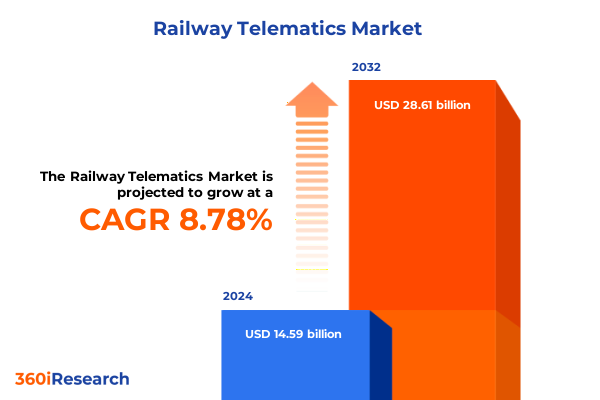

The Railway Telematics Market size was estimated at USD 8.12 billion in 2025 and expected to reach USD 8.72 billion in 2026, at a CAGR of 8.45% to reach USD 14.34 billion by 2032.

Unveiling the Core Landscape of Railway Telematics and Its Critical Role in Revolutionizing Efficiency, Safety, and Connectivity Across Modern Rail Networks

Railway telematics has emerged as a pivotal enabler of efficiency, safety, and operational intelligence in modern rail networks. The concept unites advanced sensors, data analytics, and communication infrastructures to transform static equipment into dynamic, connected assets. This connectivity delivers real-time visibility across rolling stock, infrastructure health, and passenger flows, empowering operators to make informed decisions and preempt service disruptions. As railways worldwide pursue digital transformation agendas, telematics is no longer an optional enhancement but a strategic imperative for sustainable competitiveness.

Over the past decade, rail operators have recognized telematics as the linchpin for unlocking advanced capabilities, from predictive maintenance to automated traffic management. By harnessing onboard units, integrated sensors, and sophisticated software platforms, industry stakeholders can detect anomalies before failures occur, optimize energy usage, and streamline maintenance workflows. This introductory section sets the stage for an in-depth exploration of how telematics is reshaping the railway industry’s operational ethos, accelerating performance metrics, and fostering a data-driven culture.

Examining the Transformative Technological Shifts Driving Next Generation Railway Telematics Through Data, Connectivity, and Intelligent Automation

The railway telematics landscape is undergoing rapid transformation driven by a confluence of emerging technologies. Cloud computing platforms now support scalable data ingestion from thousands of sensors deployed on locomotives and trackside assets, while edge computing capabilities allow for real-time analysis at the source. Artificial intelligence and machine learning algorithms leverage historical and live data to forecast component degradation and optimize maintenance schedules, reducing unplanned downtime. In parallel, the proliferation of Internet of Things (IoT) devices is enabling more granular tracking of asset performance parameters and passenger movement patterns.

Connectivity advancements play a central role in this shift, with 5G and satellite communications offering broader coverage and lower latency than legacy systems. Rail operators are increasingly adopting hybrid communication architectures that blend GSM-R with LTE, satellite links, and Wi-Fi networks to ensure uninterrupted data flow across remote corridors and urban centers. Cybersecurity considerations have also risen to prominence, prompting the deployment of hardened gateways and encryption protocols that safeguard sensitive operational data. Taken together, these transformative shifts are creating a more resilient, automated, and intelligent railway ecosystem.

Analyzing the Cumulative Impact of 2025 United States Tariff Measures on Railway Telematics Supply Chains, Cost Structures, and Market Dynamics

In 2025, United States tariff policies have exerted a profound influence on the global railway telematics supply chain. The imposition and continuation of duties on imported steel, electronics, and telecommunications equipment have inflated the cost of critical hardware components such as onboard units and specialized sensors. These levies have prompted rail operators and equipment vendors to reevaluate procurement strategies, favoring domestic production or nearshoring where possible to mitigate cost pressures and lead-time variability.

Beyond hardware, tariff measures have affected service providers that rely on cross-border expertise for system integration and support. Consulting firms and software integrators have restructured delivery models to account for increased operational expenses, which in some cases has slowed project deployment timelines. Meanwhile, software providers offering asset management, fleet management, and predictive maintenance platforms have absorbed a portion of these costs to remain competitive, yet the cumulative impact continues to drive pricing adjustments. Navigating this tariff environment requires strategic supply chain diversification, collaborative partnerships with local manufacturers, and flexible contracting frameworks to sustain innovation and service quality.

Deriving Strategic Insights from Multi-Dimensional Segmentation to Inform Targeted Railway Telematics Solutions Across Offerings, Applications, and Communication Types

A nuanced understanding of market segmentation reveals where value is concentrated and where innovation can be most effectively applied. When examining the industry based on offering, the hardware segment encompasses essential elements such as onboard units, sensors, and telematics devices, each playing a unique role in capturing operational data. Meanwhile, consulting services, integration services, and support & maintenance offerings form the core of the services segment, ensuring that systems are implemented, optimized, and sustained over time. The software category comprises asset management, fleet management, and predictive maintenance platforms that ingest, analyze, and visualize the data flow from connected hardware.

Shifting focus to application-based segmentation uncovers key use cases such as fleet management, which orchestrates train scheduling and resource allocation, and passenger information systems that enhance traveler experience through real-time updates. Predictive maintenance emerges as a strategic priority, using analytics to forecast failures and plan interventions, while signaling & control applications anchor safety and traffic coordination functions. End-user segmentation identifies target audiences: freight operators prioritize reliability and cargo monitoring, infrastructure managers emphasize track health and capacity planning, maintenance providers seek diagnostic tools to streamline workflows, and passenger operators focus on service quality and punctuality. Communication type segmentation illustrates the technological foundation supporting these applications, spanning dedicated GSM-R networks, high-speed LTE coverage, satellite links for remote routes, and Wi-Fi deployments in station environments.

This comprehensive research report categorizes the Railway Telematics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Communication Type

- Application

- End User

Exploring the Nuanced Regional Dynamics Shaping Railway Telematics Adoption Across the Americas, Europe Middle East Africa, and Asia-Pacific Markets

Regional dynamics shape both the pace of adoption and the technological preferences within the railway telematics sector. In the Americas, North American operators are driving growth through investments in freight monitoring and intermodal connectivity, integrating advanced sensor networks into existing rolling stock fleets. Latin American countries are increasingly adopting telematics as part of broader infrastructure modernization initiatives, with government programs supporting public-private partnerships to deploy predictive maintenance solutions.

Across Europe, Middle East & Africa, regulatory harmonization and interoperability standards underpin pan-continental rail corridors, encouraging adoption of unified communication protocols and asset management frameworks. Operators leverage robust signaling & control systems based on European Rail Traffic Management System (ERTMS) specifications, supplemented by telematics to optimize train spacing and energy efficiency. In Asia-Pacific, high-speed rail expansion and urban transit projects have catalyzed demand for sophisticated fleet management platforms and real-time passenger information services. Governments in the region are incentivizing local manufacturing of hardware components to align with strategic industrial policies and foster technology transfer.

This comprehensive research report examines key regions that drive the evolution of the Railway Telematics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing Key Industry Participants and Their Competitive Strategies to Drive Innovation and Value in the Evolving Railway Telematics Ecosystem

Leading companies in the railway telematics space demonstrate distinct competitive strategies and areas of expertise. One global technology provider has built a comprehensive portfolio that spans onboard hardware, end-to-end system integration, and cloud-based analytics platforms, enabling seamless asset lifecycle management. Another key participant specializes in modular sensor arrays and ruggedized communication devices, targeting both legacy fleets and greenfield projects with scalable, upgradeable solutions. A historic OEM has expanded its telematics capabilities through strategic acquisitions, integrating advanced software suites for fleet optimization into its traditional rolling stock offerings.

Regional champions also contribute to the ecosystem’s diversity. A European supplier has distinguished itself through deep domain knowledge in track monitoring and structural health analysis, partnering with infrastructure managers on predictive maintenance pilot programs. In Asia-Pacific, a network equipment conglomerate leverages its telecom expertise to deliver hybrid connectivity solutions that blend satellite, LTE, and Wi-Fi radios. Collaboration between these established entities and emerging tech firms is fueling co-innovation, wherein startups provide niche AI algorithms for anomaly detection and incumbents offer deployment scale and regulatory experience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Railway Telematics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alstom SA

- Amsted Industries Inc.

- CRRC Corporation Limited

- Hitachi Rail Limited

- Huawei Technologies Co., Ltd.

- Intermodal Telematics B.V.

- Knorr-Bremse AG

- Nexxiot AG

- ORBCOMM Inc.

- Progress Rail Services Corporation

- Robert Bosch GmbH

- Siemens Mobility GmbH

- Thales SA

- Trimble Inc.

- Trinity Industries, Inc.

- Wabtec Corporation

Identifying Actionable Strategic Recommendations for Industry Leaders to Capitalize on Railway Telematics Opportunities and Mitigate Emerging Operational Risks

Industry leaders seeking to capitalize on railway telematics opportunities should prioritize strategic collaboration and data interoperability. Establishing open architecture frameworks that facilitate seamless integration among hardware, services, and software providers will accelerate solution deployment and reduce integration costs. Investing in predictive analytics capabilities, whether through in-house teams or partnerships with specialized vendors, will enable maintenance teams to shift from reactive to proactive workflows, improving fleet availability and reducing lifecycle expenses.

Diversification of the supply chain is critical in the current tariff environment. Leaders should cultivate relationships with domestic and nearshore suppliers of key components to safeguard project timelines and control costs. Embracing interoperable communication standards will future-proof networks as 5G and next-generation satellite services become more prevalent. Finally, operators can gain competitive advantage by embedding cybersecurity best practices into every stage of telematics deployments, from device provisioning to cloud data storage, thereby maintaining stakeholder trust and ensuring regulatory compliance.

Detailing the Rigorous Research Methodology Employed to Ensure Credible, Comprehensive and Actionable Market Intelligence for Railway Telematics Stakeholders

Our research methodology combined extensive secondary research with direct engagement of industry experts. We reviewed technical whitepapers, regulatory documents, and peer-reviewed studies to establish a foundation of publicly available knowledge. This was complemented by primary interviews with senior executives at train operators, infrastructure managers, equipment vendors, and consulting firms to gain nuanced perspectives on adoption barriers, deployment strategies, and technology roadmaps.

Data triangulation was employed to validate findings, cross-referencing company disclosures, industry association reports, and project case studies. Qualitative insights were synthesized alongside quantitative indicators such as fleet counts, retrofit initiatives, and regional infrastructure investment figures. Expert workshops provided a forum to test preliminary conclusions and refine strategic implications, ensuring that our analysis is both comprehensive and actionable. This rigorous approach underpins the credibility of our insights and supports informed decision-making across the railway telematics value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Railway Telematics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Railway Telematics Market, by Offering

- Railway Telematics Market, by Communication Type

- Railway Telematics Market, by Application

- Railway Telematics Market, by End User

- Railway Telematics Market, by Region

- Railway Telematics Market, by Group

- Railway Telematics Market, by Country

- United States Railway Telematics Market

- China Railway Telematics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Critical Takeaways and Strategic Imperatives to Navigate the Future Trajectory of Railway Telematics in an Ever-Evolving Transportation Landscape

In summary, railway telematics stands at the forefront of rail industry transformation, enabling operators to harness data for enhanced reliability, safety, and passenger satisfaction. The convergence of advanced sensors, AI-driven analytics, and sophisticated communication networks is redefining how maintenance, operations, and customer experience are managed. While tariff policies and supply chain complexities present challenges, they also incentivize strategic sourcing and drive technological innovation.

As the industry evolves, success will hinge on collaboration among equipment suppliers, software developers, and service providers, guided by interoperable standards and shared best practices. Companies that adopt a proactive approach to data governance, invest in scalable architectures, and integrate predictive insights into core operations will be well positioned to navigate uncertainties and achieve sustainable performance gains. The insights presented in this report illuminate the strategic imperatives and emerging trends that industry stakeholders must address to lead with confidence in the dynamic railway telematics landscape.

Engaging with Our Senior Sales Lead to Access In-Depth Market Research on Railway Telematics and Propel Strategic Decision Making with Expert Guidance

To explore the full depth of insights and gain a comprehensive understanding of railway telematics dynamics, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. Engaging directly will enable you to tailor the research to your strategic priorities, discuss customized data requirements, and ensure your organization benefits from targeted intelligence. Ketan’s expertise in translating complex industry trends into actionable growth initiatives will streamline your decision-making process and accelerate time-to-value. Reach out to arrange a personalized consultation and secure your copy of the full market research report for an in-depth analysis that empowers your organization to lead with confidence in the evolving railway telematics landscape.

- How big is the Railway Telematics Market?

- What is the Railway Telematics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?