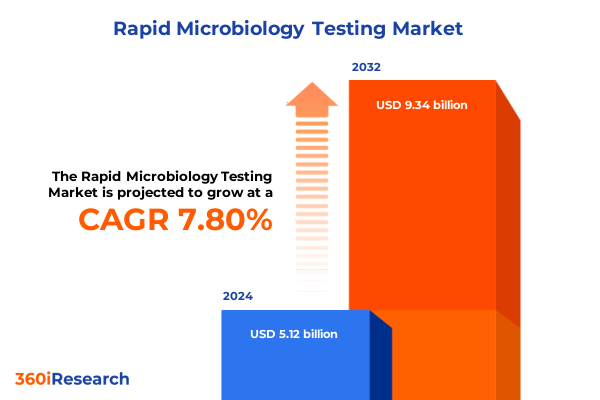

The Rapid Microbiology Testing Market size was estimated at USD 5.45 billion in 2025 and expected to reach USD 5.86 billion in 2026, at a CAGR of 7.79% to reach USD 9.21 billion by 2032.

Introducing the Evolution and Strategic Imperatives Shaping Rapid Microbiology Testing Trends and Opportunities in the Modern Healthcare Landscape

Rapid microbiology testing has emerged as a pivotal component of modern healthcare and industrial processes, fundamentally altering how infections are detected, monitored, and managed. Driven by the urgent need for faster diagnostics to combat antimicrobial resistance and ensure patient safety, laboratories and point-of-care settings alike are adopting new platforms that significantly reduce time to result. As regulatory bodies emphasize stringent quality controls and global health crises highlight critical gaps in response capability, the sector is experiencing an accelerated push toward innovative, decentralized, and automated testing solutions.

Moreover, the convergence of molecular diagnostics, flow cytometry, and digital imaging technologies is reshaping traditional workflows, enabling more precise pathogen identification and susceptibility profiling within hours rather than days. This transition is further supported by initiatives promoting antimicrobial stewardship programs and hospital accreditation standards that demand rapid reporting of microbiological data. Simultaneously, the expansion of pharmaceutical, food safety, and environmental monitoring applications underscores the versatile utility of rapid assays beyond clinical diagnostics.

In addition, the proliferation of point-of-care and near-patient testing models reflects an industry-wide commitment to delivering actionable results in diverse settings, from intensive care units to field laboratories. As we embark on this executive summary, readers will gain comprehensive perspectives on the transformative forces defining the rapid microbiology testing landscape, the multifaceted impacts of recent tariff policies, key segmentation and regional considerations, leading company strategies, and practical recommendations for sustaining competitive advantage in this dynamic environment.

Unveiling the Technological, Regulatory, and Operational Transformations Driving the Next Generation of Rapid Microbiology Testing Solutions Globally

The rapid microbiology testing ecosystem is undergoing a period of profound transformation characterized by advances in automation, molecular technologies, and digital integration. Automated microbial identification and rapid culture systems are becoming increasingly sophisticated, utilizing artificial intelligence and machine learning algorithms to accelerate data interpretation and reduce manual intervention. These technological breakthroughs not only expand the analytical capabilities of clinical laboratories but also enable decentralized testing in remote or resource-limited settings where timely decision-making is critical.

Furthermore, regulatory landscapes are evolving to keep pace with innovation, with accreditation agencies updating guidelines to accommodate novel platforms while ensuring robust validation and quality control measures. This regulatory clarity is fostering greater confidence among end users and encouraging investment in next-generation instruments. Concurrently, the growing emphasis on antimicrobial stewardship and the global drive to curb antibiotic resistance have underscored the importance of rapid susceptibility testing, prompting vendors to integrate phenotypic and genotypic assays into unified workflows.

In addition, the surge in demand for environmental and industrial microbiology testing-driven by heightened safety standards in food and beverage manufacturing as well as cosmetics-has created new opportunities for methods that offer high throughput and traceability. As a result, industry players are forging strategic partnerships to streamline supply chains, accelerate method development, and address the need for comprehensive solutions that span consumables, instruments, and reagent kits.

Assessing the Far-Reaching Impacts of United States Tariff Measures in 2025 on Microbiology Testing Supply Chains and Strategic Sourcing Dynamics

In 2025, revised United States tariff measures have exerted tangible effects on the rapid microbiology testing sector, influencing both procurement strategies and supply chain resilience. The imposition of higher duties on imported instruments and consumables has led many organizations to reevaluate their sourcing models, prioritizing domestic manufacturing capabilities or diversifying vendor portfolios to mitigate cost volatility. As a consequence, procurement teams are increasingly collaborating with strategic suppliers to negotiate long-term agreements that offer predictable pricing and assured availability of critical supplies.

Moreover, the cascading impact of tariff policies has prompted end users to reassess inventory management practices, adopting leaner stock-holding approaches supported by just-in-time delivery frameworks. This shift has accelerated the adoption of digital inventory tracking systems and real-time analytics, allowing laboratories to maintain continuous testing operations without overinvesting in warehoused supplies. At the same time, manufacturers are reinforcing local assembly lines and forging partnerships with regional distributors to circumvent tariff barriers and streamline logistics.

As a result, the industry is witnessing a reconfiguration of traditional trade flows, with heightened collaboration among domestic suppliers, service providers, and testing laboratories. This evolving landscape underscores the need for agile operational models and proactive engagement with policy developments to ensure uninterrupted access to innovative rapid testing solutions.

Revealing Strategic Insights Across Product, Method, Sample, Application, Pathogen, and End User Dimensions Shaping Rapid Microbiology Testing Market Segments

Analyzing the rapid microbiology testing market through multiple segmentation lenses reveals critical insights into where value is being created and where innovation is accelerating adoption. Product segmentation highlights the essential role of instruments, which encompass automated microbial identification, flow cytometry, molecular diagnostic, microbial detection, and rapid culture systems. These advanced platforms are central to delivering faster turnaround times and higher throughput, particularly in clinical settings where time to diagnosis can directly influence patient outcomes. While consumables and reagents & kits continue to underpin every test, the evolution of instrument technology is driving the development of more integrated and user-friendly consumable formats tailored to specific assays.

Method-based segmentation further underscores the growing preference for nucleic acid-based and viability-based rapid tests, which deliver high specificity and reliable viability assessments respectively. As laboratories seek to streamline workflows, cellular component-based and growth-based approaches maintain relevance in contexts where phenotypic analysis remains indispensable. Within each methodological category, ongoing miniaturization and multiplexing facilitate the simultaneous detection of multiple pathogens, effectively bridging the gap between speed and comprehensiveness.

When considering sample type, the prominence of blood culture, respiratory culture, and urine culture applications reflects the urgent need to diagnose life-threatening infections, while stool and wound cultures continue to benefit from rapid screening tools that enhance infection control measures. Application segmentation reveals that clinical disease diagnostics drive the majority of testing volume, yet environmental, industrial, and pharmaceutical & biotechnology testing are experiencing distinct trajectories. In industrial contexts, cosmetics and personal care products testing as well as food and beverage safety assays require highly sensitive methods that comply with rigorous regulatory standards.

Target pathogen segmentation points to sustained focus on bacterial assays, complemented by expanding fungal, mycobacterial, parasitic, and viral panels. This diversification of target profiles is supported by end-user requirements spanning contract research organizations, laboratories and hospitals, food and beverage companies, and pharmaceutical and biotech firms. Across this broad user base, customized service models and integrated offerings are increasingly valued as organizations seek to maximize return on investment and operational efficiency.

This comprehensive research report categorizes the Rapid Microbiology Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Detection Method

- Sample Type

- Application

- End User

- Target Pathogen

Delivering Vital Regional Perspectives on Infrastructure, Innovation, and Adoption Across the Americas, EMEA, and Asia-Pacific Rapid Microbiology Testing

Regionally, the Americas continue to lead in technology adoption and regulatory alignment, supported by robust healthcare infrastructure and significant investments in laboratory automation and digital health initiatives. North American laboratories frequently pilot advanced platforms to accelerate drug development pipelines and enhance hospital infection control programs. Meanwhile, Latin America is emerging as a growth frontier, with increasing public–private partnerships driving capacity building in clinical and environmental testing laboratories.

In Europe, Middle East, and Africa, the regulatory environment is characterized by harmonized standards that facilitate cross-border trade of diagnostic instruments and consumables. European clinical laboratories benefit from reimbursement policies favoring rapid diagnostics, while Middle Eastern nations are investing in state-of-the-art public health laboratories to bolster pandemic preparedness. In Africa, the emphasis on decentralized testing solutions is catalyzed by international health initiatives aimed at expanding access to rapid diagnostics, particularly in rural and resource-limited communities.

Asia-Pacific presents a heterogeneous landscape in which advanced economies such as Japan, South Korea, and Australia lead in adopting molecular and automated systems, whereas emerging markets in Southeast Asia and India prioritize cost-effective assays and mobile testing platforms that address high infectious disease burdens. Local manufacturing ecosystems are strengthening throughout the region, enabling faster response to supply chain disruptions and fostering collaborative research ventures between global vendors and domestic biopharma entities.

This comprehensive research report examines key regions that drive the evolution of the Rapid Microbiology Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Market-Leading Company Developments, Strategic Initiatives, and Competitive Dynamics Steering the Future of Rapid Microbiology Testing

Leading corporations are differentiating themselves through targeted investments in next-generation platforms, strategic partnerships, and geographic expansion. Established diagnostic specialists are integrating artificial intelligence and cloud connectivity into their instrument portfolios to enable predictive maintenance, remote monitoring, and real-time data sharing. This focus on connected diagnostics enhances laboratory efficiency and supports antimicrobial stewardship initiatives by providing clinicians with actionable insights at the point of care.

Additionally, several companies have adopted collaborative models with reagent and consumable manufacturers to offer bundled solutions that simplify procurement and reduce implementation timelines. By aligning end-to-end workflows-from sample preparation to result interpretation-these integrated offerings appeal to high-volume clinical laboratories and contract research organizations seeking streamlined processes. Furthermore, some vendors are establishing regional innovation centers to co-develop customized assays that address local pathogen profiles and regulatory requirements.

Competitive dynamics are also influenced by collaborations between technology firms and diagnostics providers to incorporate emerging modalities such as microfluidics and nanopore sequencing into rapid testing frameworks. These alliances foster cross-disciplinary innovation and enable accelerated time to market for transformative solutions. As market pressures intensify, companies that can deliver versatile platforms supporting multiple methodologies and sample types are poised to capture broader adoption across clinical, environmental, and industrial applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rapid Microbiology Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BioMérieux SA

- Becton, Dickinson and Company

- Danaher Corporation

- Thermo Fisher Scientific, Inc.

- Abbott Laboratories

- Merck KGaA

- Charles River Laboratories International, Inc.

- Bruker Corporation

- Sartorius AG

- Bio-Rad Laboratories, Inc.

- NEOGEN Corporation

- Quidel Corporation

- QIAGEN N.V.

- Rapid Micro Biosystems, Inc.

- Hygiena LLC

- Avantor, Inc.

- BTNX Inc.

- Colifast AS

- Don Whitley Scientific Limited

- Eurofins Scientific SE

- Gradientech AB

- Guangdong Huankai Microbial Sci. & Tech. Co., Ltd.

- PerkinElmer, Inc.

- R-Biopharm AG

- Rqmicro AG

- Serosep Ltd.

- SGS SA

Delivering Actionable Strategic Recommendations to Accelerate Innovation, Optimize Processes, and Strengthen Positioning in Rapid Microbiology Testing

Industry decision-makers should prioritize collaborative innovation to stay ahead of evolving diagnostic demands. By forging partnerships with technology developers and academic institutions, laboratories and equipment manufacturers can co-create high-value assays that address emerging pathogens and regulatory requirements. In parallel, adopting modular instrument architectures enables seamless integration of new methodologies and reduces the need for wholesale system replacements, thereby safeguarding existing capital investments.

Moreover, enhancing supply chain agility through diversified sourcing strategies and digital inventory management systems will mitigate risks associated with tariff fluctuations and logistical disruptions. Establishing regional hubs for consumables assembly and reagent formulation can reduce lead times and ensure continuity of testing operations, while just-in-time procurement models supported by predictive analytics can optimize working capital.

Finally, industry leaders are encouraged to embed digital connectivity and data analytics into every phase of the testing workflow. Leveraging cloud-based platforms for remote monitoring, quality assurance, and predictive maintenance not only improves operational efficiency but also reinforces compliance with accreditation standards. By integrating real-world data streams from clinical and industrial testing sites, organizations can drive continuous process improvement, accelerate method validation, and deliver unparalleled value to end users.

Explaining the Rigorous Mixed-Method Research, Data Triangulation Processes, and Validation Techniques Underpinning Rapid Microbiology Testing Findings

The research underpinning this analysis employed a rigorous mixed-methodology framework to ensure comprehensive coverage and data integrity. Initial secondary research synthesized published literature, regulatory guidelines, and peer-reviewed studies to map the landscape of rapid microbiology testing technologies and identify key trends. This phase was complemented by detailed company profiling that examined product portfolios, recent collaborations, and regional footprints.

Subsequently, primary research was conducted through structured interviews with industry experts, laboratory directors, procurement managers, and regulatory consultants. These discussions provided nuanced perspectives on adoption drivers, pain points, and validation requirements across clinical, industrial, and environmental settings. Insights gleaned from these conversations were triangulated with quantitative data to confirm emerging patterns and assess the relative importance of different methodological approaches.

Data validation processes included cross-referencing vendor disclosures, regulatory submissions, and independent field studies to ensure the accuracy of technology performance claims. Additionally, iterative review cycles with subject-matter experts and peer benchmarking exercises reinforced the objectivity of market segmentation and competitive analyses. This multi-layered approach guarantees that the findings presented here are grounded in current industry realities and provide actionable intelligence for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rapid Microbiology Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rapid Microbiology Testing Market, by Offering

- Rapid Microbiology Testing Market, by Detection Method

- Rapid Microbiology Testing Market, by Sample Type

- Rapid Microbiology Testing Market, by Application

- Rapid Microbiology Testing Market, by End User

- Rapid Microbiology Testing Market, by Target Pathogen

- Rapid Microbiology Testing Market, by Region

- Rapid Microbiology Testing Market, by Group

- Rapid Microbiology Testing Market, by Country

- United States Rapid Microbiology Testing Market

- China Rapid Microbiology Testing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Summarizing Key Takeaways and Strategic Implications for Stakeholders Navigating the Evolving Realm of Rapid Microbiology Testing Innovations

In conclusion, rapid microbiology testing is at the forefront of a paradigm shift in diagnostics, driven by automation, molecular innovation, and digital transformation. The cumulative effects of regulatory updates, tariff measures, and evolving end-user requirements have redefined procurement strategies and underscored the importance of supply chain resilience. Multidimensional segmentation analysis highlights the interplay between product innovation, methodology choice, sample diversity, application scope, pathogen targets, and end-user dynamics.

Regional perspectives reveal both mature markets with high technology adoption and emerging economies prioritizing scalable, cost-effective solutions. Key industry players are responding with integrated platforms, strategic alliances, and regional investments that reinforce their competitive positioning. By following the actionable recommendations outlined-emphasizing collaborative innovation, supply chain agility, and digital integration-organizations can navigate this complex landscape and capitalize on growth opportunities.

Moving forward, stakeholders who embrace flexible workflows and leverage real-time data will be best equipped to address future challenges, enhance patient outcomes, and drive sustainable expansion across clinical, environmental, and industrial domains.

Empowering Industry Leaders to Harness Deep Rapid Microbiology Testing Insights Through Collaboration With Associate Director of Sales & Marketing Ketan Rohom

To take full advantage of the insights presented throughout this report and accelerate your strategic initiatives in rapid microbiology testing, reach out today to Ketan Rohom, Associate Director of Sales & Marketing, who can guide you through tailored research options aligned with your unique business objectives. Engaging with Ketan Rohom will provide direct access to in-depth data, custom analytical support, and expert advisory services designed to enhance decision-making across product development, market expansion, and competitive positioning. By collaborating with our sales and marketing leadership, you can secure the comprehensive intelligence needed to stay ahead of industry shifts, optimize procurement strategies, and drive innovation within your organization. Don’t miss the opportunity to transform your approach to rapid microbiology testing with a fully supported research partnership-contact Ketan Rohom today to explore your report package and unlock actionable pathways to growth.

- How big is the Rapid Microbiology Testing Market?

- What is the Rapid Microbiology Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?