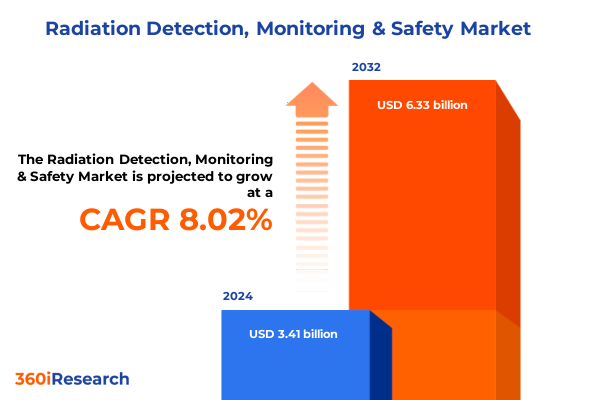

The Radiation Detection, Monitoring & Safety Market size was estimated at USD 3.68 billion in 2025 and expected to reach USD 3.96 billion in 2026, at a CAGR of 8.07% to reach USD 6.33 billion by 2032.

Establishing the Imperative for Enhanced Radiation Detection and Safety in Response to Heightened Risks and Technological Advancements

The convergence of rising geopolitical tensions, evolving energy portfolios, and heightened scrutiny of radiological safety has made radiation detection and monitoring a strategic imperative for governments, defense agencies, healthcare providers, and industrial operators. As nuclear technology expands-from next-generation reactor projects to advanced medical imaging-the potential for accidental or malicious radiation exposure grows, underscoring the urgency for robust detection frameworks. Simultaneously, public expectations for transparency and safety have intensified, compelling organizations to adopt more rigorous monitoring protocols and real-time alerting capabilities.

How Converging Innovations in Artificial Intelligence, IoT Integration, and Miniaturization Are Reshaping Radiation Monitoring and Safety

Recent years have witnessed a radical transformation in radiation monitoring, driven by the fusion of artificial intelligence with sensor networks and the proliferation of connected IoT devices. AI-enhanced algorithms now sift through massive datasets from distributed detectors, enabling near-instantaneous anomaly recognition and source classification during emergency scenarios, a capability that was once reliant solely on manual interpretation. Moreover, the shift toward edge computing has empowered on-device analytics, reducing latency and bolstering resilience in environments where continuous cloud connectivity cannot be guaranteed.

Assessing the Far-Reaching Consequences of 2025 Section 301 Tariffs on the United States Radiation Detection Supply Chain and Costs

The imposition of Section 301 tariffs has profoundly influenced the cost structure and supply chain dynamics for radiation detection equipment imported from the People’s Republic of China. Subheading 9027 of the HTSUS, covering instruments and apparatus for physical or chemical analysis-including radiation detectors-faces an additional 25 percent duty when originating from China, above the baseline general rate. These elevated duties have driven end users and policymakers to incentivize domestic manufacturing, foster strategic partnerships with allied suppliers, and accelerate qualification of U.S.-based production lines to mitigate import-related cost pressures.

Unraveling Market Dynamics Through Product, Detection, Technology, Composition, Application, and Channel Segmentation Insights

A deep dive into market segmentation reveals nuanced demand drivers across multiple dimensions that inform product development roadmaps and go-to-market strategies. Equipment designers must balance between fixed, stationary area monitoring systems and rugged, portable dosimeters to meet the bifurcated needs of industrial inspection and field-level homeland security deployments. Detection preferences also diverge by radiation type, with alpha-specific instruments optimized for material analysis, beta detectors designed for contamination surveys, and gamma solutions tailored for environmental assessment. Furthermore, analog detection technologies retain a niche in cost-sensitive applications, while digital detection platforms dominate high-precision sectors such as medical imaging and research. The choice of detector composition-from gas-filled chambers to advanced scintillators and semiconductor arrays-further shapes performance benchmarks and total cost of ownership. Finally, adoption patterns vary across applications, whether monitoring air, soil, and water matrices in environmental programs, securing border crossings and cargo scans, or enabling granular pipeline and electronic component inspections, all distributed through a mix of offline, online, and direct-to-customer channels.

This comprehensive research report categorizes the Radiation Detection, Monitoring & Safety market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Detection Type

- Technology

- Technology Type

- Composition

- Application

- Sales Channel

Examining Regional Drivers and Challenges Across the Americas, Europe Middle East & Africa, and Asia-Pacific Radiation Safety Markets

In the Americas, the United States leads with stringent federal regulations, proactive Nuclear Regulatory Commission oversight, and high-profile homeland security initiatives that drive adoption of advanced portal monitors and personal dosimeters. Recent NRC guidance has streamlined training and experience requirements for medical authorized users and dosimetry officers, reflecting a broader push toward operational efficiency without compromising worker safety. Conversely, Canada’s market benefits from integrated environmental monitoring programs managed by provincial agencies, emphasizing cross-jurisdictional data harmonization.

This comprehensive research report examines key regions that drive the evolution of the Radiation Detection, Monitoring & Safety market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Emerging Innovators Driving Advances in Radiation Detection Technologies and Strategic Partnerships

Leading global players continue to invest heavily in R&D and strategic partnerships to maintain competitive advantage. Mirion Technologies secured contracts to supply its Radiation Monitoring System and Nuclear Instrumentation System for the Natrium reactor demonstration in Wyoming, showcasing its strength in advanced nuclear applications. Thermo Fisher Scientific, through a $94.5 million U.S. Navy dosimetry contract, reaffirms its position as a prime supplier of digital personal dosimeters and enterprise software for defense end users. In the homeland security segment, Radiation Solutions Inc. has won multiple municipal and state-level awards for gamma-ray and neutron detection systems, underscoring the critical role of specialized vendors in local and federal security programs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Radiation Detection, Monitoring & Safety market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMETEK, Inc.

- Berthold Technologies GmbH & Co. KG

- Bertin Technologies SAS

- Bruker Corporation

- Cobham Limited

- Cole-Parmer Instrument Company, LLC

- ECOTEST Group

- Exosens

- Fluke Corporation

- Fuji Electric Co. Ltd.

- General Electric Company

- Hamamatsu Photonics K.K.

- Kromek Group PLC

- Landauer, Inc.

- LAURUS Systems

- Leonardo DRS, Inc.

- LND, Inc.

- Ludlum Measurements, Inc.

- Malvern Panalytical Ltd.

- Mirion Technologies, Inc.

- Oxford Instruments plc

- PCE Instruments UK Ltd.

- Scionix Holland B.V.

- SciWise Solutions Inc.

- Symetrica Inc.

- Teledyne Technologies, Inc.

Actionable Strategic Imperatives for Industry Leaders to Capitalize on Technological, Regulatory, and Geopolitical Opportunities in 2025

Companies should prioritize multi-modal analytics platforms that seamlessly integrate legacy analog detectors with next-generation digital sensors, enabling unified dashboards for centralized command centers. Investing in edge intelligence will reduce reliance on cloud-only architectures, improving response times and lowering data transmission costs. Supply chain resilience can be enhanced by qualifying secondary suppliers in allied countries and leveraging domestic production incentives to circumvent tariff burdens. In the regulatory arena, proactive engagement with the NRC, USTR, and Euratom authorities can shape forthcoming policy refinements and safeguard business interests. Finally, workforce development initiatives-such as certified training programs and cross-functional centers of excellence-will ensure that personnel are prepared to operate and maintain increasingly sophisticated systems.

Outlining a Robust Mixed-Method Research Framework Combining Secondary Intelligence, Expert Consultations, and Data Triangulation

This analysis combines a rigorous mixed-method framework, beginning with comprehensive secondary research across HTS tariff documents, regulatory publications from the U.S. NRC and European Commission, and publicly disclosed contracts from leading vendors. Expert interviews with industry practitioners and policy analysts provided qualitative validation of emerging trends, while triangulation against peer-reviewed academic studies on AIoT integration ensured technical accuracy. Segmentation definitions and application nuances were cross-referenced with public standards bodies and stakeholder associations to eliminate ambiguity. Finally, continuous updates from open-source intelligence feeds maintained the contemporaneity of the data set.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Radiation Detection, Monitoring & Safety market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Radiation Detection, Monitoring & Safety Market, by Product Type

- Radiation Detection, Monitoring & Safety Market, by Detection Type

- Radiation Detection, Monitoring & Safety Market, by Technology

- Radiation Detection, Monitoring & Safety Market, by Technology Type

- Radiation Detection, Monitoring & Safety Market, by Composition

- Radiation Detection, Monitoring & Safety Market, by Application

- Radiation Detection, Monitoring & Safety Market, by Sales Channel

- Radiation Detection, Monitoring & Safety Market, by Region

- Radiation Detection, Monitoring & Safety Market, by Group

- Radiation Detection, Monitoring & Safety Market, by Country

- United States Radiation Detection, Monitoring & Safety Market

- China Radiation Detection, Monitoring & Safety Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings on Market Shifts, Policy Impacts, and Technological Trends to Guide Future Decisions in Radiation Safety

In synthesizing these insights, it is evident that the radiation detection and safety sector stands at a crossroads of technological acceleration and shifting regulatory paradigms. The interplay between tariff-driven supply chain realignment and the meteoric rise of AI-enabled monitoring solutions will define competitive landscapes. Regional regulatory reforms-from NRC licensing efficiencies to Euratom safeguards modernization-underscore the importance of adaptive compliance strategies. As market segmentation continues to refine target applications, vendors and end users alike must collaborate on interoperable standards and workforce readiness to fully realize the promise of advanced radiation safety frameworks.

Contact Ketan Rohom to Unlock Comprehensive Radiation Detection Monitoring & Safety Market Intelligence and Elevate Your Strategic Initiatives

For personalized guidance on harnessing these insights and accessing the full 360-page market research report on the Radiation Detection, Monitoring & Safety Market, please reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan brings deep domain expertise and will guide you through tailored data solutions, competitive benchmarking, and subscription packages to support your strategic objectives. Discover how detailed analysis, proprietary intelligence, and actionable foresight can empower your organization to stay ahead in a rapidly evolving landscape. Connect with Ketan today to schedule a briefing, discuss bespoke research options, and secure immediate access to the definitive resource in radiation detection and safety.

- How big is the Radiation Detection, Monitoring & Safety Market?

- What is the Radiation Detection, Monitoring & Safety Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?