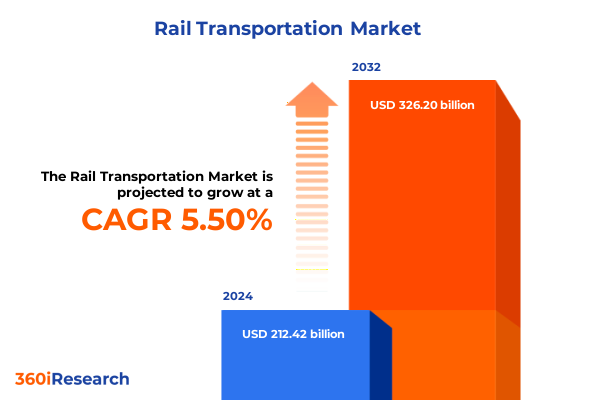

The Rail Transportation Market size was estimated at USD 221.26 billion in 2025 and expected to reach USD 230.48 billion in 2026, at a CAGR of 5.70% to reach USD 326.20 billion by 2032.

Unveiling Rail Transportation’s Integral Role in Shaping Sustainable Logistics Networks and Enhancing Economic Resilience Amid Evolving Market Demands

Rail transportation serves as a foundational pillar of national and global logistics ecosystems, seamlessly moving vast volumes of freight while connecting urban and regional passenger networks. In the United States, freight railroads handle roughly 40% of long-distance freight ton-miles yet contribute only 0.5% of total U.S. greenhouse gas emissions, illustrating their unparalleled fuel efficiency and environmental advantage compared to other modes of transport. Operating over nearly 140,000 miles of track and facilitating the movement of coal, grain, intermodal containers, and other goods, rail remains critical to supply chain resilience and economic continuity across numerous industries.

Emerging Technological and Sustainable Innovations Are Redefining the Future of Rail Operations and Passenger Experiences Across Global Networks

The rail industry is in the midst of transformative shifts driven by technological advancements and environmental imperatives. Artificial intelligence and IoT-enabled services now underpin predictive maintenance regimes, enabling operators to forecast equipment failures and optimize maintenance schedules based on real-time sensor data and digital twin simulations. These digital twin platforms are facilitating comprehensive virtual replicas of rail assets, empowering stakeholders to model operational scenarios, enhance safety, and reduce lifecycle costs through data-driven decision-making.

Assessing the Comprehensive Influence of 2025’s U.S. Tariff Measures on Rail Infrastructure Costs and Supply Chain Dynamics

In 2025, the reinstatement and expansion of U.S. Section 232 tariffs introduced a 25% ad valorem duty on all steel and aluminum imports starting March 12, which was subsequently increased to 50% on June 4, alongside a 25% tariff on automobiles and auto parts effective April and May respectively. The broadening of tariff scope to include containerized metals and downstream products has elevated material costs for track components, rolling stock manufacturing, and maintenance supplies, compelling rail operators to absorb higher capital expenditure or pass increased costs to end-users.

Uncovering Nuanced Service, Cargo, and Rolling Stock Segmentation to Illuminate Strategic Opportunities and Operational Priorities

Strategic segmentation across service types, cargo categories, and rolling stock configurations reveals critical performance drivers and market niches. Freight operations encompass bulk shipments such as coal, grain, and ore; containerized loads; intermodal units; and mixed freight, with intermodal volumes expanding steadily as shippers seek flexibility and speed. Within the passenger realm, segments range from commuter services-where off-peak and peak demand patterns necessitate agile scheduling-to high-speed, light rail, metro, and regional networks that require distinct operational frameworks to balance capacity, speed, and frequency.

This comprehensive research report categorizes the Rail Transportation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Cargo Type

- Rolling Stock

- Application

Analyzing Regional Variances Across the Americas, EMEA, and Asia-Pacific to Inform Targeted Market Strategies and Network Investments

Regional dynamics exhibit pronounced variations that influence investment and operational priorities. In the Americas, a mature infrastructure landscape is undergoing digital modernization, with Class I railroads leveraging advanced software to optimize fuel efficiency and service reliability while expanding intermodal hubs to capture shifting supply-chain flows. The Europe, Middle East & Africa corridor emphasizes high-speed rail network growth, harmonized regulatory frameworks for cross-border connectivity, and sustainability initiatives such as hydrogen fuel cell trains and solar-powered signaling systems. In the Asia-Pacific region, rapid electrification and high-speed rail deployments continue to scale, underpinned by domestic equipment manufacturers securing multi-billion-dollar contracts for urban metro expansions and intercity corridors.

This comprehensive research report examines key regions that drive the evolution of the Rail Transportation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Rail Operators, Equipment Manufacturers, and Service Providers Driving Innovation and Competitive Differentiation

Key industry players are demonstrating divergent strategies to navigate evolving market dynamics. Leading freight operators such as Union Pacific, BNSF, CSX, Norfolk Southern, and Canadian Pacific Kansas City are focusing on network resilience and contemplating consolidation to enhance coast-to-coast service efficiency, as evidenced by ongoing merger discussions between Union Pacific and Norfolk Southern. Passenger carriers like Amtrak and the Eurostar Group are prioritizing fleet modernization and route optimization to recapture pre-pandemic volumes, with Eurostar passenger counts reaching nearly 19.5 million in 2024. On the manufacturing front, Siemens Mobility’s global footprint spans rolling stock, signaling, and digital solutions, while Hitachi Rail’s acquisitions and Hyundai Rotem’s high-speed exports underscore the strategic push for clean and efficient propulsion technologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rail Transportation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alstom S.A.

- BNSF Railway Company

- Canadian National Railway Company

- Canadian Pacific Kansas City Limited

- Caterpillar Inc.

- Central Japan Railway Company

- China Railway Group Limited

- CSX Corporation

- DB Cargo AG

- DHL International GmbH

- Hallcon Corporation

- Hitachi Ltd.

- Kintetsu Railway Co., Ltd.

- Motive Power Ltd.

- MTR Corporation Limited

- Nagoya Railroad Co., Ltd.

- Norfolk Southern Corporation

- OmniTRAX, Inc.

- Patriot Rail Company LLC

- Professional Transportation, Inc.

- R. J. Corman Railroad Group

- Russian Railways

- Thales Group

- Union Pacific Railroad Company

- Wabtec Corporation

- Watco Companies, L.L.C.

Implementing Strategic Measures to Leverage Technological Advancements, Mitigate Tariff Risks, and Optimize Rail Infrastructure Investments

Industry leaders should prioritize the deployment of AI-driven predictive maintenance tools to extend asset lifecycles and reduce unscheduled downtime, thereby safeguarding service reliability and lowering lifecycle costs. Securing diversified material sources and establishing strategic partnerships with domestic steel and aluminum suppliers can mitigate the adverse effects of tariff volatility on capital projects. Embracing electrification and hydrogen traction trials will position operators at the forefront of sustainability targets and regulatory compliance, while proactive engagement with policymakers and infrastructure stakeholders can accelerate network interoperability and funding mechanisms.

Detailing Rigorous Primary, Secondary, and Analytical Research Approaches Underpinning the Comprehensive Rail Transportation Analysis

This analysis integrates primary interviews with senior executives, government officials, and infrastructure planners to capture firsthand insights into operational challenges and strategic priorities. Secondary research encompassed comprehensive datasets from the Association of American Railroads, Bureau of Transportation Statistics, and regulatory filings that underpin network performance and environmental impact assessments. Segmentation models were validated through expert workshops to ensure relevance across service types, cargo categories, and rolling stock classifications, while regional analyses leveraged localized market intelligence to reflect divergent growth trajectories and policy frameworks.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rail Transportation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rail Transportation Market, by Service Type

- Rail Transportation Market, by Cargo Type

- Rail Transportation Market, by Rolling Stock

- Rail Transportation Market, by Application

- Rail Transportation Market, by Region

- Rail Transportation Market, by Group

- Rail Transportation Market, by Country

- United States Rail Transportation Market

- China Rail Transportation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesis of Emerging Trends and Strategic Imperatives Guiding the Future Trajectory of Rail Transportation in a Dynamic Global Landscape

Rail transportation stands at a pivotal inflection point, with digital ecosystems and sustainable propulsion shaping next-generation operations amid a complex tariff environment. Segmentation insights underscore differentiated growth drivers across bulk, intermodal, passenger, and equipment domains, while regional analyses reveal bespoke strategies required for the Americas, EMEA, and Asia-Pacific. As leading operators, manufacturers, and policymakers align to meet decarbonization targets, those who deftly integrate technology adoption, supply chain resilience, and regulatory collaboration will command a competitive edge in the evolving rail landscape.

Engage Directly with Ketan Rohom to Access Exclusive Rail Transportation Intelligence and Drive Strategic Growth Through In-Depth Market Insights

To acquire the full rail transportation market research report and explore customized strategic insights, reach out to Ketan Rohom, Associate Director of Sales & Marketing, whose expertise ensures tailored support and in-depth discussion of how these findings can drive your organization’s objectives and growth trajectory.

- How big is the Rail Transportation Market?

- What is the Rail Transportation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?