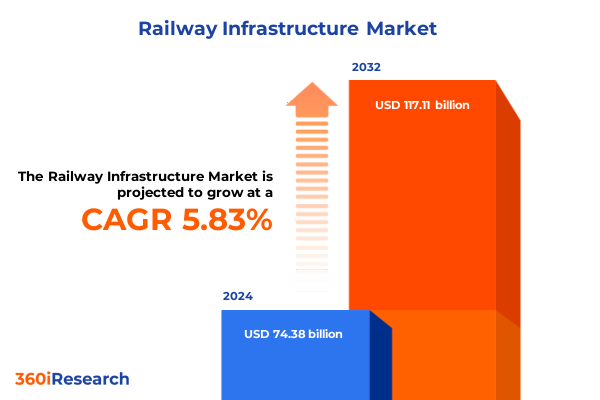

The Railway Infrastructure Market size was estimated at USD 75.45 billion in 2025 and expected to reach USD 80.96 billion in 2026, at a CAGR of 9.36% to reach USD 141.22 billion by 2032.

Unveiling the strategic imperatives driving railway infrastructure evolution across North America and global markets with a focus on innovation and resilience

The railway infrastructure sector stands at a pivotal juncture where innovation, resilience, and strategic investment converge to shape future mobility. As urban populations swell and sustainability targets tighten, networks are being reimagined to support higher speeds, greater capacities, and reduced environmental footprints. This dynamic environment demands a holistic understanding of evolving technologies from digital signaling to advanced track systems, as well as the policy frameworks that underpin funding and regulatory approvals. The United States Infrastructure Investment and Jobs Act has unlocked unprecedented capital for track renewal, station upgrades, and network electrification, while global commitments to carbon neutrality continue to drive investment in zero-emission traction and renewable energy integration.

With a complex web of public and private stakeholders, industry leaders must navigate competing priorities-balancing lifecycle costs against performance imperatives, ensuring supply chain resilience in the wake of pandemic disruptions, and deploying digital tools for predictive maintenance. Today’s projects leverage Internet of Things–enabled sensors, real-time analytics platforms, and remote inspection vehicles to drive safety, reliability, and cost efficiency. Against this backdrop, a strategic approach is essential: one that recognizes how shifting passenger behaviors, freight demands, and regulatory landscapes intersect to influence every aspect of railway infrastructure planning and execution.

Exploring the transformative shifts reshaping the railway infrastructure landscape through digitalization, sustainability, and evolving mobility patterns

The railway infrastructure landscape has been fundamentally transformed by several converging trends. Rapid digitalization now underpins control systems, enabling communications-based train control to optimize headways and enhance network throughput. Meanwhile, sustainability initiatives are accelerating adoption of green technologies-ranging from hydrogen fuel cells and battery-hybrid locomotives to solar-powered stations and recycled ballast materials. Changing mobility patterns, driven by urban densification and shifting commuter expectations, have prompted transit agencies to explore novel solutions like on-demand shuttles and integrated multimodal hubs to complement traditional rail services.

Moreover, the pursuit of resilience has spurred deployment of advanced monitoring technologies. Track inspection vehicles equipped with ultrasound flaw detectors and machine-vision systems are detecting defects earlier in the lifecycle, reducing downtime and enhancing safety. Simultaneously, electrification systems are evolving from conventional overhead catenary designs into compound catenaries that support ultrahigh-speed rail, while power substations leverage digital transformers and automated switchgear for optimized load balancing. These transformative shifts underscore an industry in flux-one that requires decision-makers to reassess legacy platforms, embrace digital twins, and craft modular infrastructures that can adapt to regulatory changes and emerging use cases without extensive capital outlays.

Analyzing the cumulative impact of United States 2025 tariffs on railway infrastructure supply chains, procurement costs, and strategic supplier adaptations

In 2025, a new wave of U.S. tariffs affected critical inputs in railway construction, most notably imposing additional duties on steel, aluminum, and signaling equipment imports. These measures, building on earlier Section 232 actions, were designed to protect domestic producers but have also elevated procurement costs and complicated long-term contracting. Rail operators and infrastructure contractors have had to renegotiate supplier agreements, diversify sourcing strategies, and absorb higher tariffs on fabricated track components and overhead catenary assemblies.

Consequently, project timelines have been extended as lead times for key sub-systems-such as ETCS level 2 signaling modules and concrete sleepers-grew in response to supply chain reconfigurations. Some stakeholders have mitigated these impacts by nearshoring fabrication facilities and partnering with domestic steel mills to leverage existing tariffs exemptions. Nonetheless, the cumulative effect has been a heightened focus on total cost of ownership, driving renewed interest in slab track solutions that reduce maintenance cycles and in direct-fastening systems that decrease installation times. Looking ahead, infrastructure planners are factoring in tariff volatility when setting contract durations, aligning procurement windows with anticipated policy reviews to stabilize budgets and minimize exposure to sudden rate adjustments.

Deriving segmentation insights spanning track infrastructure, signaling and control, electrification systems, station and yard, tunnel and bridge, and maintenance

In-depth segmentation analysis reveals nuanced opportunities and challenges across the railway infrastructure spectrum. Within track infrastructure, ballasted track solutions-comprising concrete sleepers and timber sleepers-continue to dominate regional corridors due to lower installation costs, whereas slab track systems featuring direct fastening and embedded fastener variants are gaining traction on high-speed lines for their long-term stability. Additionally, signaling and control modernization is underscored by a migration from legacy PTC installations toward communications-based train control and multi-level ETCS deployments, which range from Level 1 on mixed-traffic routes to Level 3 where continuous train integrity monitoring is critical.

Electrification equipment segmentation highlights the robustness of overhead catenary networks, which employ both compound and single catenary designs to accommodate varying speed profiles, while power substations are being retrofitted with digital switchgear for smarter grid integration. Complementing these trends, station and yard infrastructure enhancements are centered on next-generation passenger information systems, island platform expansions, side platform realignments, and advanced security systems that employ AI-driven surveillance. In the corridor expansion segment, tunnel and bridge upgrades leverage both concrete and steel bridge structures alongside bored tunnel and cut-and-cover tunnel methodologies to negotiate challenging terrain. Lastly, proactive maintenance and testing equipment-including high-precision grinding machines, dedicated track inspection vehicles, and ultrasound flaw detectors-are being integrated into comprehensive asset management strategies to lower lifecycle costs and improve network reliability.

This comprehensive research report categorizes the Railway Infrastructure market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Infrastructure Component

- Rail Service Network

- Traction Power System

Highlighting critical regional insights across the Americas, Europe Middle East Africa, and Asia-Pacific as drivers of railway infrastructure innovation

Regional dynamics play a pivotal role in shaping railway infrastructure investments and innovation trajectories. In the Americas, significant federal funding has catalyzed large-scale rehabilitation projects on aging freight and passenger corridors, while city transit agencies invest in digital signaling upgrades to accommodate growing urban ridership. The North American market is characterized by collaborative public-private partnerships that emphasize job creation and domestic manufacturing content, alongside a strong regulatory framework that prioritizes safety and interoperability.

Moving across Europe, the Middle East, and Africa, the emphasis shifts toward high-speed network expansions and cross-border interoperability initiatives. European operators are piloting hydrogen-powered regional trains under the EU’s Fit for 55 carbon reduction agenda, while Middle Eastern nations deploy cutting-edge automated systems to connect new economic zones. Africa’s phased electrification programs, often funded through multilateral development banks, focus on enhancing freight capacity for mineral transport and linking remote regions through modern rail links.

In the Asia-Pacific region, rapid urbanization and robust industrial growth have driven billions in track extensions, metro network rollouts, and bridge-tunnel projects. Governments in China and India lead with domestic manufacturing of sleepers, rails, and signaling hardware, whereas Southeast Asian markets increasingly leverage turnkey EPC contracts for integrated station and yard infrastructure solutions. Together, these regional profiles underscore the importance of tailoring investment strategies to local policy environments, funding models, and technology maturity levels.

This comprehensive research report examines key regions that drive the evolution of the Railway Infrastructure market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unpacking the strategic priorities and innovation trajectories of leading companies shaping the global railway infrastructure ecosystem

Leading companies are driving the railway infrastructure sector forward through targeted investments and collaborative innovation. A prominent rolling stock manufacturer has expanded its portfolio to include turnkey track systems, leveraging economies of scale to offer integrated ballasted and slab track packages. Similarly, a global automation specialist is embedding artificial intelligence into its CBTC platforms, enabling predictive congestion management and autonomous train operations. Another key player in signaling has introduced multi-protocol ETCS solutions that facilitate seamless transitions between Level 1, Level 2, and Level 3 operations, meeting varied regional certification standards.

In the electrification domain, a power systems leader has rolled out digital substations with real-time fault detection and remote diagnostics, while a traction components provider has commercialized next-generation compound catenary assemblies designed to reduce aerodynamic drag at high speeds. Station and yard innovators are co-developing smart surveillance networks and passenger information displays with edge-computing capabilities, improving safety and user experience. Meanwhile, leading bridge and tunnel specialists are pioneering modular precast segments and advanced ground-penetrating radar techniques for accelerated construction timelines. In the maintenance equipment arena, select firms are launching autonomous track inspection vehicles equipped with LiDAR and ultrasound sensors, offering continuous condition monitoring to minimize service disruptions. Collectively, these companies exemplify how integrated solutions and cross-sector partnerships are elevating performance benchmarks across the global rail sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Railway Infrastructure market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Administrador de Infraestructuras Ferroviarias

- Alstom SA

- Aurizon LTD

- Australian Rail Track Corporation

- Bechtel Corporation

- BNSF Railway Company

- Canadian National Railway Company

- Central Japan Railway Company

- China Railway Corporation

- CSX Transportation

- Deutsche Bahn AG

- FS Group

- Kansas City Southern Railway

- Kawasaki Heavy Industries

- Kiewit Corporation

- National Railroad Passenger Corporation

- Network Rail Infrastructure Limited

- Norfolk Southern Corp

- Siemens AG

- Skanska AB

- SNCF Group Foundation

- The Walsh Group

- Union Pacific Railroad Company

Formulating actionable recommendations to guide industry leaders in capitalizing on technological innovation, supply chain resilience, and growth strategies

Industry leaders must prioritize a multifaceted approach to maintain competitiveness and drive value creation. First, accelerating digital transformation in signaling and control systems is paramount; integrating edge analytics and cloud-native platforms will enhance capacity utilization and enable real-time decision-making. Concurrently, diversifying supply chains through geographic nearshoring and dual-sourcing arrangements can hedge against tariff volatility and component shortages.

Furthermore, investing in modular design principles for track and station components can significantly cut construction timelines and facilitate future scalability. Companies should also embed cybersecurity best practices into IoT-enabled assets, safeguarding critical communication networks from escalating threat vectors. In parallel, collaborating with materials science experts to adopt longer-lasting sleeper technologies and recycled ballast compositions will align sustainability objectives with lifecycle cost reductions. Finally, establishing cross-industry consortia to pilot emerging technologies-such as hydrogen traction, automated inspection drones, and digital twin modeling-can accelerate validation cycles and pave the way for widescale deployment.

Detailing the robust research methodology encompassing primary interviews, secondary data analysis, and rigorous validation techniques ensuring data integrity

The research underpinning this report employed a rigorous, multi-layered methodology to ensure data integrity and relevance. Initially, a comprehensive secondary research phase reviewed industry white papers, regulatory filings, and technical journals to map key trends and technological benchmarks. Publicly available government reports and infrastructure funding announcements provided a foundational understanding of regional investment frameworks, while OEM and supplier disclosures detailed product roadmaps and patent pipelines.

Building on this, primary research consisted of in-depth interviews with senior executives from rail operators, engineering procurement and construction firms, signaling integrators, and material suppliers. These conversations elucidated strategic priorities, procurement challenges, and anticipated technology adoption timelines. Data triangulation techniques cross-verified insights against project tenders, contract awards databases, and benchmarking studies. Finally, internal validation workshops with domain specialists ensured consistency, resolved discrepancies, and refined quantitative categorizations, resulting in a robust, fact-checked analysis of the global railway infrastructure landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Railway Infrastructure market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Railway Infrastructure Market, by Infrastructure Component

- Railway Infrastructure Market, by Rail Service Network

- Railway Infrastructure Market, by Traction Power System

- Railway Infrastructure Market, by Region

- Railway Infrastructure Market, by Group

- Railway Infrastructure Market, by Country

- United States Railway Infrastructure Market

- China Railway Infrastructure Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 3657 ]

Concluding synthesis of critical insights into railway infrastructure dynamics, emphasizing strategic direction and emergent opportunities for stakeholders

This executive summary has distilled the most significant trends, challenges, and strategic imperatives defining modern railway infrastructure development. By examining transformative digital and sustainable innovation, assessing the ramifications of recent tariff policies, and unpacking granular segmentation insights, stakeholders gain a holistic view of where the industry is headed. Regional analysis highlights the diversity of investment models and technology priorities, while company profiles reveal how market leaders are orchestrating cross-functional collaborations to elevate performance and cost-effectiveness.

As networks become smarter, greener, and more interconnected, the imperative for data-driven decision-making and agile procurement strategies will only intensify. Armed with these insights and recommendations, industry leaders are well positioned to refine their capital plans, optimize supply chains, and deploy next-generation solutions that deliver both immediate returns and long-term resilience. The rail sector’s evolution promises to unlock new corridors of economic growth, sustainability achievements, and enhanced mobility experiences for millions of passengers and freight customers alike.

Compelling invitation to collaborate with Ketan Rohom Associate Director Sales and Marketing for exclusive access to railway infrastructure research insights

To unlock the full potential of these in-depth insights and align your strategic roadmap with the evolving railway infrastructure landscape, reach out directly to Ketan Rohom, the Associate Director of Sales and Marketing. Ketan’s expertise can guide you through tailored options, ensuring that your organization gains exclusive access to the comprehensive research findings and actionable data sets required to outpace competitors and drive sustainable growth. Engage today to leverage personalized advisory, explore bespoke reporting formats, and secure the analytical edge needed to navigate regulatory complexities, optimize procurement strategies, and capitalize on emerging opportunities in this dynamic sector.

- How big is the Railway Infrastructure Market?

- What is the Railway Infrastructure Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?