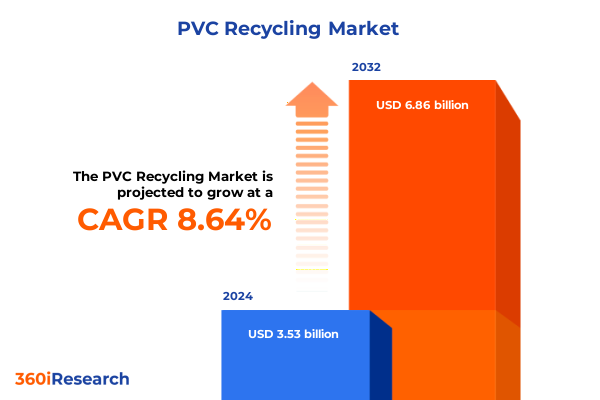

The PVC Recycling Market size was estimated at USD 3.84 billion in 2025 and expected to reach USD 4.13 billion in 2026, at a CAGR of 8.63% to reach USD 6.86 billion by 2032.

Unlocking the Potential of PVC Recycling by Delving into Regulatory Drivers, Technological Innovations, and Sustainability Imperatives

PVC recycling is at the nexus of circular economy ambitions and stringent environmental mandates, prompting industry stakeholders to reevaluate waste management paradigms. Across Europe, the Circular Plastics Alliance has convened more than 330 organizations committed to scaling recycled plastics usage to achieve 10 million tonnes by 2025, underscoring the power of voluntary collaboration to drive systemic change. Meanwhile, in the United States the Environmental Protection Agency’s National Recycling Strategy outlines a vision for resilient materials management that emphasizes improved recycling infrastructure, contamination reduction, and enhanced markets for recovered commodities. These regulatory frameworks are complemented by voluntary industry initiatives such as VinylPlus, which has recycled millions of tonnes of PVC since 2000 and set ambitious annual targets to validate the material’s circular lifecycle.

Technological innovation further amplifies PVC recycling potential. Mechanical processing remains the workhorse for rigid and post-industrial waste streams, yet chemical recycling methods such as pyrolysis and solvolysis are emerging as viable routes to reclaim high-purity PVC monomers from complex or contaminated feedstocks. Pilot-scale demonstrations by leading chemical companies illustrate the feasibility of closed-loop systems that can remove legacy additives and stabilize recyclate quality. Together, policy mandates and technological advancements are forging a robust foundation for PVC recycling to transition from niche operations to mainstream industrial practice.

Embracing Circular Economy and Advanced Recycling Methods Redefines the Future Landscape of PVC Recycling through Cross-Industry Collaboration

The PVC recycling landscape is undergoing a profound transformation as traditional mechanical approaches integrate with advanced chemical and digital solutions. Emerging feedstock recycling technologies break material down to its basic chemical constituents, enabling the removal of harmful additives and producing recyclate that meets stringent purity requirements. This evolution is catalyzed by pilot projects and alliances that test solvent-based purification and catalyzed pyrolysis techniques, demonstrating how chemical routes can complement large-scale extrusion and regranulation processes.

Parallel to technological shifts, extended producer responsibility (EPR) frameworks and design-for-recycling guidelines are reshaping product development. Regulators and industry consortia are collaborating on standardized labeling, material provenance tracking, and digital traceability platforms. These initiatives help assure brand owners and end users that recycled PVC content is verifiable and safe for sensitive applications. As voluntary pledges evolve into enforceable policies, stakeholders across the supply chain-from resin producers and compounders to waste managers-are aligning their strategies to capitalize on the higher-value markets created by circular economy imperatives.

Analyzing the Broad Reach of Recent U.S. Trade Measures and Their Compound Effects on PVC Recycling Cost Structures and Supply Chains

New trade measures in 2025 have introduced tariffs on recycled plastics imports and exports that reverberate throughout the PVC recycling ecosystem. The imposition of 25% duties on key trading partners disrupted established supply routes, particularly affecting scrap flows to and from Canada and Mexico. Approximately half of U.S. PET and PE scrap exports had historically relied on these North American corridors, and the sudden cost increase placed pressure on processing margins and feedstock availability.

Furthermore, additional levies on imports from China introduced complexity for recyclers that source specialized plastic grades. These cumulative trade barriers amplified price volatility for virgin and recycled resins alike, compelling companies to reassess sourcing strategies. In response, many have pursued localized processing solutions and strategic inventory stocking to mitigate the unpredictability of tariff-driven swings. Ultimately, the intersection of trade policy and recycling economics is reshaping the contours of PVC value chains, with industry leaders advocating for targeted exemptions and streamlined customs processes.

Decoding Market Segmentation Dynamics to Reveal Unique Consumption Patterns and Investment Opportunities within the PVC Recycling Sector

A nuanced understanding of PVC recycling requires examining how the market segments by source, product type, application, and process to reveal growth drivers and investment hotspots. Post-consumer and post-industrial sources each present distinct quality profiles: construction debris, end-of-life pipes, windows, and doors yield rigid feedstocks that are well suited to mechanical extrusion, whereas manufacturing scrap and off-spec materials offer relatively clean streams for high-volume regeneration. Flexible PVC, derived from cables, coated fabrics, and films, poses different purification challenges but commands premium markets in medical devices and specialty applications.

Technology segmentation further distinguishes mechanical approaches such as pulverization, extrusion, and regranulation from feedstock recycling processes including gasification, pyrolysis, and solvolysis. These complementary pathways allow recyclers to match processing costs with end-use requirements, optimizing resource recovery. Applications spanning automotive parts, packaging, and flooring underscore the versatility of recycled PVC, while new cross-sector partnerships aim to co-develop tailored recyclate grades that meet performance criteria. This multi-dimensional segmentation illuminates the interplay between feedstock characteristics, processing capabilities, and market demand, guiding strategic investments across the PVC recycling spectrum.

This comprehensive research report categorizes the PVC Recycling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Product Type

- Application

- Technology

Examining the Distinct Influences of Leading Global Regions on PVC Recycling Practices and Technology Adoption Trends Across Key Markets

Regional distinctions shape PVC recycling adoption and infrastructure maturity across the globe. In the Americas, the United States has seen the commissioning of new recycling facilities and joint ventures to bolster domestic feedstock availability, driven by consumer pressure and infrastructure grants. Extended producer responsibility pilots in several states are also testing financial models to internalize waste management costs and incentivize recyclate uptake. Canada benefits from robust cross-border scrap flows, while Latin American markets are nascent but rapidly evolving through partnerships that introduce scalable mechanical recycling systems.

Europe leads in regulatory alignment and public-private collaboration, with closed-loop recycling obligations and lead-content restrictions driving innovation in multilayer PVC pipes. The European Commission’s recent derogation for recycled rigid PVC ensures continuity of supply through 2026, while design-for-recycling guidelines for profile systems set benchmarks for product recyclability and material traceability. In contrast, the Asia-Pacific region grapples with fragmented policies and varying levels of infrastructure investment. Japan, South Korea, and Taiwan have implemented EPR schemes and advanced sorting technologies, yet many Southeast Asian countries remain dependent on informal collection networks. Despite this, mechanical recycling capacity in Asia-Pacific far outstrips chemical recycling, highlighting a pivotal opportunity for emerging feedstock processes to complement existing systems.

This comprehensive research report examines key regions that drive the evolution of the PVC Recycling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Pioneering Corporations Advancing PVC Recycling with Innovative Technologies, Strategic Partnerships, and Sustainability Leadership

A cohort of pioneering companies is steering PVC recycling toward maturity by deploying integrated technologies and forging cross-sector alliances. Industry leaders like INOVYN and Vynova are advancing chemical depolymerization pilot plants that break down PVC into reusable monomers, while major resin producers are partnering with recyclers to guarantee quality-assured feedstocks. Joint ventures such as Blue Polymers have launched facilities in multiple U.S. states to address feedstock shortages and increase domestic capacity.

Simultaneously, materials giants like Dow and ExxonMobil are expanding mechanical recycling footprints, investing in extrusion and regranulation lines that convert post-industrial scrap into high-grade compounds. Technology start-ups are also emerging with novel purification methods for flexible PVC waste streams, aiming to capture premium applications in medical and electrical markets. These strategic moves highlight a convergence of scale, innovation, and sustainability commitments that define the leadership landscape in PVC recycling today.

This comprehensive research report delivers an in-depth overview of the principal market players in the PVC Recycling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Axion Polymers Ltd.

- B. B. Polymers GmbH

- Biffa plc

- Clean Harbors, Inc.

- DS Smith Plastics

- Jayplas

- KW Plastics

- Luxus Ltd.

- MBA Polymers Inc.

- Mikro-Technik GmbH & Co. KG

- MTM Plastics GmbH

- Mura Technology Limited

- Plastipak Holdings, Inc.

- Plastrec Inc.

- REMONDIS SE & Co. KG

- SUEZ S.A.

- Tarkett S.A.

- TerraCycle, Inc.

- Ultra-Poly Corporation

- Veolia Environnement S.A.

- Vogt-Plastic GmbH

- Wellman Plastics Recycling

Implementing Targeted Strategies for PVC Recycling Leaders to Drive Operational Efficiency, Regulatory Compliance, and Sustainable Growth

To capitalize on the evolving PVC recycling environment, industry leaders should prioritize the integration of digital traceability platforms and blockchain-based certification schemes to ensure end-to-end material transparency. By embedding design-for-recycling principles at the product development stage, manufacturers can reduce contamination and enhance recyclate value while aligning with emerging regulatory requirements. Strategic collaborations between resin producers, compounders, and recyclers will be essential to secure reliable feedstock streams and optimize processing synergies.

In parallel, companies should engage with policymakers to advocate for nuanced tariff exemptions and support instruments that strengthen domestic recycling infrastructure. Investing in dual mechanical and chemical recycling lines can provide flexibility to process both high-purity industrial scrap and complex post-consumer waste. Finally, leveraging data analytics to monitor supply chain performance and market signals will enable nimble adjustments to evolving trade policies and demand patterns, safeguarding competitive advantage in a dynamic regulatory landscape.

Elucidating Rigorous Research Methodologies Employed to Ensure Quality, Reproducibility, and Insightful Analysis in PVC Recycling Market Studies

This market analysis combines comprehensive secondary research with stakeholder consultations and primary interviews to deliver robust insights. Secondary research involved an extensive review of regulatory documents, industry reports, and academic publications to map the policy landscape and technological advancements. Primary research included in-depth interviews with recyclers, resin producers, technology providers, and trade associations to validate findings and uncover on-the-ground challenges.

Quantitative data were triangulated through multiple sources to ensure reliability, while qualitative insights were synthesized into thematic frameworks that highlight emerging trends and investment opportunities. A structured approach to data collection and analysis, coupled with peer reviews and validation sessions, underpins the credibility of this report. Proprietary models were used to map supply chain flows, assess technological readiness, and identify potential policy impacts, ensuring a rigorous methodological foundation for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our PVC Recycling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- PVC Recycling Market, by Source

- PVC Recycling Market, by Product Type

- PVC Recycling Market, by Application

- PVC Recycling Market, by Technology

- PVC Recycling Market, by Region

- PVC Recycling Market, by Group

- PVC Recycling Market, by Country

- United States PVC Recycling Market

- China PVC Recycling Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Summarizing Key Takeaways That Inform Strategic Decision Making and Emphasize the Role of PVC Recycling in a Circular Economy

The synthesis of regulatory dynamics, technological innovation, and market segmentation underscores a pivotal moment for PVC recycling. Stakeholders that proactively adapt to evolving trade policies and align with circular economy mandates will capture first-mover advantages in high-value recyclate markets. Cross-industry collaborations and forward-looking investments in hybrid recycling technologies are poised to redefine material recovery pathways, offering resilience against supply chain disruptions.

As regions harmonize policy frameworks and expand infrastructure, the potential for large-scale closed-loop systems becomes tangible. By integrating digital traceability, design-for-recycling standards, and strategic partnerships, the PVC recycling ecosystem can achieve sustainable growth while meeting ambitious environmental targets. These insights guide decision makers toward targeted actions that align operational excellence with long-term circularity goals, reinforcing the critical role of PVC recycling in the global sustainability agenda.

Connect with Ketan Rohom to Explore Detailed PVC Recycling Market Insights and Secure Your Comprehensive Report for Informed Decision Making

Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to discover how this comprehensive PVC recycling market research can empower your next strategic initiative. When you connect with Ketan, you will gain exclusive access to in-depth analysis of regulatory developments, technological breakthroughs, and competitive landscapes tailored to PVC recycling. Whether you aim to optimize supply chains, navigate trade policy shifts, or pursue new partnerships, this report provides the insights you need to act with confidence. Don’t miss the opportunity to leverage expert guidance and secure the data-driven strategies that will position your organization at the forefront of the circular economy transformation. Contact Ketan today to request your full copy of the report and start making informed decisions that drive sustainable growth.

- How big is the PVC Recycling Market?

- What is the PVC Recycling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?