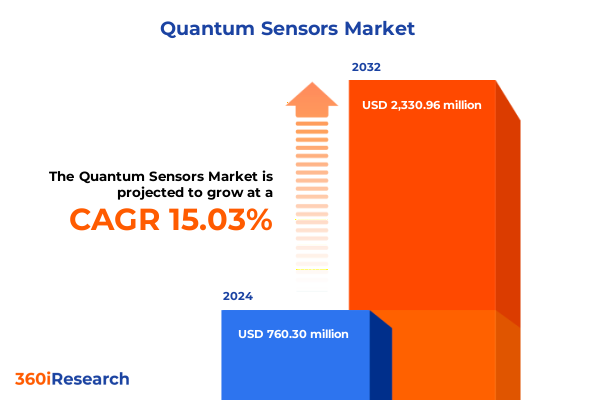

The Quantum Sensors Market size was estimated at USD 859.94 million in 2025 and expected to reach USD 983.69 million in 2026, at a CAGR of 14.99% to reach USD 2,286.40 million by 2032.

Understanding the Emerging Quantum Sensors Landscape Driven by Technological Innovation and Cross-Industry Adoption Catalysts

Quantum sensors represent a revolutionary shift in how we measure physical phenomena, harnessing the principles of quantum mechanics to achieve sensitivity and accuracy far beyond classical approaches. These devices leverage effects such as superposition, entanglement, and quantum interference to detect infinitesimal changes in acceleration, time, magnetic fields, and other critical parameters. This quantum leap in sensing capability has ignited broad interest from sectors spanning defense and aerospace to healthcare and telecommunications, each seeking to exploit higher precision, enhanced reliability, and lower power consumption. As research moves rapidly from laboratory prototypes toward commercial deployments, quantum sensors are poised to redefine standards for navigation in GPS-denied environments, magnetic imaging for medical diagnostics, and environmental monitoring for resource exploration.

Moving beyond basic proof-of-concept, the quantum sensor landscape has matured through sustained breakthroughs in materials such as nitrogen-vacancy centers in diamonds and ultracold atomic systems. These innovations have steadily lowered barriers to integration, enabling compact form factors and improved operational stability. In tandem, integrated photonics and microfabrication techniques are accelerating miniaturization, while advancements in control electronics and cryogenic engineering are supporting more robust real-world performance. Together, these converging developments have created fertile ground for startups, established technology leaders, and government laboratories to collaborate on translating quantum breakthroughs into practical, scalable sensing solutions that can address urgent challenges across multiple industries.

Assessing the Major Technological Breakthroughs and Industry Convergence Reshaping the Quantum Sensor Ecosystem Across Strategic Verticals

In recent years, quantum sensor developers have achieved pivotal milestones in extending coherence times and raising entanglement fidelity, which have directly translated into greater measurement stability and repeatability. Researchers have demonstrated that nitrogen-vacancy centers can operate under ambient conditions without heavy magnetic shielding, and that cryogenically cooled atomic ensembles can deliver record-level sensitivity for gravimetric and inertial measurements. Moreover, the integration of quantum sensors with artificial intelligence platforms has emerged as a powerful trend: AI-driven algorithms are now fine-tuning sensor parameters in real time, filtering environmental noise, and automating calibration routines to optimize performance in dynamic settings.

Beyond these technical advances, the ecosystem has experienced a shift from isolated R&D projects to strategic partnerships and consortium-driven roadmaps. For example, Bosch’s new joint venture with Element Six has introduced diamond-based magnetic field sensors aimed at healthcare and navigation applications. Meanwhile, collaborative efforts such as NASA’s space demonstration of an ultracold quantum sensor and Q-CTRL’s deployment of AI-enhanced magnetometers in GPS-denied environments underscore the maturation of quantum sensing from foundational research to operational readiness. These transformative shifts signal that quantum sensors are crossing the commercialization threshold, drawing interest and investment from major industrial stakeholders.

Evaluating the Broad Ramifications of 2025 United States Tariffs on Supply Chains, Component Costs, and Technology Adoption Rates in Quantum Sensing

Tariff policies enacted by the United States in 2025 have introduced a layer of complexity for quantum sensor manufacturers and integrators, particularly around high-precision optical and cryogenic components. Trade tensions and proposed levies on advanced photonic modules and superconducting materials have raised concerns about potential supply chain disruptions, prompting industry leaders to revisit sourcing strategies and inventory planning. Companies dependent on global suppliers now face elevated procurement costs and longer lead times, which have in turn affected timelines for new product rollouts.

Amid these challenges, defense and technology executives convening at the Aspen Security Forum expressed anxiety that unpredictable tariff frameworks could dampen defense modernization efforts and undercut collaborative initiatives with international partners. In response, many firms are accelerating domestic manufacturing investments and diversifying supplier bases to mitigate the potential for single-source disruptions. Concurrently, policymakers and industry associations are engaging in dialogue to clarify the scope of tariff coverage and explore exemptions for dual-use technologies essential to national security. These cumulative impacts underscore the need for agile supply chain strategies and proactive engagement with trade authorities to sustain innovation momentum in quantum sensing.

Unveiling Key Segmentation Patterns That Illuminate Sensor Types, Component Modules, Modalities, Industry Verticals, Applications, and Distribution Channels

Market participants are examining a spectrum of sensor types that includes quantum accelerometers capable of detecting minute inertial shifts, atomic clocks that offer unprecedented temporal precision, gravimeters sensitive to sub-microscopic gravitational variations, lidar systems delivering nanometer-scale distance measurements, magnetometers calibrated to measure magnetic flux changes, optical sensors leveraging photonic interference, and thermometers that resolve temperature fluctuations at the quantum limit. Complementing these devices, component ecosystems encompass communication modules that interface with network systems, power supply systems engineered for low-noise environments, and sensor interfaces that translate quantum measurements into classical data streams.

Diverse quantum sensing modalities further differentiate offerings: coherence-based instruments capitalize on wavefunction stability, entanglement-driven configurations enhance correlated measurement sensitivity, interferometric platforms decipher phase shifts with extreme accuracy, and single-photon detectors pick up on individual quanta for precise signal capture. These technical segments align with core end-use sectors including aerospace and defense, where navigation and targeting accuracy are paramount; automotive, which demands reliable inertial systems for autonomous vehicles; healthcare, exploiting magnetoencephalography and imaging; oil and gas, deploying gravimetry for subsurface exploration; and telecommunications, integrating atomic clocks for network synchronization.

Across applications, atmospheric sensing and geophysical surveys rely on gravimeters and lidar for environmental monitoring, while medical imaging and diagnostics harness quantum magnetometers for neural mapping. Oil and gas exploration leverage atomic clocks and accelerometers to map reservoirs, whereas precision manufacturing incorporates optical sensors to maintain tolerances at the nanometer scale. In quantum radar and navigation, entanglement-enhanced systems deliver position fixes in GPS-denied settings. Seismic imaging and gravitational surveys apply gravimetric data to model subterranean structures, and signal processing innovations draw on single-photon and interferometric sensors to optimize data throughput. Finally, distribution channels span offline deployments in controlled industrial installations to online platforms that enable remote sensor management, data analytics, and firmware updates through cloud-based interfaces.

This comprehensive research report categorizes the Quantum Sensors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sensor Type

- Component Type

- Quantum Sensing Modalities

- End-Use Industry

- Application

- Distribution Channel

Comparative Regional Dynamics Highlighting Growth Drivers and Adoption Trends in Quantum Sensing Across Americas, Europe Middle East Africa, and Asia Pacific

The Americas region has emerged as a vibrant testing ground and early adopter environment, fueled by strong defense funding, innovative R&D clusters, and a robust manufacturing base. Key initiatives in the United States and Canada span quantum gravimetry for oil reserve mapping to quantum magnetometers for biomedical research, supported by government programs that prioritize strategic technologies. In Latin America, research institutions are increasingly collaborating with North American partners to pilot UAV-mounted sensors for environmental monitoring and mineral exploration.

Europe, Middle East, and Africa collectively showcase a sophisticated innovation ecosystem underpinned by the European Quantum Technologies Flagship and national strategies such as the UK’s pledge to establish quantum technology hubs. Public-private funding initiatives and a new EU Quantum Act aim to strengthen pan-European collaboration, drive standardization, and accelerate industrialization of quantum sensor technologies. Meanwhile, several Middle Eastern countries are leveraging sovereign wealth investments to foster regional centers of excellence, and African research consortia are exploring quantum sensing applications in agriculture and climate resilience.

Asia-Pacific is distinguished by its expansive manufacturing capabilities and aggressive governmental support in China, Japan, South Korea, India, and Australia. China’s recent demonstration of a drone-mounted atomic magnetometer for submarine detection exemplifies the drive toward operational field trials and defense applications. Japan and South Korea are channeling public funds into national quantum initiatives that integrate coherence-based gravimeters for transportation safety and quantum optical sensors for semiconductor metrology. In India and Australia, academia-industry collaborations are emerging to deploy quantum lidar systems for geological surveys and environmental conservation.

This comprehensive research report examines key regions that drive the evolution of the Quantum Sensors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Quantum Sensor Innovators and Strategic Partnerships Driving Competitive Advantage and Ecosystem Expansion in the Market

Leading innovators are forging unique paths in the quantum sensors arena. Bosch Quantum Sensing, in partnership with Element Six, has commercialized diamond-based magnetometers that combine rugged industrial design with quantum-level sensitivity to address challenges in healthcare diagnostics and precision navigation. Q-CTRL has distinguished itself through quantum control software that dynamically calibrates sensor arrays, optimizing coherence parameters and suppressing environmental noise for enhanced performance. NASA’s demonstration of ultracold atomic sensors in orbit, developed with ColdQuanta, has validated these platforms for spaceborne gravimetry, opening new frontiers in Earth observation and planetary defense.

Beyond these pioneers, companies like QuantumDiamonds and SandboxAQ are introducing diamond-based microscopy tools and AI-driven quantum navigation systems, respectively, to serve semiconductor failure analysis and autonomous vehicle markets. Meanwhile, traditional technology leaders such as IBM and Honeywell are extending their expertise in superconducting qubits and atomic clocks toward sensor modules, leveraging established manufacturing infrastructures. Strategic collaborations-ranging from Lockheed Martin’s work with Canadian research labs on quantum radar prototypes to EU-funded consortia integrating multiple sensor modalities-are accelerating ecosystem growth and setting new benchmarks for interoperability, performance standards, and regulatory frameworks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Quantum Sensors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AOSense,Inc.

- Atomionics Pte. Ltd.

- Campbell Scientific, Inc.

- ColdQuanta, Inc.

- Honeywell International Inc.

- Impedans Ltd.

- L3Harris Technologies, Inc.

- LI-COR, Inc.

- Lockheed Martin Corporation

- M Squared Group

- Miraex SA

- Muquans SAS

- Nomad Atomics PTY LTD.

- Northrop Grumman Corporation

- Q-CTRL Pty Ltd.

- Q.ANT GmbH

- QinetiQ Group PLC

- Qnami AG

- QuSpin Inc.

- Robert Bosch GmbH

- RTX Corporation

- SBQuantum Inc.

- Single Quantum BV

- Solar Light Company, LLC

- Thales Group

Strategic Imperatives and Recommendations to Accelerate Innovation, Mitigate Risks, and Secure Leadership Positions in the Evolving Quantum Sensor Industry

Industry leaders should prioritize the localization of critical component manufacturing to hedge against tariff-driven cost volatility and supply chain bottlenecks. By investing in domestic foundries and forging joint ventures with regional suppliers, organizations can secure access to specialized cryogenic electronics, photonic modules, and rare-earth materials, while strengthening resilience against trade policy shifts.

It is equally important to deepen collaborations across the quantum ecosystem by engaging with academic consortia, standards bodies, and technology alliances. Active participation in roadmap definition and interoperability working groups will ensure that emerging sensor platforms seamlessly integrate into existing defense, healthcare, and industrial networks. At the same time, aligning R&D investments with real-world use cases-such as GPS-denied navigation, subsurface exploration, and biomedical diagnostics-will accelerate adoption and broaden total addressable applications.

Finally, companies must embed data-driven decision frameworks and AI-powered analytics into sensor development lifecycles. Leveraging machine learning for predictive maintenance, environmental noise mitigation, and real-time calibration will unlock higher throughput, lower error rates, and differentiated value propositions. Adopting these strategic imperatives will position organizations to lead in what is set to become one of the most disruptive sensing markets of the next decade.

Multi-Stage Research Methodology Integrating Primary Engagements, Secondary Data Validation, and Analytical Frameworks for Comprehensive Market Understanding

The research underpinning this executive summary followed a multi-stage approach. In the initial phase, secondary research entailed a comprehensive review of peer-reviewed journals, government white papers, industry news releases, and reputable technology blogs to map the current state of quantum sensor technologies. Concurrently, segmentation frameworks were defined to categorize sensor types, component modules, sensing modalities, end-use industries, applications, and distribution channels.

The second phase incorporated primary research through interviews with domain experts, including physicists, engineering leads, and C-level executives from sensor manufacturers and end-user organizations. These discussions provided qualitative insights into technology roadmaps, commercialization challenges, and customer requirements. Quantitative validation was achieved through data triangulation, aligning publicly disclosed project milestones with market intelligence databases and patent filings.

Finally, analytical frameworks such as SWOT and PESTLE were applied to synthesize strategic implications across technological, regulatory, economic, and competitive dimensions. Throughout the process, iterative reviews with internal subject matter specialists ensured rigor, relevance, and objectivity of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Quantum Sensors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Quantum Sensors Market, by Sensor Type

- Quantum Sensors Market, by Component Type

- Quantum Sensors Market, by Quantum Sensing Modalities

- Quantum Sensors Market, by End-Use Industry

- Quantum Sensors Market, by Application

- Quantum Sensors Market, by Distribution Channel

- Quantum Sensors Market, by Region

- Quantum Sensors Market, by Group

- Quantum Sensors Market, by Country

- United States Quantum Sensors Market

- China Quantum Sensors Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings to Provide a Strategic Perspective on the Future Trajectory of the Quantum Sensors Market and Its Emerging Opportunities

This executive summary has highlighted the maturation of quantum sensor technologies from laboratory curiosity to an ecosystem characterized by strategic partnerships, cross-industry applications, and regionally tailored initiatives. Breakthroughs in coherence times, entanglement-driven precision, and AI-enhanced control mechanisms are converging to deliver next-generation accelerometers, gravimeters, magnetometers, and lidar systems suited for the most demanding environments.

At the same time, evolving trade policies have underscored the necessity of resilient supply chain strategies and localized manufacturing capabilities. By dissecting segmentation patterns and regional dynamics-from the Americas’ defense-driven portfolios to Europe’s collaborative flagship programs and Asia-Pacific’s aggressive government funding-the analysis has offered a panoramic view of opportunities and challenges. The competitive landscape, marked by both pioneering startups and established multinational firms, demonstrates that strategic alliances and ecosystem orchestration will be the linchpin of future success.

In synthesizing these insights, industry decision-makers can adopt targeted recommendations that emphasize supply chain fortification, collaborative innovation, and AI-powered sensor development. Doing so will unlock the transformative potential of quantum sensing and establish a foundation for enduring competitive advantage in this rapidly evolving market space.

Engaging Direct Dialogue with Ketan Rohom to Secure Tailored Quantum Sensor Market Insights and Propel Your Strategic Decision-Making Forward

To acquire the in-depth quantum sensors market research report and explore how your organization can harness these emerging insights and strategic frameworks, we invite you to engage directly with Ketan Rohom at Associate Director, Sales & Marketing. Partnering with Ketan will ensure you receive a tailored briefing that aligns with your specific priorities, whether that involves deep dives into sensor modalities, tariff mitigation strategies, or regional expansion blueprints. By collaborating with Ketan, you will gain access to exclusive data, scenario analyses, and custom advisory support that can accelerate your decision-making processes and reinforce your competitive positioning in this rapidly evolving landscape. Take the next step toward securing your organization’s quantum sensing leadership by contacting Ketan Rohom today to purchase the full report and unlock the granular insights needed to drive measurable impact and sustained growth.

- How big is the Quantum Sensors Market?

- What is the Quantum Sensors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?