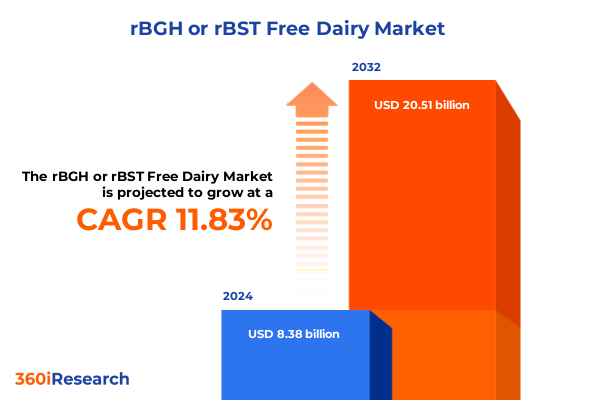

The rBGH or rBST Free Dairy Market size was estimated at USD 9.37 billion in 2025 and expected to reach USD 10.39 billion in 2026, at a CAGR of 11.83% to reach USD 20.51 billion by 2032.

Uncovering the Surge in Consumer Preference for rBGH and rBST Free Dairy as Health Safety, Ethical Farming, and Transparency Drive Retail and Supply Strategies

Consumers today demand transparency, safety, and ethical integrity in the dairy products they consume. As food safety concerns mount and awareness of agricultural practices deepens, the movement toward dairy products free of recombinant bovine growth hormone and bovine somatotropin gains unprecedented momentum. This shift is about more than a fad; it represents a fundamental reevaluation of the relationship between producers and end-users, where trust and quality standards serve as the cornerstones of purchase decisions.

In this evolving paradigm, both retail giants and independent grocers are pivoting their sourcing strategies to meet the expectations of health-conscious shoppers. Simultaneously, producers and processors are recalibrating production protocols, investing in testing and certification processes to substantiate claims of hormone absence. From farm-level herd management adjustments to sophisticated supply chain audits, stakeholders across the value chain are forging new pathways that prioritize animal welfare, product purity, and environmental sustainability.

Moreover, this transformation carries implications for brand positioning and consumer loyalty. Brands that proactively highlight rBGH and rBST free credentials through clear labeling and targeted marketing campaigns cultivate deeper connections with consumers, fostering a sense of shared values. Consequently, industry players that adapt early will capture the trust of discerning consumers while reinforcing the integrity of their offerings in a competitive marketplace.

Exploring Transformative Shifts Shaping the rBGH and rBST Free Dairy Market as Regulatory Actions, Technological Advances, and Consumer Advocacy Reshape Norms

Policy reforms, technological breakthroughs, and amplified consumer advocacy are jointly reshaping the dairy sector’s approach to growth hormone usage. Recent regulatory dialogues have intensified around labeling requirements, compelling suppliers to substantiate claims with rigorous testing protocols. At the same time, advancements in diagnostic assays enable near real-time verification of hormone absence, strengthening the credibility of free-from assertions and streamlining compliance across multiple jurisdictions.

Concurrently, the rise of digital platforms and social media communities has empowered consumers to share experiences and insights, catalyzing grassroots campaigns that elevate the visibility of hormone-free dairy. Influencers and health professionals now play pivotal roles in disseminating evidence-based perspectives, demystifying technical aspects, and debunking myths. This democratization of information accelerates adoption and incentivizes industry participants to adopt more stringent standards ahead of regulatory mandates.

Furthermore, collaborative initiatives among dairy cooperatives, certification bodies, and academic institutions are driving research into alternative production protocols. These partnerships foster pilot programs exploring pasture-based nutrition, optimized animal welfare frameworks, and enhanced traceability systems. As a result, the market witnesses a confluence of scientific rigor and consumer-driven values, aligning long-term sustainability goals with immediate market demands.

Analyzing the Consequences of United States Tariffs on rBGH and rBST Free Dairy Industries Through Supply Chain Disruptions and Shifting Import Dynamics

The latest wave of tariff adjustments imposed on dairy imports has exerted a pronounced influence on the cost structures and sourcing decisions for rBGH and rBST free products. Import duties, recalibrated in response to shifting trade negotiations, have elevated landed costs for certain dairy categories, prompting processors to reevaluate their global procurement strategies. These cost pressures have, in turn, affected retail pricing dynamics, influencing both shelf-placement negotiations and promotional planning.

Notably, tariff differentials between hormone-free and conventional dairy have prompted some importers to localize production or partner with domestic suppliers that adhere to free-from growth hormone standards, thereby mitigating the expense of cross-border levies. This realignment has generated opportunities for regional dairy cooperatives to attract new customers seeking tariff-stable alternatives, fueling investment in processing capacities dedicated exclusively to non-hormone-treated milk.

Simultaneously, supply chain stakeholders have enhanced logistical coordination to offset tariff-induced margin compression. Strategic warehousing alignments in key distribution nodes facilitate consolidation of imports, while collaborative shipping arrangements help distribute cost burdens more evenly across the network. As a result, businesses that proactively optimize their sourcing and distribution frameworks maintain competitive pricing for consumers without compromising product integrity.

Delving into Critical Segmentation Factors That Uncover Form, Product Type, Fat Content, and Distribution Nuances in the rBGH and rBST Free Dairy Sector

A nuanced understanding of market segments proves essential for tailored product development and channel optimization. Form variations, spanning frozen preparations to liquid offerings and powdered concentrates, cater to the diverse needs of industrial users, foodservice operators, and on-the-go consumers alike. Each form factor carries unique processing requirements and shelf life considerations, demanding agile production protocols and precise quality controls.

Equally, the spectrum of product types unveils granular demand patterns. Butter, whether salted or unsalted, serves as a staple in domestic kitchens and specialty food manufacturing. Cheese varieties, classified into hard and soft categories, attract gourmet connoisseurs seeking textural sophistication and artisanal differentiation. Cream products demonstrate their versatility across heavy, light, and whipping grades, supporting both savory sauces and decorative pastry applications. Milk offerings extend from fat free to reduced fat and whole compositions, reflecting a balance between nutritional positioning and sensory experience. Yogurt, with its flavored, Greek, and regular iterations, exemplifies the intersection of indulgence and functionality, appealing to health enthusiasts and flavor seekers.

Further refinement emerges through fat content distinctions, with full fat, low fat, and skim options aligning with dietary considerations and culinary benchmarks. Distribution channels also reveal evolving consumer behaviors: traditional offline footprints maintain their relevance for in-person selection and sampling, while digital storefronts-through dedicated retailer websites and third-party platforms-offer unparalleled convenience and subscription-based purchasing models. Recognizing these segmentation nuances empowers stakeholders to align product portfolios, marketing narratives, and supply chain capabilities with precise consumer expectations.

This comprehensive research report categorizes the rBGH or rBST Free Dairy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Product Type

- Fat Content

- Distribution Channel

Unraveling Regional Dynamics Across Americas, Europe Middle East & Africa, Asia-Pacific That Shape Consumer Adoption and Supply Patterns in rBGH Free Dairy

Regional disparities play a defining role in shaping demand trajectories for hormone-free dairy, with the Americas leading in both consumption volume and regulatory rigor around labeling transparency. North American markets exhibit a robust ecosystem of dedicated free-from certifications, driving consumer confidence and premium pricing power. Meanwhile, Latin American hubs demonstrate emerging enthusiasm, fueled by a growing middle class and strategic partnerships with exporters committed to hormonal safety standards.

Across Europe, Middle East & Africa, regulatory frameworks vary significantly, yet the collective trend favors stricter controls on growth hormone residues. Western European nations often set the benchmark for dairy purity, while certain Middle Eastern markets leverage free-from dairy to differentiate their foodservice offerings. In Africa, nascent demand clusters hinge on urban centers where premium brands gain traction among expatriate and affluent consumer segments.

Asia-Pacific dynamics reflect a tapestry of cultural preferences and import dependencies. Australia and New Zealand capitalize on strong pastoral traditions and export infrastructures, positioning themselves as reliable suppliers of hormone-free milk. East Asian markets, including Japan and South Korea, prioritize stringent food safety protocols and premium artisanal imports, whereas Southeast Asian nations display a growing appetite driven by urbanization and health-conscious millennial demographics. As such, regional strategies must account for regulatory heterogeneity, supply chain maturity, and evolving gastronomic trends.

This comprehensive research report examines key regions that drive the evolution of the rBGH or rBST Free Dairy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Strategic Approaches, Innovation Pipelines, and Competitive Positioning of Leading Dairy Producers Embracing rBGH Free Labeling Standards

Industry leaders have distinguished themselves through differentiated innovation pipelines and strategic alliances. Certain heritage dairy cooperatives have invested in on-farm auditing systems and traceability technologies, enabling end-to-end visibility that resonates with retailers and foodservice operators alike. These platforms integrate sensor data and blockchain records, assuring buyers that every batch of milk adheres strictly to hormone-free governance protocols.

Meanwhile, nimble private-label producers leverage modular processing units to rapidly convert conventional facilities for dedicated rBGH-free production, minimizing capital expenditure while meeting surges in demand. Their agility often extends to product prototyping, with shortened iteration cycles for novel cheese blends or high-protein yogurt formulations that capitalize on clean-label positioning.

Moreover, multinational corporations are forging joint ventures with regional dairy champions to secure supply commitments and local market insights. These collaborations balance scale economies with cultural nuance, delivering products that cater to both mass-market channels and specialty retailers. Through combined research and development efforts, they pioneer formulation enhancements that optimize texture and nutritional profiles without compromising free-from assurances.

This comprehensive research report delivers an in-depth overview of the principal market players in the rBGH or rBST Free Dairy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alta Dena Dairy by Dairy Farmers of America, Inc.

- BelGioioso Cheese, Inc.

- Berkeley Farms

- Blythedale Farm

- Chippewa Valley Farms

- Clover Farms Dairy

- Crowley Cheese, LLC

- Danone S.A.

- Farmland Fresh Dairies

- Franklin Foods Inc. by Hochland SE

- General Mills, Inc.

- Grafton Village Cheese

- Joseph Gallo Farms

- Meijer, Inc.

- Oberweis Dairy

- Oregon Ice Cream, LLC

- Promised Land Dairy

- Stonyfield Farm, Inc. by Lactalis

- Sunshine Dairy Foods

- The Erivan Dairy, Inc.

- The Kraft Heinz Company

- The Kroger Co.

- Tillamook County Creamery Association

- Unilever PLC

- Westby Cooperative Creamery

Driving Growth with Strategic Initiatives to Optimize Production Systems, Strengthen Supply Chain Transparency, and Enhance Consumer Trust for rBGH Free Dairy

Leaders in the dairy sector should prioritize integrated transparency initiatives that encompass farm-to-fork traceability and consumer-facing education campaigns. By investing in digital ledgers and mobile applications, companies can differentiate their offerings and foster stronger brand loyalty among consumers who demand evidence of hormone-free assurances. Implementing such systems not only mitigates risk but also positions enterprises as pioneers in food integrity.

Additionally, aligning supply chain partners through formalized contracts and shared performance metrics will ensure consistency in hormone-free compliance. These agreements should include detailed audit clauses, joint problem-solving protocols, and continuous improvement frameworks to address any deviations swiftly. Through collaborative governance, stakeholders can maintain uniform standards even as volumes scale and geographic footprints expand.

Furthermore, exploring value-added product lines-such as fortified dairy beverages or functional cheeses-can unlock new revenue streams that leverage the clean-label narrative. By integrating health benefits and culinary innovation, companies capture a broader audience while reinforcing their commitment to product purity. Consequently, this multifaceted approach enhances market penetration, fortifies margins, and strengthens competitive moats in the rapidly evolving dairy landscape.

Detailing the Rigorous Research Methods That Blend Quantitative Data Analysis, Qualitative Insights, Primary Stakeholder Interviews, and Ethical Standards

The research underpinning this executive summary combines robust quantitative analysis with rich qualitative insights. Data collection encompassed a comprehensive review of industry databases, import-export records, and regulatory filings to map tariff evolutions and supply chain flux. Descriptive statistics and trend analyses identified pivotal inflection points, while comparative benchmarking illuminated best practices across global dairy markets.

Qualitative depth emerged through structured interviews with primary stakeholders, including farm operators, cooperative executives, supply chain managers, and regulatory officials. These conversations yielded firsthand perspectives on implementation challenges, certification processes, and consumer feedback loops. The dialogue was supplemented by farm visits and site audits, reinforcing the accuracy of documented operational protocols.

Ethical standards guided every research phase, ensuring confidentiality, informed consent, and representative sampling across diverse market segments. Through methodological triangulation-integrating quantitative metrics, thematic coding of interview transcripts, and cross-validation against secondary sources-the study delivers a balanced and trustworthy portrayal of the evolving rBGH and rBST free dairy arena.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our rBGH or rBST Free Dairy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- rBGH or rBST Free Dairy Market, by Form

- rBGH or rBST Free Dairy Market, by Product Type

- rBGH or rBST Free Dairy Market, by Fat Content

- rBGH or rBST Free Dairy Market, by Distribution Channel

- rBGH or rBST Free Dairy Market, by Region

- rBGH or rBST Free Dairy Market, by Group

- rBGH or rBST Free Dairy Market, by Country

- United States rBGH or rBST Free Dairy Market

- China rBGH or rBST Free Dairy Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Summarizing Key Findings and Strategic Imperatives that Drive Alignment with rBGH and rBST Free Dairy Trends to Enhance Market Agility and Bolster Consumer Trust

The convergence of consumer demand, regulatory impetus, and technological innovation underscores the irreversible shift toward hormone-free dairy. Stakeholders who acknowledge these drivers and adapt their operational models accordingly will secure resilient market positions and cultivate enduring consumer trust. From tariff-induced sourcing recalibrations to segmentation-tailored product portfolios, the insights presented herein chart a clear path forward.

Moving ahead, companies must remain vigilant of emerging policy developments and invest in next-generation traceability platforms that can confirm free-from claims with scientific precision. Simultaneously, aligning product innovation with regional preferences and distribution channel dynamics will unlock new growth pockets. Collectively, these strategic imperatives not only bolster competitive advantage but also contribute to higher standards of animal welfare and environmental stewardship.

Ultimately, the rBGH and rBST free dairy landscape offers a fertile ground for pioneers willing to embrace transparency, collaboration, and continuous learning. By synthesizing the findings and recommendations of this summary, industry leaders can transform challenges into opportunities, driving sustainable progress and fortifying their brands for the next decade of consumer-driven evolution.

Unlock Actionable Insights and Connect with Ketan Rohom to Secure the Comprehensive rBGH and rBST Free Dairy Market Research Report for Strategic Advantage

Elevate your strategic decision-making by securing the definitive market research report on rBGH and rBST free dairy. Reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, who brings in-depth expertise and personalized insight into how this report can address your specific business imperatives. Engaging with Ketan ensures you access a tailored overview of the latest industry trends, competitive landscapes, and consumer preferences shaping the future of dairy free from growth hormones. Through his guidance, you will navigate the wealth of data with clarity, enabling you to implement precise actions that resonate with evolving market conditions and regulatory requirements. Do not miss the opportunity to transform raw insights into profitable strategies; connect with Ketan Rohom today to discuss pricing, delivery options, and exclusive add-on modules that align with your organizational goals. This is your gateway to maximizing stakeholder confidence, driving sustainable growth, and solidifying your leadership in the burgeoning rBGH and rBST free dairy segment.

- How big is the rBGH or rBST Free Dairy Market?

- What is the rBGH or rBST Free Dairy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?