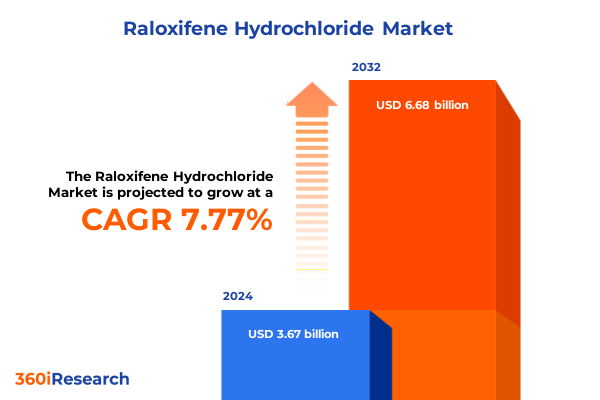

The Raloxifene Hydrochloride Market size was estimated at USD 3.95 billion in 2025 and expected to reach USD 4.26 billion in 2026, at a CAGR of 7.79% to reach USD 6.68 billion by 2032.

Exploring the Critical Role of Raloxifene Hydrochloride in Advancing Women’s Osteoporosis Prevention and Breast Cancer Risk Reduction Strategies

Raloxifene Hydrochloride has emerged as a cornerstone therapy in the management of postmenopausal osteoporosis and as a preventive agent against invasive breast cancer among high-risk women. As a selective estrogen receptor modulator, Raloxifene uniquely combines antagonistic effects in breast tissue with estrogen-agonist activity in bone, resulting in both cancer risk reduction and improved bone mineral density. This dual mechanism underpins its clinical significance and has driven extensive adoption by healthcare professionals seeking alternatives to traditional hormone replacement therapies.

In the United States, the growing prevalence of osteoporosis underscores the importance of effective therapeutics like Raloxifene. Data from the National Health and Nutrition Examination Survey indicate that approximately 12.6% of adults aged 50 and over are affected by osteoporosis, with a marked disparity between women (19.6%) and men (4.4%). Against this backdrop, Raloxifene serves a critical role in reducing fracture risk and enhancing long-term bone health, while simultaneously lowering the incidence of estrogen-receptor positive breast tumors in susceptible populations.

Examining the Transformative Shifts in Selective Estrogen Receptor Modulator Innovations and Market Dynamics Shaping Raloxifene Adoption

Over the past decade, the Raloxifene landscape has been reshaped by a wave of generic approvals and the emergence of digital distribution channels that have democratized patient access. Following the expiry of key patents, multiple generic manufacturers including Amneal, Aurobindo, Cadila, Glenmark, ScieGen, Teva, and Watson secured FDA approval for raloxifene hydrochloride tablets, providing cost-effective alternatives to the branded Evista formulation. This intensified competition has driven supply chain efficiencies and prompted established players to refine their portfolio strategies.

Simultaneously, the rise of telepharmacy and online pharmacy platforms has transformed how patients obtain chronic therapies such as Raloxifene. The U.S. online pharmacy market, valued at over $47 billion in 2024, continues to expand as consumers embrace home delivery, e-prescriptions, and integrated telehealth consultations. This shift not only enhances convenience for patients managing long-term bone health regimens but also compels industry stakeholders to optimize digital engagement and ensure regulatory compliance across emerging distribution channels.

Analyzing the Cumulative Impact of 2025 United States Tariff Policies on Raloxifene Hydrochloride Supply Chains and Cost Structures

In 2025, sweeping U.S. tariff measures have introduced significant headwinds for global pharmaceutical supply chains, particularly for active pharmaceutical ingredients (APIs) sourced from Asia. Under new regulations, APIs from China now face tariffs as high as 245%, including a 125% reciprocal levy and a specialized penalty for fentanyl precursors, while a global 10% tariff applies broadly to healthcare imports. These measures have exerted inflationary pressure on drug production costs, prompting companies to explore alternative sourcing and production strategies to mitigate risk.

The broader implications of these trade policies extend beyond immediate cost increases. Pharmaceutical manufacturers warn of potential drug shortages and supply inconsistencies if reliance on high-tariff sources remains unabated. Reports from Al Jazeera highlight that India, which supplies nearly half of U.S. generic medications, depends on China for up to 80% of its APIs, further amplifying the vulnerability of generics to tariff disruptions. Industry groups emphasize that continued assessments under Section 232 investigations could trigger additional tariff layers, creating prolonged uncertainty across the Raloxifene value chain.

Key Insights into Raloxifene Market Segmentation Across Indications, Product Types, Distribution Channels, and End User Environments

The Raloxifene market presents a multifaceted profile when viewed through the lens of therapeutic indication, with its primary clinical applications spanning both osteoporosis prevention and the reduction of postmenopausal breast cancer risk. This dual-indication framework underlies diverse prescribing patterns, as healthcare practitioners tailor treatment regimens to either fortify bone density or to exploit the drug’s anti-estrogenic properties in breast tissue.

When considering product type dynamics, the competitive landscape is defined by established branded formulations alongside a proliferation of generics that have leveraged first-to-file exclusivity pathways and rapid FDA approvals to capture market share. The entry of generics from major manufacturers has not only enhanced affordability but also intensified clinical and commercial differentiation efforts across product portfolios.

Distribution channel analysis reveals significant growth across hospital pharmacies, retail outlets, and digital platforms. While hospital pharmacies continue to serve institutional and acute care segments, the surge in online and telepharmacy services has broadened patient access to Raloxifene, reinforcing adherence through home delivery and virtual pharmacist consultations. Similarly, retail pharmacy remains a critical touchpoint for patient education and point-of-care interventions.

End user segmentation highlights three distinct settings in which Raloxifene is deployed: outpatient clinics where long-term therapy is initiated and monitored; homecare environments that leverage remote healthcare delivery and patient self-management; and hospital settings where perioperative bone health strategies may incorporate SERM therapy alongside broader osteoporosis protocols.

This comprehensive research report categorizes the Raloxifene Hydrochloride market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Indication

- Type

- Distribution Channel

- End User

Evaluating Regional Nuances and Growth Drivers for Raloxifene Hydrochloride Adoption Across Americas, Europe Middle East & Africa, and Asia-Pacific

North America remains a pivotal region for Raloxifene utilization, driven by well established clinical guidelines and widespread screening for osteoporosis among adults aged 50 and above. In the United States, ageadjusted prevalence of osteoporosis is estimated at 12.6%, with women disproportionately affected at 19.6% compared to 4.4% of men, underscoring the need for targeted bone health interventions and reinforcing Raloxifene’s strategic role.

In Europe, the burden of osteoporosis extends across diverse healthcare systems, with prevalence among women over 50 averaging around 22.5% and 6.8% in men across major markets. Despite significant treatment gaps and regional variations, strong emphasis on fracture prevention has cemented Raloxifene’s presence alongside bisphosphonates, reflecting its favorable safety profile and non-hormonal mechanism of action.

Asia-Pacific exhibits dynamic growth potential as demographic shifts accelerate across both developed and emerging markets. Meta-analyses indicate an overall prevalence of primary osteoporosis in China at 18.2%, with higher rates among women (23.4%) than men (11.5%), and notable regional disparities between northern and southern provinces. This epidemiological profile, combined with expanding healthcare infrastructure and rising awareness of bone health, positions Raloxifene as a key therapeutic option in Asia-Pacific strategic planning.

This comprehensive research report examines key regions that drive the evolution of the Raloxifene Hydrochloride market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation, Production, and Competitive Strategies for Raloxifene Hydrochloride Worldwide

Eli Lilly, the originator of Evista, continues to leverage its deep clinical development expertise and robust pharmacovigilance framework to support ongoing safety monitoring and lifecycle management of Raloxifene. The company’s established relationships with endocrine and oncology specialists underpin its leadership in branded SERM therapies and drive efforts to explore novel indications beyond postmenopausal applications.

Generic manufacturers, including Teva, Amneal, Aurobindo, Cadila, Glenmark, ScieGen, Invagen, and Watson, have collectively expanded the supply base for raloxifene hydrochloride, employing scale efficiencies and global distribution networks to ensure broad market availability. These firms often compete on cost competitiveness and supply reliability, prompting continuous enhancements in manufacturing quality and logistical capabilities.

Emerging biotechnology companies and regional pharmaceutical players are also investing in research collaborations and licensing arrangements to enhance Raloxifene’s formulation portfolio, exploring extended-release options and fixed-dose combinations with vitamin D analogs. Such partnerships reflect a strategic pivot toward differentiated product offerings, addressing adherence challenges and targeting niche patient subgroups.

This comprehensive research report delivers an in-depth overview of the principal market players in the Raloxifene Hydrochloride market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amneal Pharmaceuticals LLC

- Aurobindo Pharma Limited

- Cadila Pharmaceuticals Ltd.

- Camber Pharmaceuticals, Inc.

- Cipla Limited

- Dr. Reddy's Laboratories Ltd.

- Eli Lilly and Company

- Enzo Biochem, Inc.

- Glenmark Pharmaceuticals Ltd.

- Glochem Industries Pvt. Ltd.

- Guangzhou Tosun Pharmaceutical Co., Ltd.

- Healthy Inc.

- Medilux Laboratories Pvt. Ltd.

- Novique Life Sciences Pvt. Ltd.

- Sanika Chemical Pvt. Ltd.

- ScieGen Pharmaceuticals, Inc.

- Shreeji Pharma International

- Srini Pharmaceuticals Pvt. Ltd.

- Taj Pharmaceuticals Limited

- Teva Pharmaceutical Industries Ltd.

Strategic Recommendations for Industry Leaders to Navigate Market Challenges, Optimize Raloxifene Hydrochloride Portfolio, and Enhance Competitive Advantage

Industry leaders should prioritize diversification of API sourcing to mitigate tariff-induced cost pressures, exploring partnerships with domestic and alternative international suppliers to ensure uninterrupted production. Establishing redundant manufacturing lines and securing long-term supply agreements can safeguard against future policy shifts and supply chain disruptions.

Optimizing digital channels through telepharmacy integration and direct-to-patient programs can enhance treatment adherence and broaden market reach. By investing in patient engagement platforms and virtual monitoring tools, companies can deliver personalized support and real-time adherence analytics, ultimately improving therapeutic outcomes and customer satisfaction.

Strategic collaborations with healthcare providers, payers, and patient advocacy groups will be crucial in navigating evolving reimbursement landscapes. Leveraging real-world evidence to substantiate health economic benefits and fracture prevention data can strengthen formulary positioning and support value-based contracting models.

Continued investment in post-marketing research, including comparative effectiveness studies and patient-reported outcome initiatives, will reinforce confidence in Raloxifene’s safety-efficacy profile and drive informed prescribing patterns within both osteoporosis and breast cancer risk reduction domains.

Outlining the Rigorous Research Methodology Employed in Analyzing Raloxifene Hydrochloride Market Trends, Data Sources, and Analytical Framework

This analysis of the Raloxifene Hydrochloride market is grounded in a systematic research methodology integrating primary and secondary data sources. Primary research included in-depth interviews with key opinion leaders in endocrinology, oncology, and pharmacy practice, complemented by insights from supply chain executives and payer representatives.

Secondary research involved comprehensive reviews of regulatory filings, peer-reviewed literature, and government datasets, including census data and health surveillance reports. Data triangulation techniques were employed to validate findings across multiple sources, ensuring the robustness and reliability of conclusions.

Quantitative data were analyzed using statistical software to assess prevalence trends, distribution channel growth, and tariff impacts. Qualitative inputs were synthesized to contextualize market dynamics, strategic priorities, and innovation trajectories. This mixed-methods framework provides a holistic view of the market environment, supporting actionable insights for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Raloxifene Hydrochloride market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Raloxifene Hydrochloride Market, by Indication

- Raloxifene Hydrochloride Market, by Type

- Raloxifene Hydrochloride Market, by Distribution Channel

- Raloxifene Hydrochloride Market, by End User

- Raloxifene Hydrochloride Market, by Region

- Raloxifene Hydrochloride Market, by Group

- Raloxifene Hydrochloride Market, by Country

- United States Raloxifene Hydrochloride Market

- China Raloxifene Hydrochloride Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Reflections on Raloxifene Hydrochloride’s Strategic Importance, Emerging Opportunities, and the Path Forward for Stakeholders

Raloxifene Hydrochloride stands at a strategic inflection point, driven by evolving therapeutic indications, expanding generic competition, and shifting geopolitical factors that influence supply chain resilience. Its dual role in preventing osteoporosis and reducing breast cancer risk positions it uniquely within women’s health portfolios, supported by a robust safety profile and extensive clinical experience.

While tariff measures and distribution channel transformations present challenges, they also create opportunities for supply diversification, digital innovation, and value-based collaborations. Stakeholders who proactively adapt to these trends-by refining their commercialization strategies, strengthening partnerships, and leveraging real-world evidence-will be well-positioned to capture emerging growth avenues.

Ultimately, sustained focus on patient centricity, portfolio differentiation, and strategic agility will define the next chapter of Raloxifene’s market evolution. By aligning operational excellence with evidence-based advocacy, industry participants can ensure that Raloxifene continues to deliver meaningful health outcomes and contribute to broader public health objectives.

Take Decisive Action Today: Engage with Ketan Rohom to Secure Comprehensive Raloxifene Hydrochloride Market Intelligence for Informed Decision-Making

Ready to elevate your strategic planning with unparalleled market intelligence on Raloxifene Hydrochloride? Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure comprehensive insights tailored to your needs. Take this opportunity to gain a competitive edge by accessing in-depth analysis, segmentation breakdowns, regional nuances, and critical regulatory foresight. Reach out today and transform your decision-making process with actionable data and expert guidance designed to support your organizational goals.

- How big is the Raloxifene Hydrochloride Market?

- What is the Raloxifene Hydrochloride Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?