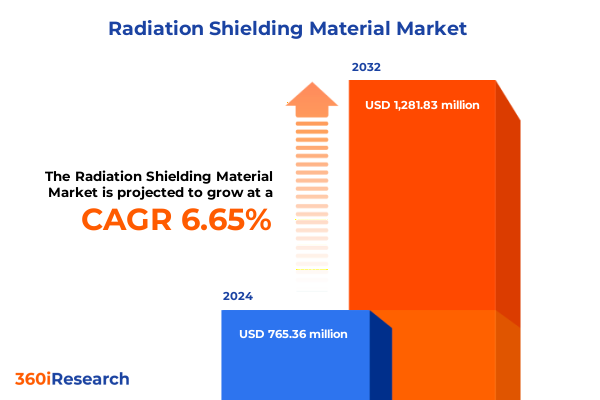

The Radiation Shielding Material Market size was estimated at USD 765.36 million in 2024 and expected to reach USD 812.74 million in 2025, at a CAGR of 6.65% to reach USD 1,281.83 million by 2032.

Introducing the Evolving Dynamics of Radiation Shielding Materials That Are Revolutionizing Safety Protocols, Innovation Pathways, and Industrial Applications

The field of radiation shielding materials stands at a critical juncture where the imperative of protecting human health and sensitive equipment converges with the drive for advanced innovation. As diverse sectors-from nuclear power plants to healthcare diagnostics-seek more efficient and sustainable shielding solutions, material developers and end users alike face mounting pressure to balance performance, cost, and regulatory compliance. This executive summary provides a concise overview of foundational concepts, emerging challenges, and the strategic implications shaping the industry landscape.

Within this context, radiation shielding extends beyond traditional lead barriers. Next-generation composites, engineered polymers, and advanced metal alloys propose unprecedented combinations of lighter weight, enhanced durability, and tailored attenuation properties. Concurrently, stringent safety protocols and evolving global standards underscore the necessity of robust validation and quality assurance processes throughout the supply chain. In response, stakeholders must navigate complex interactions between material science breakthroughs, shifting geopolitical dynamics, and end-user requirements.

With these dynamics in mind, the subsequent sections explore transformative trends, policy impacts, granular segmentation, regional differentiators, company strategies, and actionable recommendations. Collectively, these insights pave the way for informed decision making, guiding executives and technical leaders toward optimized research, procurement, and deployment of radiation shielding materials.

Exploring the Crucial Transformative Shifts Driving Innovation, Sustainability, and Technology Adoption in the Radiation Shielding Materials Ecosystem

The radiation shielding materials industry is undergoing a period of profound transformation driven by technological convergence and sustainability imperatives. In recent years, additive manufacturing techniques have enabled the fabrication of custom shielding geometries that precisely match complex component interfaces, while data-driven modeling tools allow for virtual prototyping and performance optimization prior to physical production. As a result, the capability to tailor attenuation characteristics for specific radiation types is becoming a standard expectation across critical industries.

Moreover, the shift toward greener supply chains has spurred research into alternatives to traditional lead-based barriers. Borated polyethylene blends, tungsten-reinforced composites, and non-toxic alloy formulations aim to reduce environmental disposal challenges and worker health risks during fabrication. Simultaneously, digital tracking solutions and IoT-enabled monitoring systems are enhancing transparency across distribution channels, ensuring that material origin, batch testing data, and certification statuses remain auditable at every stage.

Regulatory frameworks are also evolving in response to heightened safety concerns and public scrutiny, with several jurisdictions mandating comprehensive lifecycle analyses and end-of-use recycling pathways. Together, these shifts underline an industry realignment toward integrated innovation, where cross-disciplinary collaboration among materials scientists, software developers, and regulatory bodies fosters resilient, compliant, and high-performance shielding solutions.

Analyzing the Cumulative Effects of 2025 United States Tariffs on Supply Chains, Cost Structures, and Competitive Dynamics in Radiation Shielding Materials

The imposition of new United States tariffs in 2025 on selected radiation shielding raw materials and semi-finished components has introduced a complex set of cost and supply chain challenges. Providers that historically relied on imported steel alloys, tungsten plates, and specialized polymers have experienced immediate increases in landed costs, compelling many to reevaluate sourcing strategies. In response, manufacturers are accelerating efforts to qualify domestic substitutes and to partner with regional suppliers capable of meeting stringent purity and performance specifications.

The downstream impact has been particularly acute in sectors with tight budget constraints, such as academic research and smaller industrial operations. In these environments, elevated input costs have triggered extended procurement cycles and increased lead times. Conversely, larger defense and nuclear power clients have leveraged strategic stockpiling and long-term agreements to mitigate price volatility. These front-line adjustments underscore the intricate interplay between trade policy and operational resilience.

Looking ahead, the additives industry is exploring new alloy formulations that reduce reliance on tariffed imports while maintaining or enhancing shielding efficacy. At the same time, several firms are investing in vertical integration to capture value across multiple stages of the supply chain, from raw materials processing to finished shielding assemblies. These strategic responses highlight the vital need for agility and foresight as market participants navigate the evolving tariff landscape.

Uncovering Segmentation Insights Across Diverse Material Types, Application Sectors, Radiation Categories, End Users, Product Forms, and Distribution Channels

Segmentation analysis reveals how distinct material types drive differentiated value propositions within the shielding market. Borated polyethylene retains prominence for neutron attenuation in nuclear and research settings, while concrete formulations continue to serve as reliable bulk barriers in decommissioning and reactor operations. Lead, despite environmental concerns, remains entrenched in certain medical applications due to its cost-efficiency and ease of processing. Meanwhile, steel composites exhibit robust performance in industrial installations, and tungsten-reinforced blends are increasingly preferred for aerospace and defense platforms that demand high strength-to-weight ratios.

Application requirements further diversify demand patterns, with defense and aerospace programs prioritizing ultralight, high-density solutions for aircraft and satellite systems. Healthcare facilities, ranging from diagnostic imaging suites to radiation therapy centers and sterilization equipment, require versatile shielding that seamlessly integrates with intricate instrument geometries. In nuclear power, decommissioning projects emphasize large-scale modular blocks for containment, whereas reactor shielding and spent fuel storage demand specialized liners and engineered casks. Research institutions are exploring prototyping and pilot-scale shielding assemblies, reinforcing the importance of flexible form factors.

Radiation type considerations-covering beta, gamma, neutron, and X-ray emissions-directly inform material selection and thickness design. End users span defense contractors, hospital systems, manufacturing plants, energy utilities, and academic labs, each seeking tailored solutions that align with safety regulations and operational budgets. Forms range from prefabricated blocks and bricks to thin coatings, composite liners, and precision-cut sheets and plates. Distribution channels reflect project scale, with direct sales dominating large capital contracts, distributors and dealers serving mid-tier engagements, and online platforms facilitating volume purchases for smaller labs and maintenance operations.

This comprehensive research report categorizes the Radiation Shielding Material market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Radiation Type

- Form

- Application

- Distribution Channel

Delivering Key Regional Insights into Market Trends, Growth Drivers, and Strategic Opportunities Across Americas, Europe Middle East & Africa, and Asia Pacific

Regional dynamics play a defining role in shaping strategic priorities and investment flows within the radiation shielding market. In the Americas, the United States remains a focal point for defense modernization and nuclear decommissioning initiatives, buoyed by federal funding and stringent safety mandates. Canada’s healthcare sector also drives demand for diagnostic imaging and radiation therapy equipment, fostering opportunities for specialized shielding providers. Latin America, while nascent in large-scale nuclear infrastructure, shows growing interest in industrial applications and research partnerships.

Europe, the Middle East, and Africa (EMEA) present a mosaic of established nuclear fleets, emerging healthcare markets, and ambitious research endeavors. Western European nations are increasingly focused on lifecycle sustainability and circular economy models, prompting an uptick in recyclable polymer and composite shielding research. The Middle East has accelerated investments in medical facilities and nuclear power infrastructure, incentivizing strategic joint ventures. In Africa, early-stage projects and donor-funded research are gradually nurturing local capabilities.

Asia-Pacific stands out as the fastest-expanding region, driven by substantial nuclear energy build-outs in China and India, rapid deployment of hospital networks in Southeast Asia, and burgeoning aerospace defense programs across East Asia. Domestic manufacturing hubs are capitalizing on low-cost production while adopting advanced materials technologies. Collectively, these regional insights underscore the necessity for suppliers to calibrate product portfolios, certification processes, and distribution partnerships to align with localized regulatory and end-user requirements.

This comprehensive research report examines key regions that drive the evolution of the Radiation Shielding Material market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Companies’ Strategic Moves, Technological Advancements, Partnerships, and Competitive Positioning in the Radiation Shielding Materials Market

Leading companies are actively differentiating through strategic partnerships, technology acquisitions, and capacity expansions. Several European conglomerates have invested in specialized research centers dedicated to high-density composite development, leveraging proprietary polymer chemistries and computational fluid dynamics models to optimize attenuation performance. A number of North American enterprises have pursued vertical integration, securing stakes in raw material processing facilities to bolster supply chain resilience and capture additional value upstream.

In the Asia-Pacific region, established metalworking firms are forging joint ventures with materials science startups to co-develop tungsten-reinforced and borated composites tailored for emerging nuclear and aerospace applications. Concurrently, select companies have expanded into digital value-added services, offering IoT-based monitoring systems and predictive maintenance analytics to support large infrastructure projects. Meanwhile, specialized shielding manufacturers have enhanced their footprints in healthcare by integrating modular designs that accommodate evolving medical imaging platforms and radiation therapy modalities.

Across the board, strategic licensing agreements and targeted acquisitions have allowed market leaders to broaden product portfolios and gain rapid access to new geographies. These moves, coupled with a focus on sustainability credentials and regulatory compliance, underscore a competitive landscape characterized by dynamic alliances, accelerated innovation cycles, and an unwavering commitment to performance and safety.

This comprehensive research report delivers an in-depth overview of the principal market players in the Radiation Shielding Material market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A&L Shielding

- Abrisa Technologies

- Amray Group

- Burlington Medical, LLC

- Corning Incorporated

- ESCO Technologies Inc.

- Gaven Industries, Inc.

- Glencore Group

- Gravita India Limited

- Infab Corporation

- Jaytee Alloys & Components Limited

- Lancs Industries

- LEMER PAX SAS

- Marswell Group of Companies

- Mayco Industries

- NELCO

- Nuclear Shields B.V.

- ProtecX Medical Ltd by Burlington Medical LLC

- Radiation Protection Products, Inc.

- Ray-Bar Engineering Corp.

- SCHOTT AG

- Shree Metal Industries.

- Technical Glass Products by Allegion Plc.

- Ultraray Group Inc.

- Veritas Medical Solutions LLC

- Vulcan Global Manufacturing Solutions, Inc.

Presenting Recommendations for Industry Leaders to Enhance Efficiency, Accelerate Innovation, and Bolster Competitiveness in Radiation Shielding Materials

Industry leaders can capitalize on emerging opportunities by embracing a multifaceted strategic agenda. Prioritizing investment in advanced composite research and additive manufacturing capabilities will enable the rapid prototyping of bespoke shielding geometries, reducing time-to-market and addressing complex integration challenges. Equally important is the cultivation of robust supplier networks, including both local and global partners, to mitigate the risks posed by trade policy fluctuations and raw material scarcity.

Another key recommendation is to integrate digital solutions throughout the value chain, from real-time logistics tracking to performance validation via integrated sensor arrays. Such innovations not only enhance transparency and traceability but also create new service-based revenue streams tied to predictive maintenance and usage analytics. Simultaneously, aligning product development with emerging sustainability frameworks-such as recyclable polymer composites and circular end-of-life strategies-will position organizations to meet tightening environmental regulations and evolving customer expectations.

Finally, fostering collaborative research initiatives with academic institutions, national laboratories, and industry consortia can accelerate material breakthroughs while sharing development costs. By combining technical expertise with strategic foresight, industry decision makers can unlock differentiated offerings that deliver superior performance, regulatory confidence, and long-term value in the radiation shielding materials market.

Outlining a Robust Research Methodology Incorporating Data Collection, Analytical Frameworks, Validation Processes, and Quality Assurance in Market Analysis

This market analysis is underpinned by a rigorous research framework that combines comprehensive secondary data collection with targeted primary interviews. Publicly available industry publications, regulatory filings, patent databases, and technical white papers were systematically reviewed to establish a foundational understanding of material technologies, application drivers, and competitive landscapes. Data triangulation ensured consistency across diverse information sources and minimized reliance on any single dataset.

Primary insights were obtained through in-depth interviews with executives, materials scientists, procurement specialists, and end-user representatives spanning defense, healthcare, nuclear power, and academic sectors. These qualitative perspectives provided nuanced viewpoints on product performance, sourcing challenges, and emerging regulatory considerations. Quantitative data, including shipment volumes, production capacities, and historical trade flows, were analyzed to identify patterns and corroborate anecdotal observations.

To validate findings and enhance reliability, a proprietary advisory panel of industry veterans reviewed interim conclusions and offered strategic feedback. Throughout the process, strict quality assurance protocols and validation checks were applied, encompassing data accuracy, contextual relevance, and methodological transparency. This structured approach ensures that the insights and recommendations presented herein reflect a robust, multi-dimensional analysis of the radiation shielding materials landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Radiation Shielding Material market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Radiation Shielding Material Market, by Material Type

- Radiation Shielding Material Market, by Radiation Type

- Radiation Shielding Material Market, by Form

- Radiation Shielding Material Market, by Application

- Radiation Shielding Material Market, by Distribution Channel

- Radiation Shielding Material Market, by Region

- Radiation Shielding Material Market, by Group

- Radiation Shielding Material Market, by Country

- United States Radiation Shielding Material Market

- China Radiation Shielding Material Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Key Findings, Strategic Implications, and Future Outlook to Guide Decision Makers in the Radiation Shielding Materials Sector

The radiation shielding materials market is poised at an inflection point where innovation trajectories intersect with regulatory imperatives and shifting geopolitical landscapes. As diverse applications-from decommissioning aging reactors to equipping next-generation medical imaging suites-demand increasingly sophisticated solutions, stakeholders must balance performance requirements, environmental considerations, and supply chain resilience.

This study highlights the transformative potential of advanced composites, digital integration, and circular economy principles, alongside the tangible impacts of recent trade policy changes. By dissecting granular segmentation and regional nuances, we have uncovered pathways for targeted growth and collaboration. Leading companies are already forging strategic alliances, optimizing vertical integration, and pioneering new material formulations to stay ahead of evolving end-user needs and compliance standards.

To succeed in this dynamic environment, decision makers should adopt a proactive posture-leveraging data-driven insights to inform R&D investments, supply chain strategies, and service offerings. Ultimately, harnessing the collective findings and recommendations within this report will empower industry participants to fortify safety protocols, reduce environmental footprints, and achieve sustained competitive advantage in the radiation shielding materials domain.

Empowering Your Strategic Decisions with Expert Insights: Engage Ketan Rohom Today to Secure the Radiation Shielding Materials Market Research Report

Engaging with Ketan Rohom offers direct access to expert guidance and tailored support for leveraging critical insights uncovered within this comprehensive report. By partnering with an experienced Associate Director in Sales & Marketing, decision makers can ensure a nuanced understanding of emerging trends, regulatory developments, and competitive dynamics unique to radiation shielding materials.

Secure your organization’s strategic advantage today by reaching out to initiate a personalized consultation. Gain clarity on how the findings within this report can inform procurement strategies, research collaborations, and product innovation roadmaps. Don’t miss the opportunity to align your business objectives with data-driven recommendations-contact Ketan Rohom now to obtain the full market research report and initiate a detailed discussion on next steps.

- How big is the Radiation Shielding Material Market?

- What is the Radiation Shielding Material Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?