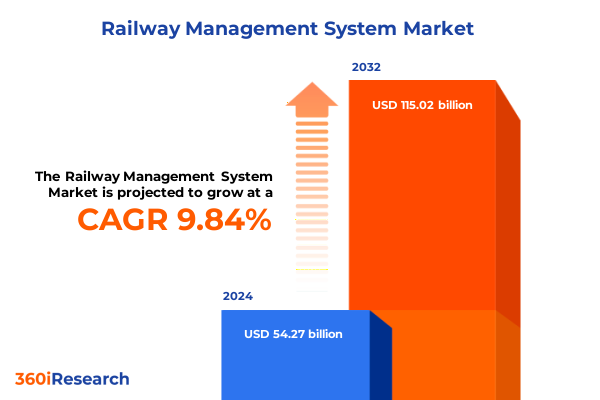

The Railway Management System Market size was estimated at USD 59.73 billion in 2025 and expected to reach USD 64.82 billion in 2026, at a CAGR of 9.81% to reach USD 115.02 billion by 2032.

Pioneering a New Era in Railway Management Systems with Cutting-Edge Innovation to Drive Operational Excellence and Passenger Experience

Railway management systems are rapidly evolving from reactive maintenance frameworks to proactive, data-driven platforms that integrate operational and passenger-facing functions. As transportation networks contend with aging infrastructure, heightened safety mandates, and rising customer expectations, there is an intense focus on systems that can seamlessly coordinate signaling, asset health monitoring, scheduling, and ticketing. This shift is underpinned by the proliferation of sensor technologies and the emergence of robust communication networks, enabling real-time visibility across rolling stock and trackside assets. By leveraging these capabilities, railway operators can reduce unplanned downtime, optimize resource allocation, and elevate service reliability. The integration of automated scheduling tools and mobile ticketing modules further enhances the end-user experience by reducing friction and ensuring timely information delivery.

In this context, digital twins have emerged as a transformative asset management strategy, creating virtual replicas of tracks and trains to simulate scenarios and predict maintenance requirements accurately. These digital models align with sensor-generated data streams to flag anomalies and forecast equipment failures before they occur, thereby safeguarding continuity of service and passenger safety. Simultaneously, artificial intelligence–driven predictive maintenance solutions now employ machine learning to analyze vast diagnostic datasets, pinpointing fault precursors with precision and enabling targeted interventions that minimize operational disruptions. As a result, railway stakeholders are moving beyond isolated technology pilots toward fully integrated platforms that unify maintenance, operations, and customer engagement under a single digital umbrella.

Navigating the Transformative Landscape of Digitalization, Sustainability, and Intelligent Automation Reshaping Railway Management Systems Worldwide

The railway industry is undergoing a profound transformation characterized by the convergence of digitalization, sustainability imperatives, and automation. Across global networks, the deployment of Internet of Things sensors, edge computing, and cloud-native architectures is redefining how infrastructure is monitored and maintained. By embracing digital twins, operators can conduct comprehensive simulations of rail assets, optimizing both long-term infrastructure investments and day-to-day operational adjustments with unprecedented granularity. These virtual models not only support dynamic capacity management but also enable scenario planning for maintenance schedules, ensuring safety and reliability even under peak demand conditions.

Parallel to this, artificial intelligence algorithms are being embedded within platform ecosystems to enhance fault detection and streamline decision making. Machine learning protocols leverage a constant influx of real-time data from track inspections and rolling stock diagnostics to anticipate equipment degradation patterns. This proactive stance on maintenance transcends traditional time-based servicing, reducing unplanned outages and extending asset lifecycles. Moreover, the transition toward green operations has accelerated investments in energy-efficient propulsion systems and regenerative braking technologies, aligning railway modernization efforts with stringent carbon reduction targets adopted in multiple jurisdictions. By coupling sustainability with automation and digital integration, rail operators are charting a new path toward resilient, cost-effective, and environmentally conscious transport networks.

Revealing the Ripple Effects of United States Tariff Measures on the Operational and Strategic Dynamics of Railway Management Systems and Freight Flow

Recent tariff adjustments imposed by the United States have significantly impacted the cost structures and procurement strategies within railway management solutions. As of February 1, 2025, the imposition of 25% tariffs on imports from Canada and Mexico and 10% tariffs on imports from China has prompted freight rail operators and system integrators to reevaluate cross-border sourcing strategies and contractual commitments. This change has driven an increase in domestic procurement initiatives and has heightened the emphasis on local manufacturing partnerships to mitigate exposure to fluctuating trade policies. Consequently, companies are recalibrating supply agreements to include clauses that address potential tariff escalations and cost pass-through mechanisms.

Additionally, the expansion of Sec. 232 tariffs on steel and aluminum imports, which took effect on March 12, 2025, has extended duty coverage to derivative products critical for rail infrastructure development, including signaling hardware and maintenance equipment. The resulting increase in input costs has led operators to renegotiate long-term maintenance contracts, secure price lock-ins, and explore alternative materials where feasible. Moving forward, strategic sourcing decisions will likely revolve around a balance between tariff risk management and operational integrity, underscoring the growing need for resilient supply chain frameworks within the railway sector.

Unlocking Deeper Perspectives Through Comprehensive Segmentation of Applications, Systems, Components, Deployments, and End Users in Railway Management Solutions

Comprehensive segmentation analysis unveils nuanced insights into how different facets of railway management systems are coalescing to meet diverse operational needs. When examined by the nature of applications, asset management spans critical functions such as rolling stock oversight and track inspection, with data analytics branching into customer insights and operational performance optimization. Predictive maintenance, once limited to condition monitoring, now harnesses advanced AI analytics, remote diagnostics, and algorithm-driven prognostics to anticipate component failures before they disrupt service. Meanwhile, signaling systems are experiencing a paradigm shift as automatic train control, traffic management, and sophisticated train protection suites converge to enable higher frequencies and improved safety. Ticketing solutions have also evolved, transitioning seamlessly across e-ticketing interfaces, mobile ticketing platforms, and contactless smart card deployments.

Different system types-from commuter rails to high-speed corridors, freight networks, and urban transit-are each demanding tailored management frameworks that reflect their unique operational tempo and regulatory contexts. The lines between hardware, software, and service components are increasingly blurred as integrated solution providers offer end-to-end packages that include installation, training, and lifecycle support. Hybrid deployment models are gaining traction, enabling cloud-based scalability while retaining on-premise controls for sensitive operations and honoring public, private, and community cloud distinctions. End users such as freight operators and passenger carriers are seeking specialized maintenance partnerships, whether through bulk cargo logistics or intermodal transport integrations, while a growing cohort of maintenance providers offers both corrective and predictive service portfolios to address the full spectrum of operational challenges.

This comprehensive research report categorizes the Railway Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Component

- Deployment Model

- Application

- End User

Decoding Regional Dynamics Shaping the Future Trajectory of Railway Management Systems Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics are reshaping the competitive contours of railway management systems around the world. In the Americas, the integration of cross-border freight corridors with automated signaling upgrades and enhanced digital ticketing has accelerated, driven by substantial infrastructure investments in North America and the need to modernize aging rail networks. The U.S. market specifically has witnessed a surge in digital interlocking and remote diagnostics contracts, underscoring an emphasis on reliability and operational flexibility.

Across Europe, the Middle East, and Africa, regulatory harmonization and sustainability mandates are guiding digital transformation initiatives. Framework agreements for signaling modernizations, including widespread European Train Control System deployments and cloud-based traffic management solutions, illustrate the region’s commitment to safety and interoperability. In parallel, Asia-Pacific’s rapid urbanization and high-speed rail expansions have spurred the adoption of real-time passenger information systems and predictive maintenance platforms. Notably, landmark projects such as the integration of digital display boards across thousands of coaches in India highlight the region’s appetite for smart mobility solutions that enhance the passenger experience and operational efficiency.

This comprehensive research report examines key regions that drive the evolution of the Railway Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Visionaries Driving Advancements in Railway Management Systems Through Cutting-Edge Technologies and Collaborations

Leading technology providers are intensifying their efforts to deliver transformative railway management solutions that span signaling, asset intelligence, and passenger services. Alstom continues to expand its global footprint, having secured a contract to modernize Madrid’s Circle Line with a state-of-the-art CBTC system that transitions the network to fully driverless operation, underscoring its leadership in signaling and metro automation. Concurrently, Alstom’s long-term framework agreement with Deutsche Bahn for digital interlocking and train safety integration exemplifies how comprehensive digitalization projects are being structured to deliver scalability and execution certainty across multiple national corridors.

Siemens Mobility is also driving innovation through strategic wins, including a share of a €2.8 billion contract to supply advanced control and safety technology to Deutsche Bahn, showcasing its deep expertise in digital control equipment and Smart Asset Suite offerings. The introduction of battery-powered multi-system locomotives and cloud-based signaling platforms highlights Siemens’ commitment to sustainable, interoperable solutions. Meanwhile, Hitachi Rail is making significant strides in predictive maintenance with the launch of its HMAX digital asset management platform, leveraging AI at the edge to deliver real-time diagnostic insights and automated maintenance workflows that enhance network reliability and safety. Collectively, these major players are forging partnerships and investing in R&D to shape the next generation of railway management ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Railway Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Advantech Co., Ltd.

- Alstom SA

- Cisco Systems, Inc.

- Fujitsu Limited

- General Electric Company

- Hitachi, Ltd.

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- Indra Sistemas SA

- International Business Machines Corporation

- ITK Engineering GmbH

- Kontron AG

- LS ELECTRIC Co., Ltd.

- MiTAC Information Technology Corp.

- Mitsubishi Electric Corporation

- Railistics GmbH

- Robert Bosch GmbH

- Schaltbau Holding AG

- Schnieder Electric SE

- Siemens AG

- Sierra Wireless by Semtech Corporation

- SMART Railway Technology GmbH

- Tech Mahindra Limited

- Teldat Group

- Telefonaktiebolaget LM Ericsson

- Toshiba Corporation

- Voestalpine AG

- Vossloh AG

- Wabtec Corporation

- ZF Friedrichshafen AG

Empowering Industry Leaders with Actionable Strategies to Enhance Resilience, Digitization, and Competitive Edge in Railway Management Ecosystems

Industry leaders should embrace a multi-pronged approach to navigate emerging complexities and capitalize on growth opportunities. First, investing in hybrid cloud infrastructures enables the fusion of on-premise operational control with scalable analytics capabilities, ensuring data sovereignty while unlocking advanced AI-driven insights. This balanced deployment model also permits rapid scaling of predictive maintenance algorithms without compromising local security requirements. Next, fostering strategic alliances with domestic manufacturing partners can mitigate tariff risks and reduce lead times, particularly for critical hardware components such as signaling relays and track sensors. Formalizing these partnerships through flexible contractual terms will enable supply chain resilience in the face of evolving trade policies.

Additionally, railway operators must prioritize interoperability and standardization across signaling and communication protocols. Adopting open-architecture systems built on established frameworks like ETCS and ATO promotes vendor neutrality and facilitates seamless cross-border operations. Coupling these standards with rigorous cybersecurity protocols will safeguard digital ecosystems against emerging threats. Equally important is developing a cohesive training and change management plan that equips frontline personnel with the skills to leverage new digital tools effectively. Structured upskilling programs and operator certifications will ensure smooth technology adoption and maximize return on investment.

Finally, continuous feedback loops between operations teams, technology providers, and regulatory authorities are vital to refine digital strategies and adapt to shifting market and policy dynamics. By embedding data-driven governance models and iterative performance reviews, industry leaders can sustain a culture of innovation, ensuring their railway management systems remain agile and resilient.

Outlining Rigorous Research Methodology Combining Primary Insights, Secondary Data Analysis, and Expert Validation for Railway Management Systems Intelligence

This analysis is founded on a rigorous research methodology comprising both primary and secondary data sources. Primary insights were gathered through structured interviews with industry executives, operational managers, and technical specialists across leading rail operators and system integrators. These discussions provided firsthand perspectives on technology adoption patterns, procurement strategies, and operational challenges. Secondary analyses leveraged an extensive review of corporate press releases, industry reports, regulatory filings, and peer-reviewed publications. Publicly available sources from major technology providers, transportation agencies, and trade associations were systematically examined to ensure comprehensive coverage of market developments and technological trends.

Data triangulation techniques were employed to validate findings and reconcile discrepancies between various information streams. Quantitative data points, such as contract values and technology deployment figures, were cross-verified with multiple reputable sources. Qualitative insights, including stakeholder perspectives on implementation hurdles and best practices, were synthesized into thematic narratives to elucidate overarching trends. Throughout the research process, expert advisory panels were consulted to review draft findings and provide critical feedback, enhancing the reliability and relevance of the final analysis. Strict adherence to ethical research standards ensured that proprietary data were respected and properly attributed.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Railway Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Railway Management System Market, by System Type

- Railway Management System Market, by Component

- Railway Management System Market, by Deployment Model

- Railway Management System Market, by Application

- Railway Management System Market, by End User

- Railway Management System Market, by Region

- Railway Management System Market, by Group

- Railway Management System Market, by Country

- United States Railway Management System Market

- China Railway Management System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Strategic Insights to Illuminate the Path Forward for Next-Generation Railway Management Systems in a Rapidly Evolving Industry

In summary, the railway management systems landscape is being reshaped by the integration of digital twins, AI-driven predictive maintenance, cloud-enabled deployments, and robust signaling frameworks. Operators that strategically align their technology roadmaps with sustainable operational practices will be best positioned to deliver safe, efficient, and customer-centric services. The recent application of tariffs underscores the importance of supply chain resilience and strategic sourcing, while regional dynamics continue to drive differentiated adoption patterns across the Americas, EMEA, and Asia-Pacific.

Leading technology providers are responding with comprehensive digital portfolios, from Alstom’s driverless metro solutions and Siemens Mobility’s Smart Asset Suite to Hitachi Rail’s HMAX platform. By fostering strategic partnerships, prioritizing interoperability, and investing in workforce enablement, rail operators can harness these innovations to realize tangible performance gains. Looking forward, the convergence of advanced analytics, automation, and green technologies promises to define the next frontier of railway management, reinforcing the sector’s role as a backbone for sustainable economic growth and seamless mobility.

Take Proactive Steps Today to Secure Your Railway Management Systems Market Research Insights and Partner with Ketan Rohom to Drive Growth and Innovation

Ready to transform your railway operations with unparalleled insights and strategic guidance? Contact Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report on Railway Management Systems that will empower you to stay ahead in a competitive landscape. Uncover detailed analyses, actionable recommendations, and expert intelligence tailored to your business objectives. Take the next step toward operational excellence by partnering with Ketan Rohom today and gain the confidence to navigate future challenges and seize emerging opportunities in the rapidly evolving world of railway management.

- How big is the Railway Management System Market?

- What is the Railway Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?