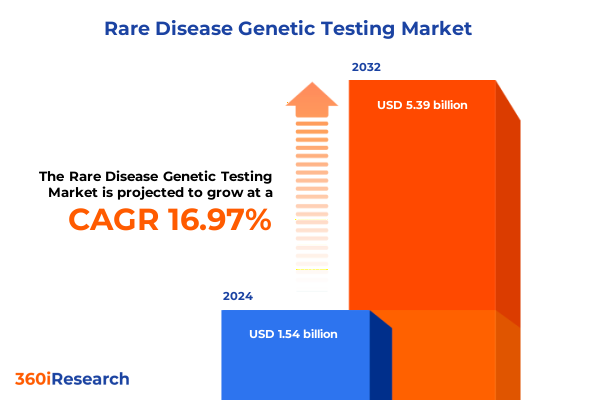

The Rare Disease Genetic Testing Market size was estimated at USD 1.79 billion in 2025 and expected to reach USD 2.09 billion in 2026, at a CAGR of 17.00% to reach USD 5.39 billion by 2032.

Highlighting the imperative for integrated genomic testing frameworks to close diagnostic gaps and expedite personalized rare disease care

Rare diseases collectively affect hundreds of millions of individuals worldwide yet remain notoriously difficult to diagnose due to their low prevalence and heterogeneous clinical presentations. Approximately 80 percent of these disorders have a genetic origin, underscoring the critical importance of robust genetic testing frameworks in delivering timely diagnoses and informing personalized treatment paths. Despite significant advances in genomic technologies, less than half of patients suffering from rare conditions receive a definitive molecular diagnosis, highlighting gaps in access, variant interpretation, and clinician awareness. In response, healthcare systems, research institutions, and diagnostic laboratories are converging around integrated testing models and collaborative data-sharing platforms to accelerate diagnosis and improve patient outcomes.

As diagnostic odysseys persist, with many families navigating multiple specialist consultations over years, the rare disease field is poised for transformation through converging scientific breakthroughs in sequencing, bioinformatics, and policy support. This research summary synthesizes the latest developments in technology, regulatory environments, tariff headwinds, and market dynamics to equip stakeholders with a clear roadmap for leveraging genetic testing across the rare disease continuum.

Unveiling the convergence of high-throughput sequencing, AI-driven analytics, and decentralized models to revolutionize rare disease diagnostics

The rare disease genetic testing landscape is undergoing transformative shifts driven by continuous declines in sequencing costs, integration of artificial intelligence for variant interpretation, and expanding adoption of multi-omics approaches. Next-generation sequencing platforms, once prohibitively expensive, now enable high-throughput exome and genome assays that reduce diagnostic turnaround times from months to days, while long-read technologies uncover complex structural variants that short-read methods often miss. Simultaneously, AI-powered variant-calling engines and phenotype-driven algorithms are automating data analysis and curating genotype–phenotype correlations at scale, drastically improving diagnostic yield in clinical settings.

Parallel to technological innovations, decentralized testing models have gained traction: at-home sample collection kits linked to virtual genetic counseling services are expanding access beyond specialized centers, particularly in underserved regions. Moreover, collaboration networks and consortia are fostering real-world data aggregation across academic, commercial, and patient-advocacy domains, supporting novel biomarker discovery and informed therapeutic development. Together, these shifts mark a paradigm where precision diagnostics evolve from niche applications to foundational components of rare disease management.

Analyzing how 2025 U.S. tariffs on imports of sequencing reagents and lab equipment are reshaping investment and innovation in rare disease diagnostics

In 2025, cumulative U.S. tariff measures have exerted multifaceted impacts on the rare disease genetic testing ecosystem by inflating import costs for reagents, laboratory equipment, and critical consumables. Core capital goods spending declined in the second quarter as businesses delayed or scaled back investments ahead of heightened import duties, with new orders for key instruments down 0.7 percent in June 2025 while shipments rose modestly by 0.4 percent-largely reflecting price increases rather than volume growth. Imported next-generation sequencing reagents and PCR kits, often sourced from Asia and Europe, face additional 15 to 25 percent duties, compounding operational costs for diagnostic laboratories and extending time-to-diagnosis for patients.

Furthermore, a March 2025 survey by the Biotechnology Innovation Organization revealed that over 94 percent of U.S. biotech firms anticipate surging manufacturing costs if tariffs are imposed on European imports, with half of companies forecasting delays in regulatory filings and R&D timelines due to supply-chain disruptions. As a result, organizations are diversifying sourcing strategies, onshoring critical manufacturing capabilities, and forging new partnerships in tariff-exempt regions to mitigate cost inflation. These strategies underscore a landscape where policy-driven variables significantly shape investment decisions and technology deployment across the rare disease diagnostic value chain.

Illuminating the nuanced interplay of technology platforms, test modalities, clinical endpoints, and disease categories that define the rare disease genetic testing market

Insights derived from close analysis of market segmentation underscore how differentiated technology platforms, test modalities, and clinical applications drive the rare disease genetic testing space. Within the technology landscape, high-resolution microarray assays maintain a niche role for copy-number variant detection, while next-generation sequencing dominates broader molecular profiling. Sequencing by synthesis platforms offer high accuracy and throughput, complemented by sequencing by ligation methods optimized for targeted panels. Polymerase chain reaction methodologies also continue to evolve: quantitative PCR serves as a rapid confirmation tool, and digital PCR enables ultra-sensitive detection of low-frequency variants.

Test-type segmentation reveals that exome sequencing remains a mainstay for clinical mutation discovery, with clinical exome workflows tailored for diagnostic yield and research exome pipelines optimized for gene discovery initiatives. Genome sequencing spans both targeted genomic regions and whole-genome approaches, unlocking insights into non-coding and structural genomic alterations. Panel testing has diversified into cancer-specific panels, cardiovascular panels, and neurological panels, while single-gene assays persist for familial and confirmatory testing scenarios.

End-user distribution tracks strong involvement from diagnostic laboratories that scale high-throughput workflows, specialty and hospital-based molecular labs expanding in private and public settings, and research institutions advancing novel assay development. Specialty clinics, leveraging point-of-care and tele-genetics models, bring genetic insights directly to patient consults. Application-driven classification highlights carrier screening as a preventive measure, while diagnostics and newborn screening focus on early, actionable interventions. Prenatal screening bifurcates into invasive procedures, such as amniocentesis, and non-invasive methods based on cell-free DNA. Research applications underpin pipeline generation for novel therapeutic targets. Disease-indication focus includes hematological disorders, enzyme-deficiency and mitochondrial metabolic disorders, neuromuscular conditions, and oncology panels, each commanding distinct workflow requirements and reimbursement pathways.

This comprehensive research report categorizes the Rare Disease Genetic Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Technology

- Disease Indication

- Application

- End User

Comparing the policy-driven, institutional, and consortium-led frameworks shaping rare disease genetic testing across the Americas, EMEA, and Asia-Pacific territories

Regional dynamics in rare disease genetic testing reflect distinct policy environments, healthcare infrastructures, and funding landscapes across the Americas, EMEA, and Asia-Pacific. In the Americas, the United States leads with a robust matrix of federal and state newborn screening programs guided by the Recommended Uniform Screening Panel, which lists core and secondary conditions for early detection across all states. Private and public investments have fueled advanced sequencing centers, enabling streamlined access to exome and genome services with payer coverage policies continuing to evolve in response to real-world outcome data.

In Europe, the Middle East, and Africa region, several national healthcare systems integrate expanded newborn screening mandates; Italy’s program has grown from three conditions in 1992 to over forty metabolic disorders under a 2016 legislative expansion. Collaborative EU frameworks, such as the European Reference Networks for Rare Diseases, facilitate cross-border data exchange and standardization of diagnostic protocols, although disparities in reimbursement and laboratory accreditation persist across member states and into the Middle East.

Asia-Pacific is rapidly advancing genomic capabilities through public–private partnerships and consortium models. The International Nanopore Sequencing Partnership for Rare Disease Engagement (INSPIRE) Consortium, launched in Bangkok, exemplifies regional collaboration to address diagnostic delays by leveraging portable long-read sequencing technologies and local variant databases to increase case resolution rates. Government-led initiatives in Japan, Singapore, and Australia are expanding newborn screening panels, while emerging markets such as Thailand and India focus on policy frameworks and capacity building to integrate genetic testing into universal health coverage schemes.

This comprehensive research report examines key regions that drive the evolution of the Rare Disease Genetic Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the major sequencing system providers, diagnostic laboratories, and AI-driven bioinformatics platforms shaping the competitive rare disease genetics arena

The competitive landscape of rare disease genetic testing is anchored by technology pioneers, diagnostic specialists, and bioinformatics innovators. Illumina’s NovaSeq™ X Plus system, launched in 2024, exemplifies high-throughput sequencing innovations that deliver enhanced throughput and reduced cost-per-base, positioning the company at the forefront of large-scale exome and genome workflows. Thermo Fisher Scientific and QIAGEN continue to expand PCR-based panels and library-preparation kits, leveraging established reagent portfolios to support hybrid sequencing strategies.

Diagnostic-focused providers such as Invitae and Fulgent Genetics differentiate through direct-to-consumer models and integrated genetic counseling services, enabling rapid at-home sample collection and end-to-end reporting. Commercial bioinformatics specialists like Deep Genomics drive algorithmic variant interpretation, having secured significant funding to scale AI-driven pipelines for rare disease gene discovery. Meanwhile, emerging players including Strand Life Sciences and MyOme are introducing digital portals and risk-assessment platforms that streamline data sharing between clinicians and researchers, reflecting the growing convergence of precision diagnostics and clinical decision support tools.

Strategic partnerships between sequencing platform vendors, clinical laboratories, and pharmaceutical companies signal an ecosystem-wide shift toward co-developed companion diagnostics and translational research collaborations. This convergence underscores a market where multidisciplinary alliances expedite variant validation, therapeutic discovery, and regulatory submissions, strengthening the overall rare disease diagnostic pipeline.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rare Disease Genetic Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3billion, Inc.

- Ambry Genetics Corporation

- Arup Laboratories

- Baylor Genetics

- Caris Life Sciences

- CENTOGENE N.V.

- Color Health, Inc.

- F. Hoffmann-La Roche Ltd.

- Fulgent Genetics, Inc.

- GeneDx, LLC

- Genomelink, Inc.

- Helix OpCo, LLC

- Illumina, Inc.

- Integrated DNA Technologies, Inc.

- Invitae Corporation

- Laboratory Corporation Of America Holdings

- Macrogen, Inc.

- Myriad Genetics, Inc.

- Nonacus Limited

- OPKO Health, Inc.

- PerkinElmer Inc.

- Progenity, Inc.

- QIAGEN N.V.

- Quest Diagnostics Incorporated

- Realm IDX, Inc.

- Sanofi S.A.

- The Cooper Companies, Inc.

- Thermo Fisher Scientific Inc.

- Variantyx, Inc.

Strategic directives for building resilient supply chains, advancing AI-driven diagnostics, and forging regulatory and payer collaborations for rare disease testing success

Industry leaders operating within the rare disease genetic testing sector should prioritize several actionable strategies to navigate evolving market complexities and policy drivers. First, they should establish resilient supply chains by diversifying reagent and equipment sourcing across markets with favorable tariff structures and developing in-house manufacturing capabilities for critical consumables. Second, organizations must invest in AI-enhanced bioinformatics pipelines and multi-omics data integration to increase diagnostic yield and support novel biomarker discovery. This entails forging partnerships with computational genomics firms and academic research networks to co-develop analytic frameworks.

Third, engaging proactively with regulatory bodies and payer groups will accelerate reimbursement pathways for advanced assays. Stakeholders should contribute to real-world evidence studies that demonstrate clinical utility and cost-effectiveness, thereby reinforcing coverage decisions. Fourth, companies must collaborate with local health ministries and consortia to expand newborn and prenatal screening programs, leveraging tele-genetics and mobile platforms to reach underserved populations. Finally, building cross-sector alliances with pharmaceutical developers to co-create companion diagnostics will position diagnostic providers as integral partners in rare disease therapeutic development, unlocking new revenue streams and supporting patient-centric care models.

Describing the mixed-methods approach combining executive interviews, market databases, and policy analyses to underpin robust rare disease testing insights

This research report integrates both primary and secondary methodologies to deliver comprehensive insights into the rare disease genetic testing market. Primary research involved in-depth interviews with diagnostic laboratory executives, technology vendors, clinicians, payers, and policy stakeholders to capture frontline perspectives on technological adoption, reimbursement challenges, and tariff impacts. Secondary research sources included peer-reviewed journals, government publications, industry white papers, and trade news outlets, ensuring triangulation of data and validation of market narratives.

Quantitative analyses leveraged proprietary databases tracking instrument shipments, reagent sales, and contractual agreements for sequencing services, while qualitative assessments incorporated case studies from regional screening initiatives and consortium efforts. The report’s segmentation framework was developed by mapping distinct test types, technology platforms, end-user categories, applications, and disease indications. Regional insights were informed by newborn screening registry data and policy reviews from authoritative sources. The overarching synthesis was subjected to iterative review by subject-matter experts to ensure accuracy, relevance, and strategic applicability for stakeholders across the genetic diagnostics ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rare Disease Genetic Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rare Disease Genetic Testing Market, by Test Type

- Rare Disease Genetic Testing Market, by Technology

- Rare Disease Genetic Testing Market, by Disease Indication

- Rare Disease Genetic Testing Market, by Application

- Rare Disease Genetic Testing Market, by End User

- Rare Disease Genetic Testing Market, by Region

- Rare Disease Genetic Testing Market, by Group

- Rare Disease Genetic Testing Market, by Country

- United States Rare Disease Genetic Testing Market

- China Rare Disease Genetic Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding that integrated innovation, strategic resilience, and multi-stakeholder alignment will define the next era of rare disease genetic diagnostics

Rare disease genetic testing stands at a pivotal juncture where technological innovation, regulatory evolution, and global collaboration converge to address diagnostic challenges that have long impeded patient care. As next-generation sequencing platforms achieve unprecedented speed and affordability, artificial intelligence and multi-omics strategies elevate variant interpretation and clinical decision support. Concurrently, policy shifts and consortium models are expanding screening access, while tariff-driven supply-chain adjustments underscore the need for strategic resilience.

Looking ahead, stakeholders that harness integrated genomics frameworks, diversify sourcing pools, and cultivate partnerships across diagnostics, therapeutics, and policy domains will lead the transition from diagnostic odysseys to precise, timely interventions. The landscape is dynamic, with opportunities amplified by collaborative research networks and emerging markets embracing genomics as a healthcare imperative. Through continued innovation and pragmatic alignment with regulatory and reimbursement ecosystems, the rare disease genetic testing sector is poised to deliver transformative impacts for patients and healthcare systems worldwide.

Contact our Associate Director of Sales & Marketing to access exclusive research insights on rare disease genetic testing and secure your strategic advantage

To explore this comprehensive market research report and gain actionable insights tailored to your strategic objectives in the rare disease genetic testing landscape, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan can provide you with a detailed overview of the report’s scope, methodology, and the exclusive intelligence that will empower your organization to navigate emerging opportunities, mitigate risks from evolving tariffs, and capitalize on technological advancements. Engage with Ketan to discuss customized research packages, volume licensing options, and enterprise access models designed to support your decision-making process. Don’t miss the chance to secure a competitive advantage with in-depth data and strategic recommendations crafted by leading industry analysts; contact Ketan today to initiate your subscription and unlock the full potential of the rare disease genetic testing market report.

- How big is the Rare Disease Genetic Testing Market?

- What is the Rare Disease Genetic Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?