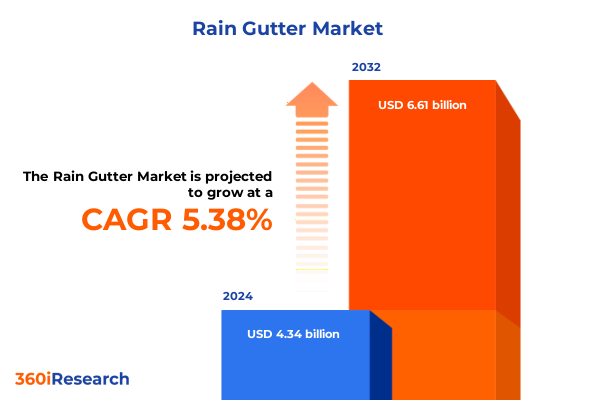

The Rain Gutter Market size was estimated at USD 4.57 billion in 2025 and expected to reach USD 4.80 billion in 2026, at a CAGR of 5.41% to reach USD 6.61 billion by 2032.

Shifting stormwater management priorities and architectural trends underscore growing significance of advanced rain gutter solutions

In an era defined by increased awareness around stormwater management and architectural innovation, the rain gutter market has stepped into the spotlight as a critical component of sustainable building design. Rising occurrences of extreme weather events are prompting builders and property managers to reexamine traditional drainage solutions, driving demand for systems that not only channel rainwater effectively but also contribute to broader water management strategies. Simultaneously, evolving building codes and heightened environmental regulations are elevating the importance of gutter systems that meet stringent performance and sustainability criteria.

Against this backdrop, advancements in material science and manufacturing technology have expanded the scope of what modern rain gutters can achieve. From corrosion-resistant alloys to integrated sensor technology, today’s solutions offer unparalleled durability and intelligence. As the industry continues to adapt to shifting climate patterns and regulatory landscapes, stakeholders across construction, manufacturing, and design disciplines are increasingly recognizing the value of investing in sophisticated gutter infrastructure. This introduction lays the foundation for a deeper exploration into the transformative trends reshaping this dynamic market.

Innovation in materials and smart infrastructure is transforming rain gutter systems into multifunctional, resilient, and sustainable building components

The rain gutter landscape is undergoing a profound metamorphosis driven by both macroeconomic factors and localized demands. On the materials front, manufacturers are prioritizing alloys and composites that deliver superior strength-to-weight ratios, extend service life, and reduce maintenance requirements. Concurrently, smart infrastructure innovations-such as embedded moisture sensors and automated flush systems-are converging with traditional drainage design to enhance real-time monitoring of water flow and system health. These technological integrations not only optimize performance but also open new revenue streams through predictive maintenance services.

Consumer preferences are also steering market dynamics toward sustainability and aesthetic appeal. Architects and homeowners alike favor gutter profiles that complement building facades while minimizing environmental impact. Renewable and recycled material compositions are gaining traction as environmental certifications and green building standards ascend in priority. Bridging these design and performance considerations, industry players are redefining the rain gutter through a convergence of functionality, style, and digital capability.

Recent tariff measures on imported metals and composite materials are reshaping cost structures and supply dynamics for gutter manufacturers in the United States

The cumulative effect of successive tariff actions on imported aluminum, steel, and specialty metals has reverberated across the rain gutter industry, reshaping cost structures and supply chains. Tariffs introduced under Section 232 and supplementary trade measures have elevated raw material prices, compelling US-based manufacturers to absorb increased costs or pass them along to end users. In response, several producers have intensified efforts to source domestically or diversify procurement strategies to mitigate exposure to geopolitical volatility.

Moreover, the tariff environment has galvanized investment in downstream processing facilities within the United States, bolstering local capacity for extrusion, coating, and assembly. Contractors and distributors are adapting contracts to accommodate lead time fluctuations and price variability, while end users are reevaluating project budgets in light of these market dynamics. As a result, the industry is witnessing a recalibration of margins, a rebalancing of import-dependent segments, and an emerging emphasis on vertically integrated operations to safeguard against external shocks.

Diverse product types materials resilience features applications installation methods and channels define the multifaceted landscape of gutter market segmentation

The framework of product types encompasses a broad spectrum, beginning with box gutters that include both concrete and stainless steel variants, and extending to fascia models offered in composite and metallic finishes. Half-round gutters bring options in copper, PVC, and zinc, while K-style systems continue to appeal for their blend of capacity and architectural character. This variety underscores the industry’s responsiveness to architectural demands, from contemporary commercial builds to heritage residential restorations.

Delving deeper, the choice of materials-aluminum, copper, steel, or vinyl-plays a decisive role in performance, longevity, and aesthetic outcome. Weather resilience emerges as a defining characteristic, with impact-resistant, rust-resistant, and UV-resistant classifications guiding specification decisions in harsh climate zones. Application-driven considerations span traditional drainage systems, tailored for flat or sloped roofs, as well as rainwater harvesting networks designed for commercial or domestic use. Installation pathways further diversify the market through new installations offered via professional or DIY channels and by repair and replacement services targeting commercial facades or residential homes. Finally, sales channels ranging from direct to distributor to online platforms intersect with end-use applications across commercial offices, retail spaces, warehouses, industrial factories, logistics centers, and multi-family or single-family homes to create a richly layered market tapestry.

This comprehensive research report categorizes the Rain Gutter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Installation Type

- Gutter Size

- Sales Channel

- Application

- End User

Regional dynamics from the Americas to EMEA and Asia-Pacific reveal distinct growth trajectories driven by climate patterns and construction trends

The Americas exhibit a mature yet evolving rain gutter market shaped by renovation-driven demand in established urban centers and new construction in growth corridors. In regions prone to hurricanes and heavy rainfall, the emphasis on impact-resistant and rust-resistant solutions has intensified. Across North and South America, sustainability mandates and water reuse initiatives are accelerating uptake of advanced harvesting systems, prompting collaborations between local authorities, developers, and manufacturers to integrate integrated drainage and reuse infrastructure.

In Europe, the Middle East, and Africa, legacy architecture coexists with hypermodern urban developments, generating multifaceted specification requirements. Historical preservation efforts in Europe champion materials that honor architectural heritage, while Northern European markets, facing aggressive climate resilience standards, prioritize systems that endure freeze-thaw cycles. Meanwhile, Gulf-region projects leverage corrosion-resistant alloys in coastal environments, and select African corridors are incorporating UV-resistant profiles to address high solar exposure. The interplay of regulatory frameworks and climatic challenges continues to inform product innovation and distribution strategies.

Across Asia-Pacific, rapid urbanization and expanding infrastructure investments are driving robust demand for rain gutter solutions engineered for monsoon conditions and industrial applications. Markets in Southeast Asia and India favor high-throughput K-style and half-round systems, while Australia’s stringent building codes elevate the adoption of locally extruded stainless steel and aluminum profiles. In each sub-region, the convergence of government-led flood mitigation programs and private sector green building certifications fosters a dynamic landscape of product development and market entry.

This comprehensive research report examines key regions that drive the evolution of the Rain Gutter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading companies are pursuing mergers product innovation and sustainability partnerships to secure competitive advantage in the global rain gutter market

Leading industry participants are differentiating through strategic mergers, geographic expansion, and technology partnerships. Several top-tier manufacturers have augmented their portfolios by acquiring specialty extrusion firms or forging alliances with composite innovators to bolster product diversity. This horizontal integration not only enhances scale but also accelerates time-to-market for next-generation solutions incorporating advanced coatings and smart monitoring capabilities.

At the same time, companies are intensifying focus on sustainability credentials, investing in recycled material streams and circular economy initiatives. Strategic collaborations with architectural firms and green certification bodies have resulted in flagship projects that showcase seamless system integration and lifecycle optimization. Moreover, service providers in the aftermarket segment are expanding digital platforms to offer predictive maintenance contracts and remote performance analytics, positioning themselves as one-stop partners for end-to-end gutter management.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rain Gutter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Almesco Limited

- Alumasc Group plc

- American Sheet Metal

- Amerimax by Omnimax International, LLC

- BMI Group

- City Sheet Metal Co. Ltd.

- Cornerstone Building Brands, Inc.

- ENGLERT INC.

- EP FABTECH

- Eurocell plc

- FIRST Corporation, S.r.l.

- Gibraltar Industries Inc.

- Guangzhou NUORAN Building Material Co., Lt

- Guttercrest Inc.

- Hebei Hollyland Co., Ltd.

- KMEW Co., Ltd.

- Les Jones Roofing, Inc.

- Lindab AB

- Phoenix Rain Gutters Arizona LLC

- Ply Gem Residential Solutions by Cornerstone Building Brands, Inc.

- Precision Gutters Ltd.

- Rheinzink GmbH & Co KG

- Royal Building Products by Westlake Corporation Inc.

- Schlüter-Systems KG

- Senox Corporation

- Singer-Ruser(hz) Building Materials Tech.co., Ltd.

- Skyline Enterprises, Inc.

- Spectra Gutter Systems

- Stabilit Suisse SA

- The Fiberglass Gutter Company

- Thompson-Mathis Metal Manufacturing

- Trim-Lok, Inc.

Strategic investments in material innovation digital adoption and sustainable practices can drive growth and resilience for gutter industry leaders

Industry leaders should prioritize investments in novel materials that combine lightweight properties with enhanced corrosion and UV resistance. Deploying digital sensors capable of real-time flow monitoring and predictive maintenance notifications will unlock new service-based revenue models while reducing lifecycle costs for end users. Concurrently, expanding domestic extrusion and processing capabilities can mitigate the impact of external trade measures and strengthen supply chain resilience.

Furthermore, forging strategic partnerships with large-scale construction and infrastructure firms will facilitate turnkey solutions that integrate gutter systems into comprehensive water management portfolios. Embracing omnichannel distribution-balancing direct sales, distributor networks, and e-commerce-ensures broad market access and responsiveness to evolving customer purchasing behaviors. Finally, embracing circular economy principles through recyclable material design and refurbishment programs will resonate with sustainability-focused stakeholders and align with emerging regulatory frameworks.

Methodological approach combining primary interviews extensive secondary research and rigorous data triangulation ensures comprehensive market insights

The research methodology underpinning this analysis combines qualitative and quantitative approaches to deliver robust insights. Primary data stem from in-depth interviews with senior executives at manufacturing, distribution, and contracting firms, complemented by face-to-face consultations with architectural and regulatory experts. These insights are further enriched through surveys of field technicians and end-user feedback, capturing real-world performance and adoption barriers.

Secondary research involved a comprehensive review of trade association publications, government regulatory documents, and specialized engineering journals. Data triangulation was achieved by cross-referencing proprietary shipment and trade flow records with publicly available customs databases. The segmentation framework was validated through a series of expert workshops, ensuring alignment with current industry nomenclature and emerging classification trends. This rigorous approach guarantees that findings reflect both strategic market dynamics and operational realities across the value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rain Gutter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rain Gutter Market, by Product Type

- Rain Gutter Market, by Material Type

- Rain Gutter Market, by Installation Type

- Rain Gutter Market, by Gutter Size

- Rain Gutter Market, by Sales Channel

- Rain Gutter Market, by Application

- Rain Gutter Market, by End User

- Rain Gutter Market, by Region

- Rain Gutter Market, by Group

- Rain Gutter Market, by Country

- United States Rain Gutter Market

- China Rain Gutter Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Concluding synthesis highlights key drivers challenges and strategic imperatives essential for stakeholders navigating the evolving rain gutter market

The analysis reveals a market in the midst of transformative evolution, propelled by shifting climate imperatives, regulatory drivers, and rapid technological advancements. Material innovations and smart infrastructure are converging to redefine performance benchmarks, while tariff-induced supply chain realignments are reshaping competitive dynamics. The segmentation insights underscore the nuanced decision criteria influencing product selection and end-user behavior across distinct applications and channels.

Moving forward, stakeholders who integrate advanced materials, digital capabilities, and sustainable practices into their strategies will be best positioned to capture emerging opportunities. Regional dynamics, from mature Americas markets to growth-focused Asia-Pacific corridors, demand tailored approaches that address local climate challenges and regulatory nuances. By embracing data-driven decision making and forging collaborative partnerships, industry participants can navigate complexity and drive sustainable growth.

Discover unparalleled insights into rain gutter market dynamics and secure your strategic advantage by connecting with Ketan Rohom

Unlock comprehensive strategic intelligence and empower your decision-making by securing access to the complete report. Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide you through the depth and breadth of the analysis. Connect today to explore detailed profiles of industry players, granular segmentation data, and insights into the evolving regulatory landscape tailored to your specific needs.

Partnering with Ketan ensures you receive personalized support in extracting actionable intelligence that aligns with your growth objectives. Whether you seek to enhance supply chain resilience or capitalize on emergent material innovations, the full market research dossier offers the clarity and strategic foresight required to navigate competitive pressures and regulatory shifts. Reach out to Ketan Rohom via professional network channels to purchase the report and propel your organization toward sustained market leadership.

- How big is the Rain Gutter Market?

- What is the Rain Gutter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?