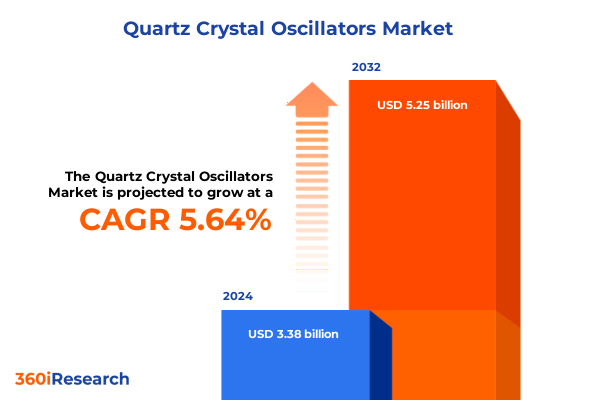

The Quartz Crystal Oscillators Market size was estimated at USD 2.97 billion in 2025 and expected to reach USD 3.14 billion in 2026, at a CAGR of 6.15% to reach USD 4.51 billion by 2032.

Understanding the pivotal role of quartz crystal oscillators in modern electronic systems and their fundamental importance to global timing solutions

Quartz crystal oscillators serve as the heartbeat of an array of electronic systems, providing precision timing and frequency control that underpin everything from smartphones to aerospace navigation. Through the quartz’s inherent piezoelectric properties, these oscillators generate oscillations with exceptional stability and reliability under diverse environmental conditions. As devices continue to shrink while demands for connectivity proliferate, the requirement for oscillators that combine compact form factors with unwavering performance intensifies. Consequently, understanding the role of these critical components becomes essential not only for component manufacturers but also for system integrators and end-use stakeholders.

Emerging end markets such as industrial automation, automotive advanced driver assistance systems, and next-generation wireless infrastructure have elevated expectations for timing solutions. Leading-edge applications demand low phase noise, minimal aging drift, and rapid startup times, characteristics intrinsic to high-quality quartz oscillators. Simultaneously, miniaturization efforts in consumer wearables and medical monitoring devices drive the evolution toward surface mount packaging and novel resonator types. Ultimately, this introduction lays the groundwork for exploring how technological, economic, and regulatory forces converge to shape the landscape of quartz crystal oscillators, emphasizing why industry leaders must stay ahead of these trends to maintain competitiveness and capitalize on new opportunities.

Exploring the transformative technological and commercial shifts reshaping the quartz crystal oscillator landscape in electronics engineering

Recent years have witnessed transformative shifts in both the technological and commercial dimensions of the quartz crystal oscillator domain. On the technology front, the integration of microelectromechanical resonators alongside traditional quartz devices has unlocked new thresholds in miniaturization and spectral purity. These resonators, leveraging capacitive and piezoelectric principles, enable designers to select the optimal balance between size and performance. In parallel, advancements in temperature-compensated and oven-controlled crystal oscillator architectures have fortified stability across harsh environmental extremes, a critical requirement in defense and aerospace applications.

Commercially, the ongoing proliferation of 5G networks and the emergence of Wi-Fi 6E have stimulated demand for high-frequency, low-phase-noise timing sources. In automotive, the transition to electric powertrains and enhanced driver assistance capabilities has directed focus toward oscillators capable of withstanding extreme temperature cycles while sustaining precise timing accuracy. Meanwhile, consumer electronics trends favor increasingly compact wearables and IoT devices, driving the adoption of surface mount packaging for seamless integration. These shifts collectively underscore a competitive landscape in which continuous innovation and agile responses to evolving end-market requirements dictate success.

Unraveling the effects of 2025 United States tariff measures on supply chain dynamics and sourcing strategies for quartz crystal oscillators

The tariff measures introduced by the United States in early 2025 have exerted a cumulative influence on sourcing strategies and cost structures across the quartz crystal oscillator supply chain. With increased duties on select electronic components imported from major manufacturing hubs, components historically procured under global contracts now face augmented costs, prompting companies to reexamine their supplier portfolios. To mitigate tariff exposure, many stakeholders have accelerated initiatives to diversify their procurement footprint, securing alternative suppliers across regions unaffected by the measures.

As a direct outcome, inventory management practices have adapted, favoring strategic stockpiling ahead of anticipated duty adjustments. Companies have also intensified quality audits of newly onboarded suppliers to ensure compliance with stringent performance thresholds, thereby safeguarding end-product reliability. In addition, original equipment manufacturers have sought closer collaborations with oscillators producers to co-develop customized solutions that streamline value chains and partially offset tariff-related cost pressures. These dynamics illustrate how regulatory policy emerges as a catalyst for reshaping traditional sourcing paradigms in the quartz crystal oscillator market.

Diving into the core segmentation layers that reveal distinct value drivers across packaging, product types, applications, and frequency bands

Segmentation in the quartz crystal oscillator industry illuminates distinct vectors of value creation rooted in packaging approaches, core product variants, application demands, and operational frequency ranges. When considering packaging, the market bifurcates into compact surface mount devices that favor automated production lines and legacy through-hole packages that retain relevance for high-reliability installations. Transitioning to product types, quartz crystal oscillators encompass a spectrum ranging from microelectromechanical resonators-available in capacitive and piezoelectric configurations-to oven-controlled units engineered for ultra-low frequency drift, as well as standard crystal, temperature-compensated, and voltage-controlled variants designed to address diverse performance thresholds.

The breadth of applications further accentuates the depth of segmentation. Within aerospace and defense, avionics, defense electronics, and navigation systems demand uncompromising phase stability across temperature extremes. Automotive segments such as advanced driver assistance systems, infotainment modules, powertrain control units, and safety and security platforms call for oscillators that balance rapid startup with resilience to vibration. Consumer electronics applications from personal computers and smartphones to tablets and wearables drive emphasis on miniaturization and extended battery life. Industrial uses covering automation, instrumentation, measurement, and robotics lean heavily on precision timing under continuous operation, while medical diagnostic, imaging, and monitoring equipment require synchronized timing for critical patient outcomes. Finally, telecommunication infrastructures-spanning networking hardware, satellite communication terminals, and wireless base stations-rely on oscillators tuned to specific frequency bands for signal integrity.

Overlaying these dimensions is the frequency-range segmentation that categorizes devices into bands below 10 megahertz, within 10 to 50 megahertz, spanning 50 to 100 megahertz, positioned between 100 and 200 megahertz, and operating above 200 megahertz. Each frequency band correlates with unique performance and integration characteristics, enabling system architects to tailor timing solutions with pinpoint accuracy.

This comprehensive research report categorizes the Quartz Crystal Oscillators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Oscillator Type

- Packaging

- Frequency Range

- Application

- Distribution Channel

Illuminating the unique competitive advantages and demand patterns across the Americas, EMEA, and Asia-Pacific regions in oscillator markets

Regional considerations play a pivotal role in shaping strategic priorities within the quartz crystal oscillator market. In the Americas, innovation hubs in North America drive demand for high-reliability oscillators tailored to aerospace, defense, and advanced automotive electronics. These end markets benefit from a robust ecosystem of semiconductor fabs and defense contractors, fostering close collaboration on application-specific oscillator development and rigorous qualification standards. Emerging trends in the Americas also highlight a growing interest in near-shore manufacturing alternatives, aiming to enhance supply chain resilience and reduce lead times.

By contrast, Europe, the Middle East, and Africa present a multifaceted landscape. Western Europe’s emphasis on telecommunications infrastructure upgrades and industrial automation projects underscores a preference for temperature-compensated and oven-controlled oscillators. Meanwhile, Middle Eastern initiatives in satellite communications and Africa’s expanding connectivity networks create demand for specialized frequency sources. This regional diversity necessitates tailored go-to-market approaches to address distinct regulatory frameworks, quality certifications, and channel dynamics.

Meanwhile, the Asia-Pacific region continues to dominate global production capacity, with key manufacturing clusters in China, Japan, and Taiwan focusing on both standard and advanced resonator technologies. This concentration has driven cost efficiencies yet also placed the spotlight on regional trade considerations and quality compliance. Across all regions, evolving digital infrastructure investments and a shift toward smart, connected ecosystems underscore the criticality of selecting oscillator partners capable of delivering not only products but also roadmap visibility and collaborative support.

This comprehensive research report examines key regions that drive the evolution of the Quartz Crystal Oscillators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the strategic approaches and competitive positioning of leading manufacturers driving innovation in oscillator technologies

Leading manufacturers in the quartz crystal oscillator domain distinguish themselves through strategic investments in research and development, capacity expansion, and targeted collaborations. Organizations with robust product portfolios offer a spectrum that ranges from standard quartz resonators to advanced oven-controlled and MEMS-based solutions, thereby addressing both mainstream and high-performance segments. These producers emphasize modular production platforms that accelerate time to market while enabling swift customization for critical applications in defense, medical, and telecom sectors.

In addition, strategic partnerships and selective acquisitions have proven instrumental for companies seeking to augment their technology stacks and geographical reach. By integrating niche specialists-particularly in microelectromechanical resonator designs-larger firms can capture value across emerging subsegments without diluting core competencies. Concurrently, the implementation of advanced manufacturing techniques, such as automated optical inspection and wafer-level packaging, has enhanced yield and consistency, reinforcing competitive positioning.

From a supply chain perspective, top performers maintain diversified supplier networks and invest in dual-sourcing strategies to minimize disruption risks. They also cultivate direct relationships with key original equipment manufacturers to co-develop next-generation timing modules, thereby ensuring alignment with evolving performance and reliability mandates. Through this combination of innovation, strategic alignment, and operational excellence, leading companies set the standard for oscillator performance and reliability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Quartz Crystal Oscillators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Seiko Epson Corporation

- KYOCERA AVX Components Corporation

- TXC Corporation

- Nihon Dempa Kogyo Co., Ltd.

- SiTime Corporation

- Siward Crystal Technology Co Ltd

- Microchip Technology Inc.

- Murata Manufacturing Co., Ltd

- Rakon Limited

- Daishinku Corporation

- TAITIEN Electronics Co., LTD

- Abracon, LLC

- TKD Science and Technology Co., Ltd.

- Pletronics Inc.

- Bliley Technologies Inc.

- Diodes Incorporated

- Greenray Industries, Inc.

- HOSONIC TECHNOLOGY (GROUP) CO., LTD.

- IBS Electronics Inc.

- Mercury Electronic Ind. Co., Ltd.

- MTI-Milliren Technologies Inc.

- QVS Tech Inc.

- River Eletec Corporation

- Transko Electronics Inc.

- ZHEJIANG A-CRYSTAL ELECTRONIC TECHNOLOGY CO.,LTD.

Presenting strategic actions for oscillator manufacturers to address supply chain resilience, emerging technologies, and end market diversification

To navigate the complexities of evolving technology demands and regulatory landscapes, industry leaders should prioritize several key actions. First, investing in microelectromechanical resonator capabilities will allow suppliers to capitalize on the push toward miniaturization and integration within system-on-chip architectures. By developing both capacitive and piezoelectric resonator variants, manufacturers can address a wider array of performance and cost requirements.

Simultaneously, forging strategic partnerships with logistics providers and second-source manufacturers can bolster supply chain resilience, mitigating the impact of future tariff adjustments or geopolitical disruptions. Establishing inventory buffers while maintaining just-in-time replenishment protocols helps balance service levels with working capital efficiency. Additionally, deepening collaborations with OEMs through joint development agreements ensures that oscillator roadmaps align with next-generation product cycles, fostering co-innovation and shared risk mitigation.

Leaders should also focus on high-reliability application verticals such as aerospace, medical, and defense, where longer qualification cycles yield durable relationships and higher entry barriers for competitors. Integrating digital services-such as remote condition monitoring and performance analytics-can further differentiate offerings, enhancing value propositions beyond hardware. By executing these recommendations in concert, oscillator manufacturers can strengthen strategic positioning and capitalize on emerging growth vectors.

Detailing the rigorous multi-source research approach, expert interviews, and data validation processes underpinning this analysis

The foundation of this analysis rests upon a comprehensive research approach that integrates multiple data sources, stakeholder perspectives, and methodological safeguards. Initially, an extensive review of industry publications, technical white papers, and regulatory filings provided a macro-level understanding of technological advancements and policy developments. This desk research laid the groundwork for identifying key trends and mapping competitive landscapes.

Following this preliminary phase, structured interviews with senior executives, product engineers, and supply chain managers enriched the analysis with nuanced insights on product roadmaps, quality control practices, and procurement strategies. Complementing these qualitative inputs, targeted surveys of end-use customers across automotive, aerospace, and telecommunications sectors offered quantitative feedback on performance requirements and purchasing criteria. To ensure rigor, the research team employed data triangulation techniques, cross-verifying findings against publicly available financial reports and validation discussions with independent technical experts.

Finally, the findings underwent peer review by a panel of industry authorities to confirm accuracy and relevance. This multi-stage methodology ensures that the presented insights reflect both empirical evidence and firsthand strategic perspectives, delivering a robust foundation for decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Quartz Crystal Oscillators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Quartz Crystal Oscillators Market, by Oscillator Type

- Quartz Crystal Oscillators Market, by Packaging

- Quartz Crystal Oscillators Market, by Frequency Range

- Quartz Crystal Oscillators Market, by Application

- Quartz Crystal Oscillators Market, by Distribution Channel

- Quartz Crystal Oscillators Market, by Region

- Quartz Crystal Oscillators Market, by Group

- Quartz Crystal Oscillators Market, by Country

- United States Quartz Crystal Oscillators Market

- China Quartz Crystal Oscillators Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Summarizing the critical insights and forward-looking perspectives shaping the future of the quartz crystal oscillator industry

In synthesizing the critical themes uncovered, it becomes clear that quartz crystal oscillators remain indispensable enablers of precise timing and frequency control across a broad spectrum of industries. Technological innovations in resonator design, packaging, and stabilization techniques continue to drive performance enhancements, responding to the stringent requirements of emerging applications. Simultaneously, commercial dynamics-ranging from tariff policy shifts to regional manufacturing hub strategies-shape supply chain architectures and sourcing decisions.

Segmentation analysis reveals that tailoring oscillator solutions to specific packaging formats, product types, applications, and frequency ranges empowers manufacturers to address differentiated end-market demands effectively. Regional overviews further underscore the need for localized strategies, as supply chain resilience and market access considerations vary markedly across the Americas, EMEA, and Asia-Pacific. Against this backdrop, leading companies distinguish themselves through R&D investments, strategic partnerships, and operational agility.

Ultimately, stakeholders poised to capitalize on the evolving landscape will be those that combine deep technical expertise with dynamic sourcing models and collaborative product development. By doing so, they can secure competitive advantage and drive sustained growth in an increasingly interconnected and precision-centric electronics ecosystem.

Engage with Ketan Rohom to secure comprehensive market intelligence that empowers strategic decisions in oscillator technology investments

Unlock unparalleled strategic advantage by tapping into deep analytical insights tailored to fuel your growth in quartz crystal oscillator markets with the team’s expertise guiding your next moves. By partnering with Ketan Rohom, Associate Director of Sales & Marketing, you gain direct access to customized breakdowns of emerging segments, in-depth scenario planning, and priority trends that shape procurement and product roadmaps. Whether you seek to refine your supply chain resilience strategy, drive innovation in MEMS-based offerings, or explore high-reliability application opportunities, personalized counsel will align the research to your unique objectives. Take this opportunity to elevate decision making with data-driven recommendations that translate into tangible competitive differentiation. Reach out now and secure the full comprehensive market research report designed to convert insights into action and sustainable growth.

- How big is the Quartz Crystal Oscillators Market?

- What is the Quartz Crystal Oscillators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?