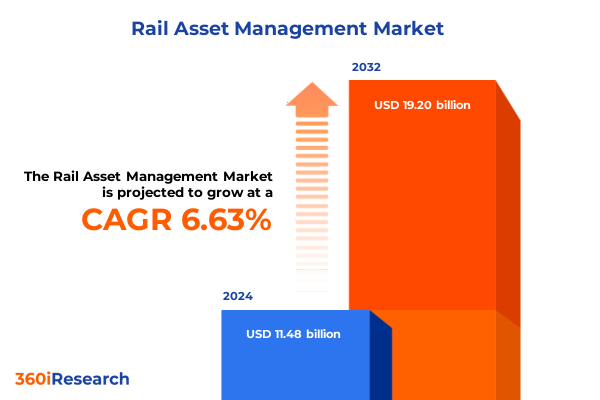

The Rail Asset Management Market size was estimated at USD 12.19 billion in 2025 and expected to reach USD 12.96 billion in 2026, at a CAGR of 6.70% to reach USD 19.20 billion by 2032.

Introduction to the Evolution and Strategic Importance of Rail Asset Management in a Dynamic Global Transportation Ecosystem

The rail sector has evolved into an intricate ecosystem where operational reliability, regulatory compliance, and digital innovation converge to shape tomorrow’s transportation landscape. As rail networks expand and age concurrently, organizations face the dual imperative of preserving legacy infrastructure while investing in next-generation systems to meet rising demand for faster, greener, and more cost-efficient mobility solutions. In this environment, asset management transcends traditional maintenance activities, emerging instead as a strategic discipline that drives performance optimization, risk mitigation, and long-term value creation.

Against this backdrop, stakeholders from infrastructure managers to passenger rail operators and freight carriers are reimagining the role of asset stewardship. No longer confined to reactive repairs, advanced maintenance regimes now incorporate data-driven decision-making, enabling real-time visibility across vast fleets and extensive track networks. This shift is further accelerated by a growing emphasis on sustainability, regulatory stringency, and the imperative to control lifecycle costs under volatile economic conditions.

This executive summary synthesizes key developments influencing rail asset management, from transformative technological adoption and service delivery paradigms to evolving trade policies and regional market dynamics. It provides decision makers with a concise yet comprehensive overview of critical strategic drivers, segmentation insights, and actionable recommendations designed to guide investment prioritization, operational planning, and collaborative innovation. By illuminating essential trends and offering a roadmap for navigating complexity, this introduction sets the stage for a deeper exploration of the forces reshaping asset management in rail transport.

Navigating Paradigm Shifts in Rail Asset Management Driven by Technological Innovation and Evolving Regulatory and Sustainability Demands

Rail asset management today is experiencing a confluence of paradigm shifts driven by breakthroughs in digital technologies, heightened sustainability mandates, and evolving risk landscapes. Internet of Things sensor networks, once confined to pilot projects, are now being deployed at scale to monitor track integrity, rolling stock health, and energy consumption metrics. This proliferation of connected devices generates unprecedented volumes of performance data, which, when coupled with advanced analytics platforms, paves the way for predictive and prescriptive maintenance models that preempt failures and extend asset lifecycles.

Moreover, regulatory bodies around the world are enacting stringent emissions standards and safety protocols, compelling operators to adapt their infrastructure and maintenance practices accordingly. The transition from traditional signaling systems to advanced train control technologies such as CBTC and ETCS reflects a broader commitment to operational safety, capacity optimization, and integration with smart city frameworks. As these regulatory and technological imperatives intersect, rail organizations are establishing cross-functional teams to manage digital transformation initiatives, embedding asset performance management software and cloud computing frameworks into their standard operating procedures.

At the same time, the competitive landscape is being redefined by new entrants offering end-to-end asset management services, often leveraging deep learning algorithms and cloud-native architectures to deliver scalable, subscription-based solutions. This shift heralds a move away from capital-intensive procurement cycles toward agile, service-oriented partnerships that align vendors’ incentives with operators’ performance outcomes. In essence, rail asset management is no longer a back-office function; it has become a strategic fulcrum for resilience, efficiency, and continuous innovation.

Assessing the Multifaceted Consequences of 2025 United States Tariff Policies on Rail Asset Procurement Maintenance and Lifecycle Strategies

In 2025, the United States government implemented a series of targeted tariffs on imported steel, aluminum, and specialized rail components, aiming to bolster domestic manufacturing and safeguard critical supply chains. While these measures have incentivized local production capacities, they have also introduced complexities in procurement planning and cost structures for rail operators. The increased duties on raw materials and finished equipment have led many organizations to reevaluate supplier relationships in North America, accelerating the search for alternative sources and reshaping vendor qualification criteria.

Consequently, project timelines for infrastructure upgrades and rolling stock maintenance have been affected by lead-time extensions and price renegotiations. To manage these disruptions, operators are exploring collaborative agreements with regional fabricators, investing in localized forging and machining capabilities, and in some cases, pre-purchasing key components to hedge against further tariff escalations. These strategies, while mitigating near-term risks, also entail inventory management challenges and working capital implications that must be balanced against operational priorities.

In addition, the ripple effects of tariff policies extend beyond cost considerations. Engineering teams have had to refine technical specifications to accommodate domestically sourced alloys, and maintenance crews must adapt to subtle material variances that can influence wear characteristics. Meanwhile, strategic sourcing departments are integrating tariff scenario planning into their risk assessment frameworks, ensuring that future procurement cycles incorporate comprehensive total cost of ownership analyses that capture duty rates, currency fluctuations, and logistical constraints.

Unveiling Critical Insights through Comprehensive Segmentation across Asset Types Service Modalities Technological Innovations End Users and Deployment Models

When evaluating market dynamics through the lens of asset type, operators and service providers are aligning investment priorities across infrastructure elements such as electrification, stations, and track works alongside rolling stock categories including freight wagons, locomotives, and passenger coaches. Within this framework, maintenance equipment segments-ranging from loco test rigs to rail grinders and wheel lathes-play a critical role in ensuring uninterrupted network performance. Parallel to these steel-based assets, signaling and communication modules, including CBTC, ETCS, and PTC systems, constitute a digital overlay that is increasingly central to capacity enhancement and safety protocols.

Transitioning to service type, the industry’s approach has evolved from predominantly corrective maintenance-comprising emergency repairs and fault rectification-to a balanced portfolio that heavily emphasizes scheduled inspections, component replacement cycles, and system upgrades. Overhaul and modernization activities, particularly fleet renewal initiatives, complement predictive maintenance measures built on condition monitoring and vibration analysis technologies. In practice, organizations blend these modalities to optimize asset availability while controlling maintenance budgets.

Technology segmentation reveals a shift toward AI and machine learning applications that harness deep learning models for anomaly detection and failure prognosis. These intelligence engines interface with asset performance management solutions such as computerized maintenance management systems and enterprise asset management platforms, which in turn are integrated with big data analytics tools including data warehousing environments and performance dashboards. Cloud computing architectures-whether private, public, or hybrid-serve as the backbone for scalable data processing, while IoT implementations focus on establishing robust sensor networks that facilitate real-time asset connectivity and environmental monitoring.

From the end-user perspective, freight operators-both national logistics companies and private carriers-prioritize reliability and throughput, whereas infrastructure managers, encompassing station operators and track authorities, concentrate on network resilience and lifecycle extensions of critical components. Passenger rail operators, whether intercity or urban transit providers, demand seamless system interoperability and high passenger satisfaction metrics. Across these segments, deployment models oscillate between on-premise setups hosted within enterprise data centers or local servers and cloud environments that offer elastic resource allocation, reflecting each organization’s appetite for security, scalability, and total cost considerations.

This comprehensive research report categorizes the Rail Asset Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offerings

- Asset Type

- Train Type

- Applications

- End User

- Deployment Model

Deciphering Regional Dynamics and Emerging Patterns in Rail Asset Management across the Americas Europe Middle East Africa and Asia Pacific

In the Americas, the rail asset management landscape is characterized by a strong emphasis on modernization of aging infrastructure coupled with significant freight volume growth. Public and private stakeholders collaborate extensively to finance track renewals, station upgrades, and the rollout of advanced signaling systems. North American operators increasingly adopt cloud-based predictive maintenance platforms that leverage historical performance data to reduce unplanned downtime. In Latin American corridors, budget constraints drive a hybrid approach, combining traditional preventive maintenance routines with selectively deployed IoT sensor programs to extend asset lifespans.

Europe, the Middle East, and Africa (EMEA) present a highly differentiated market environment. Western European nations continue to pioneer cross-border interoperability through ETCS implementations, while compliance with stringent carbon reduction targets propels electrification projects. In the Middle East, network expansions for high-speed and urban transit systems are often funded by sovereign wealth entities, resulting in rapid technology transfers and turnkey maintenance contracts. Africa, by contrast, witnesses a dual focus on rehabilitating colonial-era track networks and deploying modern signaling schemes to catalyze regional trade corridors, with international development banks underwriting capacity-building initiatives.

Asia-Pacific exhibits arguably the most dynamic growth profile, as burgeoning economies invest heavily in both passenger and freight rail. China’s state-backed rail manufacturers drive standardization and deep integration of AI-enabled asset performance software across vast networks. India’s programs to electrify entire broad-gauge routes stimulate demand for upgraded rolling stock maintenance facilities. Meanwhile, Australia and Southeast Asian markets are adopting modular rail grinders and wheel lathe services to accommodate mining-related freight surges, underscoring the region’s dual imperatives of reliability and cost efficiency.

This comprehensive research report examines key regions that drive the evolution of the Rail Asset Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Company Profiles and Collaborative Initiatives Shaping the Future of Rail Asset Management through Innovation Partnerships

Key industry participants are forging alliances and undertaking strategic transformations to fortify their positions in the rail asset management arena. Leading OEMs have expanded their portfolios through acquisitions of specialized predictive maintenance software firms, thus creating integrated solutions that span hardware supply and analytics services. Technology providers in the AI and IoT space are collaborating with signaling specialists to embed machine learning capabilities directly within control systems, enhancing real-time decision pathways and reducing latency in failure detection.

Service companies traditionally focused on corrective maintenance are now offering holistic lifecycle management contracts that bundle overhauls, modernization programs, and preventive maintenance schedules. Partnerships between component manufacturers and digital platform vendors are giving rise to outcome-based service models, wherein fees are tied to agreed uptime and performance metrics rather than fixed hourly rates. Concurrently, rail operators are investing in joint ventures with data analytics firms to build proprietary asset intelligence platforms, aiming to retain full control over mission-critical performance data and analytics roadmaps.

This collaborative momentum is further amplified by pilot initiatives that unite network operators, academic institutions, and solution providers in testbed environments. These innovation ecosystems accelerate validation of digital twins, autonomous inspection drones, and advanced robotics for track maintenance. By pooling resources and expertise, stakeholders reduce time-to-market for breakthrough capabilities while sharing the risks of large-scale deployments. As a result, the competitive landscape is increasingly defined by the depth of technological partnerships and the agility with which companies can co-develop and commercialize novel asset management offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rail Asset Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aarsleff Rail A/S

- ABB Ltd.

- Alstom S.A.

- Ansaldo STS

- Balfour Beatty Rail Ltd.

- Bentley Systems, Inc.

- Bombardier Inc.

- Caterpillar Inc.

- CRRC Corporation Limited

- Faiveley Transport

- Ferrostaal GmbH

- Hitachi, Ltd

- Hyundai Rotem Company

- Kawasaki Heavy Industries Ltd.

- Knorr-Bremse AG

- Mermec Group

- Mitsubishi Heavy Industries

- Network Rail Infrastructure Limited

- Parker Hannifin Corporation

- Progress Rail by Caterpillar Inc.

- Railworks Corporation

- Rheinmetall AG

- Siemens AG

- SNCF Group

- Stadler Rail AG

- Strukton Rail

- Systra S.A.

- Tata Steel Limited

- Thales Group

- Toshiba Corporation

- Transmashholding

- Trimble Inc.

- Trinity Industries, Inc.

- Voith Group

- Vossloh AG

- Wabtec Corporation

Actionable Recommendations Empowering Industry Stakeholders to Enhance Operational Efficiency Reduce Lifecycle Costs and Foster Sustainable Growth in Rail

Industry leaders should prioritize the integration of predictive maintenance frameworks underpinned by advanced analytics, as real-time condition monitoring can substantially reduce unplanned service interruptions. By leveraging cloud-native AI platforms alongside on-premise data processing nodes, organizations can create resilient, hybrid architectures that align with evolving data sovereignty requirements. Moreover, configuring maintenance schedules based on data-driven failure probabilities allows for more efficient allocation of labor and capital resources.

To mitigate external risks such as tariff fluctuations and supply chain constraints, procurement teams are advised to diversify vendor portfolios and establish strategic inventories for critical components. Engaging in collaborative planning with domestic fabricators and regional suppliers will further insulate projects from abrupt cost escalations. Simultaneously, investing in workforce development through targeted training on digital tools ensures that maintenance crews and engineers can capitalize on new diagnostic techniques.

As sustainability and regulatory demands intensify, decision makers must incorporate lifecycle carbon assessments into asset management strategies. Adopting lighter, longer-lasting materials in rolling stock and emphasizing energy-efficient electrification infrastructure can deliver both environmental and economic gains. Finally, fostering open innovation through shared testbed environments and cross-industry consortia will expedite the validation of emerging technologies, enabling stakeholders to accelerate modernization roadmaps while sharing the benefits of collective learning.

Robust Research Methodology Underpinning the Comprehensive Analysis of Rail Asset Management Trends and Strategic Drivers in the Evolving Transportation Sector

The research underpinning this analysis draws on a rigorous methodology combining both primary and secondary data sources. Primary insights were gathered through in-depth interviews with executives from rail operators, OEMs, technology vendors, and regulatory bodies, complemented by structured surveys targeting maintenance managers and infrastructure planners. These perspectives were triangulated with field observations at key maintenance facilities and pilot program demonstrations to ensure real-world applicability of findings.

Secondary research encompassed a comprehensive review of publicly available technical white papers, government transportation reports, and academic journals focused on asset performance management, signaling technologies, and trade policy impacts. Industry databases and trade publications were systematically analyzed to map historical trends, benchmark service delivery models, and trace the evolution of digital adoption across core asset categories. A thorough assessment of tariff schedules and related policy documents provided the basis for the cumulative impact analysis of 2025 U.S. trade measures.

Quantitative data sets were evaluated using advanced analytics techniques, including scenario modeling and sensitivity analysis, to explore the interplay between cost variables, maintenance frequencies, and asset failure rates. Qualitative insights were coded thematically to identify emerging best practices, risk mitigation strategies, and partnership frameworks. All data inputs and analytical procedures underwent multiple quality assurance reviews, including peer validation by subject matter experts, to guarantee accuracy and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rail Asset Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rail Asset Management Market, by Offerings

- Rail Asset Management Market, by Asset Type

- Rail Asset Management Market, by Train Type

- Rail Asset Management Market, by Applications

- Rail Asset Management Market, by End User

- Rail Asset Management Market, by Deployment Model

- Rail Asset Management Market, by Region

- Rail Asset Management Market, by Group

- Rail Asset Management Market, by Country

- United States Rail Asset Management Market

- China Rail Asset Management Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Concluding Perspectives on the Strategic Imperatives and Future Outlook of Rail Asset Management in an Era of Technological Transformation

The strategic trajectory of rail asset management is increasingly defined by the integration of digital intelligence, collaborative service models, and proactive risk governance. Organizations that embrace data-driven maintenance paradigms and foster deep partnerships with technology suppliers are poised to achieve superior asset availability, cost control, and regulatory compliance. Moreover, alignment of procurement strategies with evolving trade policies and material sourcing imperatives will become a differentiator in project planning and execution.

Looking ahead, the convergence of AI-powered analytics, cloud computing, and IoT-enabled sensing will continue to reshape operational playbooks, facilitating predictive and prescriptive maintenance at unprecedented scales. Regional disparities in regulatory frameworks and infrastructure maturity will drive differentiated adoption curves, underscoring the need for adaptable, modular solutions. As the competitive landscape evolves, companies that cultivate open innovation networks and invest in workforce digital literacy will gain first-mover advantages in deploying advanced asset management platforms.

Ultimately, the future of rail asset management lies in balancing efficiency with resilience, leveraging technology to extend asset lifecycles while ensuring flexibility to navigate geopolitical and economic uncertainties. By capitalizing on the insights presented in this summary, industry leaders can chart a course toward sustainable performance, operational excellence, and enduring competitive strength.

Secure Your Competitive Edge in Rail Asset Management by Accessing Comprehensive Market Research Insights Through Personalized Consultation with Ketan Rohom

To remain at the forefront of rail asset management innovation and secure actionable insights tailored to your organization’s unique strategic challenges, engage directly with Ketan Rohom, Associate Director, Sales & Marketing. Leverage his deep understanding of industry dynamics and proven track record in translating complex research into practical roadmaps for operational optimization. By scheduling a personalized consultation, you will gain direct access to exclusive data syntheses, scenario analyses, and expert guidance on deploying cutting-edge technologies and methodologies across your asset portfolio. This conversation will illuminate how to navigate tariff-related supply chain disruptions, implement robust predictive maintenance frameworks, and align deployment models with your organizational goals. Reach out today to transform high-level research findings into measurable performance improvements and to discuss flexible licensing options for comprehensive market intelligence that empowers decisive action.

- How big is the Rail Asset Management Market?

- What is the Rail Asset Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?