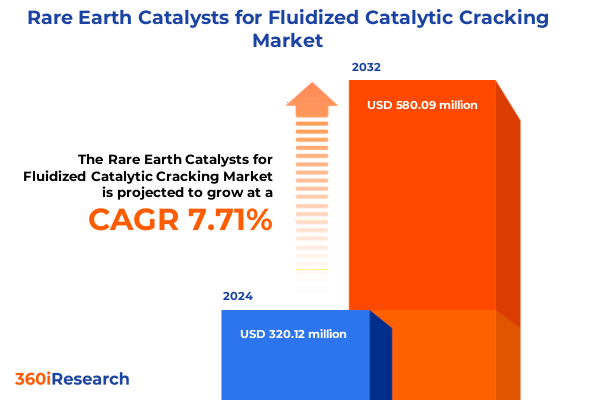

The Rare Earth Catalysts for Fluidized Catalytic Cracking Market size was estimated at USD 342.05 million in 2025 and expected to reach USD 370.60 million in 2026, at a CAGR of 7.83% to reach USD 580.09 million by 2032.

Unveiling the Transformative Potential of Rare Earth Catalysts in Fluidized Catalytic Cracking to Enhance Refinery Efficiency and Product Selectivity

Fluidized catalytic cracking stands as a cornerstone of modern refining, transforming heavy hydrocarbon feedstocks into valuable lighter fractions. At the heart of this process lie catalysts that control reaction pathways, influence product distributions, and determine operating efficiency. Rare earth elements have emerged as critical components in catalyst formulations, leveraging unique redox properties and thermal stability to extend cycle life, enhance olefin yields, and mitigate coke formation. By incorporating cerium, lanthanum, and their synergistic blends into the cracking matrix, refiners can finely tune acidity, optimize metal tolerance, and achieve superior performance under increasingly stringent quality requirements.

Against a backdrop of evolving crude slates, tightening environmental regulations, and shifting product demand, the introduction of rare earth catalysts presents refiners with a means to maintain operational flexibility and profitability. As heavier and more sulfur-rich feedstocks challenge conventional catalysts, the oxidative resilience and enhanced hydrogen transfer capabilities offered by rare earth elements become decisive advantages. This report delves into the foundational science behind these catalysts, outlines their role in advancing yield and selectivity objectives, and situates them within the broader context of global refining trends. The convergence of technological advancement and regulatory pressure underscores the urgency for stakeholders to reassess catalyst strategies and embrace innovations that drive sustainable returns.

Examining the Converging Technological Innovations and Regulatory Drivers Redefining Rare Earth Catalyst Applications in Fluidized Catalytic Cracking

The landscape of fluidized catalytic cracking has undergone a series of transformative shifts, driven by rapid advances in catalyst engineering, digital integration, and sustainability imperatives. Innovations in support materials and binder technology now allow greater dispersion of rare earth sites, leading to higher active surface areas and improved resistance to metal poisoning. This evolution in catalyst morphology, combined with the integration of real-time process analytics, empowers refiners to monitor catalyst bed health and reaction kinetics with unprecedented granularity. As a result, proactive regeneration schedules and adaptive operating conditions have become feasible, minimizing downtime and extending catalyst lifespans.

Concurrently, regulatory frameworks focused on emissions and product quality have propelled the demand for precision in yield profiles. The rise of low-sulfur fuel mandates and the push toward lower carbon intensity have elevated the need for catalysts that deliver high-value olefins while minimizing byproducts. In parallel, refiners face the challenge of processing increasingly heavy and variable crudes, compelling a shift toward robust catalyst formulations that maintain activity under harsh conditions. Moreover, collaborative models between catalyst suppliers and refiners, leveraging digital twins and advanced analytics, have emerged as a new paradigm for continuous improvement. This synergy between technological innovation and regulatory alignment underscores a fundamental shift toward adaptive, data-driven catalyst strategies.

Assessing the Wide-Ranging Consequences of United States Tariffs Implemented in 2025 on Rare Earth Catalyst Supply Security and Operational Economics

The introduction of new duties in early 2025 on rare earth imports to the United States has had a ripple effect across refining operations and catalyst supply chains. These tariffs, targeting primary exporters of neodymium, lanthanum, and cerium-based materials, have elevated procurement costs and prompted refiners to reevaluate sourcing strategies. The immediate impact has been a heightened focus on domestic beneficiation and recycling of spent catalyst, as stakeholders seek to insulate themselves from price volatility and ensure steady feedstock security. Companies are increasingly investing in closed-loop processes, recovering rare earth elements from deactivated catalyst beds to foster supply resilience.

In addition to cost considerations, the tariff regime has accelerated strategic alliances between refiners and regional mining and processing firms. These partnerships aim to secure preferential access to refined rare earth intermediates and facilitate joint development of value-added catalyst blends. Such collaborative initiatives are also shaping new research priorities, where the emphasis falls on maximizing yield per unit of rare earth content and enhancing catalyst regeneration cycles. The combined effect of policy shifts, supply diversification efforts, and intensified research underscores a reconfiguration of the rare earth catalyst market that prioritizes agility, sustainability, and long-term cost optimization.

Illuminating the Multidimensional Segmentation Landscape to Align Catalyst Type Feedstock End Use Physical Form and Particle Size with Refinery Objectives

Insights into catalyst type segmentation reveal that refiners are balancing the distinct advantages of monometallic lanthanum catalysts against the synergistic performance gains of bimetallic lanthanum-cerium formulations. Monometallic lanthanum variants continue to offer robust acidity profiles and thermal stability, while the introduction of cerium co-catalysts enhances redox functionality, mitigating coke deposition and sustaining activity during high-severity operations. This balance between acidity and redox capacity defines the choice of catalyst architecture as refiners tailor their cracking applications to specific feedstock challenges.

Turning to feedstock differentiation, atmospheric gas oil remains a versatile input that benefits from tailored rare earth catalysts designed for moderate severity regimes, whereas residual oil demands formulations with elevated metal tolerance and regenerability. Vacuum gas oil, positioned between these extremes, requires catalysts that combine surface acidity with redox resilience to handle increased heteroatom content without sacrificing olefin yields. These distinctions underscore the importance of feedstock-specific catalyst design in optimizing conversion and product value.

In examining end-use segmentation, additives and base oils derived from cracked products underscore the ongoing need for catalysts that maximize the yield of high-viscosity, low-sulfur streams. Meanwhile, petrochemical feedstocks destined for aromatics, olefins, or synthesis gas production drive demand for catalysts with precise control over cracking severity and selectivity. Transportation fuels such as diesel, gasoline, and naphtha each impose unique performance criteria, prompting refiners to select catalyst formulations that deliver targeted boiling point distributions and minimize undesirable side reactions.

Physical form segmentation highlights that extrudates-available as cylindrical rods, pellets, or spherical beads-offer consistent fluidization and heat transfer characteristics, while granules and powders cater to customized reactor configurations and regeneration strategies. Particle size further refines performance, with sub-50 micron grades maximizing active surface exposure at the expense of attrition resistance, contrasted by larger fractions that enhance mechanical strength and reduce fines generation. This granular view of segmentation provides refiners with a nuanced framework for aligning catalyst characteristics with operational objectives.

This comprehensive research report categorizes the Rare Earth Catalysts for Fluidized Catalytic Cracking market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Catalyst Type

- Feedstock

- Physical Form

- Particle Size

- End Use

Unraveling Regional Demand Patterns and Refinery Practices Driving Rare Earth Catalyst Adoption in the Americas Europe Middle East Africa and Asia Pacific

Geographical dynamics play a pivotal role in shaping the adoption and evolution of rare earth catalysts for fluidized catalytic cracking. In the Americas, strong capital investment in refinery upgrades and a focus on deep conversion units have driven demand for catalysts that excel under high-severity conditions. North American refiners, in particular, are leveraging domestic resource advantages and advanced recycling capabilities to secure reliable supplies of cerium and lanthanum, reinforcing supply chain integration while minimizing external dependencies.

Across Europe, the Middle East, and Africa, regulatory emphasis on emissions reduction and fuel quality has created a diverse catalyst landscape. Western European refiners are transitioning toward catalysts that support low-sulfur diesel and gasoline mandates, while Middle Eastern operators prioritize high-capacity units to maximize naphtha and condensate processing. African markets, characterized by emerging refinery capacity, exhibit growing interest in robust, low-cost catalyst solutions that accommodate variable crude slates and limited regeneration infrastructure.

In Asia-Pacific, the confluence of rapid industrial growth and evolving energy policies has fostered a twofold catalyst requirement. Established facilities in Northeast Asia are adopting next-generation rare earth formulations to boost olefin yields for petrochemical integration, whereas South and Southeast Asian refiners are focused on modular upgrades and catalyst packages that deliver operational resilience under variable feedstock quality. This regional differentiation underscores how local market conditions, regulatory frameworks, and resource availability jointly dictate catalyst selection and performance priorities.

This comprehensive research report examines key regions that drive the evolution of the Rare Earth Catalysts for Fluidized Catalytic Cracking market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting How Leading Players Are Leveraging Strategic Integration Collaboration and Digital Innovation to Advance Rare Earth Catalyst Solutions in Refining

Leading participants in the rare earth catalyst space have adopted distinct strategies to secure market position and drive innovation. Major multinational catalyst suppliers have expanded their rare earth processing capabilities through targeted acquisitions of specialized mineral processing firms, enhancing vertical integration from ore beneficiation to finished catalyst. These moves have enabled them to control raw material quality and cost, while fostering proprietary formulations that differentiate performance in high-severity cracking units.

Mid-sized technology firms have carved out niches by focusing on advanced support materials and binder chemistries that maximize rare earth dispersion and extend cycle lives. Through collaborative research alliances with national laboratories and academic institutions, these companies have introduced novel zeolite-based matrices that amplify redox behavior and reduce deactivation rates. Meanwhile, refinery-led joint ventures are emerging, where operators pool resources to co-develop custom catalyst blends tailored to their unique crude slates and product portfolios.

Across the competitive landscape, strategic partnerships between catalyst manufacturers and digital analytics providers are gaining traction. By coupling rare earth catalyst performance data with machine learning models, these alliances deliver predictive maintenance insights and optimize regeneration protocols. This integration of chemical innovation and digital intelligence represents a defining trend, positioning industry leaders to respond rapidly to shifting operational demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rare Earth Catalysts for Fluidized Catalytic Cracking market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albemarle Corporation

- Axens SAS

- BASF SE

- Clariant AG

- Criterion Catalysts & Technologies LLC

- Honeywell UOP LLC

- Johnson Matthey plc

- Kuwait Catalyst Company

- Sinopec Catalyst Company Limited

- W. R. Grace & Co.

- Zeolyst International LLC

Charting Practical Strategic Initiatives and Operational Best Practices to Maximize Value and Resilience in Rare Earth Catalyst Deployments

To navigate an increasingly dynamic market, industry leaders should prioritize diversifying their rare earth supply chains through a combination of strategic partnerships and internal recycling initiatives. By investing in modular beneficiation units and closed-loop recovery systems, refiners can insulate their operations from external price shocks while reducing reliance on a narrow pool of export sources. Concurrently, deepening technical collaboration with catalyst developers and research institutes will accelerate the translation of novel material science advances into commercial-grade formulations.

Operationally, the adoption of real-time process analytics and digital twins should be elevated from pilot projects to full-scale deployment. These tools enable precise monitoring of catalyst activity and coking tendencies, facilitating condition-based regeneration that maximizes uptime. In parallel, refining teams would benefit from embedding cross-functional task forces that align process, reliability, and procurement functions, ensuring that catalyst selection and regeneration scheduling seamlessly integrate with broader asset management objectives.

Finally, leadership should champion continuous improvement frameworks that incorporate performance benchmarking, lifecycle assessments, and environmental impact metrics. By establishing clear governance structures for catalyst performance reviews and sustainability targets, organizations can foster a culture of accountability and innovation. These measures collectively position companies to extract maximum value from rare earth catalysts while mitigating supply chain, regulatory, and operational risks.

Detailing the Rigorous Blend of Expert Interviews Secondary Data Triangulation and Analytical Frameworks Underpinning This Rare Earth Catalyst Study

This study synthesizes insights from a combination of primary and secondary research techniques designed to ensure robust and unbiased findings. Primary methodologies included in-depth interviews with senior technical experts at major refining companies, executives from catalyst manufacturers, and analysts specializing in rare earth supply chains. These conversations were structured to capture firsthand perspectives on performance challenges, innovation priorities, and procurement dynamics under evolving tariff regimes.

Secondary research encompassed a thorough review of peer-reviewed journals, patent filings, technical bulletins, and industry conference proceedings. Data triangulation was achieved by cross-referencing supplier disclosures, customs import-export records, and sustainability reports to validate supply chain shifts and cost implications. Where applicable, proprietary process simulations and material characterization studies were consulted to benchmark catalyst performance attributes such as acidity distribution, redox potential, and attrition resistance.

Analytical frameworks integrated segmentation analysis, geographic demand modeling, and competitive mapping to construct a multi-dimensional view of the market. Each insight was subjected to validation workshops with industry stakeholders to refine assumptions and ensure applicability across operational contexts. The result is a harmonized body of research that balances technical depth with strategic perspective, offering decision-makers a clear line of sight into the critical factors shaping the rare earth catalyst domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rare Earth Catalysts for Fluidized Catalytic Cracking market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rare Earth Catalysts for Fluidized Catalytic Cracking Market, by Catalyst Type

- Rare Earth Catalysts for Fluidized Catalytic Cracking Market, by Feedstock

- Rare Earth Catalysts for Fluidized Catalytic Cracking Market, by Physical Form

- Rare Earth Catalysts for Fluidized Catalytic Cracking Market, by Particle Size

- Rare Earth Catalysts for Fluidized Catalytic Cracking Market, by End Use

- Rare Earth Catalysts for Fluidized Catalytic Cracking Market, by Region

- Rare Earth Catalysts for Fluidized Catalytic Cracking Market, by Group

- Rare Earth Catalysts for Fluidized Catalytic Cracking Market, by Country

- United States Rare Earth Catalysts for Fluidized Catalytic Cracking Market

- China Rare Earth Catalysts for Fluidized Catalytic Cracking Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Trends and Strategic Imperatives to Guide Stakeholders in Harnessing Rare Earth Catalysts for Superior Refinery Outcomes

The exploration of rare earth catalysts for fluidized catalytic cracking reveals a pivotal axis of innovation and strategic differentiation in refining. From advances in catalyst morphology and redox functionality to the emergence of digital integration for process monitoring, the confluence of technology and operational rigor is reshaping performance benchmarks. U.S. tariff shifts have underscored the need for supply chain resilience, propelling recycling initiatives and prompting deeper collaboration between refiners and regional processors.

Segmentation analyses highlight the nuanced interplay between catalyst composition, feedstock properties, end-use requirements, and physical parameters. Regional insights demonstrate how local regulations, feedstock availability, and infrastructure maturity coalesce to influence catalyst selection. Competitive dynamics further reveal that strategic integration of material science with digital intelligence is emerging as a key differentiator among leading suppliers and operators.

Together, these findings underscore a clear imperative: stakeholders must adopt a holistic approach that balances technical innovation, supply chain diversification, and digital transformation. By doing so, they will be positioned to capitalize on evolving market conditions, drive operational excellence, and maintain sustainable growth in a sector increasingly defined by complexity and change.

Engage with Ketan Rohom to Access In-Depth Research Insights and Secure Your Copy of the Comprehensive Rare Earth Catalysts for FCC Report Today

If you are ready to gain a decisive competitive advantage through in-depth insights into the rare earth catalyst landscape for fluidized catalytic cracking, reach out to Ketan Rohom in his capacity as Associate Director of Sales & Marketing. He can provide you with detailed information on how to acquire the full-market research report, ensuring you have the critical data and strategic perspectives needed to make informed investment and operational decisions. Connecting with him will give you direct access to the methodologies, expert analyses, and regional intelligence compiled in the study, enabling your organization to capitalize on emerging opportunities and mitigate potential challenges. Don’t miss the opportunity to equip your leadership team with a comprehensive resource that translates complex market dynamics into actionable strategies-contact Ketan Rohom today to secure your copy and embark on a transformative journey toward optimized catalyst utilization and sustained profitability.

- How big is the Rare Earth Catalysts for Fluidized Catalytic Cracking Market?

- What is the Rare Earth Catalysts for Fluidized Catalytic Cracking Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?