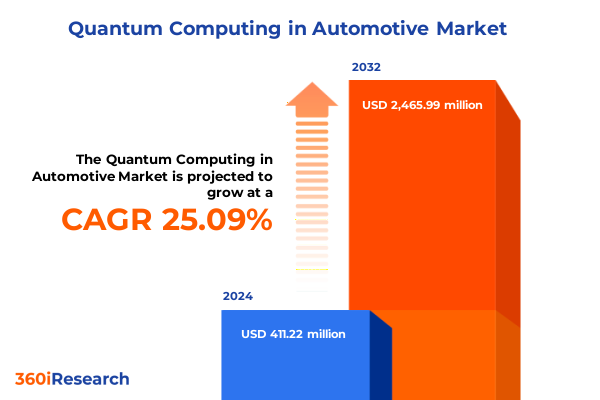

The Quantum Computing in Automotive Market size was estimated at USD 503.96 million in 2025 and expected to reach USD 624.30 million in 2026, at a CAGR of 25.46% to reach USD 2,465.99 million by 2032.

Setting the Stage for Revolutionary Quantum Computing Integration in the Automotive Industry with Foundational Insights for Strategic Decision-Making

The automotive sector is undergoing a profound technological metamorphosis, driven by escalating demands for computational power, efficiency, and security. Contemporary vehicles are no longer mere mechanical conveyances; they represent integrated cyber-physical systems that generate massive volumes of data from sensors, telematics modules, and advanced driver assistance systems. With the proliferation of electrified powertrains, autonomous functionalities, and connected services, traditional computational paradigms face limitations in addressing the complexity of simulations, optimization tasks, and cryptographic safeguards required to ensure reliability and consumer trust. Simultaneously, the march toward zero emissions and carbon neutrality has intensified research into advanced battery chemistries and production processes, amplifying the need for cutting-edge tools that can accelerate materials discovery, process modeling, and lifecycle analysis.

In response to these challenges, quantum computing emerges as a disruptive technology capable of transcending the constraints of classical architectures. By leveraging the principles of superposition and entanglement, quantum processors have the potential to perform certain classes of computations orders of magnitude faster than the most powerful supercomputers available today. This leap in capabilities can translate into optimized production scheduling, rapid simulation of novel battery materials, enhanced route planning under dynamic traffic conditions, and robust encryption schemes essential for connected vehicle security. As industry leaders evaluate next-generation digital strategies, quantum computing stands out as a transformative force that warrants strategic planning and ecosystem collaboration.

This executive summary provides a snapshot of the key market dynamics, segmentation insights, regional trends, prominent corporate players, and actionable recommendations. By synthesizing primary and secondary research findings, we aim to equip stakeholders with a comprehensive understanding of how quantum technologies can unlock unprecedented value across the automotive value chain, from design and manufacturing to operations and customer experience.

Unveiling How Quantum Advancements Are Catalyzing Unprecedented Paradigm Shifts across Automotive Design, Simulation, and Operational Optimization Efforts

The automotive landscape is experiencing a series of transformative shifts, driven by an intersection of technological innovation and evolving market demands. Central to this evolution is the proliferation of complex simulation requirements, where engineers grapple with multi-parameter optimization problems that classical systems address only through extensive computational cycles. From fluid dynamics analysis in electric motor design to stress testing of lightweight chassis materials, the complexity of these tasks has grown in step with tighter regulatory standards for emissions, safety, and performance. In parallel, the rise of connected and autonomous vehicles has generated an unprecedented influx of real-time data, necessitating advanced analytics for predictive maintenance, dynamic route optimization, and intelligent traffic management.

Against this backdrop, quantum computing is catalyzing new paradigms of problem solving by enabling algorithms that can explore vast solution spaces far more efficiently than classical methods. Approximate quantum algorithms, such as the Quantum Approximate Optimization Algorithm and Variational Quantum Eigensolver, are poised to redefine how optimization and simulation are performed. Simultaneously, quantum machine learning techniques promise to accelerate pattern recognition tasks integral to perception and decision-making systems in autonomous driving stacks. Moreover, quantum-resistant cryptography is emerging as a critical component for safeguarding vehicle-to-infrastructure and vehicle-to-cloud communications against the threat of future quantum-enabled decryption attacks.

As these transformative shifts coalesce, stakeholders across the automotive ecosystem-from OEMs to Tier 1 suppliers and technology vendors-are reevaluating their research and development priorities. Strategic alliances and consortiums are forming to pool expertise, share infrastructure, and accelerate proof-of-concept demonstrations. By embracing quantum-driven methodologies, the industry stands to overcome longstanding constraints, unlock improved energy efficiency, and pioneer new service models that redefine mobility for the coming decades.

Examining the Far-Reaching Consequences of U.S. Tariff Policies in 2025 on Quantum Component Supply Chains and Automotive Innovation Pathways

The United States tariff regime in 2025 has exerted significant influence on the global supply chain of quantum computing components, with downstream ramifications for automotive innovation. Building upon the Section 301 measures enacted in response to trade imbalance concerns, the U.S. government has maintained a 25% duty on select electronic components and microfabricated parts imported from regions where domestic capabilities are still maturing. These levies extend to specialized superconducting qubit materials, advanced photonic elements, and custom control electronics, all vital to the development of next-generation quantum hardware platforms. Concurrently, the CHIPS and Science Act’s emphasis on reshoring semiconductor production has incentivized domestic fabrication of certain quantum processors and associated control units, though higher capital expenditure requirements have driven up unit costs for early adopters.

The cumulative effect of these policies has been a dual-edged dynamic for automotive stakeholders exploring quantum integration. On one hand, increased component costs have led some manufacturers and suppliers to postpone pilot programs or shift to cloud-based quantum-as-a-service offerings to mitigate upfront CapEx. On the other hand, the push toward localizing the supply chain has accelerated collaborations between automotive OEMs, domestic semiconductor foundries, and quantum hardware startups. This realignment is fostering tighter integration of automotive-specific requirements into quantum roadmaps, from control systems optimized for harsh temperature cycles to software stacks tailored for predictive maintenance workflows.

Looking ahead, companies that proactively navigate the tariff landscape by balancing on-premise and cloud-based deployment models stand to gain a competitive edge. By investing in strategic partnerships with sheltered domestic foundries and leveraging government funding programs, stakeholders can reduce the long-term cost impact of import duties while securing priority access to critical quantum computing components. Ultimately, understanding the nuanced interplay between fiscal policies and technology sourcing strategies is essential for driving resilient innovation pathways in the automotive sector.

Delivering In-Depth Perspectives on Market Segmentation Dynamics Spanning Component Architectures, Technology Platforms, Deployment Models, Applications, and End-User Profiles

A nuanced examination of market segmentation across multiple dimensions reveals a landscape where component evolution, technology platforms, deployment preferences, application domains, and user profiles converge to shape quantum adoption in automotive. From a component perspective, control electronics and quantum processors remain central to performance benchmarks, with quantum software and services emerging as critical enablers of accessible use cases. Rapid growth in software tooling reflects industry demand for intuitive interfaces, algorithm libraries, and domain-specific applications that abstract hardware complexities for automotive engineers and data scientists.

When considering technology types, superconducting quantum computing continues to lead commercial deployments thanks to its relative maturity and existing infrastructure. Meanwhile, photonic quantum computing and trapped-ion platforms are garnering attention for their potential to operate at or near room temperature, reducing cooling costs and facilitating integration into automotive research labs. Topological qubits and quantum annealing approaches are also under investigation for specialized optimization tasks, signaling a diversification of technology roadmaps that aligns with distinct automotive use cases.

Deployment modalities further delineate strategic choices between cloud-based access and on-premise installation. Cloud quantum services offer flexibility, rapid scalability, and lower initial capital outlays, making them attractive for early-stage feasibility studies and algorithm prototyping. Conversely, on-premise systems deliver tighter security controls and deterministic performance, which are essential for proprietary research in battery materials and real-time control applications within connected vehicles.

The spectrum of applications highlights use cases such as autonomous and connected vehicle functionalities, battery optimization workflows, production planning and scheduling processes, as well as route planning and traffic management systems. Each of these domains demands sophisticated computational techniques to handle combinatorial complexity or high-dimensional simulations. Finally, end users range from automotive manufacturers spearheading integration programs to parts suppliers seeking operational efficiencies, and research institutions collaborating on foundational science. This multifaceted segmentation underscores the importance of tailored strategies that align technology investments with specific performance objectives and organizational capabilities.

This comprehensive research report categorizes the Quantum Computing in Automotive market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology Type

- Deployment Type

- Application

- End-User

Highlighting Strategic Regional Trends and Innovation Hotspots across the Americas, Europe Middle East & Africa, and Asia-Pacific Driving Quantum Adoption

Regional adoption of quantum computing within the automotive sector exhibits marked variations driven by governmental priorities, industrial partnerships, and research infrastructure investments. In the Americas, the United States stands at the forefront, propelled by robust federal funding initiatives and landmark legislation such as the CHIPS and Science Act. This has catalyzed the emergence of dedicated quantum foundries and accelerated collaboration between leading automotive OEMs and domestic hardware providers. Canadian research institutions also contribute through partnerships that bridge fundamental science with industry pilot projects, extending North America’s ecosystem for quantum-enabled mobility.

Transitioning to Europe, the Middle East, and Africa corridor, the European Union’s Horizon Europe program has earmarked substantial resources for quantum research and its industrial applications. European automotive clusters in Germany, France, and the Netherlands have launched consortiums to pilot quantum-enhanced simulation workflows for drivetrain design and manufacturing optimization. In the Middle East, sovereign wealth funds are investing in research centers aimed at long-term technology sovereignty, while African academic groups are exploring quantum algorithms for urban traffic modeling under resource-constrained scenarios.

Across the Asia-Pacific region, the landscape is characterized by aggressive national strategies and sizable public-private investments. China’s government-backed initiatives are channeling capital into domestic quantum hardware firms and forging strategic alliances with local automakers. Japan’s Ministry of Economy, Trade and Industry supports quantum computing research through flagship institutes, enabling collaborations with leading car manufacturers on battery innovation and AI-driven vehicle control systems. Additionally, Australia is building research hubs that focus on algorithmic development and workforce training, thereby enhancing the region’s capacity to translate quantum breakthroughs into automotive value chains.

This comprehensive research report examines key regions that drive the evolution of the Quantum Computing in Automotive market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Quantum Technology and Automotive Partnerships That Are Shaping the Ecosystem of Hardware, Software, and Industry Collaborations

The quantum computing and automotive convergence is being shaped by a diverse set of corporate actors spanning hardware manufacturers, software pioneers, and traditional automotive players. Among core hardware providers, leading technology companies have developed superconducting and photonic processors that serve as testbeds for automotive use cases. These platforms often underpin collaborative research efforts with OEMs, enabling tailored optimizations for vehicular control systems and energy storage materials. Simultaneously, agile startups specialize in next-generation qubit modalities and custom control electronics, catering to niche performance requirements and offering flexible integration pathways for manufacturers.

On the software front, innovative firms are crafting comprehensive toolchains that facilitate algorithm development, simulation management, and data analytics tailored to automotive challenges. These offerings bridge the gap between quantum-native programming languages and applications in vehicle design, battery research, and logistics optimization. By providing domain-specific libraries and user-friendly interfaces, software vendors accelerate time-to-insight and lower the barrier to entry for engineering teams exploring quantum-enhanced workflows.

Traditional automotive groups and Tier 1 suppliers play a pivotal role in piloting quantum use cases and defining industry standards. Strategic partnerships have emerged between automakers and quantum specialists to co-develop proofs of concept, ranging from quantum-assisted aerodynamic simulations to traffic flow optimization models. High-profile collaborations demonstrate the potential for integrated hardware-software stacks to address real-world challenges, showcase measurable efficiency gains, and inform roadmaps for scaling quantum capabilities across global manufacturing networks.

Collectively, this ecosystem of hardware innovators, software artisans, and automotive titans is forging a pathway toward commercial quantum adoption, with each player contributing specialized expertise that accelerates maturity and fosters a resilient network of partnerships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Quantum Computing in Automotive market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Amazon Web Services, Inc.

- Capgemini Group

- ColdQuanta, Inc.

- D-Wave Quantum Inc.

- Ford Motor Company

- Google LLC by Alphabet Inc.

- Honeywell International Inc.

- Intel Corporation

- International Business Machines Corporation

- IonQ, Inc.

- Isara Corporation

- Microsoft Corporation

- Nissan Motor Corporation

- ORCA Computing Limited

- PASQAL SAS

- PsiQuantum, Corp.

- QC Ware Corp.

- Quantinuum Ltd.

- Rigetti & Co, Inc.

- Terra Quantum AG

- Toshiba Corporation

- Toyota Motor Corporation

- Xanadu

- Zapata Computing, Inc.

Outlining Actionable Strategic Initiatives for Automotive Stakeholders to Leverage Quantum Capabilities for Competitive Advantage and Sustainable Growth

To capitalize on the emerging promise of quantum computing, automotive stakeholders must adopt a multi-pronged strategic approach that balances innovation with risk mitigation. First, companies should initiate targeted pilot programs focused on well-defined use cases, such as materials discovery for battery cells or operational scheduling in assembly plants. By defining clear success metrics and leveraging cloud-based quantum services for initial experimentation, organizations can validate value propositions without committing to substantial capital investments.

Concurrently, building a robust ecosystem of partners is essential. OEMs, suppliers, and technology providers should forge collaborative agreements that facilitate knowledge sharing, co-development of proof-of-concept projects, and joint grant applications. These partnerships not only distribute risk but also accelerate the co-creation of domain-specific solutions that address unique automotive challenges.

Supply chain resilience must be reinforced by diversifying sourcing strategies for critical hardware components. Engaging both domestic foundries and specialized international vendors can mitigate the impact of import duties and production bottlenecks. Moreover, pursuing government incentive programs and research grants can offset capital expenditures associated with on-premise quantum installations and advanced control electronics procurement.

Finally, organizations should invest in workforce readiness and governance frameworks to support quantum adoption. Upskilling engineers, data scientists, and operations teams through specialized training programs ensures that internal capabilities align with emerging toolchains. Establishing data governance policies and security protocols will also safeguard intellectual property and maintain compliance as quantum-resistant cryptography becomes integral to connected vehicle architectures. Through these actionable strategic initiatives, industry leaders can position themselves at the vanguard of quantum-driven automotive innovation.

Describing Rigorous Research Protocols and Data Collection Methodologies Employed to Ensure Comprehensive, Objective, and Actionable Market Intelligence

The methodology underpinning this research is founded on rigorous, multi-layered data collection and analysis techniques designed to yield comprehensive, objective, and actionable market intelligence. Secondary research formed the baseline of our insights, encompassing a meticulous review of scientific publications, industry white papers, technical patents, government policy documents, and press releases from key stakeholders. This repository of information provided critical context on technology roadmaps, fiscal incentives, regulatory frameworks, and emerging use cases within the automotive quantum computing domain.

To enrich and validate secondary findings, primary research was conducted through structured interviews and workshops with a curated panel of subject-matter experts. Participants included senior R&D leaders from automotive manufacturers, quantum hardware engineers, software architects, and policy specialists. These engagements offered firsthand perspectives on strategic priorities, implementation challenges, and success stories, enabling the triangulation of qualitative insights with quantitative data.

Data synthesis involved cross-referencing information across multiple sources to identify trends, corroborate timelines, and assess technology readiness levels. A bespoke segmentation framework was applied to categorize findings by components, technology types, deployment models, applications, and end-user profiles. This analytical lens facilitates the discernment of high-impact opportunities and potential barriers across diverse market subsegments.

Finally, the research conclusions and recommendations were subjected to iterative review cycles, incorporating feedback from a steering committee of industry experts. This process ensured that the report’s insights are not only reliable and up-to-date but also immediately relevant for strategic planning and investment decision-making within the automotive ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Quantum Computing in Automotive market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Quantum Computing in Automotive Market, by Component

- Quantum Computing in Automotive Market, by Technology Type

- Quantum Computing in Automotive Market, by Deployment Type

- Quantum Computing in Automotive Market, by Application

- Quantum Computing in Automotive Market, by End-User

- Quantum Computing in Automotive Market, by Region

- Quantum Computing in Automotive Market, by Group

- Quantum Computing in Automotive Market, by Country

- United States Quantum Computing in Automotive Market

- China Quantum Computing in Automotive Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Consolidating Critical Insights on Quantum Computing’s Transformative Role within the Automotive Sector and Charting the Path Forward for Stakeholders

The convergence of quantum computing and automotive innovation presents a paradigm-defining opportunity for industry transformation. As vehicle architectures grow increasingly sophisticated, the ability to tackle complex optimization, simulation, and cybersecurity challenges will differentiate market leaders. Quantum-enabled approaches to battery materials discovery, aerodynamic modeling, and real-time traffic management herald a new era of performance gains, sustainability initiatives, and revenue-generating service models.

Despite the immense promise, early adoption is tempered by considerations around supply chain dynamics, tariff structures, and workforce readiness. Stakeholders must navigate the nuanced interplay of policy incentives and import duties while forging strategic partnerships that align hardware capabilities with automotive-specific requirements. Moreover, balancing cloud-based experimentation with on-premise installations will be critical to managing risk and ensuring the confidentiality of proprietary algorithms.

In synthesizing the segmentation insights, regional trends, and company profiles, it becomes clear that a coordinated strategy encompassing pilot deployment, ecosystem collaboration, and talent development is essential. By proactively addressing infrastructure, governance, and operational frameworks, automotive organizations can convert quantum potential into tangible competitive advantages. As the technology matures, those who act decisively will secure early-mover status and shape the future contours of mobility.

This conclusion underscores the imperative for decision-makers to integrate quantum computing into their strategic roadmaps now. The window for pioneering value creation is open, and the time to act is at hand.

Driving Engagement with a Customized Invitation to Connect with Associate Director of Sales & Marketing for Exclusive Access to the Full Market Research

For executive teams and decision-makers who recognize the strategic importance of quantum computing in automotive innovation, this research report represents an indispensable resource offering deep insights and actionable intelligence. To explore bespoke findings, engage with detailed case studies, and access comprehensive analysis that can inform your technology adoption and investment strategies, we invite you to reach out directly to the Associate Director of Sales & Marketing, Ketan Rohom. He will guide you through customized solutions tailored to the unique needs of your organization and facilitate immediate access to the full report. Connect with Ketan Rohom to uncover exclusive data, capitalize on early-mover advantages, and position your enterprise at the forefront of the quantum-enabled automotive revolution

- How big is the Quantum Computing in Automotive Market?

- What is the Quantum Computing in Automotive Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?