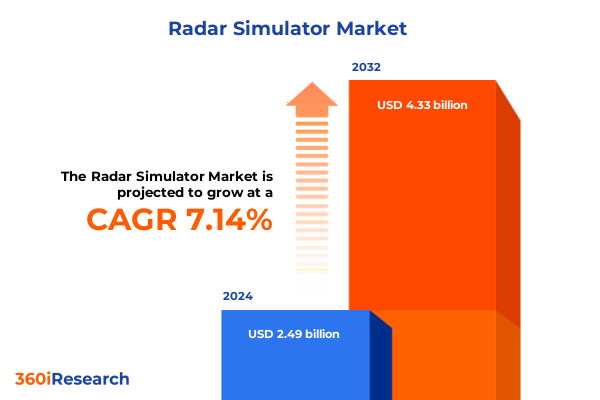

The Radar Simulator Market size was estimated at USD 2.64 billion in 2025 and expected to reach USD 2.80 billion in 2026, at a CAGR of 7.30% to reach USD 4.33 billion by 2032.

Setting the Stage for Radar Simulation Evolution Across Defense, Automotive, Maritime, and Public Safety Sectors with Emerging Technology

Radar simulators have emerged as critical enablers for validating, training, and optimizing radar systems across defense, automotive, maritime, and public safety domains. By replicating real-world signal environments in controlled settings, these platforms accelerate development cycles, reduce operational risks, and support advanced technologies such as adaptive beamforming and electronic warfare countermeasures. As radar complexity grows-driven by multi-band requirements, software-defined architectures, and integration with autonomous systems-simulation solutions have become indispensable for ensuring system reliability under diverse operational scenarios.

Over the past decade, the convergence of digital signal processing advances and high-performance computing has transformed traditional analog simulators into fully digital environments capable of high-fidelity waveform generation and real-time processing. This evolution has unlocked new possibilities in hardware-in-the-loop and software-in-the-loop testing, enabling simultaneous validation of multiple subsystems without incurring the costs and constraints of live-field deployments. At the same time, the push for sustainable practices across industries has highlighted simulation’s ability to curb energy use, minimize physical test ranges, and eliminate environmental impact associated with live trials.

Furthermore, the rise of interconnected systems-from advanced driver assistance systems (ADAS) in vehicles to network-centric defense architectures-has elevated the demand for multi-domain simulation capabilities. By providing synchronized radar, optical, acoustic, and communication channels within a unified environment, modern radar simulators support comprehensive scenario building and joint force readiness. As stakeholders seek to optimize performance across increasingly complex use cases, the sector’s technological momentum underscores the pivotal role of simulated verification in driving future innovation.

Transformative Technological Shifts Reshaping Radar Simulation through AI Integration, Digital Twins, and Cloud-Based Platforms Driving Industry Evolution

In the era of digital transformation, radar simulators are undergoing a fundamental metamorphosis fueled by artificial intelligence, machine learning, and cloud computing. AI-enabled simulation tools now automate scenario generation, leveraging algorithms that adapt in real time to evolving test conditions and operator behaviors. This shift not only enhances training fidelity but also accelerates the detection of system anomalies and facilitates predictive maintenance workflows within test environments.

Concurrently, digital twin technologies have redefined virtual prototyping and operational readiness. By creating comprehensive digital replicas of radar hardware and the surrounding electromagnetic environment, these platforms allow engineers to explore “what-if” scenarios without physical constraints. In defense applications, digital twins support extensive mission rehearsal and performance validation, reducing the need for costly live-fire exercises while preserving critical data trails for continuous improvement.

Another transformative trend is the migration toward cloud-based simulation infrastructures. By decoupling compute-intensive tasks from on-premises hardware, cloud platforms deliver scalable performance and foster collaborative workflows across geographically dispersed teams. This approach enables seamless updates to test frameworks, data sharing across cross-functional groups, and rapid prototyping of next-generation radar concepts without the overhead of maintaining dedicated lab installations.

Assessing the Layered Consequences of 2025 United States Section 301 Tariffs on Radar Simulator Supply Chains and Cost Structures

The implementation of Section 301 tariffs on Chinese imports has introduced significant cost pressures for radar simulator manufacturers reliant on specialized electronic components. As of January 1, 2025, semiconductor products face a 50 percent duty, directly impacting the procurement costs of high-performance processors, FPGAs, and sensor chips integral to modern simulation systems. At the same time, tariff increases on wafers and polysilicon further elevated expenses for solar-powered test modules and semiconductor fabrication inputs, prompting many developers to revisit their sourcing strategies and inventory buffers.

In addition, tariffs on tungsten products-used in radar component shielding and electromagnetic absorption materials-rose to 25 percent, affecting the supply chain for physical test fixtures and target assemblies. The cascading effect of these measures forced system integrators to absorb higher input costs or adjust end-user pricing, leading to extended lead times for hardware delivery and increased budgetary scrutiny from procurement authorities. Many organizations responded by qualifying alternative suppliers outside of China, rebalancing production footprints toward Southeast Asia and the United States to mitigate future trade policy volatility.

Despite temporary exemptions on certain electronics, the prevailing trade environment remains unsettled, driving stakeholders to pursue vertical integration and in-house component development. This strategic pivot aims to safeguard program timelines and preserve testing continuity amid the ongoing tariff landscape.

Unveiling Core Market Segments of Radar Simulation Technologies by Application, Product, Frequency Band, Deployment, and Operation Modes

The radar simulator market can be examined through multiple lenses, each uncovering critical enablers and opportunities. By application, the landscape spans aerospace and defense, where subdomains such as military training and weapon system testing demand ultra-high fidelity; automotive testing, which encompasses advanced driver assistance systems, autonomous driving validation, and collision avoidance evaluation; maritime surveillance supporting vessel navigation and coastal security; and public safety operations that integrate radar into emergency response and search-and-rescue scenarios.

Evaluating the market by product type reveals a clear dichotomy between analog and digital radar simulators. Analog simulators, prized for their simplicity and low-latency response, remain relevant for foundational testing, while digital platforms deliver greater flexibility, reconfigurability, and the ability to emulate complex waveform libraries across multiple frequency bands.

Frequency band segmentation offers additional nuance: the C-Band and X-Band serve critical roles in civilian air traffic control and military targeting, respectively, with the C-Band itself divided into lower and upper segments to address varying propagation characteristics. The S-Band balances range and resolution for weather and maritime systems, while the Ka-Band enables high-resolution imaging for deep-space and reconnaissance applications.

Deployment mode further distinguishes fixed installations-spanning field-deployed test ranges and controlled laboratory environments-from portable systems designed for bench-level evaluation or on-site validation. Finally, operation modes bifurcate into hardware-in-the-loop and software-in-the-loop methodologies, real-time and post-processing simulations, and advanced software-driven algorithm and digital-twin exercises, each catering to specific development and validation workflows.

This comprehensive research report categorizes the Radar Simulator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Frequency Band

- Deployment Mode

- Operation Mode

- Application

Key Regional Market Dynamics in the Radar Simulation Landscape across the Americas, Europe Middle East Africa, and Asia Pacific Territories

Geographically, the Americas region stands at the forefront of radar simulator adoption, driven by robust defense spending in the United States and Canada, the automotive industry’s rapid embrace of ADAS and autonomous vehicle testing, and growing interest in maritime border security across Latin American coastlines. Research partnerships between leading universities and government laboratories have further enriched the innovation ecosystem, reinforcing North America’s leadership in simulation technology.

In the Europe, Middle East, and Africa corridor, diverse defense modernization programs-from NATO exercises in Western Europe to Gulf Cooperation Council surveillance initiatives-have fueled investments in both fixed and portable simulation platforms. European aerospace and defense contractors collaborate with consortiums to standardize test protocols, while African nations leverage portable bench-top systems to establish foundational training capabilities in remote locations.

Within Asia-Pacific, the rising naval presence of countries such as Australia, India, and Japan has accelerated demand for maritime radar simulation, including synthetic aperture radar (SAR) and over-the-horizon systems. Automotive centers in China and South Korea continue to expand their domestic test ranges, integrating real-time digital twins to support autonomous driving regulations. Throughout the region, public safety agencies adopt radar-based search-and-rescue and perimeter surveillance applications to address natural disaster response and urban security challenges.

This comprehensive research report examines key regions that drive the evolution of the Radar Simulator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlight on Leading Radar Simulation Providers Highlighting Strategic Partnerships, Innovation Pipelines, and Competitive Positioning

The competitive radar simulator landscape features a blend of legacy instrumentation manufacturers, defense-focused integrators, and nimble technology innovators. Major incumbents continually enhance their solution portfolios through strategic partnerships, such as joint ventures with semiconductor suppliers to co-develop bespoke high-speed processing modules. Meanwhile, smaller specialized firms leverage open-architecture platforms and modular hardware to address niche applications, creating a dynamic interplay between scale, customization, and speed to market.

Notable players differentiate themselves through unique value propositions: some emphasize end-to-end integration services, encompassing both hardware and software stacks, while others focus on advanced signal processing algorithms or user-centric interface designs. A growing trend involves alliances between radar simulation specialists and cloud hosting providers to offer subscription-based simulation-as-a-service models, reducing upfront capital expenditures for end users. Across the board, intellectual property portfolios centered on waveform generation, target modeling, and real-time data analytics drive the intensity of competition and underpin long-term differentiation strategies.

As simulation demands grow more complex, established firms are accelerating investment in R&D to integrate machine learning, augmented reality overlays, and multi-sensor fusion capabilities. Smaller market entrants, by contrast, exploit agile development methods to bring disruptive innovations-such as software-defined radar simulation and containerized digital twins-to sectors that previously lacked accessible test infrastructure.

This comprehensive research report delivers an in-depth overview of the principal market players in the Radar Simulator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AceWavetech

- BAE Systems plc

- Buffalo Computer Graphics

- CAE Inc.

- Cambridge Pixel Ltd.

- Elbit Systems Ltd.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Micro Nav Limited

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Saab AB

- Textron Systems

- Thales S.A.

Actionable Strategic Recommendations for Industry Leaders to Drive Competitive Advantage and Operational Excellence in Radar Simulation Markets

Industry leaders should prioritize the expansion of digital twin capabilities across their simulation offerings, ensuring seamless interoperability between real-world hardware and virtual environments. By embedding predictive analytics and machine learning engines deep into the simulation workflow, organizations can preempt performance bottlenecks and optimize system parameters before physical deployments become necessary.

Simultaneously, diversifying supply chains through strategic supplier development and nearshoring initiatives will buffer organizations against future trade policy disruptions. Establishing alternative procurement sources in allied economies and fostering local component manufacturing can safeguard program timelines and cost predictability.

Collaboration with cloud infrastructure partners can enable pay-as-you-go simulation models, reducing entry barriers for emerging sectors and smaller clients. Embracing sustainability metrics within test protocols-such as carbon footprint reporting and energy consumption optimization-will resonate with customers seeking eco-friendly solutions. Finally, investing in talent development through simulation-driven training programs will cultivate the specialized skill sets required to navigate the increasing complexity of radar waveform design, signal processing, and system integration.

Comprehensive Research Methodology Ensuring Rigorous Data Collection, Expert Validation, and Robust Analytical Framework for Radar Simulation Analysis

The research methodology integrates comprehensive secondary research with structured primary interviews to validate key insights. Secondary sources include government trade publications, defense procurement reports, technical white papers, and peer-reviewed journals. These materials provide the foundational understanding of technological trends, regulatory frameworks, and competitive landscapes.

Primary research components involve engaging with industry stakeholders-including system integrators, test facility operators, procurement officials, and technology vendors-to gather first-hand perspectives on product requirements, deployment challenges, and investment priorities. Expert panels comprising signal processing engineers, radar system architects, and simulation specialists further refine the analysis through iterative feedback loops.

Quantitative validation is achieved by triangulating data points across multiple channels, ensuring alignment between qualitative observations and documented technical specifications. A rigorous scoring framework evaluates vendor capabilities against standardized criteria, while scenario-based modeling tools test the robustness of segmentation assumptions. This layered approach delivers a balanced, objective assessment of market dynamics and emergent opportunities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Radar Simulator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Radar Simulator Market, by Product Type

- Radar Simulator Market, by Frequency Band

- Radar Simulator Market, by Deployment Mode

- Radar Simulator Market, by Operation Mode

- Radar Simulator Market, by Application

- Radar Simulator Market, by Region

- Radar Simulator Market, by Group

- Radar Simulator Market, by Country

- United States Radar Simulator Market

- China Radar Simulator Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Closing Insights on the Future Trajectory of Radar Simulation with Critical Reflections on Opportunities, Challenges, and Strategic Imperatives

In summary, the radar simulator market stands at the intersection of technological innovation and evolving application demands. Digital transformation initiatives-driven by AI, digital twins, and cloud architectures-are reshaping test and training paradigms, while geopolitical factors and trade policies continue to influence supply chain strategies. The increasing convergence of multi-domain systems requires holistic simulation capabilities that can address integrated radar, optical, and electronic warfare scenarios.

Organizations that successfully integrate advanced analytics into their simulation workflows, diversify their sourcing networks, and align with sustainability objectives will be best positioned to capture emerging opportunities. Collaboration between vendors, government agencies, and academic institutions remains essential for pushing the boundaries of fidelity, affordability, and accessibility. As industries from defense to public safety and mobility transition toward predictive, software-driven testing environments, radar simulation providers have a pivotal role in enabling safer, more efficient system development and operational readiness.

Looking ahead, continued investments in R&D, coupled with strategic partnerships across the technology stack, will define the next wave of innovation. Those who embrace this collaborative, multidisciplinary approach can expect to lead the market’s evolution and deliver transformative value to end users worldwide.

Secure Your Comprehensive Radar Simulator Market Research Report and Connect with Ketan Rohom to Empower Strategic Decision Making and Business Growth

To explore the detailed findings, competitive benchmarks, and strategic analyses that drive success in the radar simulation domain, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Engage in a personalized discussion to discover how this comprehensive market research report can inform your product roadmaps, validate investment priorities, and unlock high-impact opportunities. Secure access to a robust body of insights and position your organization to capitalize on tomorrow’s emerging trends.

- How big is the Radar Simulator Market?

- What is the Radar Simulator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?