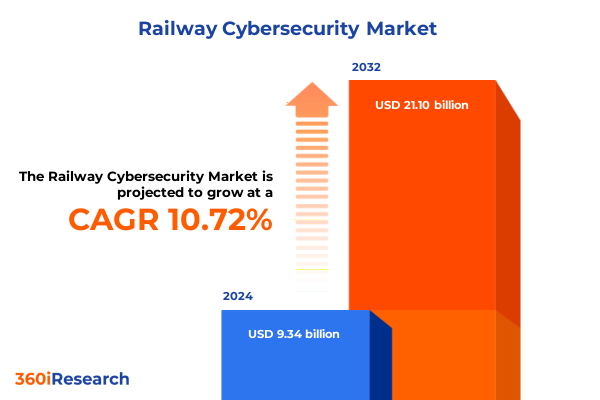

The Railway Cybersecurity Market size was estimated at USD 10.33 billion in 2025 and expected to reach USD 11.38 billion in 2026, at a CAGR of 10.74% to reach USD 21.10 billion by 2032.

Essential Foundations and Strategic Imperatives for Safeguarding Digital Connectivity and Operational Integrity Across Expansive Railway Networks Worldwide

Railway networks are undergoing rapid digitization, integrating sophisticated control systems, passenger information platforms, and maintenance management tools. This wave of modernization introduces unprecedented operational efficiencies, yet it also expands cyber threat surfaces across trackside devices, rolling stock, and central command centers. In this dynamic environment, railway cybersecurity emerges as a strategic imperative rather than an optional safeguard. With an increasing convergence of operational technology and information technology, the industry must adopt an integrated defense posture that spans network segmentation, secure firmware updates, and continuous threat monitoring to maintain service integrity and passenger safety.

Moreover, as rail operators embrace cloud connectivity for remote diagnostics and predictive maintenance, they must reconcile the tradeoffs between accessibility and security. The shift toward mobile ticketing and real-time passenger information necessitates robust encryption and identity management frameworks to prevent data breaches and service disruptions. In parallel, regulatory mandates and industry standards are evolving, compelling operators to align with stringent requirements for system resilience, incident response, and supply chain assurance. Consequently, a holistic understanding of the cybersecurity landscape is critical to safeguarding assets, protecting sensitive data, and ensuring uninterrupted railway operations.

Emerging Technological and Threat Evolution Catalyzing a Paradigm Shift in Railway Cybersecurity Strategies Across Transportation Ecosystems

The railway cybersecurity landscape is experiencing transformative shifts driven by the integration of Internet of Things (IoT) devices, artificial intelligence for anomaly detection, and cloud-based management platforms. As trackside sensors and on-board monitoring solutions proliferate, threat actors gain additional entry points, prompting operators to reevaluate traditional perimeter defenses. In response, cybersecurity leaders are adopting zero trust principles, enforcing least-privilege access, and implementing microsegmentation to isolate critical assets and reduce lateral movement opportunities.

Furthermore, the convergence of operational and information technologies demands a unified security framework capable of analyzing cross-domain telemetry and system logs in real time. Advanced threat intelligence sharing between infrastructure managers, freight operators, and passenger service providers is emerging as a best practice to identify novel attack vectors quickly. Meanwhile, regulatory bodies are placing greater emphasis on incident reporting and resilience planning, urging stakeholders to conduct regular red team exercises and tabletop simulations. Together, these shifts underscore a proactive, collaborative approach that balances innovation with risk mitigation to uphold service continuity.

Assessing the Broader Implications of Upcoming United States Tariff Measures on Railway Cybersecurity Procurement and Supply Chain Resilience

The introduction of new United States tariff measures in 2025 is reshaping procurement strategies and supply chain resilience within the railway cybersecurity sector. With increased import duties on specialized hardware components and advanced cryptographic modules, procurement teams are revisiting supplier portfolios, evaluating regional sourcing alternatives, and negotiating long-term contracts to buffer cost fluctuations. This environment compels organizations to build more robust inventory management practices and optimize their risk exposure to tariff-related disruptions.

In parallel, software providers and system integrators are adjusting licensing models and service agreements to account for higher operational expenses passed through by hardware vendors. To maintain budgetary discipline, railway operators are prioritizing modular, vendor-agnostic solutions that can adapt to evolving cost structures without compromising security. At the same time, vertical integration strategies are gaining traction as stakeholders explore joint ventures and collaborative frameworks to internalize critical cybersecurity capabilities. By proactively addressing the cumulative impact of tariff adjustments, the industry is reinforcing supply chain transparency and ensuring that defensive architectures remain resilient in the face of economic headwinds.

Unveiling In-Depth Perspectives on Security Domains Deployment Architectures Service Models and System Components Shaping Cyber Defense Postures

A multidimensional segmentation approach reveals how security domains, deployment models, end user profiles, service offerings, system categories, and component types shape railway cybersecurity priorities. Application security strategies, encompassing dynamic testing, static code analysis, and web application firewalls, are complemented by data protection measures such as loss prevention controls, encryption schemes, and tokenization services. Identity and access management solutions leverage multi-factor authentication, privileged access controls, and single sign-on mechanisms to enforce robust user governance. At the network layer, firewalls, intrusion detection and prevention systems, and virtual private network tunnels create layered defenses against external threats.

Deployment preferences vary between cloud, hybrid, and on-premises architectures, each presenting distinct benefits regarding scalability, control, and resilience. Operators in freight transport, infrastructure management, and passenger services exhibit unique risk appetites and compliance requirements, driving tailored security roadmaps. Managed services provide continuous monitoring and incident response capabilities, while professional services deliver consulting, system integration, and specialized training initiatives. Across communication, passenger information, rolling stock control, signaling, and ticketing systems, a dual focus on hardware robustness and software agility ensures that cybersecurity measures remain adaptive, interoperable, and aligned with evolving operational demands.

This comprehensive research report categorizes the Railway Cybersecurity market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Security Type

- Deployment Mode

- End User

- Service Model

- System

- Component Type

Analyzing Regional Dynamics and Security Priorities Across the Americas Europe Middle East Africa and Asia-Pacific Railway Networks

Regional dynamics play a critical role in influencing cybersecurity investments and strategic priorities within the railway sector. In the Americas, a diverse mix of established transit authorities and emerging freight corridors prioritizes the modernization of legacy signaling systems and the integration of advanced threat detection platforms. This region’s regulatory environment encourages public–private partnerships for infrastructure upgrades, resulting in a complex security ecosystem that balances federal guidelines with local transit requirements.

Europe, the Middle East, and Africa present a tapestry of varying cybersecurity maturity levels, where densely networked passenger services in urban areas intersect with remote freight lines crossing multiple jurisdictions. Here, compliance with pan-European frameworks and national cybersecurity directives drives harmonization efforts, while the proliferation of digital ticketing solutions underscores the need for interoperable identity management. Conversely, expansive rail systems in the Middle East and Africa are investing in turnkey security solutions to leapfrog legacy vulnerabilities.

Meanwhile, the Asia-Pacific region is characterized by rapid network expansion, high-speed rail deployments, and a competitive vendor landscape. Governments and private investors are accelerating digital transformation projects, integrating cloud-native architectures and AI-driven security analytics. These initiatives are reshaping risk models and compelling operators to adopt scalable, platform-agnostic defenses that can address both traditional IT threats and operational technology vulnerabilities.

This comprehensive research report examines key regions that drive the evolution of the Railway Cybersecurity market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Industry Stakeholders and Their Strategic Collaborations Catalyzing Innovation in Railway Cybersecurity Solutions

Leading industry stakeholders are forging strategic alliances and channel partnerships to drive innovation in railway cybersecurity. Global technology providers are integrating machine learning capabilities into intrusion detection systems, while specialized integrators are delivering turnkey solutions tailored to the unique requirements of freight, passenger, and infrastructure operators. Collaborative ecosystems have formed around shared threat intelligence consortia, enabling members to exchange real-time indicators of compromise and elevate collective resilience against emerging attack patterns.

Moreover, prominent system vendors are enhancing interoperability through open architectures, adopting standardized communication protocols, and offering modular service portfolios. This trend allows operators to mix and match best-in-class components from multiple suppliers, reducing vendor lock-in and accelerating deployment cycles. Meanwhile, cybersecurity specialists are partnering with telecommunications companies to secure trackside connectivity networks and cellular-based monitoring solutions. Together, these initiatives reflect a shift toward more agile, collaborative models that prioritize ongoing innovation, tighter integration, and continuous evaluation of security posture.

This comprehensive research report delivers an in-depth overview of the principal market players in the Railway Cybersecurity market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Alstom SA

- Atos SE

- Bombardier Inc.

- Booz Allen Hamilton Holding Corporation

- Capgemini SE

- Cisco Systems Inc.

- CyberArk Software Ltd.

- DXC Technology Company

- Fortinet Inc.

- General Electric Company

- Hitachi Ltd.

- Honeywell International Inc.

- IBM Corporation

- Kaspersky Lab

- Leidos Holdings Inc.

- Microsoft Corporation

- Nokia Corporation

- Palo Alto Networks Inc.

- Raytheon Technologies Corporation

- Siemens AG

- Thales Group

- Unisys Corporation

- Wabtec Corporation

Formulating Pragmatic Strategies Empowering Railway Operators and Technology Providers to Enhance Cyber Resilience and Operational Continuity

Industry leaders must enact pragmatic strategies that balance technological advancement with operational imperatives. First, railway operators should implement a multilayered defense architecture that integrates network segmentation, endpoint protection, and continuous monitoring to create overlapping security zones. Concurrently, investing in threat intelligence programs and forging partnerships with government agencies will enhance visibility into adversary tactics and enable proactive countermeasures.

In addition, organizations should prioritize regular training and awareness initiatives for both technical and non-technical staff. By embedding cybersecurity best practices into maintenance routines, ticketing operations, and customer service workflows, stakeholders can cultivate a stronger security culture across all levels. Furthermore, leveraging professional services and system integrators to conduct periodic red team exercises and vulnerability assessments will illuminate hidden weaknesses and validate incident response plans. Ultimately, by aligning governance frameworks with industry standards, fostering cross-functional collaboration, and orchestrating strategic technology deployments, railway operators can elevate their cyber resilience and secure long-term operational continuity.

Outlining Rigorous Research Approaches Data Collection Frameworks and Analytical Techniques Underpinning Insights into Railway Cybersecurity Trends

This research synthesizes insights derived from a rigorous methodology combining primary and secondary data. In-depth interviews with railway infrastructure managers, cybersecurity practitioners, and technology vendors provided qualitative perspectives on evolving threat landscapes and defensive best practices. These dialogues were complemented by a structured survey disseminated across freight, passenger, and infrastructure segments to quantify key risk factors and deployment preferences.

Secondary sources, including industry white papers, regulatory documentation, and vendor technical briefs, were analyzed to contextualize primary findings and validate emerging trends. The data collection process adhered to strict quality controls, leveraging cross-validation techniques and triangulation to ensure accuracy. Analytical methodologies encompassed thematic analysis for qualitative inputs and statistical trend mapping for survey data. This hybrid approach enabled a comprehensive understanding of both strategic imperatives and operational realities, delivering actionable insights tailored to the complex dynamics of railway cybersecurity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Railway Cybersecurity market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Railway Cybersecurity Market, by Security Type

- Railway Cybersecurity Market, by Deployment Mode

- Railway Cybersecurity Market, by End User

- Railway Cybersecurity Market, by Service Model

- Railway Cybersecurity Market, by System

- Railway Cybersecurity Market, by Component Type

- Railway Cybersecurity Market, by Region

- Railway Cybersecurity Market, by Group

- Railway Cybersecurity Market, by Country

- United States Railway Cybersecurity Market

- China Railway Cybersecurity Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesis of Core Findings and Strategic Imperatives Guiding Future Investments and Collaborative Efforts in Railway Cybersecurity Ecosystems

In synthesizing core findings, three strategic imperatives emerge as foundational to enhancing railway cybersecurity. First, the seamless integration of advanced analytics and threat intelligence into operational workflows is essential for early detection and rapid response. Second, a modular segmentation approach across security domains, deployment modalities, and end-user verticals ensures that defenses remain adaptive to evolving risk profiles. Third, collaborative engagement among operators, technology vendors, and regulatory bodies strengthens supply chain resilience and fosters a unified defense posture.

Looking ahead, the industry must remain vigilant to the dual challenge of accelerating digital transformation and intensifying cyber threats. By grounding investment decisions in robust segmentation analyses, regional considerations, and competitive benchmarking, stakeholders can optimize their security roadmaps. Ultimately, a commitment to continuous improvement, driven by evidence-based research and cross-sector collaboration, will guide the railway sector toward a more secure and resilient future.

Engage Directly with Ketan Rohom to Unlock Comprehensive Research Insights and Secure Executive-Grade Railway Cybersecurity Intelligence for Informed Decisions

To explore the full breadth of findings and gain a competitive edge in securing railway operations against evolving cyber threats, connect with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). He will guide you through tailored report packages, enabling your organization to benefit from exclusive data, detailed case studies, and practical best practices that drive tangible improvements. Reach out to arrange a personalized discussion, secure your access to premium intelligence, and shape the future of railway cybersecurity strategies today.

- How big is the Railway Cybersecurity Market?

- What is the Railway Cybersecurity Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?