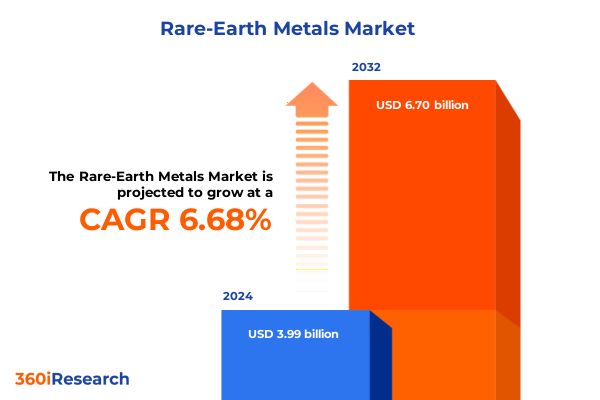

The Rare-Earth Metals Market size was estimated at USD 4.24 billion in 2025 and expected to reach USD 4.51 billion in 2026, at a CAGR of 6.74% to reach USD 6.70 billion by 2032.

Unveiling the Strategic Importance of Rare-Earth Metals in Driving Technological Innovation and Ensuring Sustainable Supply Chain Resilience

The rare-earth metals industry has emerged as an indispensable pillar of the modern global economy, underpinning critical advancements in technology, energy, defense, and consumer electronics. As the world accelerates its transition toward electrification, renewable energy solutions, and digital innovation, the pressure on global supply chains to deliver dependable sources of rare-earth elements intensifies. This convergence of rising demand and constrained supply has elevated the strategic importance of these minerals to unprecedented levels, compelling stakeholders to reassess traditional procurement strategies and invest in new extraction and processing capabilities.

Against a backdrop of heightened geopolitical tensions and evolving trade policies, the secure and sustainable provision of rare-earth metals is now a top priority for governments and private sector leaders alike. The interplay between resource-rich nations, environmentally sensitive extraction practices, and the imperative to reduce carbon footprints has catalyzed a wave of policy initiatives and collaborative frameworks. As a result, industry participants are navigating a complex landscape where technological innovation must align with environmental stewardship and regulatory compliance.

Moving forward, the rare-earth metals market will be defined by a delicate balance between fostering diversification of supply sources and ensuring the robustness of existing value chains. Achieving this balance requires an integrated approach that embraces cutting-edge research in extraction technologies, strengthens regional partnerships, and anticipates disruptions from international policy shifts. By understanding these dynamics, organizations can position themselves to capture opportunities within an evolving market that is central to the next generation of global technological progress.

How Technological Breakthroughs and Policy Evolution Are Reshaping the Rare-Earth Metals Landscape with Lasting Global Impacts

The rare-earth metals landscape has undergone transformative shifts driven by rapid technological breakthroughs and evolving policy frameworks. Innovations in electric vehicle propulsion systems have elevated the demand for neodymium-based magnets, while the expansion of wind energy projects has spurred interest in materials capable of enhancing turbine efficiency. Concurrently, breakthroughs in recycling and circular economy methodologies have begun to reshape value chains, offering pathways to reclaim critical elements from end-of-life electronics and reduce environmental impact.

On the policy front, governments worldwide are implementing targeted incentives to bolster domestic processing and refine extraction capabilities. Investment tax credits, infrastructure grants, and streamlined permitting processes are being deployed to attract capital to regions seeking to reduce dependence on a single dominant supplier. In parallel, international coordination efforts aim to establish common standards for environmental safeguards and responsible sourcing, minimizing the ecological footprint of rare-earth extraction while enhancing transparency across global supply networks.

These shifts have engendered new opportunities for collaboration between traditional mining companies, technology innovators, and research institutions. By fostering public-private partnerships, stakeholders are advancing pilot projects in bioleaching and solvent extraction, laying the groundwork for commercial-scale operations. As a result, the rare-earth sector is poised to evolve beyond its legacy of linear supply chains, embracing integrated models that align extraction, processing, recycling, and end-use application in a resilient and sustainable ecosystem.

United States Trade Measures Targeting Rare-Earth Imports and Their Expanding Impact on Industry Economics

The introduction of targeted trade measures by the United States has significantly altered the dynamics of the rare-earth metals industry. By imposing tariffs on imported concentrates and processed oxides, policymakers have sought to incentivize domestic refining capacity and secure strategic autonomy over critical minerals. Over time, these measures have triggered a realignment of supply chains, prompting downstream manufacturers to explore alternative sourcing options and invest in building resilient, localized processing infrastructure.

These cumulative trade measures have had a multifaceted impact on the industry ecosystem. Domestic producers of light and heavy rare-earth elements have benefited from a more favorable competitive environment, attracting new capital for facility expansions and research into advanced extraction processes. At the same time, end-use industries reliant on imported materials have faced upward cost pressures, driving a renewed focus on material efficiency and lifecycle extension.

Moreover, the ripple effects of these policy actions have extended to international partners, spurring collaborative initiatives to develop reciprocal trade frameworks and co-investment vehicles. As companies navigate the new tariff landscape, strategic alliances have emerged as a key mechanism for mitigating regulatory risk and leveraging shared technical expertise. In this evolving context, long-term success will hinge on stakeholders’ ability to adapt to an environment where trade policy serves not only as an economic lever but also as a catalyst for industrial innovation.

Uncovering Sector-Specific Dynamics and Growth Drivers through Detailed Rare-Earth Metals Segmentation Analysis

Digging deeper into market segmentation reveals critical nuances that inform strategic decision-making across the rare-earth metals value chain. When evaluating the distinctions between heavy and light rare-earth elements, one uncovers the specialized applications of each category. Heavy elements such as dysprosium and terbium offer superior magnetic and thermal properties essential for high-performance electric motors and advanced defense applications, while light elements including neodymium and praseodymium underpin the bulk of catalytic and phosphor technologies in consumer electronics.

The form in which these materials enter the supply chain-whether as pure metal ingots, intricate alloys, composite assemblies, or stabilized oxides-directly influences processing requirements and product performance. Alloys blend multiple elements to achieve tailored magnetic or optical characteristics, whereas oxide forms often serve as intermediate inputs for ceramic and glass additive applications. Each product form carries distinct economic and technical considerations for manufacturers seeking to optimize their downstream conversions.

Purity levels further differentiate market offerings, with ultra-high-purity grades enabling critical research and semiconductor applications while standard industrial grades suffice for large-scale metallurgy and polishing powders. The choice of extraction process-be it hydrometallurgical leaching, bioleaching, or traditional pyrometallurgical routes-drives operational cost structures and environmental footprints, shaping corporate sustainability profiles. Finally, the end-use landscape spans a broad spectrum of industries: aerospace relies on high-stress magnet assemblies, automotive OEMs demand consistent performance in battery packs, and telecommunications suppliers integrate rare-earth-based alloys for signal-enhancing components. Recognizing these segmentation insights is vital for aligning R&D efforts, supply partnerships, and investment strategies with the unique requirements of each domain.

This comprehensive research report categorizes the Rare-Earth Metals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Product Form

- Extraction Process

- Purity

- Application

- End-Use Industry

- Sales Channel

Evaluating Regional Trends and Strategic Priorities across Major Geographies in the Rare-Earth Metals Sector

The Americas region has emerged as a focal point for supply chain diversification and policy support initiatives. North American refining hubs are benefiting from government grants and private equity inflows aimed at reducing reliance on a single-source supplier. Simultaneously, downstream manufacturers are establishing joint ventures with new mine operators to secure preferential access to high-purity feedstocks. Latin American exploration efforts are also gaining traction, with promising deposits in Brazil and Mexico garnering technical feasibility studies that emphasize sustainable extraction practices.

Across Europe, the Middle East, and Africa, stakeholder priorities revolve around balancing environmental stewardship with industrial growth. The European Union’s critical raw materials strategy is accelerating investment in recycling infrastructure and circular economy pilots, while partnerships between Middle Eastern sovereign wealth funds and mining companies explore greenfield development under stringent ecological guidelines. African governments, recognizing the strategic value of rare-earth assets, are crafting regulatory frameworks that attract responsible mining operations and foster local beneficiation.

In the Asia-Pacific corridor, technological leadership and scale continue to dominate. Processing giants in East Asia are expanding into upstream mine development to safeguard their vertical integration strategies. At the same time, emerging economies are collaborating on transnational pipelines that link remote deposits to coastal smelters, supported by multinational financing mechanisms. Through regional trade blocs, Asia-Pacific nations are negotiating streamlined tariffs and technical standards, reinforcing their collective capacity to respond swiftly to market opportunities and policy shifts.

This comprehensive research report examines key regions that drive the evolution of the Rare-Earth Metals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players’ Strategic Initiatives and Competitive Positioning within the Rare-Earth Metals Market

Leading companies in the rare-earth metals domain are deploying multifaceted strategies to secure competitive advantage. Some industry incumbents have advanced proprietary extraction techniques that combine hydrometallurgical processes with biological catalysts, markedly reducing energy consumption and environmental impact. These innovations form the basis of strategic partnerships with automotive and electronics OEMs, providing a secured stream of offtake agreements and cost-sharing arrangements.

Other market leaders are doubling down on vertically integrated models, acquiring upstream mining assets and downstream processing facilities to capture value throughout the supply chain. This integrated approach has enabled them to offer end-to-end solutions-from raw ore procurement to high-purity metal delivery-that address customer demands for traceability and quality assurance. Concurrently, forward-thinking players are investing in digital twins and AI-driven analytics to optimize mineral separation techniques and predict equipment maintenance needs, further enhancing operational efficiency.

Emerging firms are carving out niches by specializing in rare-earth recycling and secondary material recovery. By establishing dedicated processing centers for end-of-life electronic components and magnet reclamation, these companies are tapping into circular economy trends and differentiating themselves through environmentally responsible business models. Collectively, these strategic initiatives illustrate the dynamic competitive landscape in which technological prowess, supply chain integration, and sustainability commitments define market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rare-Earth Metals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alkane Resources Ltd.

- Aluminum Corporation of China

- American Rare Earths Limited

- Arafura Rare Earths Limited

- Australian Strategic Materials Ltd.

- Avalon Advanced Materials Inc.

- Baotou HEFA Rare Earth

- Canada Rare Earth Corporation

- China Northern Rare Earth (Group) High-Tech Co., Ltd.

- China Rare Earth Holdings Limited

- Energy Fuels Inc.

- Energy Transition Minerals Ltd.

- Eutectix LLC

- Frontier Rare Earths Limited

- Ganzhou Qiandong Rare Earth Group Co., Ltd

- Hastings Technology Metals Ltd.

- Iluka Resource Limited

- IREL (India) Limited

- Iwatani Corporation

- Lynas Rare Earths Ltd

- Mitsubishi Corporation

- Mitsui Kinzoku

- MP Materials

- Neo Performance Materials by Luxfer Holdings PLC

- Nippon Yttrium Co., Ltd.

- Northern Minerals Limited

- Peak Rare Earths

- Rainbow Rare Earths Ltd

- Ramaco Resources, Inc.

- Rare Element Resources Ltd.

- Rio Tinto PLC

- Serra Verde

- Shenghe Resources Holding Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Solvay SA

- Texas Mineral Resources Corp.

- Thermo Fisher Scientific Inc.

- Ucore Rare Metals Inc.

- Xiamen Tungsten Co., Ltd.

Implementing Strategic Pathways for Enhanced Supply Chain Resilience and Technological Advancement in Rare-Earth Metals

Industry leaders must adopt a dual approach that prioritizes both supply reliability and technological differentiation. Strengthening alliances with alternative mining jurisdictions while investing in domestic refining capacity will serve to insulate operations from geopolitical shocks and tariff volatility. Simultaneously, expanding pilot projects for next-generation extraction methods-such as ion exchange and bioleaching-will yield scalable processes that reduce environmental impact and operational costs.

Enhancing material stewardship through robust recycling and end-of-life recovery programs is equally critical. By partnering with electronics manufacturers and automotive OEMs, companies can secure steady streams of secondary feedstocks, alleviating pressure on primary sources. These partnerships should be underpinned by data-sharing platforms and joint R&D roadmaps that streamline material characterization and processing workflows.

Finally, leaders should engage proactively with regulatory bodies to shape pragmatic policy frameworks that balance national security objectives with global trade facilitation. Participating in industry consortia and cross-border research alliances will foster shared best practices, harmonized standards, and co-investment in strategic infrastructure. Through this integrated strategy, stakeholders can transform market uncertainties into opportunities for sustained growth and resilience.

Transparent Overview of Research Approach Combining Qualitative Insights and Rigorous Market Intelligence Techniques

The research approach combines comprehensive primary interviews with senior executives across mining, processing, and end-use sectors, coupled with secondary analysis of peer-reviewed literature and policy documents. These interviews provide firsthand perspectives on operational challenges, investment priorities, and strategic partnerships shaping the current market environment. Secondary sources are meticulously vetted to ensure that data on extraction methodologies, purity standards, and application trends align with the most recent academic and industry publications.

Data triangulation is achieved by cross-referencing company filings, government trade statistics, and independent mineral resource reports. This layered approach enhances the reliability of insights on regional production capacities, technological adoption rates, and sustainability initiatives. Qualitative assessments derived from expert consultations are systematically validated against quantitative indicators to mitigate bias and reinforce analytical rigor.

Finally, the study leverages scenario modeling to explore the potential outcomes of policy shifts, emerging technologies, and macroeconomic variables. These scenarios facilitate stress-testing of supply chain configurations and investment strategies, equipping stakeholders with actionable foresight. Ethical guidelines and confidentiality agreements govern all interview processes, ensuring that proprietary and sensitive information is handled with the highest standards of integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rare-Earth Metals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rare-Earth Metals Market, by Type

- Rare-Earth Metals Market, by Product Form

- Rare-Earth Metals Market, by Extraction Process

- Rare-Earth Metals Market, by Purity

- Rare-Earth Metals Market, by Application

- Rare-Earth Metals Market, by End-Use Industry

- Rare-Earth Metals Market, by Sales Channel

- Rare-Earth Metals Market, by Region

- Rare-Earth Metals Market, by Group

- Rare-Earth Metals Market, by Country

- United States Rare-Earth Metals Market

- China Rare-Earth Metals Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Concluding on the Critical Imperatives and Future Trajectories Shaping the Rare-Earth Metals Industry Landscape Worldwide

The rare-earth metals industry stands at a pivotal juncture where technological innovation converges with strategic imperatives for secure and sustainable supply. The intricate interplay of policy incentives, global trade measures, and evolving extraction methodologies will define the path forward. Companies that excel will be those that embrace an integrated approach, weaving together advanced processing technologies, strategic partnerships, and circular economy principles.

Regional dynamics will continue to shape market access and cost structures, demanding that stakeholders remain agile in navigating geopolitical shifts and environmental requirements. Equally, the rapid evolution of application domains-from electric mobility to next-generation electronics-calls for continuous investment in purity enhancements and material customization.

By synthesizing segmentation insights with macro-level trends, industry participants can prioritize initiatives that align with high-value applications and geographies. The ability to harness proprietary research methods and engage in collaborative frameworks will separate leaders from followers, establishing a resilient foundation for long-term success. In this environment, proactive strategy formulation and sustained innovation are essential to capitalizing on the transformative potential of rare-earth metals.

Connect with Ketan Rohom to Secure Comprehensive Rare-Earth Metals Market Intelligence and Drive Strategic Decisions

To explore the full breadth of rare-earth metals market intelligence and uncover strategic pathways for your organization, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. His unparalleled expertise can guide you through the complexities of supply chain dynamics, regulatory shifts, and emerging technological applications. Engaging directly with him provides an opportunity to tailor insights specific to your unique challenges and objectives, ensuring that your decisions are underpinned by the most rigorous research methodology and the latest industry developments. Initiating a dialogue with Ketan Rohom is the first step toward transforming data into actionable strategies and unlocking new avenues for growth in the rare-earth metals sector.

- How big is the Rare-Earth Metals Market?

- What is the Rare-Earth Metals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?