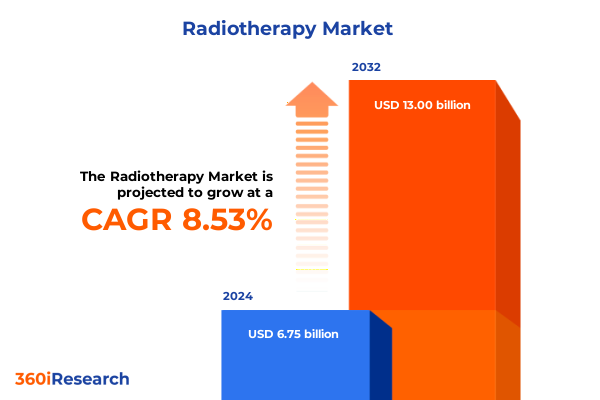

The Radiotherapy Market size was estimated at USD 7.23 billion in 2025 and expected to reach USD 7.76 billion in 2026, at a CAGR of 8.72% to reach USD 13.00 billion by 2032.

Unveiling the dynamic radiotherapy landscape where cutting-edge innovations and evolving patient needs converge to redefine cancer care delivery

Radiotherapy stands at the intersection of clinical necessity and technological possibility, serving as a cornerstone of multidisciplinary cancer care. As treatment modalities have evolved from rudimentary X-ray machines to sophisticated, image-guided systems, the radiotherapy landscape has grown increasingly complex. Today’s market spans external beam and internal radiation techniques, alongside emerging particle therapies, each offering unique clinical advantages and operational considerations. This executive summary illuminates the driving forces behind market evolution, providing stakeholders with a clear understanding of the forces shaping investment and adoption.

Against a backdrop of rising global cancer incidence and mounting pressure to improve patient outcomes, healthcare providers and industry players are compelled to innovate. From accelerating treatment times through automation to reducing collateral tissue damage via precision targeting, radiotherapy advancements are redefining therapeutic paradigms. This summary distills critical insights into market transformations, tariff implications, segmentation patterns, and regional dynamics, equipping decision-makers with a strategic lens through which to navigate opportunities and challenges.

How AI-driven adaptive planning, real-time imaging breakthroughs, and particle therapy expansions are reshaping the future of radiation oncology treatment paradigms

Emerging innovations are driving a fundamental shift in how radiation oncology is delivered, with artificial intelligence (AI) and advanced imaging forming the dual engines of transformation. Adaptive radiotherapy, powered by AI-driven algorithms, dynamically tailors treatment plans to daily anatomical changes, optimizing dose distributions and sparing adjacent healthy tissue. Studies indicate that AI-enabled workflows can reduce planning times by up to half, freeing clinical teams to focus on value-added tasks and accelerating patient access to care.

Simultaneously, real-time imaging integrations such as MR-guided linear accelerators are elevating precision to unprecedented levels. By fusing high-resolution magnetic resonance imaging with radiation delivery, clinicians can visualize soft-tissue structures continuously, enabling on-the-fly adjustments that mitigate motion artifacts and bolster targeting accuracy. This convergence of imaging and therapy is expanding the realm of treatable conditions, from moving lung lesions to intricate head and neck tumors.

Particle therapy, including proton and heavy ion modalities, represents another paradigm shift. Leveraging the Bragg peak phenomenon to deposit maximum energy at tumor depths while minimizing exit doses, particle therapy offers distinct advantages for pediatric cases and tumors adjacent to critical organs. Regulatory approvals and new center inaugurations worldwide reflect growing confidence in these platforms as precision alternatives to conventional X-ray approaches.

Assessing the compounded effects of new 2025 US trade tariffs on radiotherapy equipment supply chains, cost structures, and strategic innovation trajectories

The recent announcement of 15% tariffs on European imports under a transatlantic trade initiative has cast uncertainty over the radiotherapy equipment supply chain. Reports indicate that medical devices, including radiotherapy machines, could face these levies unless specific exclusions are negotiated, potentially elevating acquisition costs for hospitals and clinic networks in the United States.

Financial markets have already reacted, with major medical device stocks experiencing declines following the tariff announcement. Firms such as Boston Scientific, Medtronic, and Siemens Healthineers saw early trading dips as investors anticipated one-time earnings adjustments and potential margin pressures. Despite steady demand for lifesaving equipment, industry leaders warn that broad tariffs on critical imports may slow capital investments and delay upgrades to next-generation radiotherapy platforms.

Healthcare associations have lobbied for exemptions to mitigate risks to patient care. The American Hospital Association highlighted that sweeping import taxes on medical devices and supplies could disrupt treatment availability and inflate operational expenses. Moreover, derivative tariffs on steel and aluminum components, which doubled to 25% in early 2025, threaten to further amplify costs for radiotherapy manufacturers reliant on these materials, underscoring the urgency of securing targeted relief measures.

Unlocking comprehensive segmentation intelligence across technology modalities, clinical applications, product suites, end users, and therapeutic pathways in radiotherapy markets

The radiotherapy market thrives on a mosaic of specialized technology modalities. External beam radiation encompasses multiple forms of linear accelerator-based treatments, from three-dimensional conformal techniques that sculpt dose distributions to stereotactic radiosurgery systems delivering ultra-precise high-dose treatments in single sessions. Internal methods, such as brachytherapy, position radioactive sources within or adjacent to tumors, while emerging particle approaches-proton, carbon ion, and neutron therapies-exploit unique physical properties for targeted deep-tissue interventions.

Product portfolios reflect a balance of hardware and software solutions. Linear accelerators and particle therapy units anchor capital-intensive investments, supported by treatment planning systems that integrate imaging data, contouring algorithms, and optimization engines. Supplementary beam therapy devices and accessory equipment streamline delivery workflows, while dedicated software platforms drive automation, quality assurance, and clinical decision support.

Equipment offerings split between fixed installations in comprehensive cancer centers and mobile units that extend advanced therapies to community clinics or remote locations. This duality addresses both high-volume academic settings and emerging markets seeking flexible deployment models. At the application level, radiotherapy spans a spectrum of oncological indications, with breast, lung, and prostate cancers representing substantial volumes, and specialized protocols designed for colorectal, head and neck, and gynecological cases.

End users range from tertiary hospitals and advanced radio oncology centers to ambulatory surgical facilities and research institutes. Treatment intents-curative, neoadjuvant, adjuvant, and palliative-further define utilization patterns, as providers calibrate modality selection to clinical objectives, resource availability, and patient needs.

This comprehensive research report categorizes the Radiotherapy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Radiotherapy Type

- Technology

- Application

- End User

Elucidating diverse regional radiotherapy dynamics across the Americas, EMEA, and Asia-Pacific to inform targeted market strategies and investments

The Americas region, led by the United States and Canada, continues to dominate radiotherapy adoption through favorable reimbursement policies, high procedural volumes, and concentrated research investments. Established networks of comprehensive cancer centers serve as early adopters of novel platforms, while policy support for value-based care incentivizes precision therapies that can reduce long-term side effects. Market maturity in this region drives incremental upgrades toward adaptive and AI-powered solutions.

Europe, Middle East & Africa (EMEA) presents a heterogeneous landscape shaped by divergent regulatory frameworks and healthcare funding models. Western Europe leads in technology uptake, with strong clinical evidence bases and integrated health systems supporting MRI-guided and particle therapy installations. In contrast, several Middle Eastern countries leverage public-private partnerships to accelerate oncology infrastructure development, and pockets of growth in North Africa benefit from targeted investments in cancer care capacity building.

Asia-Pacific exhibits robust expansion fueled by rising cancer prevalence, growing healthcare expenditures, and government initiatives to enhance access to advanced treatments. China, Japan, and South Korea invest heavily in proton and heavy ion centers, while emerging economies such as India partner with global vendors to deploy mobile and retrofit-based solutions. The surge in regional clinical trials and local manufacturing efforts underscores a shift toward self-sufficiency and tailored service models.

This comprehensive research report examines key regions that drive the evolution of the Radiotherapy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling strategic moves and technological leadership of leading companies that are driving innovation and competition in the radiotherapy sector

Leading technology providers continue to shape the radiotherapy competitive landscape through strategic product launches, regulatory milestones, and collaborative partnerships. Elekta has distinguished itself with the global rollout of its Evo CT-Linac system, an AI-powered adaptive platform that combines high-definition imaging and online treatment planning. With first-patient treatments administered at German centers and broader European CE marking, Elekta Evo exemplifies the shift toward personalized care protocols.

Varian, now operating under the Siemens Healthineers umbrella, reinforces its market position through the introduction of RapidArc Dynamic and the Ethos adaptive therapy solution. FDA clearances for these innovations have underscored the importance of algorithmic enhancements in dose optimization and real-time adaptation. At ESTRO 2025, Varian showcased synergies between hardware and integrated software ecosystems, highlighting deep-learning autocontouring and efficiency gains within the Eclipse and ARIA CORE platforms.

Siemens Healthineers’ broader oncology portfolio, encompassing both linear accelerators and hyper-spectral imaging solutions, continues to advance the precision radiotherapy narrative. Despite the short-term uncertainties posed by proposed tariffs, the company’s strategic investments in MR-guided adaptive therapy and international consortiums reinforce its role as an innovation leader.

This comprehensive research report delivers an in-depth overview of the principal market players in the Radiotherapy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accuray Incorporated

- Agilent Technologies Inc.

- BEBIG Medical GmbH

- Canon Medical Systems Corporation

- Cardinal Health, Inc.

- Charles River Laboratories International, Inc.

- Elekta AB

- Epsilon Elektronik by BOZLU HOLDING Corporation

- GE HealthCare Technologies Inc.

- Hitachi, Ltd.

- IBA Dosimetry GmbH

- IntraOp Medical, Inc.

- Koninklijke Philips N.V.

- Leo Cancer Care

- Mevion Medical Systems, Inc.

- Mitsubishi Electric Corporation

- Panacea Medical Technologies Pvt. Ltd.

- RefleXion Medical Inc.

- Revvity, Inc.

- Siemens AG

- Sumitomo Heavy Industries Ltd.

- Toshiba Corporation

- ViewRay Technologies, Inc.

- Vision RT Ltd.

- ZEISS Group

Adopting resilient supply, AI-driven digital ecosystems, and collaborative research strategies to fortify competitive positioning in radiotherapy

Industry leaders must prioritize flexible supply chains and diversified sourcing to mitigate exposure to import tariffs and material cost fluctuations. Establishing multiple regional manufacturing hubs for critical components-such as gantry subsystems and imaging detectors-can hedge against geopolitical risks and support faster time to market. In parallel, collaborating with local distributors and service partners will ensure continuity of maintenance and spare-parts availability.

Investment in AI and digital infrastructure will be pivotal. Organizations should adopt modular, software-centric platforms that facilitate continuous performance enhancements through firmware updates and cloud-based analytics. By integrating predictive maintenance tools and remote monitoring, providers can enhance uptime, reduce operational disruptions, and derive deeper insights into clinical workflows.

To maximize clinical impact, forging alliances with academic research centers and participating in consortia for multicenter clinical trials will accelerate evidence generation for novel modalities, such as MR-guided and particle therapies. Early engagement with key opinion leaders can surface real-world evidence, strengthen reimbursement arguments, and inform future technology roadmaps, enabling providers to achieve both clinical differentiation and financial sustainability.

Combining expert interviews, rigorous segmentation analyses, and multi-source triangulation to deliver robust radiotherapy market insights

Our research methodology combined primary and secondary data collection, leveraging expert interviews, peer-reviewed literature, and regulatory filings. A panel of radiation oncologists, medical physicists, and supply chain executives provided firsthand perspectives on clinical adoption barriers and innovation drivers. Their insights were triangulated with published data to ensure consistency and reduce bias.

Secondary sources included regulatory approval databases, press releases from key industry players, and reputable scientific journals. Detailed segmentation analyses were performed to map technology modalities, product categories, equipment formats, clinical applications, end-user profiles, and treatment intents across major geographies.

Quantitative analyses utilized a bottom-up approach to validate technology deployment trends, while qualitative assessments examined strategic movements, such as mergers, partnerships, and tariff negotiations. All findings underwent a rigorous editorial review process and were validated by a technical advisory board, ensuring the report’s accuracy, comprehensiveness, and actionable relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Radiotherapy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Radiotherapy Market, by Component

- Radiotherapy Market, by Radiotherapy Type

- Radiotherapy Market, by Technology

- Radiotherapy Market, by Application

- Radiotherapy Market, by End User

- Radiotherapy Market, by Region

- Radiotherapy Market, by Group

- Radiotherapy Market, by Country

- United States Radiotherapy Market

- China Radiotherapy Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing technological innovations, market dynamics, and strategic imperatives to chart the future of radiotherapy

Radiotherapy is undergoing a renaissance, propelled by AI-enabled personalization, precision imaging integrations, and the strategic expansion of particle therapy modalities. These technological leaps are paralleled by evolving market dynamics shaped by trade interventions and shifting regional priorities.

Understanding segmentation nuances, from external beam variants to specialized end-user demands, is essential for tailoring market strategies. Meanwhile, resilience in supply chains and agility in digital adoption remain critical imperatives as companies navigate tariff landscapes and capitalize on emerging clinical evidence.

The path forward demands a balanced focus on innovation deployment, stakeholder collaboration, and data-driven decision-making. By aligning strategic investments with patient-centered outcomes and policy frameworks, industry participants can harness the transformative potential of radiotherapy to improve cancer care worldwide.

Connect with our Associate Director, Sales & Marketing to access tailored radiotherapy market research and accelerate strategic growth

To secure comprehensive insights and drive strategic decision-making in the rapidly evolving radiotherapy market, reach out to Ketan Rohom, Associate Director, Sales & Marketing, at 360iResearch. With extensive expertise in oncology market research and an unparalleled understanding of global radiotherapy dynamics, Ketan will guide you through the report’s actionable findings and bespoke analytics. Position your organization at the forefront of innovation by leveraging detailed data on technology trends, tariff impacts, segmentation insights, regional nuances, and competitive intelligence. Contact Ketan today to unlock the full potential of this market research and chart a course toward sustainable growth and competitive advantage.

- How big is the Radiotherapy Market?

- What is the Radiotherapy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?