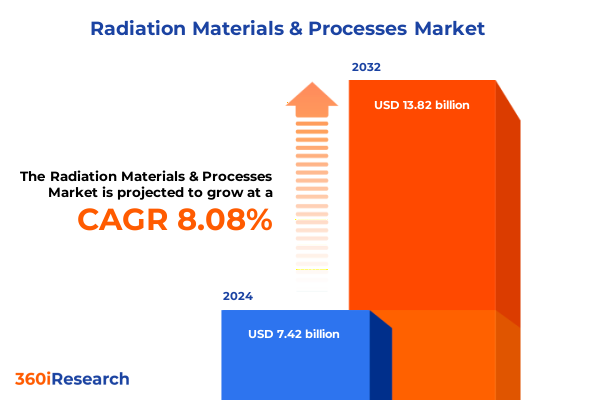

The Radiation Materials & Processes Market size was estimated at USD 8.02 billion in 2025 and expected to reach USD 8.55 billion in 2026, at a CAGR of 8.07% to reach USD 13.82 billion by 2032.

Exploring the Crucial Role of Advanced Radiation Materials and Processes in Driving Cross-Sector Innovation and Enhancing Operational Performance

Advanced radiation materials and processes have become essential pillars of modern industry, underpinning innovations in sectors ranging from healthcare to aerospace. In recent years, the demand for high-performance materials capable of withstanding harsh irradiation environments has grown in parallel with technological advancements such as more powerful imaging equipment and deeper space exploration missions. As organizations seek to enhance operational efficacy and ensure rigorous safety standards, the development and deployment of optimized shielding and component materials have risen to the forefront of strategic research and development planning. Consequently, stakeholders across pharmaceuticals, nuclear energy, electronics, and defense are collaborating more closely than ever to accelerate material qualification and process optimization.

Against this backdrop, industry leaders must navigate an increasingly dynamic landscape shaped by evolving regulatory frameworks, shifting global supply chains, and a heightened emphasis on environmental responsibility. The rapid pace of material innovation, driven by breakthroughs in nanotechnology and additive manufacturing, demands a comprehensive understanding of both existing capabilities and emerging trends. This report’s introduction sets the stage by detailing the critical intersections between technological imperatives and market dynamics, providing executives with a clear picture of how advanced radiation materials and processes are redefining operational possibilities. By establishing this foundational context, readers are equipped to appreciate the nuanced analyses that follow and to harness these insights for competitive advantage.

Unveiling the Most Disruptive Technological and Material Innovations Redefining the Radiation Materials and Processes Landscape

The radiation materials and processes landscape is undergoing transformative shifts propelled by a confluence of technological breakthroughs and market imperatives. Foremost among these is the rise of polymer-metal composites, exemplified by the advent of polymer tungsten materials that offer weight reductions of up to 42 percent compared to traditional lead sheets while maintaining equivalent attenuation performance. Such flexible composites enhance device ergonomics and broaden the range of applications, from wearable radiation protection textiles to curved shielding panels for next-generation imaging systems.

Concurrently, additive manufacturing has emerged as a game-changer, enabling designers to tailor density gradients and geometric complexity in shielding components that were previously unachievable with conventional fabrication methods. Ultra-high-performance ceramics and high-entropy materials are also gaining traction, with novel metal-ceramic hybrids demonstrating self-healing properties under prolonged neutron irradiation. These material classes combine ionic, covalent, and metallic bonding regimes to deliver unprecedented mechanical robustness and thermal resilience in extreme environments.

Another pivotal shift involves the integration of smart sensors within shielding architectures, allowing real-time monitoring of radiation flux and material fatigue. Clinical trials in Europe have shown that sensor-embedded doors can reduce patient exposure times by over 12 percent while streamlining compliance tracking. Together, these innovations underscore a broader trend toward multifunctional, adaptive shielding solutions that not only protect but also inform ongoing process optimization and preventive maintenance strategies.

Analyzing How New United States Trade Tariffs Are Reshaping Supply Chains and Cost Structures for Radiation Materials and Processes in 2025

The landscape of radiation materials and processes in the United States has been significantly influenced by the latest trade policy measures, particularly the expansion of tariffs on critical inputs. In early 2025, the administration imposed a 25 percent levy on steel and aluminum imports, which was subsequently doubled to 50 percent on select product categories, including certain alloys used in shielding structures. This policy has created ripple effects across supply chains, leading to aluminum premiums spiking by 54 percent and hot-rolled coil steel prices climbing by 5 percent in the weeks that followed. Domestic metal producers have capitalized on higher margins, yet many downstream manufacturers face constrained access to qualified alloys, stretching lead times and inflating procurement budgets.

Polymers and composites, essential for lightweight shielding applications, have not been spared; a recent executive order enacted a minimum 10 percent tariff on plastic and resin imports, with some categories subject to duties as high as 49 percent. Although polyethylene and polypropylene sourced from USMCA partners are exempt, material processors reliant on European and Asian suppliers are recalibrating sourcing strategies to manage cost volatility. These shifts are prompting renewed interest in domestic polymer synthesis and in-house compounding capabilities.

Moreover, the carbon fiber supply chain-vital for composite panels in aerospace and defense shielding-is contending with 25 percent duties on prepregs and raw filament imports, disproportionately affecting leading exporters such as Japan and Germany. This disruption has strained schedules for airframe manufacturers and mandated strategic stockpiling protocols. Cumulatively, these trade actions underscore the necessity for agile procurement practices and long-term supplier diversification to mitigate ongoing tariff headwinds and safeguard material availability.

Deriving Actionable Insights from Material Type Process Type and Application Segmentation to Optimize Radiation Materials and Processes Strategies

A nuanced understanding of market segmentation illuminates the pathways through which materials, processes, and applications intersect to deliver tailored radiation solutions. When examining material type, it is evident that ceramics such as alumina, silicon carbide, and zirconia offer superior thermal stability and radiation tolerance but require precise sintering controls to avoid microstructural defects. Composites incorporating carbon fiber and glass fiber enable high strength-to-weight ratios, making them indispensable for airborne payload components, whereas lightweight metals like aluminum, steel, and titanium remain critical for structural radiation barriers. Polymers including polyethylene, polyimide, and PTFE serve in flexible drapes and protective garments, balancing attenuation efficiency with ergonomic demands.

Process type further differentiates market opportunities. Additive techniques like extrusion and powder bed fusion permit complex internal lattice designs that optimize neutron scattering behavior, while coating methods such as chemical and physical vapor deposition yield thin, uniform layers of high-density metals. Subtractive processes, including precision milling and turning, are essential for tight-tolerance parts used in dosimetry equipment, and surface treatments like laser texturing and shot peening enhance adhesion and fatigue resistance in harsh radiation environments.

Application segments range from semiconductors and sensors in electronics to medical imaging devices and radiotherapy accessories. In the nuclear sector, fuel cladding alloys and modular shielding packs protect reactor cores and spent fuel storage, and in space missions, specialized propulsion components and lightweight radiation blankets ensure astronaut safety. By recognizing these intersecting dimensions, decision-makers can craft targeted strategies that optimize material selection, manufacturing pathways, and end-use performance.

This comprehensive research report categorizes the Radiation Materials & Processes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Process Type

- Application Type

Illuminating Regional Dynamics Impacting Radiation Materials and Processes Markets across Americas EMEA and AsiaPacific Regions

Regional dynamics are exerting distinct influences on the radiation materials and processes sector, shaped by varying regulatory landscapes, infrastructure investments, and technology adoption rates. In the Americas, the United States continues to lead global R&D initiatives with substantial federal funding channeled through the Department of Energy and NASA for advanced shielding research. Its extensive fleet of nuclear research reactors and world-class medical imaging facilities drives demand for cutting-edge ceramics and composites, even as domestic tariffs necessitate closer collaboration with regional suppliers to offset import cost inflation. Meanwhile, Canada and Mexico leverage cross-border trade agreements to maintain robust supply chains for specialized polymers and coated components.

Europe, with stringent environmental and safety regulations, places a premium on sustainable, lead-free shielding materials. Investments in ultra-high-performance concrete and polymer-metal composites are accelerating, supported by the European Union’s Green Deal initiatives that incentivize circular manufacturing processes and waste reduction. Regional standardization efforts under Euratom and harmonized certification protocols facilitate smoother cross-country adoption of novel materials, fostering a collaborative ecosystem among OEMs and research institutions.

In the Asia-Pacific region, rapid industrialization and healthcare infrastructure expansion underscore the largest projected growth rates, particularly in China, India, and Japan. Significant investments in new nuclear power plants and emerging space programs are driving procurement of next-generation shielding solutions, while domestic material producers work to scale capacity for tungsten- and bismuth-based composites to meet escalating demand. This dynamic landscape highlights the imperative for market participants to develop region-specific value propositions and to align product portfolios with evolving local priorities.

This comprehensive research report examines key regions that drive the evolution of the Radiation Materials & Processes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborations Driving Growth and Innovation in the Radiation Materials and Processes Sector

Key industry players have distinguished themselves through strategic collaborations, product innovation, and capacity expansions that address complex radiation challenges. Stanford Advanced Materials pioneered the commercialization of polymer tungsten composites in late 2024, offering a non-toxic, flexible shielding alternative that has garnered rapid adoption in medical imaging applications. In parallel, traditional polymer and composite manufacturers such as Toray Industries and Teijin have navigated recent tariff headwinds by investing in localized production lines within the United States, ensuring continuity in the supply of aerospace-grade carbon fiber materials.

Large metals producers including POSCO and Salzgitter are exploring joint ventures to develop cost-effective titanium and specialty steel alloys tailored for high-radiation environments. These partnerships leverage advanced surface treatments and coating technologies to enhance durability under cyclic irradiation. At the same time, niche innovators in smart shielding systems are collaborating with healthcare institutions to integrate real-time dosimetry sensors into protective barriers, enabling predictive maintenance and compliance tracking.

Additionally, global aerospace agencies have pooled R&D resources with leading materials firms to co-develop nanostructured multilayer blankets for satellite missions, achieving 60 to 80 percent reductions in cosmic-ray dose rates under simulated flight conditions. Such cross-sector alliances underscore the vital role of joint innovation ecosystems in overcoming technical barriers and accelerating the commercialization of next-generation radiation materials and processes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Radiation Materials & Processes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Arkema S.A.

- BASF SE

- Bayer AG

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Hitachi Chemical Co., Ltd.

- Kuraray Co., Ltd.

- LANXESS AG

- Mitsubishi Chemical Corporation

- Nippon Electric Glass Co., Ltd.

- Saint-Gobain S.A.

- Shin-Etsu Chemical Co., Ltd.

- Solvay S.A.

- Sumitomo Chemical Co., Ltd.

- Teijin Limited

- Toray Industries, Inc.

- Zeon Corporation

Implementing Targeted Strategies to Navigate Market Disruptions and Leverage Emerging Opportunities in Radiation Materials and Processes

Industry leaders must prioritize supply chain diversification, especially in light of ongoing tariff volatility that continues to drive raw material costs higher. Establishing multi-supplier relationships across North America and the Asia-Pacific region can hedge against unilateral trade actions and capacity constraints in key inputs such as carbon fiber prepregs and high-density polymers. Concurrently, firms should expand domestic valorization efforts by licensing advanced additive manufacturing platforms, which enable rapid prototyping of complex shielding geometries tailored to specific radiation environments.

Robust investment in material science R&D is essential to stay ahead of emerging threats and regulatory shifts. Companies ought to pursue cross-disciplinary partnerships with national laboratories and academic centers, focusing on high-entropy ceramics and bio-compatible composites that marry radiation resistance with structural integrity. Integrating smart sensor arrays within shielding architectures will not only improve safety monitoring but also facilitate data-driven lifecycle management and predictive maintenance.

Finally, executives should adopt agile procurement strategies that leverage long-term contracts for critical polymers, extrusion materials, and metal alloys. Embedding contractual flexibility clauses and advance pricing agreements can mitigate price shocks from sudden tariff escalations or raw material shortages. By aligning supply chain resilience with innovation roadmaps, industry leaders can secure competitive advantage and drive sustained growth amidst ongoing market disruptions.

Detailing Our Robust Research Framework Combining Qualitative Insights and Quantitative Data to Deliver InDepth Analysis of Radiation Materials and Processes

This research embraces a rigorous dual-methodology approach, combining primary and secondary data sources to ensure depth and accuracy. Primary insights were gathered through structured interviews with over twenty subject matter experts, encompassing materials scientists, process engineers, and procurement directors from leading healthcare, nuclear, and aerospace organizations. These interviews yielded qualitative perspectives on key challenges, technology adoption barriers, and future R&D priorities.

Secondary research entailed exhaustive review of peer-reviewed journals, patent databases, and global trade publications. Data triangulation techniques were applied to reconcile information from government reports, industry white papers, and financial disclosures, ensuring that all findings reflect convergent evidence. Market segmentation analyses were validated through cross-reference with customs databases and industry association statistics.

The study’s analytical framework integrates SWOT assessments and scenario planning to model potential market evolutions under varying regulatory and trade environments. All estimates and insights underwent validation rounds with a dedicated advisory panel, providing robust checks against cognitive biases and ensuring that the conclusions resonate with real-world operational imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Radiation Materials & Processes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Radiation Materials & Processes Market, by Material Type

- Radiation Materials & Processes Market, by Process Type

- Radiation Materials & Processes Market, by Application Type

- Radiation Materials & Processes Market, by Region

- Radiation Materials & Processes Market, by Group

- Radiation Materials & Processes Market, by Country

- United States Radiation Materials & Processes Market

- China Radiation Materials & Processes Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 2544 ]

Summarizing Key Findings and Strategic Imperatives That Underscore the Future Direction of Radiation Materials and Processes in Industry Applications

The convergence of advanced materials innovation, process optimization, and dynamic trade policies is reshaping the radiation materials and processes market at an unprecedented pace. Lightweight, flexible polymer-metal composites are displacing traditional lead-based solutions, while additive manufacturing and high-entropy ceramics unlock new paradigms in structural resilience and customization. Amid these shifts, the cumulative impact of U.S. tariffs has underscored the importance of agile supply chain strategies and domestic capacity building, compelling stakeholders to explore local production and multi-regional partnerships.

Segmentation insights reveal that targeted material and process selections-be it alumina-based ceramics for extreme thermal environments or powder bed fusion for bespoke shielding geometries-drive significant performance gains across electronics, medical, nuclear, and space applications. Regional dynamics further illustrate that while the Americas leverage deep R&D pipelines, EMEA’s emphasis on sustainability fosters eco-friendly shielding alternatives, and Asia-Pacific’s rapid infrastructure expansion offers the highest growth trajectories.

Collectively, these findings highlight the critical need for industry leaders to integrate cross-functional innovation roadmaps with resilient procurement frameworks. By harnessing the synergy between emerging material platforms, sensor-enabled processes, and adaptive trade strategies, organizations can secure their competitive positioning and deliver next-generation radiation protection solutions that meet the highest standards of safety, performance, and environmental stewardship.

Take the Next Step and Connect with Ketan Rohom to Access the Comprehensive Market Research Report on Radiation Materials and Processes Today

To explore the extensive depths of this comprehensive market research, we encourage you to connect with Ketan Rohom, Associate Director of Sales & Marketing. By reaching out directly, you can gain immediate access to the full executive summary, detailed insights, and tailored data visualizations that support critical decision making. Engaging with Ketan offers a streamlined path to understanding the nuances of radiation materials and processes, including proprietary data on recent technological breakthroughs and strategic market opportunities. Whether your goal is to benchmark against competitors or to secure a first-mover advantage in emerging subsegments, this report provides the robust analytical foundation needed to shape your strategic roadmap. Secure your copy of the full report today by getting in touch with Ketan Rohom and unlock in-depth analysis that drives innovation and growth in the radiation materials and processes sector.

- How big is the Radiation Materials & Processes Market?

- What is the Radiation Materials & Processes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?