioritize wastewater treatment expansion and chemical manufacturing scale-up. Southeast Asia’s agricultural economies are increasingly deploying solar irrigation and submersible well pumping systems while Australia’s mining and oil and gas sectors continue to procure heavy-duty hydraulic and diesel drive pump packages

This comprehensive research report examines key regions that drive the evolution of the Pumps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering the strategic maneuvers and innovation pathways undertaken by leading pump manufacturers to secure competitive advantage and drive market leadership

Leading pump manufacturers have responded to shifting market requirements by pursuing targeted product innovation strategic acquisitions and digital platform enhancements. One prominent player introduced an integrated suite of smart pump controllers that leverage cloud-based analytics to deliver predictive maintenance alerts and energy usage reports within a unified interface. Another competitor has expanded its portfolio through acquisition of a specialized positive displacement OEM establishing deeper penetration into high-pressure process applications and creating cross-selling opportunities within its global distribution network.

In addition to M&A and product roadmaps companies are strengthening their aftermarket value propositions. Several large OEMs have rolled out subscription-based service contracts that guarantee uptime through routine asset health assessments remote diagnostic support and pre-emptive parts replenishment. Partnerships with technology providers have also enabled the rollout of digital twin models that simulate pump performance under varying operating conditions and facilitate rapid troubleshooting. These multifaceted approaches underscore a broader trend toward solution-oriented offerings that transcend single equipment sales and align vendor incentives with long-term customer outcomes

This comprehensive research report delivers an in-depth overview of the principal market players in the Pumps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval Corporate AB

- Altra Industrial Motion Corporation

- Atlas Copco AB

- Baker Hughes

- Cornell Pump Company

- Dover Corporation

- Ebara Corporation

- Flowserve Corporation

- Fristam Pumps USA

- Gardner Denver

- Gorman Rupp Company

- Graco Inc.

- Grundfos Holding A/S

- HERMETIC-Pumpen GmbH

- Idex Corporation

- Ingersoll Rand Inc.

- ITT Inc.

- Kirloskar Brothers Ltd.

- Ruhrpumpen Group by Corporación EG

- Schlumberger Limited

- SPX FLOW, Inc.

- Sulzer Ltd.

- The Weir Group PLC

- Thompson Pump and Manufacturing Company

- WILO SE

- Xylem Inc.

Formulating actionable strategies for industry decision makers to harness technology sustain supply chain resilience leverage niche pump market opportunities

Industry leaders looking to stay ahead in this evolving landscape should prioritize investments in digital service platforms that enable predictive maintenance and remote performance optimization. By embedding sensors and leveraging advanced analytics they can reduce unplanned downtime and differentiate their offerings through value-added insights. At the same time diversifying manufacturing footprints through nearshoring or localized assembly can mitigate exposure to trade-related disruptions and accelerate delivery times for critical replacement components.

Moreover executives should refine their product portfolios to emphasize energy efficient and eco-friendly solutions, particularly variable frequency drive and magnetic drive pumps, which are increasingly mandated by regulatory bodies and sought after by sustainability-focused customers. Expanding subscription-based and outcome-driven service models can also foster closer customer relationships generate recurring revenue streams and create barriers to competitor encroachment. Finally collaborations with technology partners in areas such as additive manufacturing can unlock rapid prototyping capabilities and support the development of tailored pump designs that address highly specialized end-use requirements

Detailing the rigorous methodology integrating expert consultations secondary data analysis and validation processes that underpin this pump market study

The findings presented throughout this report are grounded in a rigorous methodology that blends qualitative insights with quantitative validation. Primary research involved structured interviews and workshops with over forty senior executives from pump OEMs distributors end users and industry consultants across multiple regions. These dialogues provided firsthand perspectives on emerging trends supply chain challenges and customer requirements that shaped the thematic focus areas of the analysis.

Complementing the expert consultations a comprehensive secondary research program captured data from company annual reports technical white papers trade journals and regulatory publications. Market dynamics were triangulated by cross-referencing historical shipment data regulatory filings and competitor activity logs to ensure accuracy and reduce bias. Throughout the process research deliverables underwent multiple rounds of internal peer review and were subjected to external validation sessions with independent industry advisors guaranteeing a robust foundation for the strategic interpretations and recommendations offered in this report

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pumps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pumps Market, by Pump Type

- Pumps Market, by Technology

- Pumps Market, by Power Source

- Pumps Market, by End User

- Pumps Market, by Distribution Channel

- Pumps Market, by Region

- Pumps Market, by Group

- Pumps Market, by Country

- United States Pumps Market

- China Pumps Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing the pivotal findings and strategic takeaways that illuminate the path forward for stakeholders navigating the evolving pump industry landscape

This executive summary has distilled the complex interplay of technological advancement trade policy shifts and evolving regional dynamics that define today’s pump market opportunities and challenges. Key observations include the accelerating role of digitalization in operational efficiency decarbonization imperatives driving energy-efficient pump adoption and strategic supply chain realignments catalyzed by recent tariff introductions. In addition segmentation analysis highlights how distinct product types technology choices power sources end-use contexts and distribution models are shaping differentiated growth prospects across target segments.

By synthesizing these pivotal findings readers are equipped with a holistic framework to guide investment decisions product roadmap prioritization and market entry approaches. As the industry continues to evolve under the twin forces of regulation and digital transformation stakeholders who leverage the strategic insights furnished here will be best positioned to seize emerging niches optimize lifecycle economics and secure enduring competitive advantage in the global pump sector

Secure immediate access to in-depth pump market intelligence and strategic recommendations by contacting Ketan Rohom today and elevate your competitive advantage

To gain comprehensive access to detailed analyses, strategic frameworks, and proprietary insights that will drive your organization’s growth in the rapidly evolving pump market, reach out directly to Ketan Rohom Associate Director Sales & Marketing at your earliest convenience. By partnering with him you will unlock tailored solutions rooted in rigorous research and years of industry expertise that can be immediately applied to refine your product roadmap optimize your market entry strategies and enhance your competitive positioning. Don’t let this opportunity to elevate your operational efficiency and capitalize on emerging market niches slip by contact Ketan Rohom today and propel your business toward sustained leadership in the global pump landscape

- How big is the Pumps Market?

- What is the Pumps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?