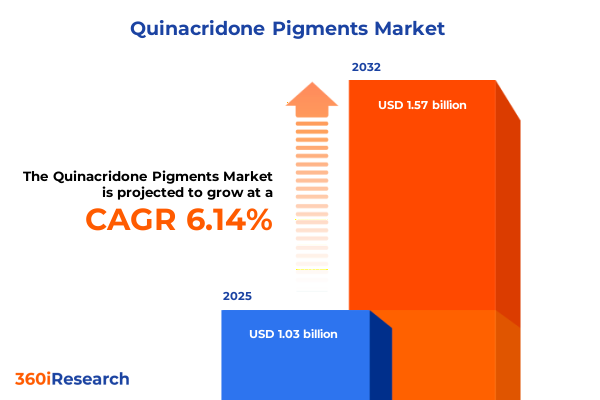

The Quinacridone Pigments Market size was estimated at USD 1.03 billion in 2025 and expected to reach USD 1.10 billion in 2026, at a CAGR of 6.14% to reach USD 1.57 billion by 2032.

Establishing the Strategic Importance of Quinacridone Pigments as Crucial Organic Colorants Driving Performance and Innovation Across Diverse Industries

Quinacridone pigments have emerged as pivotal organic colorants renowned for their exceptional chromatic intensity, lightfastness, and chemical resilience. With a molecular structure engineered to deliver vibrant reds, magentas, and violets, these pigments have transformed the performance expectations of coatings, plastics, printing inks, and textile applications. The convergence of aesthetic appeal with rigorous durability underpins their strategic relevance across multiple industrial landscapes.

At the core of their importance lies an unparalleled ability to maintain visual integrity under harsh conditions. Architectural coatings benefit from superior UV resistance, ensuring interior and exterior surfaces retain color fidelity over extended building lifecycles. In the automotive sector, both OEM and refinish applications exploit quinacridone’s weatherability to meet exacting manufacturer standards and consumer demands for long–lasting finishes. Meanwhile, usage in inks and plastics enhances depth of shade while aligning with low–VOC and eco–friendly formulation imperatives, reflecting the industry’s shift toward sustainable production practices.

Furthermore, these organic pigments foster innovation in product customization. Advances in pigment grinding and dispersion technologies have heightened compatibility with digital printing platforms and specialty polymer systems, expanding their utility in home appliances, mobile devices, and high–performance packaging. As decision makers pursue both functional excellence and brand differentiation, quinacridone pigments stand at the forefront, bridging technical performance with design freedom.

Navigating the Evolution of Quinacridone Pigment Applications Driven by Sustainability Demands Digital Innovations and Regulatory Advancements Shaping the Landscape

Industry dynamics have shifted profoundly as sustainability mandates, digital transformation, and regulatory frameworks converge to reshape quinacridone pigment applications. Driven by increasing environmental oversight, formulators are prioritizing low–VOC and solvent–free systems, prompting a surge in high–performance aqueous dispersions. This momentum has been compounded by breakthroughs in pigment surface treatments that enhance compatibility with waterborne systems, ultimately enabling manufacturers to align product portfolios with stringent global emission targets.

Moreover, the advent of digital printing has redefined performance benchmarks, unlocking rapid prototyping and agile color customization. Quinacridone’s intrinsic compatibility with inkjet and UV–curable systems allows for unprecedented control over print resolution, color consistency, and substrate adhesion. As commercial and industrial printing adapts to shorter runs and personalized packaging trends, these pigments support a seamless transition toward on–demand production models.

In addition, regulatory advancements in key markets have accelerated the retirement of legacy pigments, incentivizing research into novel quinacridone derivatives that deliver enhanced lightfastness, thermal stability, and dispersibility. This regulatory impetus dovetails with demands from the automotive and aerospace sectors for coatings that can withstand extreme environmental stresses. As a result, collaborative R&D initiatives are on the rise, bringing together pigment producers, coating formulators, and end users to co–develop next–generation colorants that meet the dual objectives of performance and compliance.

Assessing the Cumulative Impact of United States Tariff Measures on Quinacridone Pigment Supply Chains Pricing and Industry Dynamics Through 2025

The United States’ implementation of incremental tariffs on pigment imports throughout 2025 has exerted significant pressure on quinacridone supply chains and cost structures. Since the tariff adjustments took effect, downstream manufacturers have encountered heightened raw material expenses, compelling procurement teams to reevaluate sourcing strategies and inventory buffers. In response, many organizations have sought to diversify their supplier base, including forging agreements with domestic producers and nearshoring capacity to mitigate exposure to international duties.

Furthermore, these trade measures have catalyzed investments in localized production infrastructure. By expanding in–country manufacturing capabilities, firms can reduce lead times and limit reliance on imported intermediates. This strategic pivot has been reinforced by engagement with specialty chemical manufacturers willing to undertake toll production models, thereby enabling pigment buyers to maintain flexibility while containing overhead. Concurrently, some enterprises have passed incremental cost increases to downstream customers, prompting formulators to optimize blend ratios and explore high–efficiency dispersants that maximize pigment loading.

Ultimately, the cumulative impact of the 2025 tariffs extends beyond immediate price fluctuations. It has stimulated a broader reassessment of supply chain resilience, encouraging stakeholders to invest in advanced analytics for demand forecasting and to cultivate long–term partnerships focused on continuous improvement. In doing so, the industry is poised to emerge more resilient, with streamlined procurement practices and enhanced transparency across the value chain.

Uncovering In-Depth Segmentation Insights Revealing Diverse Application End Use Forms and Color Indices That Drive Demand and Innovation Dynamics

A nuanced exploration of segmentation reveals how varying applications, end use industries, forms, and color indices shape quinacridone demand. In paints and coatings, the architectural segment subdivides into exterior and interior coatings, where exterior formulations leverage UV stability for facade longevity while interior solutions emphasize low odor and rapid dry times. Within automotive coatings, OEM and refinish branches exemplify diverging performance requirements: OEM applications demand robust scratch and chemical resistance to meet manufacturer warranties, whereas refinish coatings prioritize color matching and ease of application in repair environments. Similarly, industrial coatings such as coil, powder, and wood systems exploit quinacridone’s adhesion and thermal stability to deliver durable protection across diverse substrates.

In the plastics arena, demand is further differentiated by resin type. Polyethylene and polypropylene applications harness dispersion forms to achieve consistent color without compromising polymer integrity, whereas PVC and PET systems benefit from masterbatch formats that streamline downstream processing. Printing inks illustrate another dimension of segmentation, with digital, flexographic, gravure, and offset inks each requiring tailored pigment particle sizes and surface treatments to optimize jetting, transfer, and print durability. Textile uses bifurcate into natural and synthetic fibers: on cotton and linen, quinacridone delivers vivid, wash–fast hues, while on polyester and nylon, paste forms enable high–temperature dyeing and sublimation processes.

Additionally, color index differentiation among Pigment Red 122, Pigment Violet 19, and Pigment Violet 23 informs product positioning. Pigment Red 122 is prized for its brilliant magenta tone and translucency, whereas Pigment Violet 19 offers deep purple shades with superior lightfastness. Pigment Violet 23 bridges these profiles with a balanced violet hue and excellent chemical resistance. Form segmentation across dispersion, masterbatch, paste, and powder further refines application efficiency and environmental compliance, ensuring formulators can select the optimal delivery system to meet performance, regulatory, and sustainability objectives.

This comprehensive research report categorizes the Quinacridone Pigments market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Color Index

- Application

- End Use Industry

Examining Key Regional Dynamics That Highlight Distinct Consumption Patterns Innovation Drivers and Regulatory Environments Across the Globe

Regional dynamics in the quinacridone pigment market exhibit distinct consumption patterns, innovation drivers, and regulatory frameworks. In the Americas, a mature chemical industry and robust automotive and architectural sectors underpin steady demand. North America’s stringent environmental regulations have propelled formulators to adopt low–VOC and aqueous pigment dispersions, while Latin American markets show growing interest in industrial coatings for infrastructure projects, creating opportunities for high–performance pigment solutions.

Across Europe, the Middle East, and Africa, evolving EU directives on chemical safety and sustainability foster continuous improvement in pigment manufacturing and application. European coating manufacturers leverage advanced surface treatments to meet REACH and Ecolabel standards, particularly in automotive hues that require exacting color stability. In Middle Eastern markets, large–scale construction developments and luxury automotive segments drive demand for vivid, weather–resistant coatings, while African textile producers are exploring synthetic fiber applications that benefit from quinacridone’s colorfast properties.

Meanwhile, the Asia-Pacific region represents the fastest growth area, fueled by rapid urbanization, expanding electronics production, and thriving textile hubs. In China and India, large–volume production of consumer goods and packaging inks is elevating pigment consumption, whereas Southeast Asian nations are investing in advanced plastics manufacturing that demands consistent coloration and regulatory compliance. Local producers in the region are increasingly investing in R&D centers to tailor pigment properties to regional preferences, reinforcing Asia-Pacific’s status as both a major consumer and innovator in the quinacridone landscape.

This comprehensive research report examines key regions that drive the evolution of the Quinacridone Pigments market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Company Profiles Showcasing Innovation Investment Collaborations and Competitive Differentiators Shaping the Quinacridone Pigment Sphere

Leading chemical manufacturers are intensifying efforts to consolidate their position within the quinacridone pigment domain through targeted investments, strategic partnerships, and innovative product introductions. Industry giants have allocated substantial resources toward R&D centers focused on molecular modifications that enhance dispersibility and durability, while emerging specialists are targeting niche applications that demand bespoke color performance. Collaboration between pigment producers and end users has become increasingly prevalent, enabling co–development of formulations optimized for specific substrate interactions and environmental conditions.

Strategic acquisitions and joint ventures are further consolidating market power, as large multinationals seek to broaden their product portfolios and geographic reach. These alliances often prioritize technology transfer, equipping regional manufacturers with advanced production techniques and access to high–performance pigment grades. Simultaneously, capacity expansions in regions with favorable trade conditions and cost structures are being pursued, ensuring reliable supply to meet surging demand in both mature and emerging markets.

Moreover, competitive differentiation is increasingly driven by sustainable solutions. Companies that can demonstrate lower carbon footprints, zero–VOC dispersions, and compliance with global chemical standards are gaining preference among environmentally conscious formulators. This paradigm shift underscores the necessity for organizations to embed sustainability at the core of their innovation strategies, thereby aligning long–term business continuity with evolving regulatory landscapes and customer expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Quinacridone Pigments market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Clariant AG

- Dainichiseika Color & Chemicals Mfg. Co., Ltd.

- DCL Corporation

- DIC Corporation

- Elementis plc

- Heubach GmbH

- HUPC Chemical Co., Ltd.

- Jubilant Life Sciences Limited

- Lanxess AG

- Lona Industries Pvt. Ltd.

- Meghmani Group

- Merck KGaA

- Pidilite Industries Limited

- Pylam Products Co., Inc.

- Sudarshan Chemical Industries Ltd.

- Sun Chemical Corporation

- Trust Chem Co., Ltd.

- Wenzhou Jin Yuan Chemical Co., Ltd.

Outlining Actionable Recommendations Enabling Industry Leaders to Capitalize on Emerging Technologies Sustainable Practices and Strategic Partnerships

Industry leaders must adopt a forward–looking approach to capitalize on evolving market dynamics and regulatory pressures. Embracing green chemistry principles will not only reduce environmental impact but also unlock new value chains. By investing in sustainable production methods-such as waterborne dispersions and alternative solvent systems-organizations can differentiate their offerings while preempting future compliance requirements.

In parallel, supply chain diversification is imperative. Establishing relationships with multiple suppliers across varied geographies, including localized manufacturing partnerships, can mitigate the risks associated with trade policy shifts and logistical disruptions. Furthermore, integrating advanced analytics into procurement processes will enable predictive demand planning, enhancing resilience and reducing inventory costs.

To drive innovation, industry participants should seek collaborative R&D engagements with end users and academic institutions. Such partnerships can accelerate the development of novel quinacridone derivatives tailored to high–growth applications like digital printing, high–performance automotive coatings, and next–generation packaging. Finally, investing in talent development programs focused on formulation science, pigment chemistry, and regulatory affairs will ensure organizations possess the expertise required to navigate complex market landscapes and seize emerging opportunities.

Detailing Comprehensive Research Methodology Integrating Multi Source Data Collection Expert Interviews and Rigorous Analytical Frameworks for Robust Insights

This research synthesizes insights derived from an integrated methodology combining primary and secondary data sources. A robust series of in–depth interviews with formulation experts, supply chain managers, and technical directors formed the backbone of the qualitative analysis, providing firsthand perspectives on performance priorities and purchasing criteria. These discussions were complemented by proprietary surveys distributed to key industry stakeholders, capturing nuanced information on application preferences, regional regulations, and future outlooks.

Secondary research involved a comprehensive review of academic journals, technical whitepapers, and regulatory publications to validate findings and contextualize trends within broader chemical industry developments. Data triangulation techniques were employed to ensure consistency across multiple information streams, while statistical tools enabled the aggregation and analysis of quantitative inputs. This dual–track approach ensured that conclusions reflect both the lived experiences of practitioners and the rigor of documented evidence.

Finally, the assembled data underwent iterative review by an advisory board comprising seasoned industry veterans and market analysts. This validation step not only enhanced the credibility of the insights but also fine–tuned the analytical framework to better address stakeholder needs, resulting in a thorough and actionable examination of the quinacridone pigment ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Quinacridone Pigments market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Quinacridone Pigments Market, by Form

- Quinacridone Pigments Market, by Color Index

- Quinacridone Pigments Market, by Application

- Quinacridone Pigments Market, by End Use Industry

- Quinacridone Pigments Market, by Region

- Quinacridone Pigments Market, by Group

- Quinacridone Pigments Market, by Country

- United States Quinacridone Pigments Market

- China Quinacridone Pigments Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Synthesizing Executive-Level Conclusions That Capture Major Trends Strategic Imperatives and the Outlook for Quinacridone Pigment Adoption and Innovation

The landscape of quinacridone pigments is defined by a confluence of performance imperatives, regulatory influences, and shifting end use demand. Core application areas-from architectural and automotive coatings to digital printing and advanced textiles-underscore the versatility of these organic colorants. Regulatory drivers, notably environmental mandates targeting VOCs and chemical safety, have accelerated the evolution of waterborne dispersions and eco–friendly production practices.

Segmentation insights reveal that application specificity, resin compatibility, and color index selection are instrumental in determining product differentiation. Regional analysis highlights distinct trajectories: established markets in the Americas and EMEA prioritize regulatory compliance and high–performance formulations, while Asia-Pacific continues to lead in volume consumption and localized innovation. Competitive dynamics are increasingly shaped by sustainability credentials and collaborative R&D models, positioning companies that can deliver tailored solutions with minimal environmental impact as industry frontrunners.

Looking ahead, success will hinge on the ability to navigate trade policy uncertainties, optimize supply chain resilience, and foster partnerships that accelerate innovation. By aligning strategic priorities with actionable recommendations-such as adopting green chemistry, diversifying sourcing, and investing in talent-stakeholders can chart a path toward enduring market leadership. Ultimately, quinacridone pigments will remain a critical enabler of vibrant, durable, and compliant color solutions across the global manufacturing spectrum.

Driving Informed Decision Making with Exclusive Access to the Comprehensive Quinacridone Pigment Market Report Featuring Expert Analysis and Strategic Guidance

The comprehensive analysis presented in this report unveils the depth and breadth of insights essential for strategic decision making in the quinacridone pigment space. You can leverage this granular intelligence to optimize your innovation roadmap, anticipate regulatory shifts, and secure a competitive edge in key end use verticals. With detailed coverage of application trends, form preferences, and color index performance across global regions, this resource equips you with a holistic perspective. Don’t miss the opportunity to turn actionable knowledge into market leadership and position your organization for sustainable growth.

- How big is the Quinacridone Pigments Market?

- What is the Quinacridone Pigments Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?