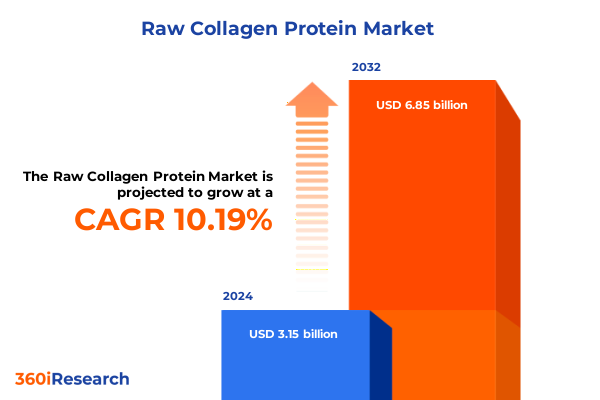

The Raw Collagen Protein Market size was estimated at USD 2.63 billion in 2025 and expected to reach USD 2.83 billion in 2026, at a CAGR of 7.17% to reach USD 4.28 billion by 2032.

An insightful introduction capturing the origins, evolution, and growing cross-industry relevance of raw collagen protein

The raw collagen protein market has emerged as a vital component in a wide array of industries, encompassing health and wellness, pharmaceuticals, cosmetics, and animal nutrition. Originating from traditional uses in the food sector as gelatin, collagen has evolved into a highly versatile biomaterial prized for its functional and bioactive properties. Amidst shifting consumer preferences toward clean-label and naturally derived ingredients, raw collagen has transitioned from a niche supplement to a mainstream ingredient driving innovation across multiple sectors.

Historically, gelatin production formed the backbone of the collagen supply chain, leveraging by-products of the meat processing industry. However, advancements in raw material sourcing and extraction technologies have facilitated the rise of specialized collagen forms, including hydrolyzed and undenatured variants, which boast enhanced solubility and bioavailability. These technical refinements, combined with growing scientific validation of collagen’s benefits for skin elasticity, joint health, and tissue repair, have spurred robust demand globally.

Against this backdrop, market participants are navigating a landscape characterized by dynamic regulatory frameworks, evolving sustainability imperatives, and diversification of application channels. As stakeholders seek clarity on competitive drivers and emerging opportunities, this introduction provides a foundational overview of the raw collagen protein arena, setting the stage for a deeper examination of transformative shifts, trade influences, segmentation nuances, regional distinctions, and strategic recommendations.

Key transformative shifts reshaping raw collagen protein through advanced extraction, sustainability imperatives, and evolving consumer demands

The raw collagen protein landscape is undergoing transformative shifts fueled by breakthroughs in extraction methods, heightened sustainability expectations, and digital integration. Enzymatic hydrolysis and membrane filtration have supplanted older acid and alkali treatments, enabling producers to achieve higher purity levels and consistent peptide profiles. As a result, quality control paradigms have shifted from batch testing toward real-time analytical monitoring, ensuring product integrity and reducing processing variability.

Concurrently, sustainability considerations have taken center stage, with industry leaders prioritizing waste valorization and renewable sourcing. Fish skin and chicken feet, once underutilized by-products, are now integral to circular economy initiatives. This pivot toward eco-efficient raw materials not only mitigates environmental impact but also resonates with conscious consumers, reinforcing brand credibility. Moreover, regulatory agencies are increasingly scrutinizing labeling claims and allergen management, prompting companies to invest in traceability solutions that leverage blockchain and IoT-enabled supply chain platforms.

Another notable trend is the growing consumer appetite for specialty collagen types-such as undenatured collagen for targeted joint support and marine-derived peptides for beauty applications. These shifts reflect broader health and wellness paradigms that emphasize personalized nutrition and natural therapeutics. As producers adapt to these evolving preferences, strategic agility in R&D, sourcing, and digital operations will become paramount to sustaining competitive advantage.

Detailed analysis of cumulative impacts from 2025 United States tariffs on raw collagen protein supply chains and cost structures

In 2025, newly imposed United States tariffs have introduced complex challenges and strategic recalibrations across the raw collagen protein supply chain. Tariff escalations on imports from several producing countries have raised input costs for manufacturers reliant on bovine and marine collagen sources, prompting immediate cost absorption strategies and renegotiation of long-term supply contracts. These measures have underscored the need for diversified sourcing to mitigate concentration risk.

In response, market participants have accelerated partnerships with suppliers in Latin America and Southeast Asia, regions exhibiting strong production capacities and favorable trade agreements. By securing alternative sourcing channels, companies aim to stabilize raw material costs and preserve margin structures. Nonetheless, the tariff-induced price pressures have resonated downstream, affecting formulation costs for nutraceuticals, functional beverages, and cosmetics, where collagen content is a key differentiator.

Moreover, potential ripple effects include shifts in product positioning and marketing strategies. Brands are increasingly emphasizing domestic manufacturing credentials to counteract import-related cost inflation, and some are exploring value-added offerings-such as customized peptide blends-to justify premium pricing. As stakeholders recalibrate their operations to navigate these trade dynamics, continuous monitoring of tariff developments and proactive supply chain optimization remain critical to sustaining market resilience.

Strategic segmentation insights revealing form, type, source, and application-based dynamics shaping the raw collagen protein market

Analysis of market segmentation across form, type, source, and application reveals distinct growth vectors and competitive dynamics within the raw collagen protein industry. From a form perspective, the powder segment remains dominant due to its versatility, ease of integration in beverages and supplements, and cost-effective transportation. Liquid formulations have gained traction among ready-to-drink functional drink portfolios, while the combined Capsules and Tablets category continues to serve targeted dosage requirements for dietary supplements, leveraging convenience and dosage precision.

When parsed by collagen type, hydrolyzed collagen leads adoption, driven by its high bioavailability and rapid absorption characteristics. Gelatin retains significance in traditional food applications, and undenatured collagen is carving out a niche in specialized joint health products that demand minimal denaturation to preserve native protein structures. Source-based differentiation underscores the rising prominence of marine-derived collagen, where fish-derived peptides are celebrated for their clean label appeal. Bovine remains a cost-effective cornerstone, while porcine and poultry sources cater to region-specific dietary and religious considerations.

Application-wise, nutraceuticals and functional foods command substantial engagement, supported by growing consumer health awareness. Cosmetic formulations leverage collagen for skin elasticity and hair and oral care benefits, and food and beverage sectors integrate collagen into dairy alternatives, bakery goods, and soups to enhance texture and nutritional value. In animal nutrition, aquaculture feed applications reflect an expanding interest in optimized protein supplementation for sustainable livestock and aquatic husbandry.

This comprehensive research report categorizes the Raw Collagen Protein market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Type

- Source

- Application

Comparative regional dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific highlighting unique growth drivers and market readiness

Regional dynamics within the raw collagen protein landscape exhibit clear differentiation in maturity, growth drivers, and strategic focus areas. Across the Americas, strong demand for sports nutrition and dietary supplements in the United States and Canada is augmented by a robust manufacturing base and extensive distribution networks. Companies in this region are also leveraging domestic collagen production to offset import dependency, particularly in light of recent trade policy shifts.

In Europe, Middle East & Africa, stringent regulatory frameworks and high consumer expectations for product quality have fostered a focus on undenatured and marine collagen variants. Skin care and oral care applications in Western Europe drive premium pricing, while emerging markets in the Middle East are witnessing increased adoption in functional food applications. Meanwhile, Africa is at an early stage of market development, presenting greenfield opportunities for strategic entrants.

The Asia-Pacific region represents the fastest-growing market, propelled by demographic trends such as aging populations in Japan and South Korea, along with robust beauty and wellness sectors in China and Southeast Asia. Marine collagen from Australia and New Zealand is gaining prominence due to perceived purity and sustainability credentials. Additionally, government support for nutraceutical innovation in countries like India is catalyzing domestic R&D efforts, positioning the region as both a major consumer and exporter of raw collagen protein.

This comprehensive research report examines key regions that drive the evolution of the Raw Collagen Protein market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiles of leading companies driving innovation, sustainability, and strategic collaboration in the raw collagen protein industry

A review of leading industry participants underscores diverse strategic approaches to innovation, value creation, and market expansion within the raw collagen protein sector. Established gelatin producers have invested heavily in bioactive peptide research, launching specialized hydrolyzed collagen lines tailored for joint support and skin health. These incumbents are also forming alliances with biotech firms to advance proprietary extraction technologies and improve yield efficiencies.

Mid-sized firms are differentiating through niche positioning, such as marine collagen offerings with traceable sourcing credentials. By securing long-term contracts with sustainable fisheries and leveraging eco-certifications, they command premium pricing and appeal to environmentally conscious consumers. At the same time, emerging start-ups are exploring advanced delivery formats, including nanoscale peptide encapsulation and customized peptide sequences designed for specific health outcomes.

Across the competitive landscape, strategic partnerships and joint ventures are increasingly common, enabling players to expand geographic footprints and share technical expertise. Companies are also integrating digital platforms to enhance customer engagement and traceability, further solidifying their positions in an industry where transparency and quality assurance are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Raw Collagen Protein market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aelicure Pharma Pvt. Ltd.

- Alpspure Lifesciences Pvt. Ltd.

- Athos Collagen Pvt. Ltd.

- Atom Pharma Pvt. Ltd.

- BSA Pharma Inc.

- Collagen Lifesciences Pvt. Ltd.

- Collagen Solutions plc

- Darling Ingredients Inc.

- Fermentis Life Sciences Pvt. Ltd.

- GELITA AG

- Gelnex S.A.

- GelTech Solutions, Inc.

- Greenwell Lifesciences Pvt. Ltd.

- Growequal India Pvt. Ltd.

- Kabir Lifesciences Pvt. Ltd.

- NB Healthcare Pvt. Ltd.

- Nippi Collagen Industry Co., Ltd.

- Nitta Gelatin Inc.

- PB Leiner NV

- Phytologix Lifesciences Pvt. Ltd.

- Protein SA

- Tessenderlo Group NV

- Titan Biotech Limited

- Weishardt International SAS

- Wellnex Corporation

Actionable strategic recommendations for industry leaders to optimize sourcing, innovate product lines, and strengthen supply chain resilience

Industry leaders must adopt a multifaceted approach to capitalize on emerging raw collagen protein opportunities and navigate market complexities. Prioritizing investment in green extraction technologies will both reduce environmental impact and differentiate product portfolios in a crowded marketplace. Simultaneously, diversifying sourcing strategies to include underutilized by-products and alternative species can buffer against trade policy fluctuations and supply disruptions.

Enhancing supply chain transparency through blockchain and IoT-enabled traceability platforms will bolster regulatory compliance and foster consumer trust. Collaboration with research institutions to co-develop tailored peptide formulations can unlock new health and wellness applications, while partnerships with established consumer brands will facilitate market penetration. In parallel, scenario planning exercises should anticipate tariff shifts and geopolitical developments to ensure resilient procurement strategies.

Moreover, expanding direct-to-consumer channels and leveraging digital marketing initiatives will amplify brand visibility and drive premium segment growth. By aligning R&D roadmaps with evolving consumer preferences-such as personalized nutrition and clean-label mandates-companies can secure competitive advantage and sustain long-term value creation.

Comprehensive research methodology detailing primary interviews, secondary data sources, and analytical frameworks employed for robust market insights

This research integrates primary and secondary data collection methods to deliver comprehensive insights and robust analysis. Primary research involved structured interviews with senior executives across raw material suppliers, manufacturers, and end users, complemented by in-depth surveys capturing quantitative metrics on production processes, capacity utilization, and purchasing behavior. Secondary sources included scientific journals, regulatory filings, patented technology databases, and credible industry publications.

Quantitative data were triangulated with customs and trade flow statistics to assess tariff impacts and supply chain realignments. Qualitative insights were validated through expert panel discussions, ensuring alignment with real-world operational dynamics. Analytical frameworks such as SWOT and PESTEL were employed to contextualize market drivers and barriers. Additionally, scenario modeling was utilized to project the effects of potential policy changes, enabling stakeholders to engage in forward-looking strategic planning.

Ethical guidelines were strictly adhered to throughout the research process, and data governance protocols ensured the confidentiality and integrity of proprietary information. This rigorous methodology underpins the credibility and reliability of the findings and recommendations presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Raw Collagen Protein market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Raw Collagen Protein Market, by Form

- Raw Collagen Protein Market, by Type

- Raw Collagen Protein Market, by Source

- Raw Collagen Protein Market, by Application

- Raw Collagen Protein Market, by Region

- Raw Collagen Protein Market, by Group

- Raw Collagen Protein Market, by Country

- United States Raw Collagen Protein Market

- China Raw Collagen Protein Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Conclusive reflections on market Drivers, segmentation opportunities, and strategic imperatives shaping the future of raw collagen protein

The raw collagen protein market is at a pivotal juncture defined by accelerating innovation, evolving regulatory landscapes, and shifting consumer expectations. Technological advancements in extraction and formulation are enhancing product performance, while sustainability initiatives are reshaping sourcing paradigms. The impact of 2025 United States tariffs has underscored the importance of diversified procurement strategies and agile supply chain management.

Segmentation analysis highlights clear opportunities across powder, liquid, and dosage formats, with hydrolyzed collagen and marine-derived peptides leading in adoption. Regional insights reveal that Asia-Pacific offers the most rapid growth potential, while mature markets in the Americas and Europe, Middle East & Africa continue to refine premium offerings. Company profiles demonstrate that collaboration, digital traceability, and targeted R&D remain key differentiators in an increasingly competitive environment.

Looking ahead, organizations that embrace sustainable practices, invest in advanced analytics, and align their product pipelines with emerging health trends will be best positioned to capitalize on the raw collagen protein market’s growth trajectory. Equipped with the strategic recommendations and data-driven insights from this report, decision-makers can confidently navigate market complexities and unlock new avenues for value creation.

Secure your strategic advantage with expert guidance from Associate Director Ketan Rohom to acquire the comprehensive raw collagen protein market report

For stakeholders seeking an in-depth exploration of opportunities and challenges within the raw collagen protein arena, the comprehensive market research report offers unparalleled strategic value. Presenting detailed analyses of evolving industry trends, segmentation dynamics across form, type, source, and application, as well as a robust evaluation of the impact of 2025 United States tariffs, the document serves as a critical decision-making tool. With expert-driven recommendations and regional performance benchmarks, this report empowers organizations to craft resilient strategies and gain competitive advantage.

To secure immediate access to these insights and drive informed growth initiatives, engage with Ketan Rohom, Associate Director, Sales & Marketing. His expertise in aligning market intelligence with organizational objectives will facilitate a seamless acquisition process and ensure that your team is equipped with the knowledge required to thrive in the raw collagen protein market landscape.

- How big is the Raw Collagen Protein Market?

- What is the Raw Collagen Protein Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?