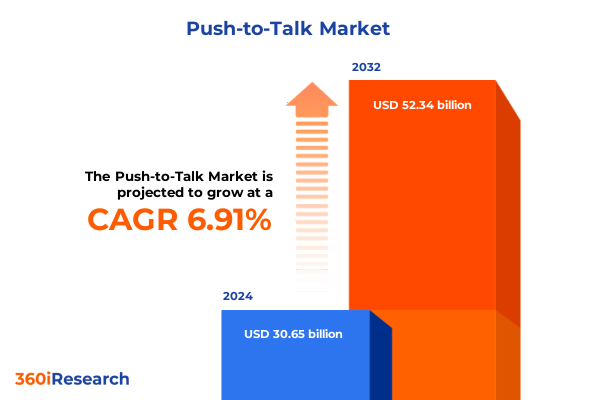

The Push-to-Talk Market size was estimated at USD 32.45 billion in 2025 and expected to reach USD 34.36 billion in 2026, at a CAGR of 7.06% to reach USD 52.34 billion by 2032.

Comprehensive introduction to the push-to-talk communications market mapping foundational concepts and its strategic relevance across diverse industry scenarios

The push-to-talk communications paradigm has evolved from a rudimentary walkie-talkie function into a sophisticated, integrated ecosystem that underpin mission-critical operations across multiple sectors. In this introduction, readers are guided through the historical trajectory of real-time voice communication, beginning with analog radio solutions deployed in public safety contexts and extending to modern smartphone-enabled platforms that harness digital connectivity. This section highlights how emerging technologies such as Voice over LTE and next-generation private broadband networks have reshaped expectations around reliability, latency, and interoperability. Additionally, the foundational value proposition of instant communication-namely, the reduction of response times and enhancement of situational awareness-remains central to the sustained relevance of push-to-talk services. By situating the discussion within core operational needs like emergency response, logistics coordination, and field maintenance, this introduction underscores why decision-makers continue to prioritize investments in robust, secure voice networking solutions that seamlessly integrate with broader digital transformation initiatives.

Exploration of converged broadband, AI integration, and hybrid cloud architectures reshaping mission-critical push-to-talk communications

The landscape of push-to-talk communications is undergoing transformative shifts driven by advancements in network infrastructure and device innovation. The advent of converged broadband and narrowband systems enables users to leverage both mission-critical voice channels and data-rich applications over a single platform. This development has been further accelerated by the integration of artificial intelligence technologies that facilitate real-time language translation, voice analytics, and predictive dispatching. As field teams embrace wearable devices, alongside rugged tablets and smartphones, the boundary between traditional radio networks and modern IP-based communications is blurring. Moreover, the migration from on-premise servers to hybrid cloud architectures reflects an industry-wide trend toward scalable, secure, and cost-effective deployment models. These shifts are redefining user expectations, compelling service providers and enterprise IT organizations to architect solutions that deliver seamless interoperability across devices, networks, and operational workflows. In doing so, the market is witnessing a paradigm shift from one-dimensional voice radio to holistic communication suites that support voice, video, and data-centric collaboration.

In-depth analysis of how 2025 U.S. tariffs have redirected supply chains, pricing strategies, and investment priorities in push-to-talk communications

United States tariffs implemented in 2025 have had a multifaceted impact on the push-to-talk communications ecosystem. The imposition of higher duties on imported radio hardware and semiconductor components prompted a strategic response among manufacturers, who reevaluated supply chain dynamics and accelerated the adoption of domestic assembly operations. Consequently, cost structures for dedicated radio devices and ruggedized smartphones were recalibrated, influencing procurement strategies across public safety agencies and industrial operators. At the same time, service providers adjusted pricing tiers to reflect increased capital expenditure on network infrastructure upgrades, particularly for next-generation private LTE deployments. Importantly, end users shifted expenditure toward software-centric subscription models and cloud-hosted services, mitigating the burden of upfront hardware investments. Regulatory measures also incentivized investments in sensitive industry verticals such as utilities and transportation, where compliance with tariffs was offset by grant programs supporting critical communications modernization. Taken together, these developments highlight how government trade policies can catalyze industry realignment, encouraging local production while simultaneously driving innovation in service delivery.

Comprehensive insights into device, service, vertical, and application segmentation revealing nuanced push-to-talk market dynamics

Segmenting the push-to-talk communications market provides clarity on how device preferences, service delivery models, operational use cases, and application requirements intersect. By device type, the market comprises dedicated radios, which include analog and digital variants tailored to mission-critical voice, alongside smartphones differentiated by Android and iOS operating systems, tablets categorized as commercial or rugged, and emerging wearable devices optimized for hands-free operation. Service models span cloud-based solutions-offered through both private and public cloud environments-and on-premise deployments that prioritize control and customization. End user verticals range from commercial enterprises and heavy industries, such as oil and gas defined by downstream, midstream, and upstream segments, to public safety sectors covering emergency medical services, fire response, and law enforcement, as well as transportation networks across air, rail, and road, and utilities infrastructure. Across these segments, communication requirements vary from data-only use cases focused on telemetry to voice-only scenarios, with video streaming and integrated voice-and-data applications supporting enhanced situational intelligence. Examining these segment intersections reveals which combinations deliver optimal reliability, security, and cost-efficiency, guiding vendors and buyers toward the most effective solution design.

This comprehensive research report categorizes the Push-to-Talk market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Service Model

- End User Vertical

- Application

In-depth regional exploration of Americas, EMEA, and Asia-Pacific market nuances driving tailored push-to-talk communications strategies

Regional variations in push-to-talk communications adoption and innovation underscore the importance of tailored strategies for market expansion. In the Americas, robust investment in private broadband networks and a legacy of public safety radio systems have fostered a fertile environment for hybrid solutions that bridge narrowband reliability with broadband versatility. Carriers are collaborating with technology providers to launch managed network services, targeting sectors such as utilities and public transit with integrated voice and data platforms. Europe, the Middle East, and Africa present a diverse regulatory landscape, where initiatives like TETRA modernization in European Union nations coexist with emerging private network deployments in Middle Eastern logistics hubs and Sub-Saharan safety programs. This region-wide heterogeneity demands adaptable offerings that address both legacy infrastructure migration and rapid digitalization. Meanwhile, Asia-Pacific exhibits explosive growth in cloud-based push-to-talk services, fueled by smart city projects, industrial automation, and cross-border transportation corridors. Strategic partnerships between local telecom operators and global vendors have accelerated the rollout of next-generation voice solutions, particularly within densely populated urban centers where spectrum efficiency and interoperability are paramount.

This comprehensive research report examines key regions that drive the evolution of the Push-to-Talk market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Expert analysis of how established manufacturers, telecom operators, and cloud-native innovators are shaping the competitive push-to-talk communications landscape

Leading companies in the push-to-talk communications arena are distinguished by their ability to innovate across hardware, software, and service dimensions. Established radio manufacturers have evolved their portfolios to include digital narrowband radios and broadband-enabled devices, while technology giants offer integrated solutions that unify voice, video, and data under managed service models. Telecommunications operators differentiate through dedicated private network offerings that pair spectrum licensing with end-to-end device management and application ecosystems. Concurrently, emerging entrants leverage cloud-native platforms to deliver scalable, subscription-based push-to-talk services, catering to distributed workforces in industries such as transportation, logistics, and public safety. Collaboration between chipset vendors, network operators, and application developers has driven the creation of specialized modules for seamless integration of voice communication into enterprise resource planning and dispatch systems. By benchmarking feature sets, security protocols, and service-level agreements, buyers can navigate a competitive landscape in which vendor partnerships, certification programs, and global support networks play an integral role in deployment success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Push-to-Talk market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Cisco Systems, Inc.

- Hytera Communications Corporation Limited

- JVC Kenwood Corporation

- Motorola Solutions, Inc.

- Nokia Corporation

- Sonim Technologies, Inc.

- Telefonaktiebolaget LM Ericsson

- Thales Group

- Zebra Technologies Corporation

Actionable strategies for diversifying supply chains, enhancing interoperability, and aligning with regulatory frameworks to drive push-to-talk market leadership

Industry leaders can capitalize on emerging opportunities by adopting a multi-pronged strategic approach. Prioritizing the diversification of supply chains through partnerships with regional assemblers and semiconductor suppliers will mitigate tariff-related disruptions and ensure continuity of device production. Investing in cross-platform interoperability frameworks that enable seamless handoff between legacy radio networks, broadband infrastructure, and cloud-based services will enhance user experience and operational resilience. Furthermore, engaging with vertical-specific pilot programs-such as utility modernization initiatives or smart transportation corridors-allows organizations to tailor feature sets and pricing models to the unique workflows of these sectors. Leaders should also leverage data analytics and artificial intelligence to optimize network performance and predict maintenance needs, unlocking operational efficiencies and reducing downtime. Finally, proactive collaboration with regulatory bodies to influence spectrum allocation and compliance guidelines can position companies at the forefront of policy-driven growth, securing early access to emerging bands and favorable deployment terms.

Transparent explanation of combined primary interviews, secondary analysis, and scenario modeling ensuring rigorous and unbiased push-to-talk communications research

The research underpinning this report combines rigorous primary and secondary methodologies to ensure comprehensive and objective analysis. Primary research included in-depth interviews with senior executives from equipment manufacturers, network operators, enterprise end users, and regulatory authorities to capture firsthand perspectives on technology adoption, procurement challenges, and future requirements. These qualitative insights were augmented by a detailed review of industry white papers, regulatory filings, and conference proceedings to contextualize emerging standards and policy shifts. Data points were triangulated through a structured validation process, comparing findings across multiple independent sources to mitigate bias and confirm consistency. Quantitative analysis leveraged usage statistics, deployment case studies, and device shipping data, while scenario modeling provided a structured approach to evaluating the impact of tariff changes and technology transitions. The resulting framework supports a balanced narrative, blending strategic foresight with empirical evidence to guide decision-making in the dynamic push-to-talk communications sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Push-to-Talk market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Push-to-Talk Market, by Device Type

- Push-to-Talk Market, by Service Model

- Push-to-Talk Market, by End User Vertical

- Push-to-Talk Market, by Application

- Push-to-Talk Market, by Region

- Push-to-Talk Market, by Group

- Push-to-Talk Market, by Country

- United States Push-to-Talk Market

- China Push-to-Talk Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Conclusive synthesis highlighting key technological, regulatory, and segmentation factors driving the future of push-to-talk communications market

As organizations navigate the evolving push-to-talk communications environment, a nuanced understanding of technological advancements, regulatory influences, and market segmentation is essential for informed decision-making. From the integration of AI-driven analytics that enhance real-time dispatch efficiency to the strategic pivot toward hybrid cloud deployments that balance performance and security, the market trajectory points toward increasingly sophisticated, mission-critical voice and data collaboration platforms. The adaptations driven by U.S. tariffs in 2025 underscore the importance of agile supply chains and cost optimization strategies, while regional insights reveal the necessity of localized approaches to spectrum management and infrastructure deployment. Collectively, these insights provide a holistic view of the market’s current state and future potential, equipping stakeholders with the clarity needed to design resilient, scalable communication solutions that deliver quantifiable operational benefits.

Contact Associate Director Ketan Rohom today to secure tailored market research insights that drive strategic growth in push-to-talk communications

In today’s fiercely competitive market landscape, understanding the nuances of push-to-talk communications is critical to making informed investment and strategic decisions. Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, offers you unparalleled access to expert guidance tailored to your organization’s unique challenges and growth aspirations. Reach out now to secure a detailed consultation that will position your team at the forefront of mission-critical communications innovation and drive quantifiable business outcomes

- How big is the Push-to-Talk Market?

- What is the Push-to-Talk Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?