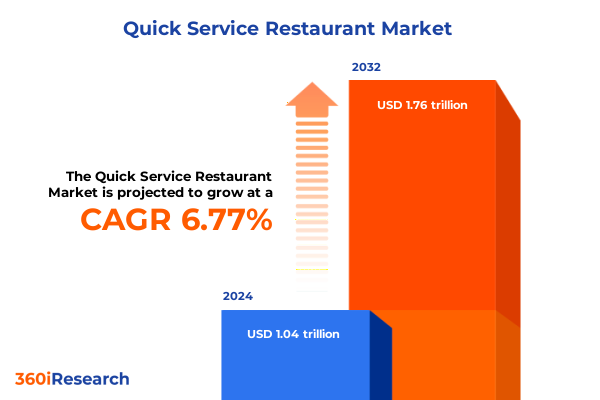

The Quick Service Restaurant Market size was estimated at USD 317.80 billion in 2025 and expected to reach USD 334.99 billion in 2026, at a CAGR of 5.53% to reach USD 463.48 billion by 2032.

Setting the Table for Innovation and Growth in the Quick Service Restaurant Industry Amid Evolving Consumer Preferences and Operational Challenges

The quick service restaurant industry stands at a pivotal juncture, driven by the intersection of technological innovation, shifting consumer values, and operational imperatives. In an environment where speed, convenience, and value converge, stakeholders across the ecosystem-from operators and suppliers to investors and service providers-seek a unified perspective on emerging dynamics and competitive pressures. This executive summary aims to distill key findings, contextualize industry trends, and outline actionable perspectives to guide informed decision-making.

This overview lays the groundwork for a nuanced understanding of how the market is evolving in response to digital transformation, economic headwinds, and sustainability concerns. It highlights the critical mechanisms through which businesses are adapting their models, refining customer engagement strategies, and optimizing supply chains. By synthesizing insights from multiple analytical layers, this section sets the stage for a deeper exploration of the forces reshaping the quick service restaurant sector in the United States and beyond.

Navigating the Rapid Digitalization, Sustainability Imperatives and Evolving Consumer Expectations Reshaping the Quick Service Restaurant Sector

Over the past several years, the quick service restaurant landscape has undergone a series of transformative shifts that extend beyond menu revisions and extended operating hours. Technological advancements have accelerated the adoption of digital ordering platforms, prompting operators to integrate proprietary apps alongside third-party delivery services in order to capture new revenue streams and enhance customer convenience. At the same time, there is a growing imperative to adopt sustainable sourcing practices and reduce operational carbon footprints, driving investment in alternative packaging, energy-efficient kitchen equipment, and supply chain transparency initiatives.

Consumer expectations have likewise evolved, with demand for personalized experiences and on-the-go fulfillment converging to create new operational benchmarks. Loyalty programs have become sophisticated engines for data-driven marketing, while social media engagement has taken on heightened importance as word-of-mouth and user-generated content increasingly influence brand perception. As a result, quick service operators must continuously refine their value proposition, balancing the need for throughput with an elevated emphasis on quality and customization.

Assessing How Recent United States Tariff Measures of 2025 Have Altered Supply Chains, Cost Structures and Competitiveness in Quick Service Restaurants

In 2025, new tariff measures imposed by the United States government have introduced a range of complexities for quick service restaurant operators, many of which rely on imported agricultural products, packaging materials, and specialized kitchen equipment. These duties have elevated the cost base, particularly for ingredients sourced from key trading partners, compelling businesses to reexamine supplier agreements, explore nearshoring options, and renegotiate terms to mitigate margin erosion. Furthermore, elevated import costs have had a cascading effect, prompting shifts in menu engineering strategies in order to preserve price affordability for end consumers.

As industry participants grapple with increased input costs, some operators have responded by establishing strategic alliances with local producers, thereby shortening supply chains and enhancing resilience against future tariff fluctuations. Others have embraced innovative procurement models, leveraging data analytics to forecast price volatility and optimize inventory management. Collectively, these adaptive responses underscore the sector’s ability to absorb external shocks while maintaining a commitment to consistent product quality and customer satisfaction.

Uncovering Critical Perspectives from Service Models to Ordering Channels Influencing Performance and Consumer Behavior in Quick Service Restaurants

A nuanced perspective on market segmentation reveals that service type diversity remains central to operational differentiation and customer outreach. The proliferation of drive-thru lanes has persisted alongside dine-in enhancements, while delivery services-encompassing both proprietary in-house fleets and partnerships with third-party logistics platforms-have solidified their status as indispensable channels. Simultaneously, takeaway options provide a flexible alternative for time-sensitive guests, allowing operators to tailor capacity and staffing models accordingly.

On the product side, a rich tapestry of food types underpins the market’s competitive battleground. Iconic protein-centric menus such as burgers and chicken maintain their stronghold, yet adjacent categories including coffee and bakery, pizza offerings, fresh salads, and sandwich portfolios continue to capture diverse consumer occasions. This dynamic has encouraged operators to invest in cross-category innovation, blending concepts such as coffee-forward breakfast sandwiches or salad bowls with premium protein add-ons to expand occasion versatility.

Meal time segmentation further amplifies operators’ ability to capture distinct demand windows. While lunch remains the busiest interval for speed and convenience, breakfast has emerged as a high-growth frontier fueled by early commuters and on-the-go professionals. Dinner service benefits from extended hours of operation and digital pre-ordering incentives, whereas snack-focused offerings fill gaps throughout the day, driving ancillary revenue without disrupting core meal operations.

Ordering channel differentiation also plays a pivotal role in consumer engagement. Traditional in-store transactions continue to thrive in urban high-traffic locations, while online ordering platforms enable seamless transactions across mobile apps, web portals, and self-service kiosks. This omnichannel architecture allows operators to optimize capacity, reduce queue times, and leverage data-driven personalization to foster deeper guest relationships.

This comprehensive research report categorizes the Quick Service Restaurant market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Food Type

- Meal Type

- Ownership Model

- Ordering Channel

- Restaurant Type

Examining How Distinct Regional Dynamics Across the Americas, Europe Middle East Africa and Asia Pacific Influence Quick Service Restaurant Strategies

Regional dynamics exert a profound influence on strategic priorities and consumer preferences across global quick service restaurant markets. In the Americas, operators contend with a mature yet fiercely competitive environment, where brand loyalty and value-driven promotions determine market penetration. North American markets feature dense urban clusters that prioritize drive-thru efficiency and digital loyalty incentives, while Latin American regions underscore menu adaptation to local palates and collaborations with regional suppliers.

Across Europe, the Middle East and Africa, diversity in culinary traditions and regulatory frameworks shapes operational and menu strategies. European markets emphasize quality, provenance and healthier menu options, driving the adoption of plant-based alternatives alongside classic protein offerings. In the Middle East, rapid urbanization and high smartphone penetration create fertile grounds for seamless delivery integrations, whereas African markets present emerging growth opportunities tied to rising disposable incomes and expanding retail infrastructure.

In the Asia-Pacific region, innovation often leads the global curve, with advanced mobile payment systems and omnichannel ordering integrated into daily routines. Local tastes influence menu localization, whether through region-specific sauces, seasoning profiles or entirely new product lines. Furthermore, the region’s emphasis on compact urban footprints has accelerated the rollout of ghost kitchens and micro-fulfillment centers, demonstrating a willingness to experiment with asset-light models to reach price-sensitive segments.

This comprehensive research report examines key regions that drive the evolution of the Quick Service Restaurant market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Quick Service Restaurant Operators Driving Innovation Through Strategic Partnerships Menu Diversification and Operational Excellence

Leading quick service restaurant operators have distinguished themselves through a combination of strategic alliances, menu reinvention and operational rigor. Across the competitive spectrum, several players have deepened collaborations with fintech providers and loyalty platform specialists to enhance transaction speed and personalized engagement. Franchise models have been refined to incorporate advanced training modules, digital operational dashboards and shared service centers that centralize procurement and logistics,

Menu diversification has been another critical axis of differentiation. Top performers regularly leverage limited-time offerings to create urgency and generate trial, while also incorporating premium and health-forward items to appeal to expanding wellness-conscious segments. Behind the scenes, investment in automated kitchen technologies-ranging from robotics-assisted food assembly to AI-driven demand forecasting-has streamlined labor-intensive processes and optimized throughput during peak service hours.

Furthermore, the best-in-class operators continue to forge partnerships with local sustainability groups and non-governmental organizations to advance zero-waste initiatives, renewable energy adoption and community outreach programs. These efforts have not only reinforced brand reputation but also attracted socially conscious investors and deepened consumer trust across key demographics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Quick Service Restaurant market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Yum! Brands, Inc.

- McDonald’s Corporation

- Starbucks Corporation

- Inspire Brands Inc.

- Domino’s Pizza, Inc.

- Chipotle Mexican Grill, Inc.

- Papa John’s International, Inc.

- Jack in the Box Inc.

- American Dairy Queen Corporation

- Ark Restaurant Corporation

- ArmyNavy Burger Inc.

- Bonchon Franchise LLC

- Carls Jr. Restaurants LLC

- Chick-fil-A, Inc.

- Fujian Wallace Food Co., Ltd.

- Goldilocks Bakeshop Inc.

- Jollibee Foods Corporation

- Kotipizza Group Oyj

- Restaurant Brands International Inc.

- Shakeys Pizza Asia Ventures Inc.

- Subway IP LLC

Strategic Imperatives for Quick Service Restaurant Leaders to Capitalize on Digital Trends Streamline Operations and Enhance Customer Engagement

To remain competitive in an increasingly complex landscape, industry leaders should proactively invest in digital ecosystems that unify ordering, payment and loyalty mechanisms. Integrating omnichannel data streams will enable refined personalization strategies, reduce acquisition costs, and foster deeper brand affinity. Additionally, operators should explore modular kitchen designs and flexible staffing models that can pivot rapidly in response to shifting demand, ensuring high service levels without excessive overhead.

Another strategic imperative involves forging local sourcing partnerships to build supply chain resilience while supporting community economies. Establishing multi-tiered procurement frameworks that blend regional producers with global suppliers will mitigate the impact of future tariff fluctuations and geopolitical disruptions. Concurrently, operators must accelerate the transition to sustainable packaging and energy management practices in order to align with evolving regulatory requirements and consumer expectations.

Finally, executive teams should cultivate a culture of continuous innovation by piloting new concepts within controlled market segments or ghost kitchen formats. Implementing rigorous performance metrics and feedback loops will accelerate time-to-market for successful initiatives, while allowing timely course corrections. By embedding a test-and-learn ethos into organizational DNA, quick service restaurant brands can maintain agility, drive incremental revenue streams, and sustain competitive differentiation.

Defining the Rigorous Multi Stage Research Framework Combining Qualitative and Quantitative Approaches to Analyze the Quick Service Restaurant Ecosystem

This research employed a multi-stage methodology blending qualitative insights with quantitative validation to ensure comprehensive coverage of the quick service restaurant ecosystem. The initial phase comprised in-depth interviews with industry executives, supply chain specialists and technology providers to map current challenges and emerging opportunities. Transcripts from these discussions formed the basis for thematic coding, highlighting recurring patterns across operational, financial and consumer-facing dimensions.

In parallel, a primary survey captured perspectives from a broad cross-section of operators, franchisees and end consumers. Responses were stratified across the defined service type, food type, meal time and ordering channel segments to identify nuanced performance differentials. Statistical analyses were conducted to uncover correlation patterns between innovation adoption rates, cost management practices and customer satisfaction metrics.

Secondary research leveraged proprietary datasets and publicly available industry publications to cross-validate primary findings and contextualize global best practices. Regional case studies provided granular insights into market-specific strategies, while competitive benchmarking exercises isolated key differentiators among top-performing brands. Triangulating these multiple data sources ensured the robustness and reliability of conclusions, empowering stakeholders with actionable intelligence grounded in empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Quick Service Restaurant market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Quick Service Restaurant Market, by Service Type

- Quick Service Restaurant Market, by Food Type

- Quick Service Restaurant Market, by Meal Type

- Quick Service Restaurant Market, by Ownership Model

- Quick Service Restaurant Market, by Ordering Channel

- Quick Service Restaurant Market, by Restaurant Type

- Quick Service Restaurant Market, by Region

- Quick Service Restaurant Market, by Group

- Quick Service Restaurant Market, by Country

- United States Quick Service Restaurant Market

- China Quick Service Restaurant Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesis of Core Insights Highlighting the Future Pathways for Growth Differentiation and Resilience in the Quick Service Restaurant Landscape

Drawing together the analysis reveals a sector characterized by resilience and adaptability in the face of digital disruption, shifting trade dynamics and evolving consumer values. Operators that effectively integrate omnichannel technologies, foster supply chain agility, and prioritize sustainability will be best positioned to thrive amidst competitive headwinds. The interplay between menu innovation, regional customization and operational excellence emerges as the critical nexus through which market leaders differentiate themselves from peers.

Looking ahead, the acceleration of digital ordering, the pursuit of localized sourcing strategies, and the strategic deployment of automated systems will continue to define the frontier of growth. As regulatory landscapes and consumer priorities evolve, quick service restaurant operators must remain vigilant in monitoring external triggers while embedding a culture of continuous learning and innovation. Ultimately, those who marry strategic foresight with operational discipline will capture the greatest share of the opportunities on offer in the global quick service restaurant arena.

Engage Directly with Ketan Rohom for Tailored Quick Service Restaurant Market Intelligence to Elevate Your Strategic Vision

To explore the full breadth of insights within this comprehensive quick service restaurant market research report, prospective purchasers are invited to connect directly with Ketan Rohom, Associate Director, Sales & Marketing, who can facilitate tailored consultations to align the findings with your strategic priorities. Engaging with Ketan enables decision-makers to access deep-dive data analyses, competitor benchmarking, and bespoke advisory services essential for charting a successful roadmap in a rapidly evolving sector. Reach out to initiate a conversation that transforms high-level intelligence into actionable plans and unlocks the strategic advantage your organization requires to lead in the quick service restaurant space.

- How big is the Quick Service Restaurant Market?

- What is the Quick Service Restaurant Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?