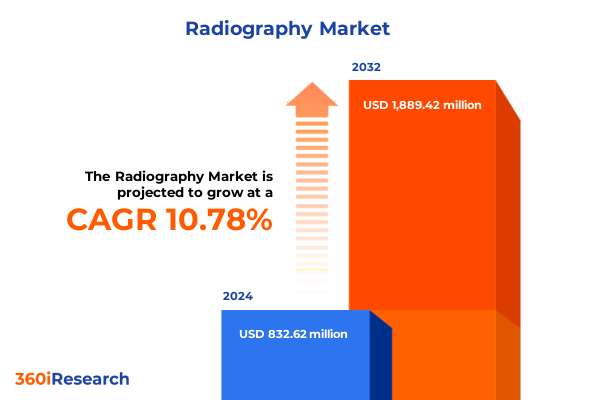

The Radiography Market size was estimated at USD 922.65 million in 2025 and expected to reach USD 1,015.46 million in 2026, at a CAGR of 10.78% to reach USD 1,889.42 million by 2032.

Exploring How Radiography Stands at the Forefront of Healthcare Innovation, Combining Advanced Imaging Technologies with Enhanced Patient-Centric Diagnostics and Workflow Optimization

Radiography has long served as a cornerstone of diagnostic medicine, evolving from traditional film-based X-rays to sophisticated computed radiography (CR) and ultimately to high-resolution digital radiography systems that redefine clinical imaging workflows. Early film radiography relied on chemical development processes that introduced delays, but the advent of computed radiography leveraged photostimulable phosphor plates to capture and convert X-ray images into digital data, marking the first major leap toward immediacy in imaging. Building on this foundation, digital radiography systems utilize direct digital detectors to produce instant high-quality images, minimizing patient movement and enhancing diagnostic throughput, a shift that has proven indispensable across both inpatient and outpatient settings.

The introduction of wireless digital detectors and portable X-ray units has further accelerated the transformation of radiography, enabling point-of-care imaging solutions in emergency departments, intensive care units, and remote locations. Wireless systems eliminate cumbersome cabling, facilitating rapid positioning of detectors and streamlined image acquisition, which collectively improve patient comfort and operational efficiency. Meanwhile, portable digital radiography platforms have expanded access to essential imaging services, particularly in field medicine and home-based care environments, where the ability to provide bedside diagnostics contributes directly to improved patient outcomes.

Against this backdrop of technological advancement, artificial intelligence (AI) has emerged as a powerful ally for radiology professionals, augmenting human expertise with algorithms designed to detect and highlight subtle anomalies such as early-stage tumors or microfractures. Leading medical device manufacturers are integrating AI-powered diagnostic tools that analyze radiographic images in real time, offering decision support that enhances accuracy and consistency while alleviating clinician workloads. These AI systems operate as collaborative assistants rather than replacements for radiologists, reinforcing the clinical decision-making process and enabling more strategic allocation of human expertise toward complex case interpretations.

Radiography’s evolving role now extends beyond conventional structural imaging into emerging frontiers such as spectral and photon-counting technologies, which promise to deliver enhanced tissue contrast and material decomposition capabilities. Researchers in orthopaedic imaging are increasingly experimenting with spectral X-ray systems to differentiate bone density variations and detect subtle fractural microarchitecture, paving the way for more precise assessments of musculoskeletal disorders. Concurrently, pilot studies integrating radiography with molecular imaging agents aim to merge anatomical and functional insights within a single session, heralding a new era of comprehensive diagnostics that improve early disease detection and patient prognostication.

Revolutionary Shifts Reshaping the Radiography Landscape with AI Integration, Wireless Portability, Hybrid Imaging, and Dose Optimization Driving Next-Gen Diagnostic Capabilities

The integration of artificial intelligence into radiographic imaging has catalyzed a paradigm shift in diagnostic capabilities, transforming static image capture into dynamic, data-driven insights that support clinical decision making. AI-powered systems now assist in real-time fracture detection, lesion segmentation, and pattern recognition, enabling radiologists to identify pathologies with greater speed and precision while reducing the potential for human oversight. Industry leaders emphasize that these tools are designed to complement the radiologist’s expertise rather than supplant it, embedding automated pre-reads and decision support within existing workflows to streamline case interpretation and prioritize critical findings.

Concurrently, the proliferation of wireless and portable radiography solutions has redefined the spatial constraints of imaging, allowing healthcare providers to deliver high-quality diagnostics at the point of care in emergency departments, ambulatory centers, and even in patients’ homes. These advancements eliminate lengthy patient transfers to centralized imaging suites, reduce queuing times, and enable rapid assessment in trauma or bedside scenarios. The flexibility afforded by lightweight, battery-powered detectors and compact portable X-ray units supports agile clinical operations, particularly in underserved and rural environments where access to fixed imaging infrastructure may be limited.

Looking ahead, hybrid imaging modalities and cloud-based radiography platforms are poised to further elevate diagnostic workflows by integrating complementary imaging techniques and enabling seamless data management. Hybrid systems that merge X-ray with MRI, CT, or ultrasound data facilitate comprehensive evaluations in oncology, orthopedics, and vascular medicine, offering clinicians multi-modal insights without the need for sequential appointments. Simultaneously, cloud integration supports secure storage, remote access, and collaborative review of high-resolution images, enhancing interdisciplinary consultation and unlocking advanced analytics capabilities while addressing evolving data security standards.

An increased focus on radiation safety and patient experience is driving the adoption of dose-management tools and personalized exposure tracking within radiography suites. Advanced digital systems now incorporate AI-based dose estimation algorithms that tailor X-ray parameters to individual patient anatomy and clinical indications, reducing unnecessary exposure while maintaining image clarity for critical diagnoses. These safety enhancements align with stringent regulatory frameworks across multiple regions, underscoring the commitment to patient-centric design and clinical excellence.

Assessing the Broad Ramifications of United States Import Tariffs on Radiography Equipment Supply Chains, Cost Structures, and Strategic Sourcing Decisions in 2025

The imposition of heightened import duties on medical imaging components has introduced significant complexity to the radiography equipment supply chain, with healthcare providers and manufacturers alike grappling with increased procurement costs and logistical hurdles. Recent policy actions by the U.S. administration have extended tariff coverage to key medical technology imports, compelling industry stakeholders to re-evaluate sourcing strategies and inventory holdings to mitigate potential disruptions. Experts warn that these trade measures could erode buffer stocks of critical components, impede rapid replenishment, and ultimately strain patient care delivery across diverse clinical settings.

In response to mounting concerns over operational viability, major industry associations and lobbying groups have urgently appealed for exemptions or deferments to shield essential healthcare equipment from adverse trade repercussions. The Advanced Medical Technology Association (AdvaMed) has publicly urged federal authorities to carve out clear, expedited waiver processes for medical imaging devices, emphasizing the humanitarian imperative of preserving uninterrupted access to lifesaving diagnostics. Similarly, the Medical Imaging & Technology Alliance (MITA) has advocated for the removal of radiographic equipment from punitive tariff measures, framing imaging devices as indispensable tools in national healthcare infrastructure and patient outcomes.

Amid these policy challenges, leading radiography equipment vendors are exploring a range of strategic responses to safeguard their market positions and maintain supply continuity. Manufacturers such as GE Healthcare have acknowledged margin pressures and have initiated short- and long-term mitigation efforts, including shifting production closer to end markets, streamlining cross-border shipments, and pursuing local manufacturing partnerships. By diversifying supplier networks and optimizing import-export flows, these organizations aim to reduce tariff exposure while sustaining the innovation pipeline for advanced diagnostic platforms.

Looking beyond immediate cost pressures, industry commentators caution that prolonged trade uncertainties could slow the pace of research and development investments for future radiography systems. With manufacturers confronted by elevated component costs and fluctuating supply lead times, strategic prioritization of R&D budgets may shift toward short-cycle product enhancements rather than breakthrough innovations. To preserve long-term technological leadership, companies are advised to embed tariff risk assessments within their innovation frameworks and to consider collaborative R&D models that distribute financial burdens across strategic partners.

Illuminating Core Radiography Market Segmentation Through Modality Diversification, Application Specializations, End User Dynamics, Product Ecosystems, and Deployment System Preferences

Radiography market segmentation based on modality reveals distinct value propositions across computed radiography, digital radiography, and traditional film radiography. Computed radiography systems continue to serve regions where cost constraints and existing infrastructure favor photostimulable phosphor workflows, offering a transitional path toward digital adoption. In contrast, digital radiography platforms lead in high-volume clinical settings where rapid image acquisition and real-time processing drive operational efficiency. Meanwhile, film radiography, though largely supplanted, retains niche applications in settings with minimal digital infrastructure or where archival film records remain integral to clinical practice.

Application-based segmentation underscores the diverse clinical demands placed on radiography technologies, spanning cardiovascular assessments, chest imaging, dental diagnostics, mammography, and orthopedic evaluations. Within dental imaging, extraoral solutions cater to panoramic and cephalometric studies, while intraoral devices address routine cavity detection and endodontic procedures. Mammography segmentation further divides into digital mammography systems that enable computer-aided detection, film mammography that persists in select screening programs, and tomosynthesis units that provide three-dimensional breast tissue visualization. Orthopedic imaging encompasses specialized systems for extremity examinations, joint integrity analyses, and spinal assessments, each calibrated to distinct anatomical and diagnostic criteria.

End user segmentation highlights the importance of healthcare setting in radiography adoption, with ambulatory care centers leveraging lean digital systems for outpatient diagnostics, clinics utilizing compact and cost-effective units, diagnostic centers prioritizing throughput and image clarity, and hospitals demanding integrated radiography solutions within broader imaging departments. Product type segmentation spans hardware components such as detector systems and X-ray generators, services including installation, maintenance, and training offerings that ensure system uptime and user proficiency, and software modules that enable image management, workflow orchestration, and AI-driven analytics. Deployment system segmentation further differentiates between portable units that facilitate mobile diagnostics in field and bedside contexts and stationary systems designed for high-throughput fixed-location imaging suites.

An additional layer of service segmentation emphasizes the critical role of comprehensive support models in sustaining radiography operations. Installation services ensure accurate system calibration and integration with hospital networks, while ongoing maintenance contracts deliver preventive servicing and spare part readiness that minimize downtime. Training programs are increasingly offered through digital learning platforms and virtual reality simulators to accelerate user proficiency and compliance with evolving regulatory standards. These service offerings, when bundled with advanced software updates and remote diagnostic capabilities, reinforce end-user confidence and contribute to a holistic radiography ecosystem that supports continuous performance optimization.

This comprehensive research report categorizes the Radiography market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Modality

- Product Type

- System

- Application

- End User

Analyzing Regional Dynamics in Radiography Adoption Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Uncover Distinctive Market Drivers and Infrastructure Trends

Across the Americas, healthcare systems have accelerated the adoption of digital and portable radiography solutions to meet rising demands for rapid diagnostics and decentralized care. Major medical centers in North and South America have invested in AI-enabled digital radiography platforms to improve throughput and enhance diagnostic confidence, while remote and field clinics increasingly rely on portable units to serve rural and underserved populations. These technology deployments are supported by government subsidies and telehealth initiatives, which promote connectivity and remote image review across vast geographic regions.

In the Europe, Middle East & Africa region, regulatory harmonization efforts have fostered the standardization of radiation dose limits and quality assurance protocols, compelling radiography vendors to prioritize dose-optimization features in their product offerings. Emerging markets within this region exhibit infrastructure modernization through public-private partnerships, where legacy analog systems are being replaced with digital detectors and cloud-based image management platforms. At the same time, mature healthcare markets continue to drive incremental improvements in workflow efficiency through integrated imaging information systems and AI-enhanced analytics.

The Asia-Pacific landscape presents a dynamic mix of established healthcare hubs and rapidly developing markets, where domestic device manufacturers are expanding local production to mitigate import constraints and capitalize on favorable government procurement policies. Chinese radiography vendors operating U.S.-based factories exemplify this trend by ensuring continuity of supply amid global tariff pressures, while regional healthcare providers deploy portable and wireless radiography solutions to bridge gaps in access and improve point-of-care diagnostics in rural areas.

Cross-regional collaborations and knowledge-sharing networks are further accelerating technology transfer and best practice dissemination across these markets. Joint research consortia and academic partnerships are facilitating comparative studies of workflow optimization, dose management, and AI-augmented diagnostic protocols, thereby harmonizing clinical standards and expediting the adoption curve for innovative radiography technologies worldwide.

This comprehensive research report examines key regions that drive the evolution of the Radiography market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Radiography Innovators and Industry Titans Advancing Diagnostic Imaging Through Strategic Partnerships, Technological Breakthroughs, and Global Footprint Expansion

GE Healthcare, Siemens Healthineers, and Philips have emerged as frontrunners in the radiography domain by leveraging deep research and development investments to introduce AI-augmented imaging platforms that address complex diagnostic challenges. GE Healthcare has responded to trade headwinds by recalibrating its global manufacturing footprint and refining cost structures to preserve margins while maintaining a robust product innovation pipeline. Siemens Healthineers similarly navigates supply chain intricacies by establishing localized production sites and integrating advanced dose-minimization technologies across its digital radiography suites, promoting both clinical safety and operational efficiency. Philips, meanwhile, continues to strengthen its position through strategic partnerships with technology startups, enhancing its AI-driven image analysis capabilities and expanding remote collaboration tools that facilitate tele-imaging workflows across diverse healthcare settings.

Canon Medical Systems and Fujifilm Medical Systems complement the competitive landscape by delivering modular and scalable radiography solutions tailored to regional market needs. Fujifilm’s focus on high-resolution flat-panel detectors and integrated image management software enables end users to optimize workflow and reduce radiation exposure in sensitive patient cohorts, while Canon’s innovations in detector materials and intuitive user interfaces have garnered attention in orthopedic and dental imaging circles. Emerging entrants such as United Imaging and other regional specialists are also challenging incumbents by adopting local manufacturing strategies and forging alliances with clinical networks to deliver cost-effective digital radiography platforms that address both urban and rural care delivery gaps.

New market entrants and digital health startups are further invigorating the competitive landscape by pioneering technologies such as photon-counting detectors, spectral imaging solutions, and cloud-native orchestration platforms. These agile players emphasize rapid prototyping and iterative innovations, often collaborating with academic centers to validate emerging applications in oncology screening and musculoskeletal diagnostics. As a result, the radiography vendor ecosystem is becoming increasingly dynamic, with traditional manufacturers and disruptors alike vying to define the next generation of diagnostic imaging standards.

This comprehensive research report delivers an in-depth overview of the principal market players in the Radiography market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agfa-Gevaert N.V.

- Allengers Medical Systems Limited

- Analogic Corporation

- BPL Medical Technologies Pvt. Ltd.

- Canon Medical Systems Corporation

- Carestream Health, Inc.

- Esaote S.p.A.

- FUJIFILM Holdings Corporation

- GE HealthCare Technologies, Inc.

- Hitachi, Ltd.

- Hologic, Inc.

- Konica Minolta, Inc.

- Koninklijke Philips N.V.

- Mindray Medical International Limited

- Samsung Medison Co., Ltd.

- Shimadzu Corporation

- Siemens Healthineers AG

- Trivitron Healthcare Private Limited

- United Imaging Healthcare Co., Ltd.

- Varex Imaging Corporation

Presenting Strategic Recommendations for Industry Leaders to Navigate Technological Disruption, Enhance Supply Chain Resilience, and Capitalize on Emerging Radiography Opportunities

Healthcare technology executives should prioritize the integration of artificial intelligence alongside robust user training programs, ensuring that radiology teams can harness algorithmic decision support to its fullest potential. By embedding AI-driven image analysis into core radiography workflows, organizations can accelerate diagnostic turnarounds, reduce variability in clinical interpretation, and elevate overall care quality. Simultaneously, investment in hybrid imaging capabilities and dose-optimization features will reinforce competitive differentiation by meeting growing clinician and regulatory demands for both multi-modal insights and enhanced patient safety.

To mitigate the impact of trade-related uncertainties and safeguard supply continuity, industry leaders must actively diversify supplier portfolios and explore strategic partnerships for localized manufacturing or assembly. Engaging in advocacy efforts, such as collaboration with trade associations to secure tariff exemptions or delayed implementation, will help preserve affordability and access to critical imaging tools. Furthermore, adopting cloud-based image management platforms and modernizing operational infrastructures can deliver greater scalability and resilience, enabling radiography providers to adapt quickly to evolving clinical and regulatory landscapes.

Sustaining a competitive advantage also requires a continuous focus on workforce development and academic collaborations. Establishing partnerships with universities and training institutions to offer specialized curricula in AI applications, radiography physics, and digital workflow optimization will cultivate a new generation of radiology professionals equipped to drive innovation. These initiatives should be complemented by regular skill-up programs and certification pathways to ensure that clinical teams maintain proficiency with emerging technologies and evolving best practices.

Detailing a Robust Multi-Source Research Methodology Employing Qualitative and Quantitative Analytical Frameworks to Ensure Comprehensive and Credible Radiography Market Insights

This report’s methodology commenced with an extensive review of secondary sources, encompassing peer-reviewed journal articles, regulatory body publications, and credible news outlets to capture the latest developments in radiography technology, policy shifts, and clinical adoption patterns. Regulatory documents detailing radiation safety standards and health policy directives were examined to contextualize industry compliance requirements and regional market access dynamics. In parallel, white papers and technical briefs from leading medical device manufacturers provided insights into product innovation trajectories and emerging diagnostic competencies.

Building upon this foundational research, a rigorous primary data collection phase engaged industry experts through structured interviews, encompassing senior radiology practitioners, biomedical engineers, and supply chain executives. These qualitative insights were complemented by targeted vendor surveys that probed strategic priorities, product roadmaps, and risk mitigation strategies. Quantitative data were triangulated using cross-verification techniques to ensure consistency and accuracy, and findings underwent a multi-tiered validation process, including peer reviews and methodological audits, to uphold the highest standards of analytical rigor and reliability.

Advanced statistical tools, including cluster analysis and time-series validation, were employed to identify emerging usage patterns and forecast scenario sensitivities. Geospatial mapping techniques illustrated regional adoption trends and infrastructure readiness at a granular level, supporting more nuanced interpretations of market dynamics across different healthcare ecosystems. Throughout this process, a robust quality control framework ensured data integrity and replicability, reinforcing the credibility of the report’s conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Radiography market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Radiography Market, by Modality

- Radiography Market, by Product Type

- Radiography Market, by System

- Radiography Market, by Application

- Radiography Market, by End User

- Radiography Market, by Region

- Radiography Market, by Group

- Radiography Market, by Country

- United States Radiography Market

- China Radiography Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthetizing Critical Radiography Market Insights and Strategic Implications to Empower Healthcare Stakeholders in Driving Future Diagnostic Excellence and Operational Effectiveness

The convergence of advanced digital detectors, AI-driven image analysis, and portable point-of-care platforms underscores an inflection point in radiography’s evolution, reshaping diagnostic workflows and redefining clinical collaboration models. Stakeholders equipped with insights into modality segmentation, regional adoption patterns, and the strategic responses of leading vendors will be better positioned to navigate complex trade environments and leverage innovation catalysts. By appreciating the nuanced interplay between technology integration and policy dynamics, healthcare organizations can refine investment decisions and operational strategies that enhance both patient outcomes and organizational agility.

As radiography continues to expand its diagnostic reach, the imperative for industry leaders is to embrace data-driven methodologies, foster cross-sector partnerships, and proactively engage in regulatory dialogue to safeguard supply chain resilience and sustain invention momentum. In doing so, the radiography community can accelerate the transition toward more personalized, efficient, and equitable imaging services, ultimately advancing the global standard of care and fortifying the role of radiology as a cornerstone of modern healthcare delivery.

Coordinated action among device manufacturers, clinical stakeholders, and policy makers will be essential in driving sustainable growth and avoiding fragmentation in standards. By championing open innovation consortia and engaging in harmonized regulatory frameworks, the industry can ensure that next-generation radiography solutions achieve broad adoption and deliver consistent patient benefits worldwide.

Engaging Healthcare Executives to Connect with Ketan Rohom for In-Depth Radiography Diagnostic Report Access and Partnership Opportunities to Advance Market Strategies

To gain comprehensive insights into the transformative forces shaping radiography and to explore tailored strategies for leveraging emerging opportunities, readers are invited to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. A personalized briefing with Ketan will provide clarity on how to integrate advanced imaging innovations into organizational roadmaps and how to address evolving supply chain and regulatory challenges.

Secure your own copy of the detailed radiography diagnostic report today and benefit from expert guidance on implementing data-driven decisions, optimizing portfolio investments, and strengthening competitive positioning. Reach out to Ketan Rohom to arrange a confidential consultation and unlock the actionable intelligence needed to chart a successful path forward in the dynamic radiography landscape.

Act now to receive an executive summary, customizable data dashboards, and priority access to expert webinars that translate complex radiography insights into practical strategies for immediate execution.

- How big is the Radiography Market?

- What is the Radiography Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?