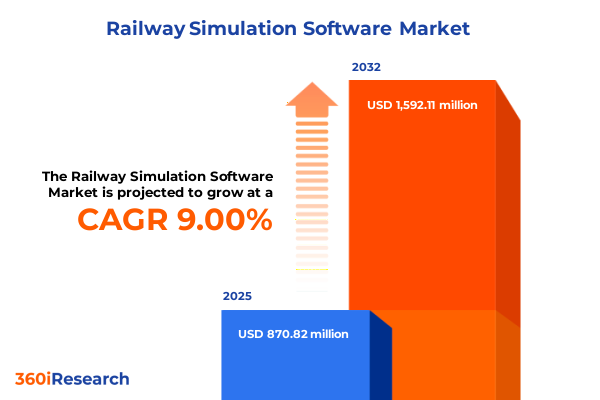

The Railway Simulation Software Market size was estimated at USD 870.82 million in 2025 and expected to reach USD 949.66 million in 2026, at a CAGR of 9.00% to reach USD 1,592.11 million by 2032.

Navigating the Future of Railway Simulation Software with Comprehensive Insights to Drive Operational Excellence and Strategic Decision-Making

In an era where digital transformation reshapes every facet of transportation, railway simulation software emerges as a cornerstone for future-ready operations. These sophisticated platforms enable stakeholders to create virtual environments that mirror real-world rail networks, providing a risk-free arena for testing scenarios from high-speed service rollouts to maintenance drills. This capability not only enhances safety protocols but also empowers decision-makers to optimize resource allocation through simulated stress-testing and what-if analyses.

As evolving regulatory standards and rising passenger expectations converge, the demand for adaptable and scalable simulation solutions intensifies. Rail operators seek integrated systems capable of unifying data streams from signaling, rolling stock telemetry, and workforce schedules into a cohesive model. The resulting digital twin facilitates continuous performance monitoring and predictive insights, thereby reducing unscheduled downtime and strengthening network resilience. This dynamic landscape underscores the imperative for railway organizations to adopt cutting-edge simulation software as part of a broader strategy to maintain competitive advantage and foster sustainable growth.

Examining Key Technological and Operational Transformations Propelling the Railway Simulation Software Market Toward Unprecedented Innovation

The railway simulation software landscape is undergoing a profound metamorphosis driven by breakthroughs in artificial intelligence, cloud computing, and immersive technologies. Machine learning algorithms now analyze terabytes of operational data to predict equipment failures before they occur, enabling condition-based maintenance that minimizes service disruptions. Meanwhile, cloud-native architectures deliver elastic resource provisioning, allowing organizations to spin up large-scale simulations without the constraints of on-premises hardware.

Simultaneously, augmented and virtual reality innovations are reshaping training paradigms for engineers and conductors, delivering immersive learning experiences that accelerate proficiency and reinforce safety habits. This generational shift fosters deeper engagement than traditional classroom methods, equipping personnel with the confidence to navigate complex network scenarios. As automation and real-time monitoring tools converge, railway simulation software evolves from a niche modeling tool into a strategic decision-support system, guiding investments and operational protocols in an increasingly interdependent ecosystem.

Analyzing the Aggregate Effects of 2025 US Tariffs on Supply Chain Costs and Strategic Priorities in Railway Simulation Software

The introduction of new US tariffs in 2025 has reverberated across the railway simulation software value chain, influencing both cost structures and strategic priorities. Increased duties on imported hardware components have elevated the total cost of ownership for simulation labs, prompting organizations to reevaluate capital expenditure plans. Providers of high-fidelity simulation rigs have responded by diversifying supply bases and exploring domestic manufacturing partnerships to mitigate exposure to trade fluctuations.

On the software licensing front, tariffs have indirectly driven interest in cloud-based subscription models, where service providers absorb hardware import costs within managed offerings. This shift accelerates the migration from perpetual licenses to pay-as-you-go frameworks, offering operators greater financial flexibility. Furthermore, procurement teams are now emphasizing vendor resilience, favoring partners with multi-region data centers and localized support networks. Although tariffs present near-term headwinds, they also catalyze innovation in deployment strategies and supplier ecosystems, ultimately reinforcing long-term market adaptability.

Unveiling Strategic Market Segmentation Insights Spanning Applications End Users Deployment Models Train Types and License Categories in Simulation Software

A nuanced examination of railway simulation software market segmentation reveals differentiated growth patterns across applications, end users, deployment models, train types, license structures, and component offerings. Within application domains, operator training emerges as a dominant use case, encompassing immersive augmented reality modules, accessible desktop simulators, and fully virtual reality environments that allow personnel to rehearse emergency protocols and routine maneuvers. Infrastructure design tools complement this by providing specialized platforms for signal system design and track layout optimization, enabling planners to visualize complex network expansions before committing to civil works. Maintenance planning capabilities bifurcate into condition-based schemas that leverage real-time sensor data and scheduled maintenance frameworks grounded in traditional lifecycle models. Meanwhile, operations planning modules refine crew scheduling and timetable optimization, striking a balance between resource utilization and service reliability. Traffic management solutions round out the suite with predictive analytics engines and real-time monitoring dashboards that dynamically adjust train control measures.

End user segmentation underscores the diverse stakeholder ecosystem deploying these solutions. Research centers and universities spearhead methodological innovation, whereas infrastructure developers employ simulation tools to validate large-scale projects. Railway operators harness the full spectrum of modules to enhance service delivery, and rolling stock manufacturers integrate virtual testing environments to accelerate vehicle certification. From a deployment standpoint, organizations must choose between cloud and on-premises configurations. Hybrid deployments blend private and public cloud resources to meet strict data governance requirements while scaling capacity on demand. Pure private cloud offerings cater to operators with stringent cybersecurity mandates, whereas public cloud options appeal to those prioritizing ease of deployment and cost efficiency.

Train type segmentation highlights varied performance metrics. Commuter rail networks value throughput optimization, freight networks focus on load balancing algorithms, high-speed rail requires precision timing simulations, and metro systems demand rapid-response control schemes. License models split into perpetual ownership agreements, suited for operators with established IT budgets, and subscription-based options that range from annual commitments to more flexible monthly arrangements, enabling smaller entities to access enterprise-grade features. Finally, component-level analysis distinguishes comprehensive software and services packages-comprising implementation, support and maintenance, and training services-from standalone software licenses. This differentiation highlights vendor strategies aimed at deepening customer engagement through supplemental service offerings.

This comprehensive research report categorizes the Railway Simulation Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Train Type

- Deployment Model

- Application

- End User

Comparative Regional Dynamics Shaping the Adoption and Evolution of Railway Simulation Software Across the Americas EMEA and Asia-Pacific Markets

Regional dynamics profoundly influence how railway simulation software solutions are adopted and customized, reflecting diverse regulatory environments, infrastructure maturity, and funding mechanisms. In the Americas, a combination of public–private partnerships and national rail modernization initiatives drives investment in digital twin platforms, particularly within the United States where intercity network upgrades are prioritized. Canada’s focus on cross-border freight corridors has spurred demand for advanced traffic management simulations that harmonize operations between jurisdictions. Across Central and South America, resource constraints shape leaner implementations emphasizing cloud-based services to circumvent extensive on-premises capital outlays.

Within Europe, Middle East, and Africa, longstanding rail networks in Western Europe serve as testbeds for integrated simulation suites that blend real-time monitoring with predictive maintenance. European Union regulatory frameworks mandate rigorous safety certifications, compelling operators to adopt comprehensive virtual validation workflows. In the Middle East, rapid urbanization and metro expansions in Gulf Cooperation Council states have fueled demand for turnkey simulation solutions that accelerate project timelines. In Africa, nascent rail corridors present greenfield opportunities where operators favor modular, scalable software to support future network growth.

Asia-Pacific represents the fastest-growing region, underpinned by aggressive high-speed rail programs in China, Japan, and South Korea. Significant capital allocations to bullet train networks emphasize precision modeling for track dynamics and aerodynamic performance. Additionally, metro expansions in India and Southeast Asia amplify the need for dynamic crew scheduling and timetable optimization tools. Cloud deployments gain traction across the region, driven by digital infrastructure initiatives and competitive service offerings from hyperscale providers, further democratizing access to advanced simulation capabilities.

This comprehensive research report examines key regions that drive the evolution of the Railway Simulation Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Industry Players and Their Strategic Innovations Steering the Railway Simulation Software Ecosystem Toward Sustainable Growth

A constellation of specialized software vendors, technology conglomerates, and emerging disruptors drives innovation in the railway simulation software domain. Leading the charge, global mobility engineering firms integrate simulation offerings within broader transportation portfolios, emphasizing digital twin frameworks and end-to-end lifecycle management. Their scale facilitates multi-country deployment capabilities and deep integration with signaling and rolling stock telemetry systems.

Dedicated simulation technology companies differentiate through niche expertise. Some leverage proprietary physics engines to deliver hyper-realistic track and vehicle dynamics, while others pioneer cognitive modeling modules that simulate human factors such as operator behavior and fatigue. Cloud-native pure-play providers prioritize API-led architectures, enabling seamless interoperability with third-party scheduling and asset management platforms. Collaborative ventures between software developers and academic research groups further enrich product roadmaps, infusing the industry with cutting-edge algorithms and new pedagogical approaches to training.

Strategic partnerships, alliances, and selective acquisitions underscore the competitive landscape. Key players are broadening their service portfolios to include professional services, consultancy, and managed simulation-as-a-service, thereby locking in recurring revenue streams and deepening client relationships. As market volumes grow, established vendors face pressure from agile challengers that adopt lean development cycles and customer-driven feature roadmaps. This dynamic fosters a continuous innovation cycle, compelling all competitors to invest in next-generation technologies such as edge computing for real-time simulation at remote sites and blockchain-enabled audit trails for regulatory compliance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Railway Simulation Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alstom SA

- Altair Engineering, Inc.

- ANSYS, Inc.

- AnyLogic Company

- Bentley Systems, Incorporated

- CAE Inc.

- Corys TESS

- Dassault Systèmes SE

- ESI Group Société Anonyme

- FAAC Incorporated

- Hexagon AB

- Hi-SimuX

- Hitachi, Ltd.

- Lander Simulation & Training Solutions

- Mitsubishi Electric Corporation

- MOSIMTEC

- Siemens Mobility GmbH

- Transurb Simulation

Strategic Roadmap for Industry Leaders to Capitalize on Emerging Trends in Railway Simulation Software Through Innovation Partnerships and Operational Excellence

To capitalize on the accelerating evolution of railway simulation software, industry leaders must adopt a multi-pronged strategic roadmap that aligns technological ingenuity with operational imperatives. First, investing in modular, extensible platforms will allow organizations to add functionality iteratively and avoid costly rip-and-replace cycles. These architectures should prioritize microservices and open APIs to future-proof integrations and unlock data synergies across enterprise systems.

Second, embracing artificial intelligence–driven predictive analytics can transform maintenance and operational planning. By integrating machine learning models that detect nascent fault patterns and optimize crew dispatching in real time, operators can achieve measurable reductions in downtime and labor costs. Collaboration with academic institutions and research centers can fast-track algorithm validation and ensure that models remain aligned with field realities.

Third, cultivating strategic partnerships with hyperscale cloud providers and local system integrators will create resilient, geographically distributed infrastructures capable of supporting mission-critical simulations. These alliances should emphasize robust cybersecurity frameworks and compliance with regional data sovereignty requirements. Furthermore, embedding immersive AR/VR training modules within simulation suites can enhance workforce readiness, reduce onboarding times, and reinforce safety protocols through scenario-based drills.

Finally, leaders should establish a dedicated center of excellence to continuously monitor emerging tariffs, regulatory shifts, and technology breakthroughs. This proactive stance, combined with agile procurement strategies, will mitigate geopolitical risks and ensure that simulation investments yield maximum return on investment while positioning organizations at the vanguard of industry innovation.

Transparent Methodological Framework Underpinning the Comprehensive Analysis of the Railway Simulation Software Market Employing Qualitative and Quantitative Techniques

The insights presented in this report rest upon a rigorous research methodology combining both qualitative and quantitative approaches to ensure robust validity. Initially, secondary research encompassed a comprehensive review of industry journals, regulatory filings, conference proceedings, and white papers to establish a foundational understanding of market drivers, technological innovations, and regulatory influences.

Primary research followed, involving structured interviews with senior executives, software architects, and operational planners from rail operators, infrastructure developers, and simulation vendors. These in-depth discussions provided firsthand perspectives on current use cases, pain points, and investment priorities. Concurrently, an online survey collected quantitative data from a larger sample of industry participants, capturing numerical trends related to deployment preferences, licensing models, and regional adoption rates.

Data triangulation played a pivotal role in validating findings, as insights from primary interviews were cross-referenced with survey results and secondary sources. Any discrepancies were addressed through follow-up engagements to clarify data points. The analysis period spans from late 2024 through mid-2025, ensuring timeliness. Key assumptions, such as anticipated software refresh cycles and expected regulatory updates, are documented in the full report along with methodological limitations to maintain transparency and guide interpretation of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Railway Simulation Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Railway Simulation Software Market, by Component

- Railway Simulation Software Market, by Train Type

- Railway Simulation Software Market, by Deployment Model

- Railway Simulation Software Market, by Application

- Railway Simulation Software Market, by End User

- Railway Simulation Software Market, by Region

- Railway Simulation Software Market, by Group

- Railway Simulation Software Market, by Country

- United States Railway Simulation Software Market

- China Railway Simulation Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Market Dynamics and Strategic Imperatives to Guide Stakeholders in Navigating the Evolving Railway Simulation Software Landscape

The railway simulation software market stands at a critical juncture, where technological advancements converge with evolving operational demands to redefine industry benchmarks. Digital twins, AI-driven analytics, and cloud-enabled architectures are no longer optional luxuries but strategic imperatives for organizations seeking to optimize safety, efficiency, and resilience. Regional nuances-from tariff impacts in the United States to high-speed rail proliferation in Asia-Pacific-underscore the need for tailored approaches rather than one-size-fits-all solutions.

Segmentation analysis reveals that diverse application areas, end user requirements, and deployment preferences necessitate modular software suites capable of addressing specific use cases. Simultaneously, competitive dynamics highlight the importance of innovation partnerships and service-oriented business models to sustain growth. By adhering to a clear strategic roadmap-emphasizing platform extensibility, predictive maintenance, immersive training, and agile procurement-industry stakeholders can navigate geopolitical headwinds and regulatory complexities with confidence.

In sum, the synthesis of market dynamics and strategic imperatives outlined in this summary provides a roadmap for senior decision-makers to make informed investments. Embracing these insights will empower organizations to harness the full potential of simulation technology and maintain a competitive edge in an increasingly digital railway ecosystem.

Engage Directly with Ketan Rohom to Unlock Exclusive Insights and Propel Your Strategic Vision With Our Comprehensive Railway Simulation Software Market Report

To explore the in-depth findings and leverage tailor-made strategies for transforming your operations, connect with Ketan Rohom, Associate Director, Sales & Marketing. His expertise in aligning market intelligence with business objectives will ensure you extract maximum value from the comprehensive railway simulation software report. By engaging directly, you gain privileged access to detailed data, customized insights, and strategic guidance designed to address your specific challenges. Don’t miss the opportunity to stay ahead of competitors, optimize investment decisions, and accelerate innovation by partnering with an established thought leader in market research. Secure your copy of the report today and start charting a path to enhanced efficiency, resilience, and growth.

- How big is the Railway Simulation Software Market?

- What is the Railway Simulation Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?