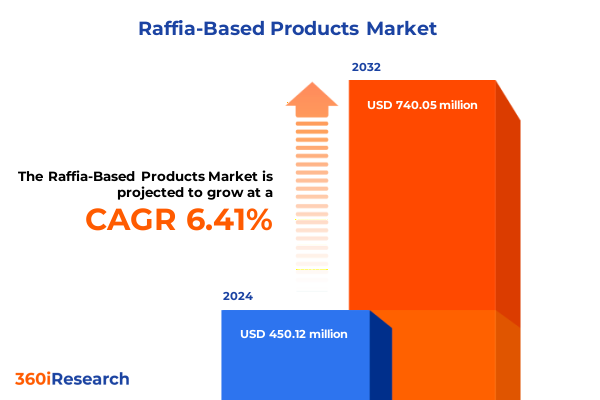

The Raffia-Based Products Market size was estimated at USD 473.57 million in 2025 and expected to reach USD 506.58 million in 2026, at a CAGR of 6.58% to reach USD 740.05 million by 2032.

Unveiling the Raffia-Based Products Landscape Through the Lens of Sustainability, Durability, and Market Evolution

The global raffia-based products sector has emerged as a dynamic intersection of traditional craftsmanship and modern application demands. Originating from the leaf fibers of raffia palms predominantly cultivated in tropical regions of Africa and Madagascar, raffia has long been prized for its durability, flexibility, and eco-friendly attributes. Over recent years, a confluence of heightened consumer interest in sustainable materials and expanding industrial requirements has elevated raffia from a niche artisanal raw material to a mainstream contender across diverse end markets.

As environmental stewardship becomes a corporate imperative, raffia fibers offer a compelling alternative to synthetic polymers in multiple domains. The unique textural qualities of raffia-based decorative items complement consumer preferences for organic aesthetics, while the robust tensile strength of mats, sheets, ropes, and twines aligns with stringent performance standards in agriculture, construction, and packaging applications. Simultaneously, innovations in processing techniques have broadened the range of household and industrial use cases, positioning raffia products as versatile solutions for contemporary challenges.

Anchoring this report is an exploration of how shifting sustainability regulations, evolving distribution channels, and segmentation-specific growth drivers are reshaping the competitive landscape. The analysis highlights the critical intersections of product type diversity, application requirements, distribution strategies, and end-user profiles, setting the stage for strategic insights and actionable recommendations that industry stakeholders can leverage to secure lasting market advantage.

Emerging Sustainability and Technological Trends Driving Rapid Evolution in the Global Raffia-Based Products Market

In recent years, the raffia-based products market has undergone profound transformation driven by both consumer trends and technological advancements. A surge in consumer demand for eco-conscious goods has catalyzed product innovations that enhance fiber performance while preserving biodegradability. Novel chemical and mechanical treatments now enable the production of lightweight yet high-strength mats and sheets suitable for erosion control in agriculture, as well as customizable decorative elements for event and home decor markets.

Concurrently, the integration of digital design tools and automated weaving machinery has accelerated time-to-market for customized product lines. Producers are now capable of delivering precision-engineered wall hangings or bespoke tote bags within shortened lead times, addressing the growing expectations for personalization in fashion accessories and home furnishing. These advancements have also precipitated cost efficiencies, enabling small and mid-sized manufacturers to compete with established players by offering niche, value-added raffia solutions.

Moreover, regulatory shifts around single-use plastics and synthetic packaging materials have opened pivotal opportunities for raffia-based packaging in food and retail sectors. Rising incentives for compostable and recyclable packaging have prompted several large retail chains to pilot raffia-based gift and shopping bags, setting a precedent for accelerated adoption. These transformative shifts underscore a broader realignment of industry value chains, where ecological performance and digital agility now stand at the forefront of competitive differentiation.

Evaluating the Multifaceted Consequences of 2025 U.S. Tariff Revisions on Raffia Import Strategies and Domestic Manufacturing Dynamics

The United States’ implementation of adjusted tariff schedules in early 2025 has introduced a new layer of complexity for raffia importers and domestic stakeholders alike. As part of a broader review of natural fiber classifications, the Harmonized Tariff Schedule amendments raised the Most-Favored-Nation duty on untreated raffia fibers and basic mats from 4.2% to 7.5%, while higher-grade finished goods such as decorative home furnishings and fashion accessories saw incremental increases from 3.6% to 6.8%. These changes have cumulatively elevated landed costs and influenced global supply chain realignments.

Importers have responded by diversifying their sourcing portfolios, shifting incrementally toward West African suppliers with preferential trade agreements or exploring regional North American processing partnerships to mitigate tariff exposure. At the same time, domestic manufacturers have recalibrated pricing strategies to capture incremental margin opportunities created by higher tariff barriers for imported goods. These price adjustments have been accompanied by renewed investments in mechanization and in-house finishing capabilities to bolster onshore production of value-added raffia products.

Despite headwinds, the tariff realignment has also served as a catalyst for strategic innovation. Companies are increasingly exploring tariff engineering-modifying product specifications or assembly locations to reclassify under more favorable headings-while expanding direct-to-consumer online channels to absorb cost increases without eroding end-user price expectations. Collectively, these dynamics illustrate the multifaceted impact of the 2025 tariff adjustments on competitive positioning, supply chain strategies, and product portfolio development in the North American raffia sector.

Dissecting Market Segmentation Dimensions to Reveal Strategic Growth Vectors Across Product Types, Applications, Channels, and End Users

A granular examination of market segmentation reveals distinct growth vectors anchored in product diversity and end-use requirements. Based on product type, Decorative Items have garnered substantial traction as consumer spending shifts toward experience-driven aesthetics. Within this category, Event Decor subsegments such as backdrops and banners have become staples for eco-friendly gatherings, while Garden Decor featuring borders and planters has tapped into the booming home-garden movement. Home Furnishing products-ranging from rugs to table mats and wall hangings-have capitalized on the preference for tactile, handcrafted finishes in interior design. Simultaneously, Fashion Accessories including belts, hats, and an expanding portfolio of handbags-encompassing clutches, crossbody styles, and tote bags-have bridged artisanal appeal with runway trends. Beyond these, staples like Mats and Sheets, Ropes and Twines, and Woven Sacks continue to underpin essential industrial and agricultural applications. Transitioning to application environments underscores the fiber’s versatility. In Agriculture, raffia is prized for crop support, erosion control, and plant protection solutions that minimize synthetic waste, while Construction uses erosion mats and scaffolding ropes optimized for strength and environmental compliance. In Fashion, the same belts, handbags, and hats reflect a cross-functional overlap with product type trends. Home Decor applications span floor coverings such as carpets and rugs, table accessories like coasters and placemats, and wall coverings encompassing art panels that deliver organic design statements. Packaging applications have likewise expanded, from seafood and vegetable bags in food packaging to bulk bags and pallet covers in industrial settings, extending to gift and shopping bags in retail contexts. Distribution channels further mediate market access, as Offline strategies rely on direct sales relationships, specialty store assortments, and supermarket and hypermarket placements that emphasize tactile product experiences. Online channels via company websites and third-party e-commerce platforms enable customized order management and global reach, supporting rapid response to emerging trends. End users span Commercial customers-hotels, restaurants, and retail outlets requiring banquet decor and room furnishings-to Household consumers differentiating between daily functional uses and decorative accents. Industrial end users, including agriculture firms, construction companies, and food processing facilities, reinforce raffia’s role as a high-performance natural fiber across demanding operational environments.

This segmentation framework highlights the importance of aligning product development, channel strategies, and end-user engagement to capitalize on growth trajectories. Manufacturers that fine-tune their offerings across these intersecting dimensions are positioned to capture incremental value and foster deeper stakeholder relationships across the value chain.

This comprehensive research report categorizes the Raffia-Based Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- Distribution Channel

- End User

Unearthing Regional Consumption Patterns and Supply Chain Dynamics Across the Americas, EMEA, and Asia-Pacific Raffia Markets

Analyzing the global footprint of raffia-based products illuminates regional disparities in consumption drivers, supply chain infrastructures, and regulatory environments. In the Americas, the United States and Brazil have become focal importers of decorative items and packaging solutions. Rising demand from event planning and consumer lifestyle segments in North America contrasts with the sustained agricultural applications in South America, where erosion control and crop support remain paramount. Meanwhile, logistical efficiencies across major ports have streamlined import processes, even as regional suppliers invest in expanded warehousing and last-mile solutions to capture premium distribution channels.

Across Europe, Middle East, and Africa, market dynamics vary significantly. Western Europe’s rigorous sustainability mandates and consumer inclination for artisanal home decor have driven growth in home furnishing and fashion accessory segments, while the Middle East’s hospitality boom has increased demand for event decor and high-quality decorative wall panels. In Africa, proximal access to raffia palm cultivation regions has fostered a vibrant manufacturing cluster, with local suppliers exporting woven sacks, ropes, and twines to international markets. However, infrastructural constraints and fluctuating trade policies require stakeholders to maintain agile logistics partnerships and continuous policy monitoring to mitigate volatility.

In the Asia-Pacific region, rapid urbanization and rising disposable incomes in China, India, and Southeast Asia have spurred demand for fashion accessories and home decor applications. Simultaneously, expanding construction and infrastructure programs have elevated requirements for erosion mats and scaffolding ropes. Regional manufacturers have responded with cost-competitive offerings, leveraging automated processing lines to meet bulk order timelines. Cross-border e-commerce platforms have further catalyzed consumer exposure to imported raffia decorative items, reinforcing a feedback loop that accelerates product innovation and aesthetic diversification.

Collectively, these regional insights emphasize the need for tailored market entry strategies, dynamic supply chain optimization, and localized product adaptations to harness each region’s distinctive growth levers.

This comprehensive research report examines key regions that drive the evolution of the Raffia-Based Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Strategic Alliances, Product Innovation, and Sustainability Initiatives Shaping Competitive Positioning in Raffia Markets

Competition within the raffia-based products sector has intensified as leading players pursue differentiation through sustainable sourcing, value-added processing, and channel expansion. A cadre of global manufacturers has forged strategic alliances with agroforestry cooperatives to secure traceable fiber supplies, ensuring both environmental stewardship and social impact. These partnerships have facilitated the certification of eco-friendly decorative items and packaging solutions, enhancing brand credibility among sustainability-driven buyers.

On the innovation front, several companies have invested in proprietary mechanical refining techniques that yield uniform fiber diameters, supporting the production of high-precision woven sacks and technical twines for industrial applications. Concurrently, creative collaboratives between design studios and fashion houses have spawned limited-edition raffia handbags and event decor collections, underscoring the material’s adaptability and premium appeal. Distribution strategies have likewise evolved, with firms expanding direct-to-consumer portals and establishing flagship experiential stores that showcase comprehensive product lines, from artisanal hats to large-format garden planters.

Moreover, some market leaders have pioneered circular economy initiatives, offering take-back programs for end-of-life mats and sheets, which are then repurposed into composite building materials. These efforts not only reduce waste but also open new revenue streams and reinforce corporate sustainability commitments. Collectively, these strategic initiatives underscore a competitive landscape where vertical integration, product portfolio diversification, and sustainability credentials are increasingly decisive factors influencing stakeholder partnerships and end-user preferences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Raffia-Based Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apex Polymers Industries

- Azuka Synthetics LLP

- C.E. Pattberg GmbH & Co. KG

- FLEXOBAG LDA

- Fresco Print Pack Pvt Ltd

- Gopala Polyplast Ltd

- Gujarat Raffia Industries Limited

- Haldia Petrochemicals Ltd

- Les Ateliers Feel Good

- Massini Industries S.R.L.

- Pawan Plastics

- Prayag Polytech Pvt Ltd

- Rana Saria Polypack Pvt Ltd

- Safari Industries (India) Ltd

- Saul Sadoch - Rex Prodotti Cartotecnici S.p.A.

- Senthil Plastics

- SG Global Packaging

- Shital Handloom

- Sunil Chemical Industries

- Texplast Industries Ltd

Strategic Imperatives for Industry Stakeholders to Enhance Sustainability, Mitigate Tariff Risks, and Spur Innovation in Raffia Products

Industry leaders should prioritize integrated sustainability frameworks that span from raw material cultivation to end-of-life product stewardship. By establishing transparent sourcing protocols and securing certifications for eco-friendly processing, companies can strengthen their value propositions in both consumer and industrial segments. Moreover, investing in mechanical and chemical refinement technologies will be critical to maintaining competitive performance standards across demanding applications such as erosion control and scaffolding support.

To counterbalance the impact of tariff fluctuations, stakeholders are advised to pursue tariff engineering strategies and regional processing partnerships that optimize supply chain cost structures. Building or partnering with localized finishing facilities in North America can mitigate duty exposure on finished decorative items and fashion accessories. Simultaneously, expanding direct-to-consumer online channels will enable organizations to preserve margin integrity while delivering personalized products to end users with minimal intermediaries.

Further, fostering collaborative innovation with design firms and end users can accelerate the development of differentiated product lines, particularly in high-value segments like event decor and luxury fashion accessories. Complementary investments in circular business models-such as product take-back and recycling programs-will not only address mounting regulatory pressures but also cultivate new revenue streams and brand loyalty. By executing these strategic imperatives, industry leaders can convert emerging challenges into sustainable growth opportunities and assert lasting market leadership.

Comprehensive Methodological Framework Combining Secondary Research, Primary Stakeholder Engagement, and Advanced Analytical Models

The research methodology underpinning this report integrates comprehensive secondary research, primary data validation, and rigorous analytical frameworks to ensure authoritative insights. Initially, extensive secondary sources were examined, including trade publications, industry whitepapers, and governmental databases, to construct a macro-level understanding of global production and trade flows. This desk research laid the foundation for identifying key industry players, regulatory trends, and innovation trajectories across product types and applications.

Subsequently, a series of in-depth interviews and surveys were conducted with executive leaders, product developers, and procurement specialists across the raffia value chain. These engagements provided firsthand perspectives on emerging demand drivers, supply chain constraints, and strategic imperatives influencing investment decisions. To triangulate findings, quantitative data points were cross-referenced with publicly available financial reports and customs statistics, enabling a robust evaluation of competitive dynamics and tariff impacts.

Finally, advanced analytical models were deployed to map segmentation-specific growth corridors, regional trade patterns, and company performance benchmarks. Data integrity was assured through iterative quality checks and peer reviews by sector experts. This multi-layered methodology ensures that the insights and recommendations presented herein are both current and actionable for stakeholders navigating the evolving raffia-based products market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Raffia-Based Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Raffia-Based Products Market, by Product Type

- Raffia-Based Products Market, by Application

- Raffia-Based Products Market, by Distribution Channel

- Raffia-Based Products Market, by End User

- Raffia-Based Products Market, by Region

- Raffia-Based Products Market, by Group

- Raffia-Based Products Market, by Country

- United States Raffia-Based Products Market

- China Raffia-Based Products Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 4611 ]

Synthesizing Market Dynamics, Segmentation Insights, and Strategic Imperatives to Guide Future Growth in Raffia Products Sector

The evolving landscape of raffia-based products encapsulates a harmonious blend of traditional craftsmanship and cutting-edge industry demands. An increasingly sustainability-conscious consumer base, coupled with technological innovations in fiber processing and digital fabrication, has expanded applications ranging from decorative home furnishings and fashion accessories to industrial-grade erosion mats and packaging solutions. Meanwhile, regional disparities and trade policy shifts-particularly the 2025 U.S. tariff adjustments-have reshaped cost structures and supply chain configurations, prompting stakeholders to recalibrate sourcing and distribution strategies.

Segmentation insights demonstrate how product type diversity and application-specific requirements underpin targeted growth opportunities, while distribution channel evolution underscores the importance of omnichannel engagement. Competitive dynamics have intensified as leading firms deploy strategic partnerships, circular economy initiatives, and proprietary processing techniques to differentiate their offerings. Collectively, these trends point to a future where agility, sustainability credentials, and collaborative innovation will determine market leadership.

As decision-makers chart the next phase of growth, the integration of the strategic imperatives and regional considerations outlined in this report will be essential. By aligning product portfolios with emerging regulatory standards, consumer preferences, and logistical efficiencies, stakeholders can capitalize on the robust potential of raffia-based materials and secure lasting competitive advantage.

Empower Strategic Decision-Making by Linking with Our Associate Director to Secure Exclusive Raffia Market Intelligence and Growth Roadmaps

To gain an in-depth understanding of the global raffia-based products landscape and equip your organization with actionable strategic recommendations, contact Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive market research report. This authoritative study provides unparalleled insights into transformative industry trends, segmentation-specific opportunities, regional dynamics, competitive intelligence, and regulatory developments shaping the raffia ecosystem. By engaging directly with our team, you’ll receive customized guidance on leveraging emerging growth corridors, navigating tariff complexities, and optimizing product portfolios to maintain a competitive edge.

Reach out today to access tailored solutions and exclusive data that will empower your strategic planning and drive sustainable growth within the raffia-based products sector. Seize this opportunity to transform industry challenges into profitable initiatives with expert support and in-depth analysis designed to inform critical business decisions.

Take decisive action now to secure your organization’s leadership position in a rapidly evolving market by partnering with Ketan Rohom and unlocking the full potential of our market intelligence offering.

- How big is the Raffia-Based Products Market?

- What is the Raffia-Based Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?