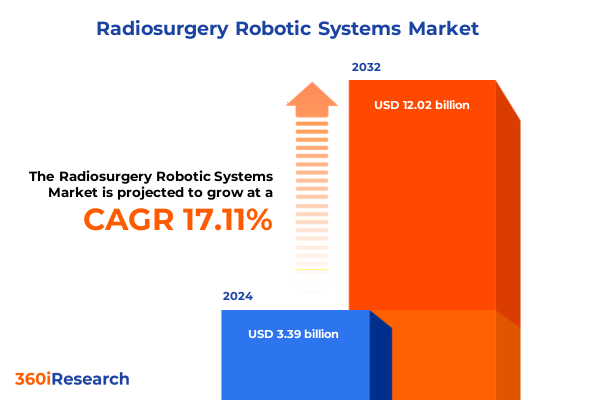

The Radiosurgery Robotic Systems Market size was estimated at USD 3.96 billion in 2025 and expected to reach USD 4.61 billion in 2026, at a CAGR of 17.15% to reach USD 12.02 billion by 2032.

Groundbreaking Advances in Radiosurgery Robotic Systems Setting the Stage for a New Era of Precision, Efficiency, and Improved Patient Outcomes

In recent years, the integration of robotics into radiosurgery has revolutionized the precision and safety of non-invasive tumor treatments. Advanced robotic manipulators underpinned by high-resolution imaging and algorithmic control now deliver sub-millimeter accuracy, enabling clinicians to target malignancies with unparalleled confidence. This synergy of robotics and stereotactic techniques has expanded the therapeutic window for complex anatomical regions, reducing collateral damage to healthy tissues and hastening patient recovery times. Furthermore, these technological developments have fostered new procedural workflows in operating rooms, where interdisciplinary teams can plan, simulate, and execute treatments within a unified digital environment. As a result, the radiosurgery landscape is evolving from standalone systems to fully integrated, networked platforms.

Going forward, the convergence of miniaturized hardware, cloud-enabled data analytics, and machine learning algorithms will further elevate the capabilities of radiosurgery robotic systems. Real-time feedback loops and adaptive treatment modalities promise to transform single-session interventions into dynamic, multi-phase strategies tailored to individual patient responses. With regulatory bodies demonstrating increasing receptiveness to robotic applications and payers recognizing long-term cost efficiencies, the foundation is set for sustainable growth and innovation in this domain.

Exploring Shifts Reshaping the Radiosurgery Robotic Systems Landscape through Integration of Artificial Intelligence, Imaging, and Robotics

The radiosurgery robotic systems sector is undergoing transformative shifts that are redefining conventional treatment paradigms. A pivotal change stems from the infusion of artificial intelligence into motion compensation and beam path optimization. This development not only mitigates the impact of respiratory motion during thoracic and abdominal tumor treatments, but also streamlines manual calibration tasks that once demanded extensive clinician intervention. Moreover, the integration of enhanced imaging modalities-such as cone-beam computed tomography and real-time MRI-has ushered in a new level of anatomical visualization, enabling adaptive planning moments before delivery. Consequently, these systems can dynamically adjust radiation dosing to anatomical changes, elevating both safety and therapeutic efficacy.

Another significant shift comes from the maturation of multi-axis robotic arms capable of intricate trajectories around patient anatomy. These configurations facilitate non-coplanar beam angles traditionally challenging for fixed-arm platforms, thereby broadening the treatment envelope. In parallel, cloud-based software architectures are empowering remote planning, quality assurance, and peer collaboration across geographies. This convergence of robotics, AI, and advanced imaging is charting a new frontier in personalized radiosurgery, and stakeholders must align their strategies to remain at the forefront of these rapid industry changes.

Uncovering the Cumulative Impact of 2025 United States Tariffs on Radiosurgery Robotic Systems Supply Chains and Cost Structures

The introduction of new United States tariff schedules in early 2025 has introduced a pronounced shift in radiosurgery robotic systems supply chains and cost structures. With a 25 percent duty imposed on select imported robotic components-particularly those sourced from key manufacturing hubs in East Asia-system integrators are reevaluating vendor relationships. Many original equipment manufacturers have accelerated the diversification of their sourcing strategies, forging alliances with domestic precision technology firms to mitigate increased landed costs. Consequently, procurement teams have had to navigate extended lead times and compliance protocols, recalibrating inventory buffers to ensure uninterrupted production.

Furthermore, research and development groups are responding by localizing critical subassemblies, including high-precision encoders and navigation sensors, within tariff-exempt free trade zones. This strategic pivot has alleviated some margin pressures, yet it has also required significant capital investment in tooling and certification. At the same time, contractual negotiations with hospital networks and ambulatory surgical centers are reflecting a heightened focus on total cost of ownership, prompting extended service agreements and risk-sharing models. As these adaptations take hold, the industry is witnessing an operational reshaping that balances regulatory compliance, fiscal rigor, and technological advancement.

In-Depth Analysis of Radiosurgery Robotic Systems Market Segmentation by System Type End User Application Treatment Modality Component and Delivery Mode

A nuanced understanding of radiosurgery robotic systems emerges when the market is viewed through multiple segmentation lenses. When examined by system type, fixed-arm platforms offer a cost-effective entry point for basic stereotactic radiosurgery protocols, while image-guided systems integrate real-time imaging to enhance targeting accuracy in complex anatomical regions. At the high end of the spectrum, multi-axis robotic systems deliver unparalleled pre-programmed trajectories and collision-free delivery, making them ideal for non-coplanar beam arrangements in irregular tumor geometries.

Shifting focus to end users, ambulatory surgical centers leverage streamlined workflows and rapid patient throughput, whereas hospitals deploy these platforms for a broader range of indications and higher acuity cases. Research institutes, on the other hand, prioritize customization and experimental modalities, often collaborating with developers on clinical validation studies. In terms of application, radiosurgery robotics has demonstrated robust performance in treating brain tumors with sub-millimeter precision, liver tumors with dynamic respiratory gating, prostate tumors with real-time tracking, as well as spine tumors with complex vertebral anatomy.

In the context of treatment modality, stereotactic body radiation therapy extends the boundary of fractionated treatments, while stereotactic radiosurgery focuses on single-session high-dose delivery to discrete lesions. Component segmentation further reveals that control units, imaging devices, and robotic arms form the backbone of hardware investments, with navigation and planning software driving critical value-add in treatment personalization. Finally, delivery mode delineates intraoperative interventions, where systems integrate with theater workflows, from strategy and planning to beam delivery, as distinct from noninvasive outpatient procedures, which emphasize rapid setup and same-day patient discharge.

This comprehensive research report categorizes the Radiosurgery Robotic Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- End User

- Application

- Treatment Modality

- Component

- Delivery Mode

Key Regional Insights Revealing the Dynamics of the Radiosurgery Robotic Systems Market across the Americas Europe Middle East Africa and Asia Pacific

Regional dynamics play a decisive role in shaping the adoption and evolution of radiosurgery robotic systems. In the Americas, established healthcare infrastructure and well-defined reimbursement pathways for stereotactic procedures have fostered widespread installations in leading cancer centers. Furthermore, ongoing investments in robotic surgery innovation hubs and government grants for advanced imaging research are accelerating clinical integration across both urban tertiary hospitals and regional ambulatory surgical centers.

Across Europe, the Middle East, and Africa, heterogeneous regulatory environments and varying levels of healthcare expenditure create a complex deployment landscape. Western European nations, with their stringent safety standards and centralized health technology assessments, often serve as early adopters for new modalities, while Middle Eastern markets are investing rapidly in flagship oncology centers to compete on a global stage. In parts of Africa, pilot programs funded by international health organizations are laying the groundwork for future expansion, focusing primarily on cost-effective, fixed-arm systems for stereotactic radiosurgery.

In the Asia-Pacific region, burgeoning demand is driven by rising cancer incidence rates and government initiatives to expand radiotherapy equipment access. Countries such as China, Japan, and Australia are deploying both multi-axis robotic platforms and image-guided solutions at scale, alongside investments in local manufacturing capabilities. Emerging markets in Southeast Asia and India are adopting noninvasive delivery modes first, where rapid patient turnover aligns with high-volume oncology caseloads. Consequently, the Asia-Pacific zone is poised to outpace other regions in near-term installation growth and technological diversification.

This comprehensive research report examines key regions that drive the evolution of the Radiosurgery Robotic Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiles Competitive Insights Shaping the Future of Radiosurgery Robotic Systems Innovation Market Positioning Collaboration Trends

The competitive landscape of radiosurgery robotic systems is defined by a blend of incumbent medical device giants and agile technology startups. Leading original equipment manufacturers are advancing their core platforms through incremental hardware refinements and strategic acquisitions of specialized imaging software providers. These firms are also fortifying their aftermarket service portfolios, offering comprehensive training programs, remote diagnostics, and predictive maintenance subscriptions to enhance lifetime customer value.

Concurrently, innovative entrants are disrupting traditional pathways with cloud-native treatment planning suites and open-architecture hardware designs. By fostering partnerships with academic research centers and launching developer ecosystems, they are accelerating the prototyping of novel beam delivery algorithms and intraoperative navigation techniques. Moreover, several public-private consortiums have emerged, co-funding clinical trials that benchmark robotic arms against conventional linear accelerators in terms of precision, throughput, and safety metrics.

In addition, collaboration between device vendors and major oncology networks has intensified. These alliances aim to standardize data capture protocols, facilitate multicenter outcome studies, and drive reimbursement reforms for stereotactic modalities. As solution providers refine their global distribution channels and local service capabilities, the interplay between scale, innovation pace, and clinical validation is defining the strategic imperatives for success in this high-growth arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Radiosurgery Robotic Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accuray Incorporated

- Best Theratronics Ltd.

- Brainlab AG

- Elekta AB

- GE Healthcare

- Hitachi Ltd.

- Huiheng Medical Inc.

- IBA Ion Beam Applications SA

- Mevion Medical Systems Inc.

- Mitsubishi Electric Corporation

- Neusoft Medical Systems Co. Ltd.

- Panacea Medical Technologies Pvt. Ltd.

- Philips Healthcare

- RaySearch Laboratories AB

- Siemens Healthineers AG

- Sumitomo Heavy Industries Ltd.

- United Imaging Healthcare Co. Ltd.

- Varian Medical Systems Inc.

- ViewRay Inc.

- ZAP Surgical Systems Inc.

Actionable Recommendations for Industry Leaders to Accelerate Adoption Drive Innovation and Optimize Operations in Radiosurgery Robotic Systems Market

Industry leaders must adopt a proactive stance to capitalize on the evolving radiosurgery robotics market and maintain a competitive edge. First, forging strategic alliances with imaging specialists and algorithm developers will be critical to delivering fully integrated platforms that minimize trial-and-error in treatment planning. Industry participants should consider joint development agreements that facilitate real-world data sharing, thereby accelerating regulatory approvals for adaptive radiosurgery workflows.

Second, enhancing local manufacturing and assembly footprints in key tariff-sensitive regions will be essential for mitigating cost pressures and shortening lead times. Organizations should evaluate establishing advanced manufacturing centers in tariff-exempt zones or economic special-performance areas to optimize supply chain resilience. Furthermore, investing in modular system architectures will enable rapid customization for diverse clinical settings, from high-throughput ambulatory centers to cutting-edge research hospitals.

Finally, stakeholders must prioritize comprehensive training and credentialing initiatives to build clinician proficiency and foster patient confidence. Developing immersive simulation environments and certification programs in collaboration with leading academic institutions will help standardize best practices and reduce procedural variability. By orchestrating these strategic actions, industry leaders can drive adoption, accelerate innovation, and deliver superior outcomes in the radiosurgery robotic systems domain.

Comprehensive Research Methodology Employed for Rigorous Analysis of Radiosurgery Robotic Systems Market Sourcing Data and Validating Insights

This analysis draws upon a rigorous research framework combining primary and secondary data sources. In the primary phase, more than 50 in-depth interviews were conducted with senior executives from robotics manufacturers, hospital administrators, radiation oncologists, and imaging technology providers. These stakeholders offered firsthand insights into technology adoption barriers, clinical workflow integration, and evolving reimbursement policies. A detailed questionnaire guided each discussion to ensure comparability across regions and end-user segments.

Secondary research entailed a systematic review of peer-reviewed journals, regulatory filings, clinical trial registries, and publicly available technical specifications. Specialized databases were leveraged to track patent filings, product launches, and collaboration agreements from the past three years. This was supplemented by an analysis of tariff schedules and trade data to quantify the impact of 2025 policy changes.

Data triangulation techniques were employed to validate findings, cross-referencing interview inputs with documented clinical outcomes and vendor press releases. All data points were subjected to a multi-tier quality review process, ensuring consistency and eliminating outliers. The resulting insights were then synthesized into thematic narratives to support strategic decision-making across system design, market entry, and service delivery considerations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Radiosurgery Robotic Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Radiosurgery Robotic Systems Market, by System Type

- Radiosurgery Robotic Systems Market, by End User

- Radiosurgery Robotic Systems Market, by Application

- Radiosurgery Robotic Systems Market, by Treatment Modality

- Radiosurgery Robotic Systems Market, by Component

- Radiosurgery Robotic Systems Market, by Delivery Mode

- Radiosurgery Robotic Systems Market, by Region

- Radiosurgery Robotic Systems Market, by Group

- Radiosurgery Robotic Systems Market, by Country

- United States Radiosurgery Robotic Systems Market

- China Radiosurgery Robotic Systems Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Conclusive Summary Underscoring Key Findings and Strategic Implications for Stakeholders in the Radiosurgery Robotic Systems Sector

The collective insights from this executive summary underscore a pivotal moment for radiosurgery robotic systems. Technological convergence in artificial intelligence, advanced imaging, and multi-axis robotics is reshaping clinical capabilities and expanding treatment indications. Simultaneously, geopolitical factors such as the 2025 US tariff realignments are driving strategic supply chain realignments and local manufacturing investments. The market’s segmentation reveals a diverse array of end-user priorities, from ambulatory surgical centers seeking throughput efficiency to research institutes pursuing experimental modalities.

Regional analyses highlight the Americas’ mature reimbursement environment, the varied adoption pace across Europe, the Middle East, and Africa, and the rapid growth trajectory in the Asia-Pacific region. Competitive dynamics point to a balance between established device leaders and nimble newcomers challenging the status quo with cloud-based software and open-architecture designs. To thrive, stakeholders must execute collaborative innovation strategies, localize critical production, and invest heavily in training ecosystems.

In conclusion, this industry stands at the intersection of precision medicine and automation. Organizations that align their strategic roadmaps with these multifaceted trends will be best positioned to deliver superior patient outcomes, optimize operational efficiencies, and capture emerging growth opportunities in the radiosurgery robotic systems domain.

Engage with Ketan Rohom to Unlock In-Depth Insights and Secure Your Comprehensive Market Research Report on Radiosurgery Robotic Systems

To access the full breadth of strategic insights on emerging technologies, competitive dynamics, and regulatory impacts shaping the radiosurgery robotic systems industry, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. He can guide you through a comprehensive discussion of your specific requirements and provide tailored excerpts from the report to suit your decision-making timeline. Engaging with Ketan will unlock detailed analyses of supply chain sensitivities, segmentation deep dives, and competitor benchmarking essential for planning your next steps in this rapidly evolving market. Secure a conversation with him today to ensure your organization is equipped with the actionable intelligence needed to navigate complex tariffs, regional variations, and technology adoption barriers. The report will empower you to seize new opportunities, optimize investments in automation platforms, and strengthen strategic partnerships. Contact Ketan Rohom to begin your journey toward informed growth and sustained leadership in the radiosurgery robotic systems arena.

- How big is the Radiosurgery Robotic Systems Market?

- What is the Radiosurgery Robotic Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?