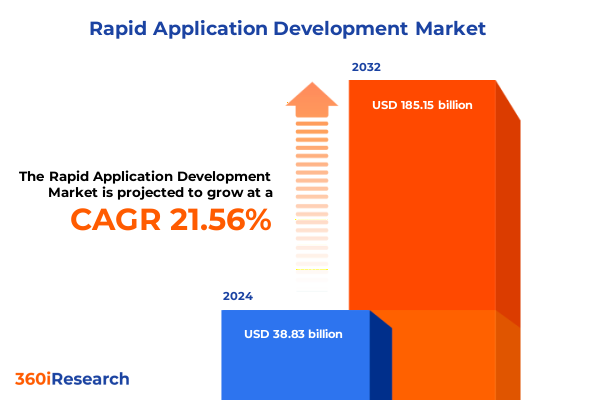

The Rapid Application Development Market size was estimated at USD 46.79 billion in 2025 and expected to reach USD 56.51 billion in 2026, at a CAGR of 21.71% to reach USD 185.15 billion by 2032.

Discover how emerging rapid application development techniques are empowering organizations to speed software delivery and unlock unprecedented agility

Rapid application development has emerged as a critical enabler for organizations striving to compress software delivery timelines while ensuring high levels of quality and stakeholder alignment. As digital transformation initiatives intensify across diverse industries, decision-makers are increasingly drawn to methodologies that emphasize modular design, iterative prototyping, and close collaboration between business and IT teams. This trend reflects a broader shift toward agile governance models and a recognition that traditional waterfall approaches often fall short in delivering timely solutions in environments that demand continuous adaptation.

Against this backdrop, low-code and no-code platforms have gained significant traction by democratizing software creation, empowering citizen developers to contribute meaningfully to application lifecycles. Meanwhile, core IT teams are realigning their focus toward complex integrations, security hardening, and performance optimization, leveraging rapid development frameworks to offload routine customization tasks. Together, these dynamics are forging a new paradigm in enterprise delivery where adaptability, speed, and cross-functional engagement are paramount. This report delves into the critical drivers, market forces, and strategic imperatives shaping the rapid application development landscape, offering decision-makers a clear view of the innovations and best practices that will define success in the years ahead.

A profound wave of digital transformation AI integration and citizen development is redefining rapid application development across enterprise environments

The rapid application development ecosystem is undergoing a metamorphosis catalyzed by several interlocking forces. Driven by pervasive digital transformation efforts, organizations now view software as a strategic asset rather than a support function. This mindset shift has spurred investments in artificial intelligence augmentation-enabling features such as natural language generation for automated code scaffolding and machine learning–driven suggestions that optimize user experiences.

Concurrently, the rise of citizen development has challenged established IT governance models, prompting a redefinition of roles and responsibilities. Enterprises are adopting governed self-service approaches, where professional services guide business users through templates and reusable component libraries, ensuring compliance and security without stifling innovation. This balance between agility and control is further complicated by the need to integrate legacy systems, necessitating adaptable integration layers that can bridge old and new architectures seamlessly.

Moreover, the acceleration of remote and hybrid work has reshaped collaboration patterns, driving demand for cloud-native development environments that maintain productivity regardless of location. The convergence of these transformative shifts underscores the imperative for platform providers to embed advanced collaboration tools, real-time versioning capabilities, and robust access controls into their offerings. As a result, rapid application development is evolving into a holistic discipline that encompasses not only coding efficiency but also governance, collaboration, and intelligent automation.

United States tariffs introduced in 2025 are reshaping supply chain strategies operational costs technology adoption within rapid application development

In 2025, United States tariff policies introduced additional duties on imported hardware components and certain enterprise software licenses, creating a ripple effect across the rapid application development ecosystem. Platform providers that rely on specialized infrastructure for private cloud and on-premises deployments have faced elevated costs, compelling many to reassess their supply chain strategies and renegotiate vendor contracts. As a consequence, there has been a tangible shift toward cloud-first deployment models, where hyperscale providers can absorb tariff impacts more effectively through diversified sourcing and scale-driven discounts.

At the same time, organizations maintaining on-premises or hybrid solutions are exploring alternative procurement strategies, such as co-location partnerships and regional equipment leasing, to mitigate capital expenditure pressures. This environment has also stimulated renewed interest in SaaS licensing structures that bundle infrastructure with platform services, effectively sidestepping tariff-related surcharges. However, the migration to subscription-based models brings its own complexities around data sovereignty, compliance controls, and long-term operational budgeting.

Looking ahead, the cumulative effect of these tariff measures is reshaping vendor roadmaps, with many accelerated development of lightweight, containerized offerings that can operate in variable cost environments. Enterprises are advised to monitor policy developments closely and collaborate with their technology partners to build flexible, tariff-resilient architectures that support continuous innovation without compromising cost efficiency.

Deep insights into how platform types components deployment models business functions organization sizes and industry verticals influence adoption trends

A closer examination of platform adoption reveals nuanced dynamics across multiple dimensions. Based on type, organizations differentiate their strategies between low-code development platforms that offer extensibility for professional developers and no-code alternatives that empower nontechnical stakeholders. Enterprises balancing speed and complexity often integrate these approaches into cohesive governance frameworks that delineate use cases for each segment.

When viewed through the lens of component, market participants assess services and solutions in tandem. Services encompass managed offerings that handle operational oversight and professional services that guide consulting engagements, deployment and integration efforts, and ongoing support and maintenance. In parallel, solution stacks are dissected by form factor, spanning desktop-based clients suited for intensive design tasks, mobile-based interfaces that enable on-the-go development, server-based platforms optimized for enterprise data centers, and web-based environments that facilitate universal access without local installation.

In terms of deployment model, the choice among cloud-based, hybrid, and on-premises architectures reflects an organization’s tolerance for external hosting, regulatory constraints, and desire for customization. Meanwhile, business function drives usage patterns: finance teams leverage rapid application development for automating reconciliation workflows; HR and operations adopt the technology to manage talent lifecycles; IT departments focus on infrastructure provisioning and integration; and sales and marketing teams prioritize customer engagement applications.

Further, organization size influences platform selection and support models. Large enterprises demand scalability, multi-tenant controls, and enterprise-grade security, whereas small and medium enterprises seek out-of-the-box simplicity and cost predictability. The industry vertical dimension reveals differentiated adoption priorities, with BFSI institutions emphasizing compliance and audit trails, education providers valuing ease of use for remote learning solutions, government bodies requiring stringent access controls, healthcare organizations focusing on patient data security, IT and telecommunication firms prioritizing rapid proof-of-concept builds, manufacturing companies seeking production floor automation, media and entertainment enterprises deploying creative collaboration apps, and retail and eCommerce players developing customer-facing portals.

This comprehensive research report categorizes the Rapid Application Development market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Deployment Model

- Business Function

- Organization Size

- Industry Vertical

Regional perspectives uncover drivers adoption challenges and growth opportunities for rapid application development across Americas EMEA and Asia Pacific

Regional nuances significantly shape the pace and character of rapid application development adoption. In the Americas, mature technology ecosystems and a well-established cloud infrastructure have fostered early experimentation with no-code citizen development, particularly among forward-thinking start-ups and agile divisions within larger firms. Yet this region also contends with complex regulatory frameworks around data privacy, prompting organizations to adopt hybrid models that retain sensitive workloads on-premises while leveraging cloud-based innovation hubs.

Europe, the Middle East, and Africa (EMEA) present a layered environment where privacy regulations such as the General Data Protection Regulation influence architectural decisions. Governments and enterprises here balance stringent compliance requirements with the imperative to modernize legacy public sector applications. Cloud adoption continues to accelerate, but on-premises solutions maintain a foothold in industries where localization and data residency are paramount. Collaboration between local system integrators and global platform vendors has emerged as a best practice, enabling tailored deployments that respect regional mandates.

In the Asia-Pacific region, the rapid proliferation of digital services across emerging economies has driven demand for scalable, low-cost development platforms. Organizations are eager to harness mobile-first solutions, tapping into the large base of remote knowledge workers and field technicians. At the same time, established markets such as Japan and Australia are pioneering AI-augmented development tools, integrating advanced analytics and natural language interfaces. Cross-border partnerships and localized data centers are critical for meeting performance and compliance needs in this diverse and dynamic market landscape.

This comprehensive research report examines key regions that drive the evolution of the Rapid Application Development market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading technology providers are leveraging innovation partnerships and integrations to gain competitive edge in rapid application development solutions

Key platform vendors are adopting differentiated go-to-market strategies to capture evolving enterprise needs. Several legacy software incumbents are broadening their portfolios through strategic acquisitions of emerging low-code startups, integrating AI-driven code generators and visual modeling tools into their core suites. These offerings emphasize seamless integration with existing ERP and CRM systems, appealing to customers seeking to modernize without disruptive rip-and-replace projects.

Conversely, pure-play low-code providers are forging alliances with hyperscale cloud partners, enabling tight coupling with advanced infrastructure capabilities such as serverless compute and managed container orchestration. This partnership approach accelerates time to market for complex applications that require dynamic scaling. Additionally, some vendors have doubled down on vertical-specific templates, offering pre-built modules for industries like banking and healthcare to reduce time-to-value and ensure domain compliance.

Competitive differentiation increasingly hinges on developer ecosystem strength. Firms investing in community forums, hackathons, and certification programs have seen heightened adoption rates, as professional developers and citizen developers alike demonstrate platform loyalty through published extensions and custom modules. Furthermore, an emerging battlefront centers on low-code governance suites that provide centralized policy management, usage analytics, and security scanning, addressing executive concerns around shadow IT and compliance risk.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rapid Application Development market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Alpha Software Corporation

- Amazon Web Services, Inc.

- Appian Corporation

- Appinventiv

- Betty Blocks

- Bizagi Group Corp

- Claris International Inc.

- Curotec, LLC

- ELEKS Holding OÜ.

- Google, LLC

- HokuApps Limited

- Idera, Inc.

- Iflexion

- Intellectsoft LLC

- International Business Machines Corporation

- INTUZ

- Kissflow Inc.

- knack

- Mendix Technology B.V.

- Microsoft Corporation

- Netguru S.A.

- Nintex Global Ltd.

- Oracle Corporation

- Oro, Inc.

- OutSystems

- Quickbase, Inc.

- Radzen Ltd.

- Salesforce, Inc.

- ServiceNow, Inc.

- Technothinksup Solutions

- Temenos Headquarters SA

- Thoughtworks, Inc.

- Toobler Technologies

- Zoho Corporation

Strategic actionable recommendations for organizations to harness rapid application development and amplify innovation outcomes

Industry leaders must take decisive action to harness rapid application development as a strategic growth lever. First, embedding governance frameworks that clearly delineate roles for IT professionals and citizen developers will mitigate shadow IT risks while preserving the agility that business units demand. By establishing guardrails and reusable component libraries, organizations can accelerate delivery without compromising on compliance and quality standards.

Second, integrating artificial intelligence and machine learning capabilities into development workflows can dramatically reduce manual coding tasks. Automated code suggestions, predictive user journey modeling, and intelligent testing assistants are now sufficiently mature to warrant enterprise pilots. Leaders should prioritize partnerships with vendors that offer extensible AI toolkits and open APIs to facilitate seamless integration with existing toolchains.

Third, diversifying deployment models-embracing a balanced mix of cloud-native, hybrid, and on-premises solutions-will ensure resilience against geopolitical shifts such as tariff changes and localization requirements. Organizations should design architectures that allow workload portability across hosting environments and avoid vendor lock-in by leveraging containerization and open standards.

Finally, to foster platform adoption at scale, enterprises must invest in comprehensive training and certification programs. Upskilling initiatives that target both professional developers and business users will cultivate a collaborative culture of innovation. Coupled with an emphasis on performance monitoring and continuous feedback loops, these programs will drive higher user satisfaction and more effective application outcomes.

Comprehensive research methodology describes how interviews combined with rigorous secondary analysis underpin insights into rapid application development

Our research methodology combines qualitative and quantitative approaches to deliver a holistic understanding of the rapid application development market. We conducted structured interviews with senior IT executives and line-of-business leaders to capture firsthand perspectives on pain points, vendor selection criteria, and strategic priorities. These insights were complemented by consultations with independent analysts and technology experts to validate thematic trends and emerging use cases.

In parallel, extensive secondary research was performed across corporate filings, patent databases, industry publications, and regional regulatory documents. We applied a rigorous data triangulation process to reconcile divergent viewpoints and ensure consistency of narrative. Furthermore, vendor solution briefings and proof-of-concept demonstrations provided in-depth technical exposure to platform capabilities, enabling us to develop granular feature-level comparisons.

This methodological rigor ensures that our findings reflect the most current developments in governance frameworks, AI-driven automation, and deployment architectures. By synthesizing multiple data sources, we offer a balanced view that accounts for both strategic imperatives and operational realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rapid Application Development market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rapid Application Development Market, by Type

- Rapid Application Development Market, by Component

- Rapid Application Development Market, by Deployment Model

- Rapid Application Development Market, by Business Function

- Rapid Application Development Market, by Organization Size

- Rapid Application Development Market, by Industry Vertical

- Rapid Application Development Market, by Region

- Rapid Application Development Market, by Group

- Rapid Application Development Market, by Country

- United States Rapid Application Development Market

- China Rapid Application Development Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesis of core findings highlights the strategic imperative of embracing rapid application development to drive digital transformation and efficiency

As enterprises confront an accelerating pace of digital disruption, the ability to deliver tailored software solutions rapidly has never been more critical. The convergence of low-code/no-code platforms, AI augmentation, and evolved governance models establishes rapid application development as a cornerstone of organizational agility. Leaders who embrace these methodologies achieve faster time to value while maintaining robust security and compliance postures.

Moreover, regional and tariff-driven factors underscore the necessity of adaptable deployment strategies that can flex with shifting operational costs and regulatory landscapes. Platform providers and end-users must collaborate to design architectures that optimize for both performance and resilience. Finally, the rise of citizen development alongside professional services creates new opportunities for shared ownership of digital innovation, fostering a culture where continuous improvement and cross-functional engagement drive sustained competitive advantage.

In sum, the insights presented throughout this report illuminate a pathway for organizations to harness rapid application development effectively. By aligning strategic objectives with technological capabilities, enterprises can navigate complexity, accelerate growth, and secure their position as leaders in the digital economy.

Unlock rapid application development insights by reaching out to Ketan Rohom Associate Director of Sales & Marketing to secure your market research report today

To unlock game-changing insights and steer your innovation roadmap toward success engage directly with Ketan Rohom Associate Director of Sales & Marketing to explore how our in-depth market research can become your strategic advantage and secure early access to the comprehensive rapid application development market insights report tailored for leaders like you

- How big is the Rapid Application Development Market?

- What is the Rapid Application Development Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?