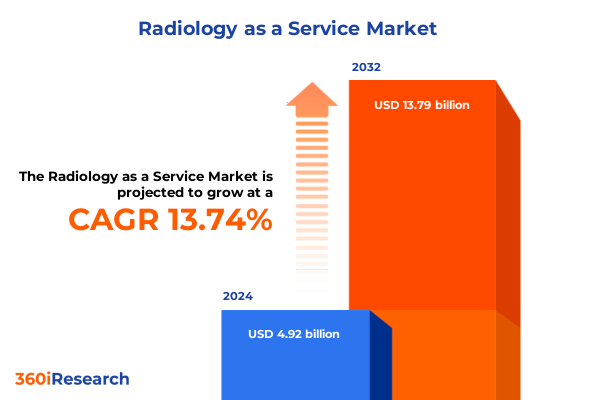

The Radiology as a Service Market size was estimated at USD 5.55 billion in 2025 and expected to reach USD 6.28 billion in 2026, at a CAGR of 13.85% to reach USD 13.79 billion by 2032.

Unveiling the Transformative Promise of Radiology as a Service to Revolutionize Clinical Diagnostics and Healthcare Delivery Worldwide

Radiology as a Service represents a pivotal evolution in the way imaging diagnostics are delivered, managed, and consumed by healthcare providers. By shifting from traditional on-premise systems toward remotely managed, cloud-enabled platforms, organizations can streamline their imaging workflows and enhance collaboration among multidisciplinary teams. This shift not only accelerates diagnostic turnaround times but also creates opportunities for scalable deployments, where capacity can be dynamically adjusted in response to fluctuating demand and emergent clinical needs.

Moreover, the convergence of advanced imaging infrastructures with sophisticated analytics engines is fostering a data-rich environment in which clinical decision-making is both more precise and more personalized. The ability to seamlessly integrate multimodal imaging data-from high-resolution CT scans to functional PET studies-into unified cloud-based ecosystems empowers radiologists and referring physicians with deeper insights, enabling earlier disease detection and more effective treatment planning. As healthcare systems strive to optimize value-based care, Radiology as a Service emerges as a catalyst for improved patient outcomes and operational resilience across diverse care settings.

Charting the Radical Evolution in Radiology Infrastructure and Technology That Is Redefining Diagnostic Efficiency and Patient Outcomes Across Care Settings

The landscape of radiology is undergoing rapid and far-reaching transformation driven by technological breakthroughs and evolving care paradigms. Traditional imaging suites are now complemented by virtualized environments where scans are acquired onsite and processed offsite in high-performance computing centers. This decoupling of acquisition and interpretation not only reduces the need for in-house IT infrastructure but also allows radiology departments to harness the latest upgrades in hardware and software without the burden of capital-intensive refresh cycles.

Concurrently, artificial intelligence and machine learning algorithms have moved from proof-of-concept to production, with increasingly sophisticated models capable of assisting in lesion detection, triage prioritization, and quantitative imaging biomarkers. These AI-driven capabilities are embedded within Radiology as a Service platforms, augmenting the radiologist’s expertise while reducing repetitive tasks and supporting higher throughput. Additionally, the proliferation of interoperable standards and APIs is breaking down data silos, enabling seamless data exchange among electronic health records, picture archiving and communication systems, and research databases.

The rise of patient-centric models is further reshaping the sector, as service providers develop portals and mobile solutions that allow patients to securely access their reports and imaging studies. This heightened transparency fosters greater patient engagement and adherence to follow-up care recommendations. As these transformative forces continue to converge, they are redefining the metrics of success in radiology, emphasizing flexibility, responsiveness, and end-to-end digital integration.

Evaluating the Far-Reaching Consequences of 2025 United States Tariff Policies on Medical Imaging Supply Chains Costs and Market Accessibility

In 2025, the United States upheld a series of tariff measures that have significant implications for the importation of medical imaging equipment and components. These duties, speculated to extend or expand existing Section 301 tariffs, are primarily targeting advanced imaging modalities sourced from major manufacturing hubs abroad. As a result, suppliers of CT, MRI, PET, ultrasound, and X-ray systems have encountered increased landed costs, prompting many to reevaluate their procurement strategies and supply chain footprints.

The immediate consequence of elevated import duties is a distortion in the pricing structure for end users. Healthcare providers facing tighter budgetary constraints are compelled to consider pass-through pricing, delayed upgrade cycles, or alternative sourcing arrangements to mitigate cost pressures. In parallel, domestic original equipment manufacturers and regional assembly partners find themselves presented with an opportunity to fill gaps in the supply chain, supported by government incentives aimed at bolstering national production. This strategic pivot has accelerated conversations around reshoring certain manufacturing processes and diversifying component suppliers to reduce exposure to tariff-driven volatility.

Over the medium term, these tariff dynamics have the potential to reshape competitive positioning in the Radiology as a Service market. Service providers that can demonstrably control total cost of ownership-through hybrid deployment models or localized maintenance offerings-are better positioned to maintain pricing stability and secure long-term contracts. Moreover, heightened regulatory scrutiny of imported equipment may lead to extended approval timelines, reinforcing the advantage for platforms that integrate modular, regionally compliant components from inception.

Illuminating the Segmentation Framework Driving Radiology as a Service Customization Across Modalities End Users Deployment Models Services and Applications

The Radiology as a Service market thrives on a nuanced segmentation fabric that begins with imaging modalities. Computed tomography remains a cornerstone of advanced diagnostics, with cone beam and multislice variants offering distinct trade-offs between spatial resolution and scanning speed. Magnetic resonance imaging similarly branches into high-field and low-field systems, each tailored for specific clinical use cases, while hybrid and dedicated PET solutions cater to both oncological staging and neurological exploration. Ultrasound continues to diversify through two-dimensional and three-dimensional technologies, and X-ray imaging evolves along computed and digital radiography lines, reflecting a relentless pursuit of image clarity and dose optimization.

End users further define the market’s contours, as outpatient clinics prioritize streamlined interfaces and rapid result delivery, diagnostic centers seek turnkey solutions that support high-volume throughput, and hospitals demand robust service-level agreements that guarantee uptime and safeguard against workflow disruptions. Across deployment models, a clear dichotomy has emerged: cloud-native platforms that eliminate local infrastructure constraints, hybrid architectures that blend on-premise processing with cloud scalability, and strictly on-premise systems for organizations with stringent data governance requirements.

Service offerings themselves are segmented into consulting, implementation, managed services, and training streams. Consulting engagements address regulatory compliance frameworks and workflow optimization strategies, ensuring that processes adhere to evolving standards. Implementation projects focus on customization and systems integration, knitting together diverse modalities into cohesive digital ecosystems. Managed services encompass maintenance contracts and remote monitoring capabilities, guaranteeing peak performance and rapid incident resolution. Meanwhile, training modules-both online and onsite-empower stakeholders to leverage new functionalities, from AI-augmented reading tools to advanced visualization suites. Finally, applications in cardiology, neurology, oncology, and orthopedics underscore the platform’s versatility, while payment models ranging from license fees to subscription and pay-per-use carve distinct economic pathways for adoption.

This comprehensive research report categorizes the Radiology as a Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Imaging Modality

- Deployment Model

- Application Area

- End User

Exploring Regional Market Dynamics and Adoption Patterns That Shape the Delivery and Uptake of Radiology as a Service in Critical Global Zones

Regional dynamics play a pivotal role in shaping Radiology as a Service adoption patterns and service delivery models. In the Americas, market maturity is driven by broad cloud infrastructure investments, streamlined reimbursement pathways, and a growing emphasis on value-based care initiatives. Providers in this region demonstrate a strong appetite for hybrid deployment approaches that balance data sovereignty with the flexibility to scale imaging workloads dynamically.

Within Europe, the Middle East, and Africa, regulatory harmonization efforts-anchored by cross-border healthcare directives and privacy regulations-are forging new channels for collaborative radiology networks. Public-private partnerships are leveraging service providers to expand access in underserved areas, while centralized reading hubs are emerging in major economic centers. Data residency requirements and stringent security protocols encourage a preference for on-premise or private-cloud configurations, particularly for sensitive modalities such as functional MR and PET imaging.

The Asia-Pacific region stands out for its accelerated growth trajectory, underpinned by robust healthcare digitization programs and ambitious capacity expansion in emerging markets. Governments are incentivizing the deployment of remote reading services to address radiologist shortages, and telehealth-enabled radiology is gaining traction in rural and periurban zones. Localized service bundles that integrate workflow consulting, equipment customization, and pay-per-use pricing models are proving especially effective in catalyzing rapid adoption among clinics and diagnostic centers.

This comprehensive research report examines key regions that drive the evolution of the Radiology as a Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Challenger Companies Propelling Innovation Competitive Positioning and Partnerships in the Radiology as a Service Ecosystem

The competitive landscape of Radiology as a Service is characterized by established imaging conglomerates and agile technology disruptors. Leading equipment manufacturers have extended their portfolios with cloud-based service layers, integrating AI-driven tools and global support networks to maintain market leadership. Their extensive installed base and deep domain expertise underpin comprehensive service-level offerings that span the full imaging lifecycle.

Meanwhile, digital-native entrants are forging partnerships with specialized AI vendors, delivering niche solutions that address specific clinical workflows such as triage automation and quantitative analysis. These challengers leverage lightweight deployment models and modular architectures to accelerate time to value for end users, appealing to organizations seeking rapid innovation without the overhead of legacy integration.

Strategic alliances and joint ventures continue to reshape industry contours, as service providers align with telehealth platforms, data analytics firms, and regional distributors. Such collaborations facilitate market entry in geographies with complex regulatory landscapes and support the co-creation of tailored service packages. The resulting ecosystem of interoperable solutions cultivates differentiated value propositions, enabling providers to compete on the basis of speed, customization, and cost efficiency.

This comprehensive research report delivers an in-depth overview of the principal market players in the Radiology as a Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accelerated Radiology Pty Ltd

- Ambra Health

- Change Healthcare Inc.

- CodaMetrix, Inc.

- Coreline Soft Co., Ltd.

- DeepHealth, Inc.

- DeepTek Inc.

- Enlitic Inc.

- Everlight Radiology Pty Ltd

- GE HealthCare Technologies Inc.

- Induro Medical Technologies, LLC

- InHealth Group Limited

- Koninklijke Philips N.V.

- Medica Group Ltd

- Nano-X Imaging Ltd.

- NightHawk Radiology Services, LLC

- ONRAD Inc.

- Radiology Partners, Inc.

- RadNet, Inc.

- RamSoft, Inc.

- Siemens Healthineers AG

- Teleradiology Solutions India Private Limited

- The Radiology Group, LLC

- The Telemedicine Clinic AS

- Trice Imaging, LLC

- USARAD Holdings, Inc.

- Virtual Radiologic Corporation

- Within Health

Delivering Targeted Strategic Roadmaps and Practical Steps to Elevate Operational Excellence Clinical Efficiency and Growth in Radiology as a Service Ventures

Industry leaders aiming to harness the full potential of Radiology as a Service should begin by articulating a clear digital transformation roadmap that aligns with organizational objectives and patient care imperatives. This strategic blueprint must encompass both short-term milestones, such as migrating legacy imaging archives to cloud repositories, and long-term aspirations, including the adoption of AI-powered diagnostic support systems. By establishing concrete KPIs around throughput, report turnaround, and user satisfaction, stakeholders can secure executive buy-in and ensure project momentum.

Investments in interoperability frameworks and ecosystem integrations are equally critical. Providers should prioritize platforms that support open APIs and standardized data formats, enabling seamless connectivity with electronic health records, oncology registries, and clinical decision support systems. Such architectural agility not only reduces vendor lock-in but also paves the way for rapid deployment of emerging capabilities like federated learning networks and real-time dose monitoring.

Furthermore, forging collaborative partnerships with payers, regulatory bodies, and professional societies can accelerate adoption and reinforce quality standards. By participating in pilot programs and contributing real-world evidence to clinical validation studies, service providers can establish thought leadership, influence reimbursement policies, and drive the evolution of guidelines that underpin safe, effective Radiology as a Service delivery.

Detailing a Robust Multi-Stage Research Framework and Comprehensive Data Collection Methods That Validate Findings and Reinforce Analytical Integrity

This study employs a multi-phase research framework designed to capture both depth and breadth of market intelligence. Primary research consisted of in-depth interviews with radiologists, IT decision-makers, and healthcare executives across leading hospitals, diagnostic centers, and imaging clinics. These conversations provided first-hand insights into workflow challenges, technology adoption drivers, and procurement criteria, enabling a granular understanding of stakeholder priorities.

Secondary research included a systematic review of peer-reviewed journals, regulatory filings, company publications, and public financial reports to corroborate market trends and competitive developments. Data points obtained from these sources were triangulated through cross-validation exercises, ensuring consistency and reliability. Market dynamics were further contextualized by expert surveys and a comprehensive analysis of technology roadmaps, resulting in robust perspectives on future innovation trajectories and regulatory scenarios.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Radiology as a Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Radiology as a Service Market, by Service Type

- Radiology as a Service Market, by Imaging Modality

- Radiology as a Service Market, by Deployment Model

- Radiology as a Service Market, by Application Area

- Radiology as a Service Market, by End User

- Radiology as a Service Market, by Region

- Radiology as a Service Market, by Group

- Radiology as a Service Market, by Country

- United States Radiology as a Service Market

- China Radiology as a Service Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 4293 ]

Synthesizing Core Findings into Strategic Implications That Illuminate the Future Trajectory and Enduring Value Proposition of Radiology as a Service Paradigm

The synthesis of these findings paints a compelling picture of a Radiology as a Service paradigm that is both resilient and transformative. Core themes-namely, the fusion of cloud scalability with AI-driven diagnostics, strategic navigation of tariff-induced cost pressures, and the importance of segmented, region-specific offerings-emerge as critical determinants of success. Organizations that proactively adapt their operational models to these forces stand to achieve significant gains in productivity, patient satisfaction, and cost containment.

As the market continues to mature, stakeholders must maintain a forward-looking posture, anticipating regulatory shifts, and technological breakthroughs that will redefine the competitive landscape. Through purposeful investments in digital infrastructure, interoperability, and skill development, healthcare providers and technology vendors alike can co-create a future in which Radiology as a Service not only supports clinical excellence but also underpins sustainable, value-driven care delivery.

Connect with Associate Director Ketan Rohom to Unlock Exclusive Insights and Gain Access to the Comprehensive Radiology as a Service Market Intelligence Report

Elevate your strategic decision-making by engaging directly with Ketan Rohom, the Associate Director of Sales & Marketing, to secure comprehensive market intelligence tailored for your organization’s growth. By connecting with this seasoned expert, you gain privileged access to nuanced insights, bespoke analysis, and priority support that empower you to navigate complex challenges in deploying Radiology as a Service solutions. Take this opportunity to deepen your understanding of emerging trends, benchmark your positioning against industry leaders, and harness data-driven strategies that drive sustainable value. Reach out now to unlock the full potential of the Radiology as a Service market research report and accelerate your initiatives with precision and confidence.

- How big is the Radiology as a Service Market?

- What is the Radiology as a Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?