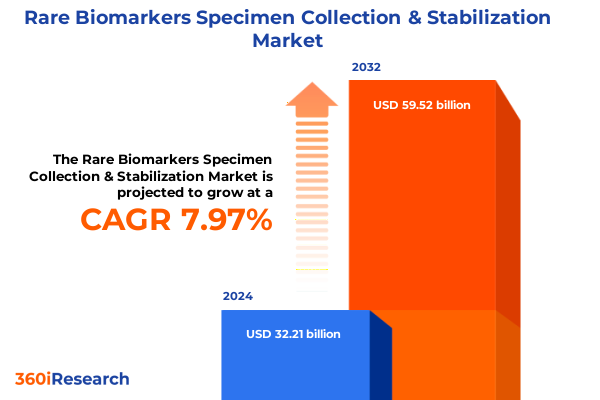

The Rare Biomarkers Specimen Collection & Stabilization Market size was estimated at USD 34.71 billion in 2025 and expected to reach USD 37.41 billion in 2026, at a CAGR of 8.00% to reach USD 59.52 billion by 2032.

Pioneering the Future of Precision Medicine with Advanced Specimen Collection and Stabilization Solutions for Rare Biomarker Research

Advancements in translational science have sharpened industry focus on the collection and stabilization of specimens containing rare biomarkers, which deliver unprecedented insights into disease biology and patient stratification. These analytes-including circulating cell-free nucleic acids, circulating tumor cells, and extracellular vesicles-offer a window into early disease detection, treatment monitoring, and therapeutic response assessment. As research pivots toward personalized medicine and minimal residual disease detection, the precision of specimen handling protocols becomes critically important to preserving biomarker integrity from the point of draw through processing and analysis.

In this challenging environment, researchers and clinical laboratories face an evolving set of technical hurdles and regulatory requirements. Variables such as pre‐analytical delay, temperature fluctuations, and enzymatic degradation pose significant threats to the stability of ultra‐low‐abundance targets. Consequently, there is a growing imperative to deploy specialized collection tubes, advanced isolation reagents, and robust stabilization strategies that maintain sample fidelity without compromising downstream assay sensitivity. This introduction sets the stage for understanding how the convergence of innovative technologies, regulatory harmonization, and strategic industry partnerships is shaping a new era for rare biomarker specimen workflows.

Examining the Revolutionary Technological and Regulatory Shifts Reshaping the Rare Biomarker Specimen Landscape Across the Life Science Ecosystem

The landscape of rare biomarker specimen collection and stabilization is undergoing seismic shifts driven by breakthroughs in microfluidic platforms, digital sample tracking, and integrated automation. Recent years have seen the proliferation of benchtop instruments capable of isolating circulating tumor cells with unprecedented efficiency, alongside reagents engineered to quench nuclease activity immediately upon blood or plasma collection. These technological innovations not only reduce manual variability but also accelerate throughput, enabling high‐volume processing required for large‐scale research and multicenter clinical trials.

Simultaneously, regulatory bodies are advancing new guidelines to ensure consistency and reproducibility across laboratories. Harmonized standards for pre‐analytical variables-such as temperature control validation and time‐to‐processing thresholds-are being codified to support global collaborations and cross‐study comparisons. In parallel, the movement toward open data and standardized reporting frameworks is enhancing transparency, driving broader acceptance of rare biomarker assays in regulatory submissions for companion diagnostics and therapeutic monitoring. Together, these developments represent a transformative convergence of technology and policy that is redefining best practices in specimen management.

Analyzing the Cumulative Impact of New United States Tariffs Implemented in 2025 on Rare Biomarker Specimen Collection Supply Streams

In early 2025, the United States implemented a series of tariffs on imported laboratory consumables and equipment, aiming to balance domestic manufacturing growth with trade policy objectives. These levies, affecting a spectrum of blood collection tubes, enzymatic reagents, and microfluidic system components, have led to increased landed costs for key inputs into rare biomarker workflows. As a result, procurement teams are reevaluating supplier relationships, negotiating longer‐term contracts, and absorbing incremental expenses through adjusted project budgets.

Although the immediate impact has been a noticeable uptick in per‐sample processing costs, industry leaders are mitigating risk through strategic supply chain diversification. Onshoring of reagent production, bulk purchasing alliances, and co‐development agreements with regional manufacturers are emerging as effective countermeasures. Moreover, the shift has accelerated adoption of reusable stabilization platforms and modular isolation systems designed for lower cost of ownership. Over the medium term, the tariff‐induced pressure is catalyzing a more resilient and vertically integrated ecosystem for rare biomarker specimen collection and stabilization.

Uncovering Segmentation Insights That Illuminate Product Types Specimen Categories Techniques Collection Methods and Applications in Research and Diagnostics

A nuanced segmentation analysis reveals the complexity underpinning this market. From a product perspective, stakeholders navigate an array spanning blood collection tubes optimized for cell‐free nucleic acid capture, dedicated isolation kits and reagents tailored to specific analyte classes, and fully integrated systems that combine collection, stabilization, and initial processing in a single workflow. Meanwhile, the variety of specimen types plays a major role in shaping demand dynamics; laboratories focused on circulating cell‐free DNA and RNA require different stabilization chemistries than those isolating intact circulating tumor cells or harvesting extracellular vesicles such as exosomes.

Equally important are the stabilization techniques themselves, which include chemical preservative formulas that inhibit enzymatic degradation, lyophilization protocols that remove water content for ambient storage stability, and temperature control methods where controlled freezing or refrigerated transport maintains biomarker viability. Collection methods further define the landscape, with manual phlebotomy techniques coexisting alongside fully automated platforms that reduce handling errors and increase reproducibility. Applications span genetic testing initiatives uncovering germline and somatic mutations, infectious disease screening that leverages viral nucleic acid detection, neurology research probing cerebrospinal fluid markers, and oncology diagnostics that guide targeted therapy decisions. Finally, end users range from contract research organizations managing multicenter trials to diagnostic centers conducting routine clinical assays, hospital laboratories integrating biomarker panels into patient care pathways, and research institutes developing next‐generation analytical methods.

This comprehensive research report categorizes the Rare Biomarkers Specimen Collection & Stabilization market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Specimen Type

- Stabilization Technique

- Collection Method

- Application

- End User

Revealing Regional Variations and Opportunities Across the Americas Europe the Middle East Africa and Asia Pacific in Rare Biomarker Workflows

Regional dynamics in the rare biomarker segment highlight distinct opportunities and challenges. In the Americas, the presence of major pharmaceutical and biotechnology hubs, combined with progressive reimbursement frameworks, underpins robust adoption of advanced specimen workflows. Leading academic centers and clinical laboratories are investing in high‐throughput automated platforms that support large‐scale studies, while a strong contract research infrastructure facilitates rapid translation from discovery to clinical validation.

Over in Europe, the Middle East and Africa region, regulatory harmonization under initiatives like the In Vitro Diagnostic Regulation in Europe and expanding healthcare spending in Gulf Cooperation Council countries are driving wider adoption of standardized pre‐analytical protocols. Cross‐border collaborations in translational research have intensified, prompting harmonized sample collection methodologies and shared biobanking resources. Meanwhile, emerging markets in Africa are beginning to establish foundational laboratory networks to support infectious disease surveillance and oncology biomarker research.

In the Asia‐Pacific region, rapid capacity building in China, India, Japan and Australia is fueling demand for both reagent and instrument suppliers. While supply chain bottlenecks and infrastructure disparities remain, government support for precision medicine and public‐private partnerships are accelerating market maturation. Moreover, localized production of collection and stabilization consumables is gaining momentum, shortening lead times and reducing exposure to import tariffs.

This comprehensive research report examines key regions that drive the evolution of the Rare Biomarkers Specimen Collection & Stabilization market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Profiles of Leading Companies Driving Innovation Partnerships Supply Solutions for Rare Biomarker Specimen Collection and Stabilization

A core set of strategic players is steering innovation in specimen collection and stabilization. Established life science companies with broad reagent portfolios are leveraging deep expertise in nucleic acid chemistry to develop next‐generation preservative formulas, while instrument manufacturers are integrating microfluidic separation modules into compact, automated platforms. At the same time, specialist start‐ups are entering the market with proprietary technologies for exosome enrichment and cell‐free RNA stabilization, prompting larger competitors to pursue partnership agreements and licensing deals to expand their offerings.

Collaborations between reagent suppliers and automation providers are increasingly common, facilitating turnkey solutions that combine validated collection consumables with dedicated processing instruments. In parallel, alliances with academic research centers and biobanks are underpinning co‐development of specialized kits, ensuring compatibility with emerging multi‐omic analytical pipelines. This interwoven ecosystem underscores the importance of cross‐sector collaboration in driving performance improvements, accelerating time to results, and reducing operational complexity for end users.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rare Biomarkers Specimen Collection & Stabilization market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adaptive Biotechnologies Corporation

- Angle plc

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Biomatrica, Inc.

- Burning Rock Biotech Limited

- Delfi Diagnostics, Inc.

- DNA Genotek Inc.

- Exact Sciences Corporation

- Freenome Holdings, Inc.

- Guardant Health, Inc.

- Invivoscribe, Inc.

- Merck KGaA

- MiRXES Pte Ltd.

- Natera, Inc.

- Norgen Biotek Corp.

- Personalis, Inc.

- PreAnalytiX GmbH

- QIAGEN N.V.

- Roche Diagnostics Corporation

- Roche Holding AG

- Streck, Inc.

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

Delivering Actionable Strategies for Industry Leaders to Enhance Collection Efficiency Assurance Stabilization Integrity and Competitive Advantage

Industry leaders can derive substantial benefits by implementing targeted strategies designed to strengthen their position throughout the specimen management value chain. First, investing in modular automation solutions that accommodate diverse specimen types enhances throughput while minimizing operator variability. By integrating virtual tracking systems, organizations can maintain real‐time visibility of sample location and condition, thus safeguarding against potential pre‐analytical deviations.

Second, building strategic supply chain resilience through dual‐sourcing agreements and local manufacturing partnerships can mitigate the impact of trade policy shifts. Organizations should prioritize partnerships with specialized reagent developers that offer customizable stabilization chemistries aligned to specific biomarker classes. Concurrently, adopting standardized protocols and validation frameworks endorsed by regulatory agencies will streamline cross‐laboratory comparability and accelerate regulatory submissions.

Finally, cultivating collaborative relationships with clinical research networks and diagnostic laboratories fosters early adoption of novel preservation approaches and creates feedback loops for continuous improvement. By engaging end users in co‐development initiatives and establishing consortium‐based performance evaluation studies, companies can ensure that their specimen collection and stabilization systems meet the highest standards for analytical fidelity, operational efficiency and patient safety.

Detailing Rigorous Research Methodology Incorporating Data Collection Analysis Validation and Quality Control Protocols in Rare Biomarker Specimen Studies

This research synthesis relied on a multi‐tiered methodology combining qualitative and quantitative approaches to ensure robust, actionable insights. Primary data were gathered through structured interviews with laboratory directors, procurement specialists, and translational scientists across major academic medical centers and commercial organizations. These expert perspectives were complemented by a comprehensive review of technical literature, regulatory guidance documents, and peer‐reviewed publications focusing on pre‐analytical variables and stabilization methods.

Quantitative analysis involved rigorous assessment of product portfolios, patent filings, and technology adoption rates, supplemented by third‐party datasets from industry associations. All data points underwent strict validation protocols, including cross‐referencing supplier specifications with independent performance evaluations and simulated laboratory testing results. The findings were further refined through a dedicated quality control process, featuring expert panel reviews to verify methodological rigor and confirm alignment with current best practices in rare biomarker specimen management.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rare Biomarkers Specimen Collection & Stabilization market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rare Biomarkers Specimen Collection & Stabilization Market, by Product

- Rare Biomarkers Specimen Collection & Stabilization Market, by Specimen Type

- Rare Biomarkers Specimen Collection & Stabilization Market, by Stabilization Technique

- Rare Biomarkers Specimen Collection & Stabilization Market, by Collection Method

- Rare Biomarkers Specimen Collection & Stabilization Market, by Application

- Rare Biomarkers Specimen Collection & Stabilization Market, by End User

- Rare Biomarkers Specimen Collection & Stabilization Market, by Region

- Rare Biomarkers Specimen Collection & Stabilization Market, by Group

- Rare Biomarkers Specimen Collection & Stabilization Market, by Country

- United States Rare Biomarkers Specimen Collection & Stabilization Market

- China Rare Biomarkers Specimen Collection & Stabilization Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Consolidating Key Findings and Strategic Imperatives to Shape the Future Direction of Rare Biomarker Collection and Stabilization Innovation

The confluence of technological innovation, regulatory evolution and strategic industry action is propelling the field of rare biomarker specimen collection and stabilization into a new era of precision and reliability. Key findings underscore the critical role of advanced stabilizing chemistries and automated platforms in preserving ultra‐low‐abundance analytes, while harmonized regulatory frameworks and collaborative partnerships are facilitating broader adoption across global markets.

By integrating the insights presented here-ranging from microfluidic enrichment approaches to temperature control logistics-stakeholders can enhance sample integrity, optimize operational efficiency, and navigate supply chain complexities with greater confidence. As the sector continues to evolve, organizations that invest in resilient infrastructures, data‐driven decision making and cross‐sector collaboration will be best positioned to harness the full potential of rare biomarkers for cutting‐edge research and clinical applications.

Engage Directly to Access the Comprehensive Market Research Report and Collaborate with an Expert Associate Director to Elevate Your Strategic Positioning

For decision makers ready to navigate the complexities of rare biomarker specimen collection and stabilization, partnering directly with Associate Director, Sales & Marketing Ketan Rohom provides an efficient avenue to access the comprehensive market research report. His expertise and tailored guidance can help you align strategic initiatives with the most critical market insights, unlocking opportunities to optimize your operational workflows and stay ahead of emerging trends. Engage now to secure your copy, benefit from custom data interpretations, and position your organization for sustained competitive growth.

- How big is the Rare Biomarkers Specimen Collection & Stabilization Market?

- What is the Rare Biomarkers Specimen Collection & Stabilization Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?